Intestate Succession

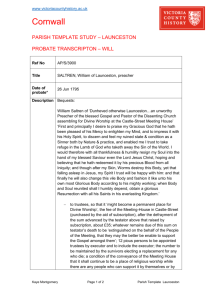

advertisement