Project Guidelines

advertisement

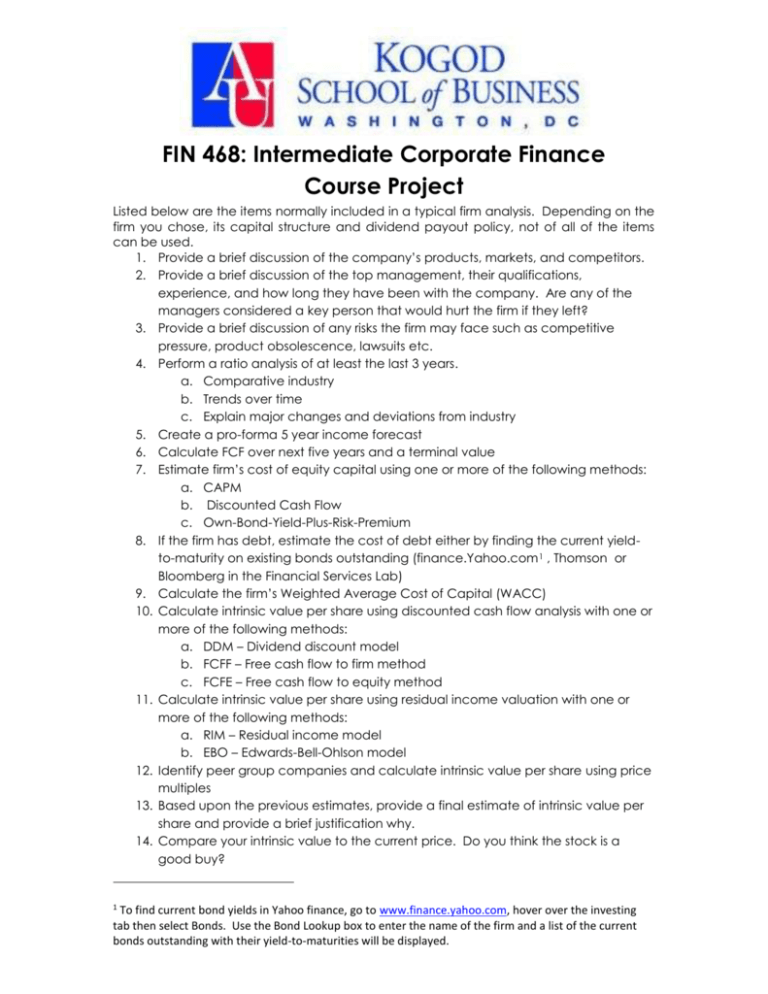

FIN 468: Intermediate Corporate Finance Course Project Listed below are the items normally included in a typical firm analysis. Depending on the firm you chose, its capital structure and dividend payout policy, not of all of the items can be used. 1. Provide a brief discussion of the company’s products, markets, and competitors. 2. Provide a brief discussion of the top management, their qualifications, experience, and how long they have been with the company. Are any of the managers considered a key person that would hurt the firm if they left? 3. Provide a brief discussion of any risks the firm may face such as competitive pressure, product obsolescence, lawsuits etc. 4. Perform a ratio analysis of at least the last 3 years. a. Comparative industry b. Trends over time c. Explain major changes and deviations from industry 5. Create a pro-forma 5 year income forecast 6. Calculate FCF over next five years and a terminal value 7. Estimate firm’s cost of equity capital using one or more of the following methods: a. CAPM b. Discounted Cash Flow c. Own-Bond-Yield-Plus-Risk-Premium 8. If the firm has debt, estimate the cost of debt either by finding the current yieldto-maturity on existing bonds outstanding (finance.Yahoo.com 1 , Thomson or Bloomberg in the Financial Services Lab) 9. Calculate the firm’s Weighted Average Cost of Capital (WACC) 10. Calculate intrinsic value per share using discounted cash flow analysis with one or more of the following methods: a. DDM – Dividend discount model b. FCFF – Free cash flow to firm method c. FCFE – Free cash flow to equity method 11. Calculate intrinsic value per share using residual income valuation with one or more of the following methods: a. RIM – Residual income model b. EBO – Edwards-Bell-Ohlson model 12. Identify peer group companies and calculate intrinsic value per share using price multiples 13. Based upon the previous estimates, provide a final estimate of intrinsic value per share and provide a brief justification why. 14. Compare your intrinsic value to the current price. Do you think the stock is a good buy? 1 To find current bond yields in Yahoo finance, go to www.finance.yahoo.com, hover over the investing tab then select Bonds. Use the Bond Lookup box to enter the name of the firm and a list of the current bonds outstanding with their yield-to-maturities will be displayed.