National Welfare Rights Network

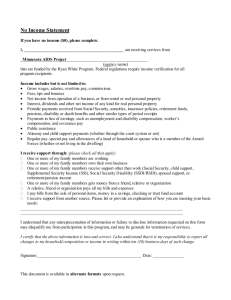

advertisement