IMMIGRATION-TO

advertisement

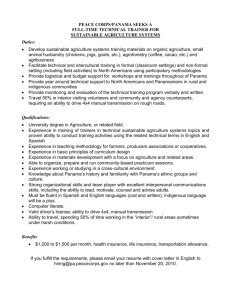

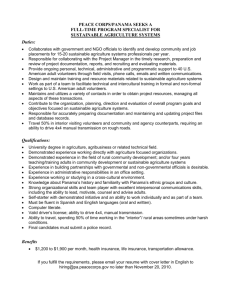

INVESTING IN PANAMA Escobar, Della Togna, Icaza & Jurado Attorneys at Law September 2nd, 2011 – Panama City, Panama Background Jacqueline Escobar – Graduated from Duke University – Masters in Law (International Commerce Expert) Marisel Della Togna – Former Deputy Director of Panamanian Internal Revenue Service (Tax Consultant) Marisel Jurado – MBA and Masters in Accounting (Corporate Law Expert) Maruquel Icaza – Graduated from American University, – Former Vice Consul Panamanian Embassy at Washington, D.C. (Immigration Consultant) Panama´s Overview • Reasonable life here on about $1,200 a month. • Comparative advantages Panama´s Economy: Dollarized economy. Services based economy (banking, commerce, transportation, ports and tourism). The country's industry includes, manufacturing of aircraft spare parts, cements, drinks, adhesives, textiles and more. HEALTH CARE AND INSURANCE Infrastructure (e.g. Punta Pacífica Hospital which is affiliated to the John Hopkins Hospital in the US) Low cost medical services and health insurance premiums Recognized local and international insurance companies (Blue Cross Blue Shield) Your health insurance policy can cover you for hospitalization and/or medical expenses. You can obtain Local or International Coverage. By Law, all vehicles have to be insured. INCORPORATION IN PANAMA The most common legal instruments for Incorporations in Panama: 1- Panamanian Corporations (Used to do business in Panama or to protect assets such as properties, any legal activity) 2- Private Interest Foundation (Asset Protection) PANAMANIAN CORPORATIONS Law 32 of 1927 •IDENTITY OF DIRECTORS Nationals or foreigners may establish a corporation • SHARE STRUCTURE Bearer and nominative shares are also permitted. A single person or a corporation may own all shares. • CORPORATE DIGNITARIES & RESIDENT AGENT Panamanian law requires a President, a Secretary and a Treasurer, and a local resident agent. • DURATION AND DOMICILE OF CORPORATION Law 2 of 2011 • KNOW YOUR CLIENT – DUE DILIGENCE Steps to Set Up a Corporation Check name availability in the Public Registry. Preparation of legal documentation (i.e. corporate by-laws). Upon registry, the Resident Agent prepares share certificates and legal books for the corporation. The annual corporate tax is of US$300 Length of time for organizing a company: 3-5 days Doing Business in Panama 1. Set up a company 2. Obtention of tax payer I.D. number (R.U.C.) 3. Obtain a Commercial License to operate in Panamá (Aviso de Operación – Retail activities restriction by Law) 4. Register the company in the Municipality Office (Municipal Taxes) 5. Hire personnel / Labor contracts sealed in the Ministry of Labor 6. Register personnel in the Social Security of Panama (The rate paid is of 12% employers – 8% employees) ASSET PROTECTION PRIVATE INTEREST FOUNDATIONS Private Interest Foundation Law 25 of 1995 •These private interest foundations shall not be profit oriented. • They may engage in commercial activities in a non-habitual manner. • The founders must select a name to identify the foundation. • The objectives, duration, domicile, and board of the foundation must also be indicated, along with the beneficiary or beneficiaries. Private Interest Foundation Foundation charter must be notarized and registered as trust deed does. The private interest foundation is very similar to a trust in its operation, but unlike the trust, there is no need to transfer the assets to a third party. When the assets are from outside the territory of Panama, no taxes are levied when these assets (whether movable or immovable, shares, bonds, and others) are transferred. Private Interest Foundation •It may be established for the benefit of a person or persons, a family, or a specific social purpose. •PIFs are a viable solution for estate planning, providing privacy, and protection of assets. Private Interest Foundation Your Foundation books are mantained 100% private and confidential by law. The Beneficiaries are not registered in the Public Registry. Beneficiaries can be appointed through a Private letter of wishes written and signed by the Protector. The PIF does not require Paid In Capital IMMIGRATION PENSIONADO PROGRAM Law No. 9 /June 24, 1987 Pension income of at least US$ 1,000.00 per month and an additional US$ 250.00 for each dependent. Private and public pensions apply (retired by the government, social security or private pension programs) Your application must be processed by a Panamanian attorney through a Power of attorney. Indefinite legal residence status Does not grant you a Passport nor a Panamanian