Blue Cross Plus 101 Tips for Employees

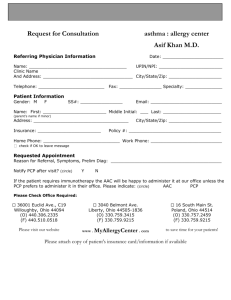

advertisement

Blue Cross Plus 101 Tips for Employees Brought to you by the UCSF Health Care Facilitator Program HR Benefits/Financial Planning 2007 1 Topics Plan structure/design In-Network Benefits Out-of-Network Benefits Specific Coverage Issues Prescription Drug Benefits Behavioral Health Benefits Problem solving 2 Plan Structure and Design 3 What’s the Plus in Blue Cross Plus? Blue Cross Plus* is a Point of Service plan that gives members choice and flexibility Blue Cross Plus combines features of both HMO and PPO plans Members can choose to receive health care services from: – In-network providers HMO structure; PCP/medical group network or; – Out-of-network providers Blue Cross Preferred Provider Organization (PPO) providers or: Non Preferred Provider Organization (PPO) providers *Subscriber must live in the California service area to be eligible for this plan. 4 The question asked most often……….. What’s the difference between Blue Cross Plus and the Blue Cross PPO Plan? Plans vary in – Monthly premium – Benefits covered – Cost for services PPO plan does not include an HMO network; you selfrefer for all services Both plans provide coverage for services from PPO and non-PPO providers – the difference is in the cost for these services 5 How does the plan work? You Choose to........ *Select In-Network level Open Panel HMO All care is coordinated through a Primary Care Provider (PCP) – Exceptions - Direct Access Programs, OB/GYN You pay a $20 co-pay for most services, $250 for hospital inpatient and $75 ER co-pay No claim forms, no deductibles *Based on benefits, 2007 *Select Out-of-Network level PPO/non-PPO docs Self-refer for care After a $500 individual deductible, $1500 family (3 or more) the plan pays 70% of Usual Customary and Reasonable (UCR) charges for most services or 70% of the contracted rate if there is one Self-referral to PPO providers means no balance billing World Wide Coverage 6 Blue Cross Plus Utilizing the In-Network Benefit Level 7 How does it work? You select a Primary Care Physician (PCP) and Medical Group to manage your care – PCP must be within 30 miles of your home/work – Each family member can choose different Medical Group and/or PCP When your PCP determines you need a specialized service, your PCP will refer you to a specialist, hospital or lab that is contracted with your Medical Group – some exceptions Some services must first be authorized by the Medical Group 8 Blue Cross Plus, In-Network Open Panel HMO Blue Cross Plus In-Network Medical Group A i.e. Brown & Toland Medical Group Primary Care Specialists Providers Hospitals Labs Medical Group B i.e. Marin IPA Primary Care Specialists Providers Hospitals Labs 9 Blue Cross Plus Utilizing the Out-of-Network Benefit Level Blue Cross, Preferred Provider Organization (PPO) and Non-PPO Providers 10 What is a PPO? PPO stands for Preferred Provider Organization Blue Cross PPO Providers have contracted rates for services – This means lower costs for services and lower out-of-pocket expenses – No balance billing – Usually no claim forms 11 Blue Cross Plus, Out-of-Network How does it work? – You self-refer to Blue Cross Preferred Provider Organization (PPO) providers and non-PPO doctors – After a $500 individual deductible, $1500 for family (3 or more), the plan pays 70% of Usual, Customary and Reasonable (UCR) charges for most services or 70% of the contracted rate if there is one – Self-referral to non-PPO providers means you are responsible to pay the amounts above UCR - also called balance billing 12 How do I find a PPO Provider? Complete a provider search through the Blue Cross website: – http://www.bluecrossca.com/uc Health Scope – License/Certification – http://www.healthscope.org 13 How are Usual, Customary and Reasonable Charges (UCR) Determined? Usual, Customary and Reasonable (UCR) charges are based on guidelines set by the Department of Insurance Typically this includes regional data blended with national standards for costs It is determined annually 14 What is Balance Billing? Balance billing is the amount above the Usual, Customary and Reasonable (UCR) charge for a service that a non-PPO provider may charge you, for example…… – A Non-PPO provider charges $125 for a service Blue Cross determines that UCR is $100 Blue Cross will pay 70% of $100 or $70 and you are responsible for paying the difference* – You pay $55 to the provider instead of the $30 that would have been required if the provider was charging you the UCR rate – The $25 difference is the ‘Balance Billing’ *Assumes you’ve met the annual deductible 15 How do I obtain the UCR for services prior to obtaining care? Ask your physician to contact Blue Cross and ask for the ‘Disclosure of Legality’ form – Provider completes form and includes procedure codes and fees – Blue Cross responds to both provider and member with pricing 16 Out-of-Pocket Maximums Your Blue Cross Plus plan has both an In-Network and Out-of-Network Out-of-Pocket Maximum (OOPM) to protect you from catastrophic out of pocket medical expenses, meaning…… If your co-pays, co-insurance and deductibles paid in a plan year, equal your OOPM, additional care for covered services in that year are paid at 100% review plan for excluded services Check the plan EOC to determine what costs count towards your OOPM. (Some costs are excluded.) 