Présentation Basic Principles of Competition_Dr Frederic Jenny

advertisement

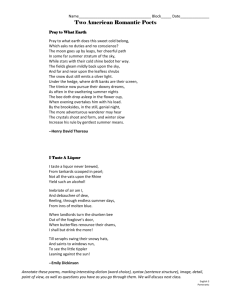

Basic competition concepts: a trip to FairyLand Frederic Jenny Professor of economics Chair OECD Competition Committee Kuala Lumpur CUTS Seminar June 7 and 8 2013 1 Fairy Land HappyValley Mayhem Land HellHole Land 2 HappyValley, Capital of Fairy Land Harmony HappyValley Dismal Peak 3 Setting In the capital town of HappyValley (population 1000) in the country of Fairyland , there are only two general stores belonging respectively to Mr Eh and Mr Bee. Each one has incorporated ihis general store and their companies are listed on the stock market of HappyValley. To establish a grocery on a piece of land, it is necessary to have a permit and the municipality of HappyValley has annouced that it will not give a ne permit for another grocery. 4 History Mr Eh and Mr Bee are the only source of Coca Cola and Pepsi-Cola in Happy Valley . From January to March 2012 each one of the two retailers sold cans of Coca-cola at a price of 10. They bought the cans from CokeBottler Inc at a price of 7,50 each and they have no other selling costs. When both grocers were selling Coca cola cans at 10, each one had 250 consumers a day ( so there were 500 drinkers of CocaCola in Happy Valley). Each retailer also sold 5 cans of Pepsi-Cola which they were selling at a price of 7, having bought them for 6,5 and ( so in total there were 600 drinkers of Coca-cola or Pepsi-Cola in Happy Valley). (Questions: how much profit did each one make everyday on his sales of Coke and Pepsi ? Why did those 500 consumers keep on buying Coca-cola cans at such a high price and what else could they have done ? What are the possible market definitions ? ) 5 Competition On April 1st 2012 Mr Bee decided to lower the price of Coca-cola cans to 9.5 in order to attract some consumers from Mr Eh. When Mr Bee lowered his price to 9.5 he sold 410 Coca-cola cans per day (250 to consumers who used to buy from his store and were now happier because he was selling Coca-cola cheaper than he used to, 100 who deserted the store of Mr Eh which they previously patronized because the price of Coca-cola cans was now cheaper in the store of Mr Bee, 40 inhabitants of Happy Valley who did not previously buy Coca Cola because at 10 the price was too high but who are eager to buy one can at price 9.5 and 20 consumers who used to buy Pepsi-Cola in Mr Bee’s store and in Mr Eh’s store but have now decided to buy Coca-Cola in Mr Bee’s store instead). ( Questions: Was it a profitable move for Mr Bee ?Why did some of the consumers switch from Mr Eh’s store to Mr Beeh’s store ? What was the average price paid for a can of Coca-cola before April 1st and after April 1st. If we assume that the revenue of the inhabitants of Happy Valley remained constant what happened to their purchasing power ? ) 6 Economic Underpinnings of Competition Policy Market economy: the dual role of the price system: - relative prices and profits as determinants of consumer behaviours - prices and profits as determinants of investment and production The dilemma: how to make economic freedom compatible with economic efficiency ? 7 Consumer: Given my income,the price of fish and the price of bread I will not buy more than two loafs of bread par week. If I could buy bread at a lower price,I would buy more High price of bread High profit in bread making The dual role of the price of the price system Producer: Given the price of bread I make a large profit when I produce bread. I do not make so much profit on pastries. To make more money I will reduce the quantity of pastries and increase the quantity of bread. 8 The Role of Competition in Market Mechanisms Competition forces firms to reduce their cost to remain competitive Competition forces firms to reduce their profit margins to the minimum . Competition forces firms to innovate 9 Benefits from Competition Protects the standard of living of citizens Prevents abuses of market power and guarantees economic freedom Forces firms to be as efficient as possible 10 Competition and fairness Mr Eh reacted with anger to Mr Bee’s price slashing. He vented his anger by writing a letter to all the citizens of HappyValley denouncing his competitor and suggesting that he was smuggling imitation Coca-cola cans from Mayhem, a neighbouring country and selling them cheaply, passing them off as the real thing. Consumers organizations reacted with alarm and asked for an enquiry. A few customers stopped buying Coca-cola cans from Mr Bee and decided to buy from Mr Eh, even though he was selling at a higher price, because they were concerned about the quality of the products of Mr Bee. Mr Bee attacked Mr Eh for having written this letter. Question: What is the relationship between unfair trade practices and anticompetitive practices ? 