I.D. Card Private Income Retiree Visa This visa has an income requirement of US$ 850.00 monthly. Approximately US$350K (Time deposit) with current interest rates. The time deposit has to be free of any liens. This visa has to be renewed every five (5) years. Grants Special Panamanian Passport but not Panamanian I.D. Card IMMIGRANT VISA AND RESIDENCE PERMIT TO FOREIGNERS WITH ECONOMIC SOLVENCY The Self-Economic Solvency Visa offers three (3) different investment options to qualify for residency status in the Republic of Panama: Investment Option A: Requires a minimum of US$300,000 in a three (3) year time deposit (or "certificate of deposit" or "CD") without liens at any licensed bank in Panama. Investment Option B: Requires a minimum of US$300,000 in a titled property (real estate) in Panama without any liens. Investment Option C: Requires a time deposit and property, for the amount of US$ 300,000 for both investments. General Documentation Required Registration Process is the first step. To register at the Immigration Office, the applicant must go in person with his original passport and 2 pictures. Power of attorney (we provide it) Health certificate issued by a Panamanian Doctor. Police report. Complete passport copies (all pages including cover), notarized in Panama (we take care of that). Six (6) photographs Sworn statement about personal background. (We provide the form) All document coming from a foreign country needs to be authenticated by a Panamanian Consulate in the U.S or by Apostille. If it is a private document, it has to be notarized before sending it to the Consulate. All documentations requires to be translated into Spanish by a Panamanian authorized translator. OPENING BANK ACCOUNTS BANKING REGULATIONS A foreigner can have a Panama Bank Account. The bank account minimum is $1000, for both checking and savings accounts, in USD or Euros. Article 194 of this law specifically enshrines the client’s right to privacy and confidentiality in its relationship with the bank with respect to third parties, and Article 110 makes explicit the bank’s obligation to maintain this confidentiality. More than 75 banks are stationed in Panama, 36 of them with international (offshore) licenses. The financial sector represents a full 8% of the GDP, and employs 17% of the labour force. BANK ACCOUNT REQUIREMENTS- PERSONAL ACCOUNT AND ACCOUNT- Please note that requirements can vary from Bank to Bank. CORPORATE Requirements to apply for a personal account (deposit) – Basic requirements. • Personal interview with Branch Manager – Main Branch • Required documents: • • • • - Passport – original - Bank reference letters (preferable two) - Personal reference letters (from a known friend /customer with residence in Panama ) - Business reference letters (job, accountant, lawyer or broker). (Two in total). Internal bank papers will need to be signed and completed by applicant. Application documents will be evaluated by our Compliance Office Bank reserves the right to request additional information if considered necessary Brief description of background and current activities. Requirements to apply for a deposit account in the name of a corporation (local) with foreign directors and/or signers – Basic requirements • Personal interview / bank forms • Copy of articles of incorporation and its amendments (if applicable) • Legal I.D. for all directors of corporation are required • Reference /Presentation letter from lawyers in Panama. • Bank reference letters • Business/commercial letters of reference of corporation and or directors and signers to account • Validation Certificate of Corporation issued by the Registry Public in Panama (recent) • Brief description of background and current activities of the authorizing signatures. PANAMANIAN TAX LEGISLATION & BENEFITS MAJOR TAXES 1. INCOME TAX Individuals Companies Up to 11,000 O% 11,000 – 50,000 15% + 50,000 USD5,850 for the first 50,000 and 25% of the surplus PERIOD TAX 2011 27.5% 2012 25% 2. ALTERNATIVE METHOD FOR CALCULATION Companies with taxable income of more than 1.5 millions pay income tax on the greater of applying the traditional method (25%) or 4.67% of total net revenues 2.1 ADVANCE INCOME TAX - Companies that earn taxable income 1% of the monthly taxable income 3. TRANSFER OF MOVABLE GOODS & SERVICES TAX / VAT (7%) Exceptions – (10% & 15%) 4. SELECTIVE CONSUMPTION TAX (varies depending on the goods such as cars, cigarettes, liqueurs, etc.) 5. COMMERCIAL OR INDUSTRIAL LICENSE TAX • 2% of the company’s total capital , with a minimum payment of 100 and a maximum of 60.000 6. INCOME TAX RELATED TO REAL ESTATE a. Habitual Business a. Brand new - Progressive Table b. Used – general income tax tariffs as individuals or companies b. Non-habitual Business a. Income tax at a rate of ten percent (10%) on taxable income. The taxpayer is obliged to pay a sum equal to 3% of the total value of the transfer or the cadastral value, whichever is greater 7. TRANSFER OF REAL ESTATE TAX a. Property vs. Panamanian Corporation (2%) 8. 