17 Blue Cross Plus Out-of-Pocket Maximum 2007 Individual In-Network Out-of Network $1,500 $5,000 Family $4,500 (3 or more) $15,000 18 Specific Coverage Issues You should always verify in the EOC or with Blue Cross customer service if you have any questions, or to confirm your benefits. 19 Changing Your PCP/Medical Group You can change your Medical Group and/or PCP outside of open enrollment by contacting Blue Cross Customer service at the number shown on your insurance card – Usually, if you call by 15th of month, change effective 1st of next month – Blue Cross must approve your request for it to become effective – If you are currently undergoing care for an escalated health care issue, Blue Cross may limit your ability to transfer to a new medical group Each family member may have their own PCP/Medical group 20 Student Dependents Student dependents living in CA – select a PCP near their school and use the in-network benefit level and/or; – Self-refer to PPO and non-PPO providers and use the out-of-network benefit level Student dependents living out of state – select a PCP near their CA home address and use the in-network benefit level when visiting home and/or; – Self-refer to PPO and non-PPO providers and use the out-of-network benefit level when at school 21 Direct Access Benefits If your medical group participates in Direct Access, you can self-refer to the following specialists and receive the in-network benefit level ($20 co-pay for office visit): Allergists/Immunologists Dermatologists ENTs/Otolaryngologists 22 Bay Area Medical Groups’ participation in Blue Cross Plus Direct Access Program: YES – Brown & Toland – John Muir/Mt. Diablo – Santa Clara IPA NO – – – – – – Alta Bates Marin IPA Chinese Community Hills Physicians Mills-Peninsula Sonoma County IPA This information subject to change, contact your medical group to determine participation in Direct Access. 23 Obtaining OB/GYN services Members may self-refer to an OB/GYN provider in their Medical Group Network – Per the Knox Keene Health Care Service Plan Act of 1975, members may seek OB/GYN services from their network without prior approval 24 Chiropractic & Acupuncture Benefits Members may self-refer to Chiropractors and Acupuncturists that are available through the American Specialty Health Plan (ASHP) network – These services are covered only at the in-network level of the Blue Cross Plus plan and only when provided by an ASHP network provider. There is no out-of-network coverage. – Members can contact the American Specialty Health Plan (ASHP) to get a list of providers (800) 678-9133 Review your Evidence of Coverage (EOC) booklet for additional information Questions? - Contact Blue Cross member services – (888) 209-7975 25 Infertility Coverage Services related to diagnosis and treatment of infertility are covered only at the Out-of-Network level and only from Blue Cross PPO providers – These services are not subject to the plan deductible – For detailed information, review your Evidence of Coverage (EOC) booklet http://www.bluecrossca.com/clients/uc.htm – Questions? - Contact Blue Cross member services, (888) 209-7975 26 Emergency Care Blue Cross strictly enforces the following definition of an Emergency: “Emergency is a sudden, serious, and unexpected acute illness, injury, or condition (including without limitation sudden and unexpected severe pain) which the member reasonable perceives, could permanently endanger health if medical treatment is not received immediately. Final determination as to whether services were rendered in connection with an emergency will rest solely with us or your medical group.” If you believe you have a medical emergency, you should seek medical treatment immediately. 27 Emergency Care In Area Emergencies: Seek treatment and request treating provider contact your PCP/medical group as soon as possible to request medically necessary continued care. Out of Area Emergencies (more than 20 miles from your medical group): contact Blue Cross within 48 hours if you are admitted to a hospital. 