11 Legal constraints on business practices: unfair trade practices -1) Practices forbidden by unfair trade laws: ( because they are “unfair” they discourage competitors from investing or entering into a transaction) : Ex: 1) diversion of a competitor’s customers through means other than competition on the merits (such as hiring away the competitor’s employees, inducing the competitor’s employees to leak strategic documents of their employer such as customer lists, business plans and other records); 2) attempts to induce selective dealers of a competitor into breaches of contracts or exploitation of a breach of contract or covert acquisition of a branded good by dealers not part of the distribution system of the manufacturer of the branded goods; 3) dissemination of unjustified derogatory comments about a competitor’s ability 12 Legal constraints on business practices: restrictive practices 2- Practices forbidden by commercial law ( restrictive practices, for example because they do not allow transactions to deliver the expected benefits ) : ex: resale price maintenance ex: misleading advertising, 13 Legal constraints on business practices: anticompetitive practices -3) Practices forbidden by competition law ( if anticompetitive that is if they restrain or eliminate competition on the market): Anticompetitive collusive practices ex: price fixing, ex: market sharing, ex: collective boycotts Anticompetitive abuses of dominant positions Exclusionary practices ex: tying, bundling, ex: refusal to deal ex price discrimination ex: predatory pricing , Exploitative practices ex: abusively high prices etc…. 14 Unfair competition, restrictive practices and anticompetitive practices Unfair trade practices are targeted at a competitor and are seeking to gain an advantage to the detriment of a competitor; they may not have an effect the market equilibrium (price and quantity) Restrictive practices are business practices which are prohibited independently of their effect on competitors or on the market Anticompetitive practices are aimed at lessening competition on the market (and are seeking change the market equilibrium); they may have an effect on all competitors (actual or potential) and consumers. 15 Ex: Resale price maintenance Ex: Refusal to deal Restrictive practices Always forbidden Unfair trade practices Forbidden if unfair ex: diversion of a competitor’s customers ex: dissemination of comments on a competitor ex copying of brand name or product Anticompetitive Practices forbidden only if anticompetitive effect on the market ex: price fixing ex: market sharing bid rigging ex : abuse of dominance bundling predatory pricing refusal to deal ex: some ( but not all) exclusive or selective distribution arrangements 16 Unfair trade practices are not necessarily anticompetitive practices ex: the diversion of a competitor’s customers by unfair means (means other than competition on the merits) may have no effect on the market if there are many competing firms Unfair trade practices Forbidden if unfair Anticompetitive Practices forbidden only if anticompetitive effect on the market 17 But unfair trade practices may also be anticompetitive practices ex: the diversion of a competitor’s customers by unfair means (means other than competition on the merits) can be an abuse of the dominant position of the firm engaging in the practice if it prevents its only competitor from competing. Unfair trade practices forbidden if unfair Anticompetitive Practices forbidden only if anticompetitive effect on the market 18 Competition When Mr Eh was charging 10 ( while Mr Bee was charging 9.5) for a Coca cola can, he lost a lot of customers ( 100 people deserted his store and he was left with only 150 customers for Coca-cola and 50 customers for Pepsi-cola). So on May 1st, Mr Eh retaliated by slashing his price to 9 to regain his lost customers and to attract some new the customer. When he slashed his price to 9 ( while Mr Bee was charging 9.5) he regained his lost customers (100), He gained half of the additional customers which Mr Bee had attracted thanks to his lower price ( 30 people who are even more interested in paying 9 rather than 9.5) and 40 more customers who would not have bought Coca-cola cans at the price of 9.5 but are willing to buy them at a price of 9). On May 15 Mr Bee lowered his own price to 9. ( Questions: what is the « competitive price » and how doe it compare to the original price? Who gained and who lost and how much was gained and lost?) 19 Price elasticities When Mr Eh and Mr Bee both charge a price of 10 per can of Coca-cola, each one has 250 customers ( 500 in total). When they both charge a price of 9 per can of Coca-cola, they have a total of 600 customers. Let us assume that each customer buys one can a day. When the price goes down by 10% ( (10-9)/10), the demand goes up by 20% ( 100/500) Hence the price elasticity of demand for Coca-cola cans is equal to + 20%/ -10%= -2 The demand is elastic ( larger than 1 in absolute value) meaning that a small decrease in price induces a bigger increase in total demand. Note also that the price elasticity for the demand of Mr Bee’s Coca-cola cans with respect to the price he charges ( when his competitor charges 10) is quite large: When Mr Bee lowers his price by (10-9.5)/10= - 5% then his sales increase from 250 to 410 or (160/250)= +64%. Hence the price elasticity of the demand for Mr Bee’s Coca-cola cans with respect to the price he charges ( when his competitor charges 10) is equal to ( +64/-5=-12.8 ). Such a large value of the elasticity indicates that Mr Bee and Mr Eh are potentially very close competitors. 