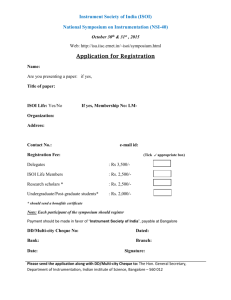

Negotiable Instruments Act, 1881

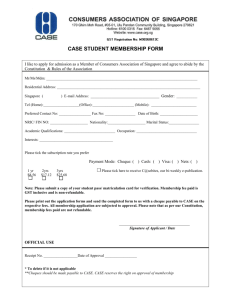

advertisement