28 Second Opinions You have the right to a second opinion by an appropriately qualified health care professional You must have initially seen a specialist you were referred to by your PCP If there is no appropriately qualified health care professional in the network, you may be authorized to see someone out-ofnetwork 29 Reasons for requesting a Second Opinion include… The treatment plan in progress is not improving your medical condition You are diagnosed with a condition that threatens loss of limb, body function Your PCP or the initial specialist is unable to diagnose your condition For additional reasons, consult your EOC 30 Blue Cross Plus and Behavioral Health Benefits 31 What are the Behavioral Health Benefits? Behavioral Health Benefits are ‘carved out’ meaning there is a separate plan administrator United Behavioral Health (UBH) is the administrator You initiate services by contacting UBH directly Members can choose to receive behavioral health care services from: – in-network providers (UBH network) or – non-network providers 32 How does UBH work? In-Network Services Out-Patient Therapy – Call UBH directly, (888) 440-8225. UBH will either refer you to a provider or you can designate an in-network provider – www.liveandworkwell.com enter access code 11280 – You pay $0 co-pay for first 5 visits, then $10 for 6+ visits – No claim forms, no deductibles – $500 annual out-of-pocket maximum Inpatient Hospitalizations – No co-pay – Notify UBH within 48 hours for emergency admissions Review EOC for substance abuse benefits 33 How does UBH work? Out-of-Network Services Out-Patient Therapy You call UBH and notify them that you are self-referring for care at the out-of-network level After a $500 individual deductible, the plan pays 70% of UCR for most services (only 50% of UCR if you fail to notify first) $5,000 annual out-of-pocket maximum Most providers require payment in full up front and you submit claim forms to UBH to request reimbursement Out-patient, out-of-network visits limited to 20 per individual annually Review EOC for in-patient care and substance abuse benefits 34 Other Behavioral Health Resources UCSF Faculty and Staff Assistance Program (FSAP) – FSAP provides confidential short term assessment and counseling,* and when appropriate, coordinates referral services to your HMO provider or other community /health care services resources (415) 476-8279 www.ucsfhr.ucsf.edu/assist *One to three sessions 35 Blue Cross Plus and Prescription Drugs Benefits 36 What are the Prescription Drug Benefits? Prescription drug benefits are administered by WellPoint, parent company of Blue Cross of CA Three tier design providing coverage for – generic drugs – Brand name drugs – Non-formulary drugs (drugs not listed on the formulary) Questions? Contact WellPoint Pharmacy Mgt – (800) 700-2541 – Precision RX, Mail Order (866) 274-6825 https://www.precisionrx.com/wpx/index.jsp 37 Blue Cross Plus Prescription Drugs, 2007 Drug status Formulary subject to change RETAIL – 30 Day Supply Formulary Generic Formulary Brand Name NonFormulary $15 Co-pay $25 Co-pay $40 Co-pay $30 Co-pay $50 Co-pay $80 Co-pay Network Pharmacy MAIL - 90 Day Supply 38 Prior Authorization of Medications A small number of drugs require a Prior Authorization – Ensures that patients receive medication appropriate for their condition – Limits the use of expensive medications when there are less expensive alternatives – Designed to help contain drug costs and ensure the University can continue to offer excellent health coverage for a fair premium during a time when medical and prescription drug costs are rising – List of drugs requiring PAB available on line: www.bluecrossca.com/uc, select ‘Pharmacy Programs’ 39 Prior Authorization of Benefits (PAB) Process – Physician completes appropriate form and faxes form to WellPoint Pharmacy Management, 888-831-2243 – WellPoint Pharmacy Management completes review for urgent requests within one day of receipt and nonurgent requests within two working days – The prescribing physician is notified of the outcome. In the event the decision is a denial, a letter is sent explaining the medical reasons for the denial – Have questions? Call (800) 700-2541 40 Problem Solving Tips for Blue Cross Plus Members 41 Problem Solving Review the EOC to determine the specific process for resolving disputes with the plan Write down your list of concerns before you make your phone call or visit Keep a log of all communication – Names of representatives you speak with – Dates of calls – Information provided to you 42 What if you get a bill for a service? Typically you should not get any bills for services received when using the HMO level, the innetwork level of your plan, if you do…… – Call the customer service number on the bill and ask, “why am I being billed”? – Billing error - Rep may need to re-direct claim to medical group or health plan – Authorization