20 Market Market definition is a tool to identify and define the boundaries of competition between firms. It allows to establish the framework within which competition policy is applied by the Commission. The main purpose of market definition is to identify in a systematic way the competitive constraints that the undertakings involved face. The objective of defining a market in both its product and geographic dimension is to identify those actual competitors of the undertakings involved that are capable of constraining their behaviour and of preventing them from behaving independently of an effective competitive pressure. It is from this perspective, that the market definition makes it possible, inter alia, to calculate market shares that would convey meaningful information regarding market power for the purposes of assessing dominance or for the purposes of applying Article 85. 1) COMMISSION NOTICE on the definition of the relevant market for the purposes of Community competition law (OJ C 372 on 9/12/1997) 21 Market and market shares Market: where competition takes place ( an answer to the question who is or could be competing with whom ?) Market definition includes « considering whether products: 1) can technically serve the same purpose; 2) are perceived by consumers as fulfilling the same need, and 1) whether they will do so in a way that is cost-effective enough for sufficient customers to consider them realistic economic alternatives ». Example: is Coca-cola on the same market as Pepsi cola, other carbonated drinks, other non alcoholic drinks, other drinks, water ? Defining a market with mathematical precision is rarely possible Market shares, a proxy for the determination of the absence or possible existence of market power, to be considered together with barriers to entry, can be calculated only after the scope of the market has been defined. 22 Market definition "A relevant product market comprises all those products and/or services which are regarded as interchangeable or substitutable by the consumer, by reason of the products' characteristics, their prices and their intended use." Relevant geographic markets are defined as follows: "The relevant geographic market comprises the area in which the undertakings concerned are involved in the supply and demand of products or services, in which the conditions of competition are sufficiently homogeneous and which can be distinguished from neighbouring areas because the conditions of competition are appreciably different in those areas". 1) COMMISSION NOTICE on the definition of the relevant market for the purposes of Community competition law (OJ C 372 on 9/12/1997) 23 Product market Demand-side substitutability : the extent to which customers could and would switch among substitute products in response to a change in relative prices or quality or availability or other features. Supply-side substitutability: the extent to which suppliers of alternative products could and would switch their existing production facilities to make alternative products in response to a change in relative prices, demand or other market conditions. 24 Defining a product market: the hypothetical monopolist test (SSNIP test). 'SSNIP' stands for 'small, but significant non-transitory increase in price: If enough customers of supplier A switched to supplier B if A increased its price by 5 to 10% (above the competitive level) to make the increase in price unprofitable for A, then A and B are on the same market. If enough customers of suppliers A and B switched to supplier C if A and B increased their price by 5 to 10% (above the competitive level) to make the increase in price unprofitable for A and B, then A, B and C are on the same market 25 Sources of information for market definition Evidence on characteristics and usage of products and consumer preferences Internal documents on the commercial strategies of firms such as internal communications, public statements, and studies on consumer preferences, market research, advertising plans, general marketing plans or business plans from the Customers and competitors can be interviewed. Information from customers about their buying patterns, how they have responded to previous price rises and how they are likely to react to a hypothetical price rise, whether there are switching costs ? Examination of patterns in price changes, for reasons not connected to costs. For example, two products showing the same pattern of price changes, for reasons not connected to costs or general price inflation, would be consistent with (although not proof of) these two products being close substitutes. 26 Sources of information for market definition Evidence of product switching by a relatively large proportion of customers to a rival product in response to a relatively small price rise in the product in question would indicate that these two goods are close substitutes Evidence of price divergence over time, without significant levels of substitution, would be consistent with the two products being in separate markets Evidence on own or cross price elasticities of demand. Own price elasticity: by which proportion does the quantity demanded for product A vary ( decrease or increase) when the price of A varies by 10% ( increase or decrease) , holding everything else constant? Cross price elasticity: by which proportion does the quantity demanded for product A vary ( decrease or increase) when the price of B varies by 10% ( increase or decrease) holding everything else constant? 