9. PROPERTY TAX a. Progressive table b. 1% of land value for condos (if improvements are exempt) CAPITAL GAINS TAX (10% - 5% witholding) 10. IMPORT DUTIES (varies depending on the good – in many cases ISC supplanted import tax) 11. BANKING & FINANCIAL INSTITUTION TAX / Insurance Tax (FECI) 12. OTHERS: Oil Tax, Municipal Tax, Vessel Flag Tax I N C O M E TA X Individuals earning income in Panama, who stay more than 183 consecutive or alternate days, must pay income tax Sums derived from income generated in Panama that are remitted abroad pay withholding tax of 27.5 % (for companies) or 15% (highest rate for indivIduals) on 50% of the total income Foreign Income non-taxable •Invoicing from a company in Panama •To conduct transactions (offshore) in Panama that have its effects abroad •To distribute dividends generated from foreign income or from companies that do not require commercial license TERRITORIALITY PRINCIPLE TRANSFERS ABROAD • Interest, commissions and others credited or remitted abroad, pay income tax at regular rates over 50% of remitted sum,withheld from the total amount paid to the foreign creditor. • The beneficiary of the service may deduct the payment remitted from its taxable income. GENERAL PRINCIPLES ON DIVIDEND TAXES TAXABLE • Distribution of such earnings derived from its internal sales in Panama. Dividends: Nominative 10% Bearer 20% NON-TAXABLE • Foreign source income is not subject to tax. Example: company has administration and accounting in Panama; operations are abroad. • Co. established in CFZ or special regimes (export & re-export) sales – distribution of such earnings. REAL ESTATE RELATED TAXES Real Estate Tax Progressive Table / 1% condos Transfer Real Estate Property Tax 2% Capital Gains Tax 3% TAX ABATEMENT – REAL ESTATE RESIDENTIALS: COSTS FROM UP TO MORE THAN MORE THAN 100,000 UP TO YEARS 100,000 15 250,000 10 250,000 5 INDUSTRIAL, COMMERCIAL AGRO – INDUSTRIAL: 10 PANAMA AS TAX HAVEN Panama has triumphed in the process of not being considered a tax haven. Finally, after a successful negotiation and subscription of 12 double taxation agreements and the implementation of deep changes within the internal revenue and tax administration, the OCDE introduced our country into the so called “white lists”. P E N S I O N A D O P RO G R A M B E N E F I T S Selective Consumption Tax (ISC) of 5% plus 7% Service Tax on cars (*) Import tax exemption for households up to US$10,000 Import tax exemption for household goods 25% discounts on utility bills 25% discount on airline tickets and 30% on other transportation 15% discount on loans made in your name 1% reduction on home mortgages for homes used for personal residence (The house has to be purchased at your name not a company or SA) 20% discount on doctor's bills 15% on hospital services if no insurance applies 15% off dental and eye exams 10% discount on medicines 20% discount on bills for professional and technical services 50% discount on entrance to movie theaters, cultural and sporting events 50% discount at hotels during Monday to Thursday, 30% on weekends, among others. (*) Law 33 of 2010 SPECIAL TAX REGIMES COLON FREE ZONE (ANNUAL GROWTH 15%) EXPORT PROCESSING ZONES PANAMA-PACIFIC SPECIAL ECONOMIC AREA ($400M) PETROLEUM OIL FREE ZONES CALL CENTERS (14,000 JOBS) CITY OF KNOWLEDGE AND THE INTERNATIONAL TECHNOLOGICAL PARK TOURISM PENSIONADO PROGRAM TIEA PANAMA - US In effect since April 2011 1. Includes the following taxes imposed by the United States: (a) Federal income taxes; (b) Federal taxes related to employment; (c) Federal estate and gift taxes; and (d) Federal excise taxes. 2. Includes the following taxes imposed by the Republic of Panama: (a) Income Tax (b) Real Estate Tax (c) Vessels Tax (d) Stamp Tax (e) Notice of Operations Tax (f) Tax on Banks, Financial and Currency Exchange Companies. (g) Insurance Tax (h) Tax on the Consumption of Fuel and Oil Derivates (i) Tax on the Transfer of Movable Goods and the Provision of Services (j) Tax on the Consumption of certain Goods and Services (k) Tax on the Transfer of Immovable Goods 3. Under section 274(h) of the U.S. Internal Revenue Code, an individual may deduct from income expenses Escobar, Della Togna, Icaza & Jurado 47th Street and Aquilino de la Guardia Ave., The Ocean Business Plaza, Suite 1003 Panama City, Panama www.edtij.com mjurado@edtij.com Tel.(507)340.63.24 Fax. (507)340.63.25