issue - You may need to contact referring physician for verification of authorization – Eligibility issue - You may need to contact UCSF HR and/or your health plan to verify and update your eligibility – If the above doesn’t work, contact Blue Cross and let them know you have been billed for a service that you think should be covered by the plan 43 What if You Can’t Get a Timely Appointment With Your PCP? Per the California State Department of the Patient Advocate, you have the right to get health care without waiting too long and to get an appointment when you need one If you can’t get an appointment within a reasonable time frame….. – Ask to speak to the office supervisor and firmly request that they fit you in at an earlier date – File a grievance with your health plan – Contact the Department of Managed Care 1-888-466-2219 – Select a new PCP 44 What if You Receive a ‘Denial’ for a Covered Service? Request an ‘Appeal’ if Your Medical Group or Plan Denies Requested Services – If you’ve received a denial of service, follow the appeal process outlined in the denial letter – The appeal process is also outlined in Evidence of Coverage (EOC) booklet – Decision should be provided in writing within 30 days of receipt – Not satisfied with the results of the grievance process? Contact the CA Department of Managed Care 1-888-466-2219 45 What if You Are Dissatisfied with the Plan’s Customer Service? Submit a Complaint – Blue Cross allows you to ‘call in’ to initiate the formal complaint process, or you can submit your complaint in writing to the plan – This process is outlined in Evidence of Coverage (EOC) booklet – Not satisfied with the results of the grievance process? Contact the CA Department of Managed Care 1-888-466-2219 46 What about health care services/costs that are not covered? Health Care Reimbursement Account – Allows you to set money aside on a pre-tax basis to pay for qualifying health care expenses through a monthly payroll deduction Eligible expenses based on IRS rules Limited to expenses not covered by insurance; includes copays and other out of pocket expenses Budget carefully, if you don’t use the money set as side, you lose it! – Enroll each year during Open Enrollment 47 Where can I find this information? Almost all the information being covered today is outlined in your Evidence of Coverage (EOC) booklet The EOC contains detailed information regarding what is and what is not covered by your medical plan and your cost for services You may download a copy from the Blue Cross website or call Blue Cross to request it – www.bluecross.com/uc – (888) 209-7975 48 If you need to select or change your PCP/Medical group….. 49 Things to Consider Determine your needs – Do you want a physician that specializes with specific client groups? – Would you prefer a physician of the same gender, age, race, religion or language? – Do you want a physician that contracts with a specific medical group? Contact the provider office – – – – Is the practice accepting new patients with your insurance? What hours are available for appointments? What are the standards for wait time and visit length? Did you receive good customer service from the office staff? 50 Complete a provider search through the Blue Cross website: – http://www.bluecrossca.com/uc – Members must select a PCP that is within 30 miles of the home or work address Health Scope – For License/Certification information – California Health Care Quality Ratings – http://www.healthscope.org Office of the Patient Advocate – Annual Quality of Care Report Card – http://www.opa.ca.gov/ 51 Help is available! As mentioned previously you may be able to get information and assistance from: – Your physician or specialist’s office – Blue Cross customer service (888) 209-7975 – Blue Cross Website www.bluecrossca.com/uc Includes a link to the Evidence of Coverage Booklet and many other documents, forms and tools – CA Department of Managed Health Care (DMHC) www.hmohelp.ca.gov (888) 466-2219 52 Help is available! Local Resources: Brown and Toland Medical Group – (415) 553-6588 – customerservice@btmg.com UCSF Medical Center http://www.ucsfhealth.org/ – – – – UCSF Referral Service: (415) 885-7777 UCSF Hospital Billing: (415) 673-1111 UCSF Physician Billing: (415) 353-3333 UCSF Patient Relations: (415) 353-1936 53 Help is available! For escalated problems you cannot solve on your own, contact: – UCSF Health Care Facilitator Program Sue Forstat, HCF, (415) 514-3324, sforstat@hr.ucsf.edu Jason Neft, Assistant HCF, (415) 476-5269, jneft@hr.ucsf.edu HCF Program Website: www.ucsfhr.ucsf.edu/benefits/hcf 54 The End Please complete your evaluation form. Your feedback will help us improve our program. Please make sure you signed in on the sign-in sheet. Thank You for Participating 55