27 Competition and Innovation Mr Bee realizes that price competition is now quite intense in the market for Coca-cola and wonders what he could do to gain back some of the customers of Mr Eh. So in July, Mr Bee decides that he cannot lower his price any further ( both because the price is already low and because it would be easy for Mr Eh to retaliate) but decides that he will create a space in the grocery store with stools and a table where consumers can sip their Coca-cola and chat of they feel like it. A number of young consumers like the idea of having a place to hang out and decide to buy their Coca-cola from Mr Bee rather than from Mr Eh so that they can be with their friends when they drink Coca-cola. Mr Eh sees that even though he has the same price as his competitor, he now has fewer curtomer because a lot of young people go buy their Coca-cola cans from Mr Bee. He decides to organize concerts with popular musicians in a small courtyard adjacent to his grocery store three evenings per week. After a few weeks however both grocers have to discontinue offering a “ café” space or entertainement because it is too costly for them given the intensity of the competition between them; Questions: what is the relationship between competition and innovation ? 28 Market product competition and innovation Market product competition can give firms an incentive to innovate Ex Michael Porter generic competitive strategie Cost leadership ( process innovation) Differentiation ( product innovation) Creating a niche market ( product innovation ?) Ex Arrow hypothesis 29 Market product competition and innovation Market product competition can limit the ability of innovators to access the market and therefore lessen innovation Ex Intel EC Decision ( targeted discounts) Market competition can limit the ability of innovators to finance RD or to exploit innovation. The prospect of post-innovation competition can deter firms from investing in RD Ex Schumpeterian hypothesis 30 Market product competition and innovation Limitation of price competition can facilitate the diffusion of innovation Ex)Game Consoles ( restrictive distribution agreements) I Phones ( restrictive distribution agreements) 31 Market product competition and innovation Innovation by a firm can make further innovation difficult or impossible Ex Role of Intellectual Property Rights in industries with incremental innovation processes ( are they defined too broadly ? In biotechnlologies) Ex Role of network effects ( Video games) Ex : Innovation preemption 32 Market product competition and innovation Innovation by a firm can increase the incentive of competitors to innovate Ex I Phone ( Apple) Innovation race for smart phones : Motorola Nokia Samsung 33 Market product competition and innovation Innovation by a firm can increase the incentive for market competition Ex: AMD's growing threat 34 Baker’s four principles First, competition in innovation itself – that is, competition among firms seeking to develop the same new product or process – encourages innovation. Second, competition among rivals producing an existing product encourages those firms to find ways to lower costs, improve quality, or develop better products. Third, firms that expects to face more product market competition after innovating have less incentive to invest in R&D. Fourth, a firm will have an extra incentive to innovate if in doing so it can discourage potential rivals from investing in R&D Jonathan B. Baker, Beyond Schumpeter vs. Arrow: How Antitrust Fosters Innovation The American Antitrust Institute, American Antitrust Institute Working Paper No. 07-04 35 Cartel On July 1st Mr Eh and Mr Bee meet each other at a social function and each one says to the other : I cannot raise my price for Coca-cola cans unless you also raise your price also because if I am the only one to raise my price I will lose my customers. But if we decide together to bring back the price to 10, we will make more money than today. They agree to follow this strategy and increase the price of Coca-Cola cans to 10. Further they agree that their employees will make daily visit to the store of the other to ensure that he effectively charge 10 per can. Finally, Mr Eh agrees to write a check of 5000 to the order of Mr Bee and Mr Bee agrees to write a check to Mr Eh for 5000 with the understanding that these chacks will be cashed by the beneficiary only if the signator has cheated on the agreement. The checks are given to to a mutually trusted cousin with the understanding that if one of them cheats the cousin will give to the victim of the cheating the check signed by the cheater so that the victim can cash it. ( Question who loses and who benefits ? Should such behaviour be condemned? Why do they choose to have the exchange of checks ?) 