Engineering Economic Analysis

advertisement

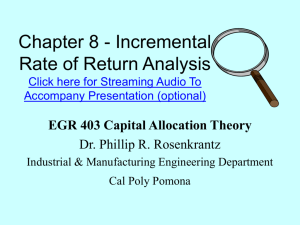

Chapter 7A Difficulties Solving for the IRR Click here for Streaming Audio To Accompany Presentation (optional) EGR 403 Capital Allocation Theory Dr. Phillip R. Rosenkrantz Industrial & Manufacturing Engineering Department Cal Poly Pomona EGR 403 - The Big Picture • Framework: Accounting & Breakeven Analysis • “Time-value of money” concepts - Ch. 3, 4 • Analysis methods – Ch. 5 - Present Worth – Ch. 6 - Annual Worth – Ch. 7, 7a, 8 - Rate of Return (incremental analysis) – Ch. 9 - Benefit Cost Ratio & other techniques • Refining the analysis – Ch. 10, 11 - Depreciation & Taxes – Ch. 12 - Replacement Analysis EGR 403 - Cal Poly Pomona - SA10 2 Multiple IRR Occurs when a cash flow produces more than one point at which NPW = 0. This happens when there is more than one sign change in the cash flow series Example 7A-1 Cash Flow Year 0 1 2 3 4 5 Cash Flow 19 10 -50 -50 20 60 80 60 40 20 0 -20 -40 -60 1 2 EGR 403 - Cal Poly Pomona - SA10 3 4 5 6 3 Example 7A-1 This series of cash flows produces two solutions for IRR: 10.2% and 47.3%. EGR 403 - Cal Poly Pomona - SA10 4 Cash Flow Rule of Signs • This happens when we convert the IRR equation to a polynomial. • Then, by Descartes’ rule Number of sign changes, m 0 1 Number of positive values of X 0 1 2 3 2 or 0 3 or 1 4 4, 2 or 0 EGR 403 - Cal Poly Pomona - SA10 5 Cash Flow Rule of Signs Expands on This Notion • There may be as many positive values of “i” as there are sign changes in the cash flow. • Sign changes are counted when: • + To -. • - To +. • A zero cash flow is ignored. EGR 403 - Cal Poly Pomona - SA10 6 Zero Sign Changes • Receiving a gift. • Giving your friend a loan and not being paid back. In either case no “i” can be computed. EGR 403 - Cal Poly Pomona - SA10 7 Solving for ROR • We use an “external rate of return” to adjust cash flows so that we have only one sign change. • External interest rate is almost like a money market rate and is different than the MARR. • Move the least amount of positive cash flow forward that you can to eliminate all but one sign change. (Note: Cannot move negatives cash flows forward) EGR 403 - Cal Poly Pomona - SA10 8 Example 7A-2: Solving for a more realistic IRR • We have two sign changes. • The easiest way to reduce that to one is by moving the cash flow in years 0 and 1 to year 2. • Use the “external interest rate” to move the two cash flows ahead • 8.4% is a more realistic IRR for this project than 10.2% or 47.3% Year 0 1 2 3 4 5 Cash Flow External Interest Rate = 6% Revised 19 Move two years: 19 (F/P, 6%, 2) = 21.40 0 10 Move one year: 10 (F/P, 6%, 1) = 10.60 0 -50 21.4 + 10.6 = 32 -18 -50 -50 20 20 60 60 IRR = 8.4% EGR 403 - Cal Poly Pomona - SA10 9