36 Competition will not Prevail Spontaneously Powerful lobbies try to get legal protection from competition ( ex agriculture in Europe, lawyers, cement manufacturers etc) Firms try to avoid competing in order to maintain their economic rent. They fix price and market shares. They erect barriers to entry to keep potential competitors away. Monopolistic firms or multinationals engage in exclusionary tactics to eliminate their weak competitors or in exploitative practices 37 Competition law is the Legal Instrument Necessary to Ensure that Competition Prevails where it can Play a Useful Role Prohibition of anticompetitive agreements between firms (horizontal or vertical) Prohibition of abuses of monopolies or dominant positions Merger control State Aid Control (in some countries) But there is no « one size fits all » competition law. The law must be adapted to the level of economic development, the specificity of the legal system, the socio-political circumstances of the country, etc... 38 Conditions that May Influence Entry 1) Sunk costs (create an asymmetry between the incumbent and the potential entrant which has not yet committed its funds and diminish the possibility of hit and run entry) 2) Structural conditions such as absolute cost advantages ( but will it last in the future ?), economies of scale (combined with sunk costs), economies of scope (combined with sunk costs), high capital costs (absolute magnitude of the total costs necessary to enter a market, and relative cost of borrowing money to fund the entry), reputational effects, network effects, barriers to exit, first mover advantages, vertical integration. 3) Strategic behaviour by incumbents such as predatory pricing, limit pricing, investing in excess capacity, fidelity rebates and bundled rebates, product differentiation and advertising (with some controversy), tying, exclusive dealing arrangements,patent hoarding. 4) Legal/regulatory barriers 40 40 Consumer surplus Definition: the consumer surplus attached to a unit of a good consumed is the maximum amount that the consumer would be willing to pay over and above what she pays for that unit rather than going without it. 41 41 Consumer surplus PA 10 Demand holding real income constant Q1 QA42d42 Effect of a price cartel on the consumer surplus 1) Net loss of consumer surplus (value ½ (1 x100)= 50 Price 2) Excess profit (1x500) Protecting consumer surplus: Goal of antitrust laws P=10 Exploitation Excess Profit P=9 Note: additional consumers when price goes down + 60 when Mr Bee lowers his price to 9,5 and an additional +40 when the price of Mr Eh goes down to 9 Exclusion Loss of consumer surplus 43 43 500 600 Quantity Cartels Decisions Fixing price Are Cartels unstable ? Allocating Market Shares Distributing Profits Controling Investment How to make them more unstable ? Preventing Entry Enforcing the Agreements Punishing the traitors 44 44 Merger 1 In October Mr Eh and Mr Bee learn that there is an investigation by the competition authority about their arrangement. They abandon their cartel and start competing again. The price of Coca-cola cans goes back down to 9. Consumers are happy but the grocers are making little money. Mr Bee who belongs to a wealthy family ( with a number of businesses both in FairyLand and abroad) proposes to Mr Eh to buy him out ( to takeover his grocery). He makes him an offer that Mr Eh refuses ( even though Mr Eh has two daughters to marry and needs cash). But Mr Bee announces plans to undertake a hostile takeover of Mr Eh’s company. Because the combination of the turnovers of the two groceries is above the threshold Mr Bee has to notify the proposed merger to the competition authority which Mr Bee does on November 12 2012. In his notification Mr Bee argues that consumers can easily travel to Harmony, the next town five kms away where there is another grocer, and that this threat means that the merged grocer of HappyValley will not be in a position to raise its price since it would likely face a loss of consumers which would make the increase in price unprofitable. Mr Bee also argues that since consumers can substitute water for Coca-Cola, the merged grocer will not be in a position to raise the price of Coca-cola in the future. Finally, he argues that because the merged grocer will now be selling more in town, it will be able to negotiate a better deal with suppliers ( since it will be buying more from them) which means that consumers will benefit ( through lower prices) from the enhanced efficiency of the grocery business. 45 Question: as an antitrust authority how do you look at the merger ? What are the main issues ? Merger 2 At the end of November 2012 ( before the Competition Commission of FairyLand has had made its decision on the merger between the groceries of Mr Eh and Mr Bee) , two things happen: First, the mayor of HappyValley announces that he will reverse the town’s policy and will henceforth allow the creation of a new grocery. Simultaneously a foreign grocer with a reputation for aggressiveness in pricing , the Allfornothing company has indicated that it wants to enter the grocery market in FairyLand and that it would like to start operations in HappyValley. It announces plans to take over Mr Eh’s groceries and offers a higher price than did Mr Bee. Mr Eh announces that he is ready to sell his grocery to the Allornothing company. The mayor of HappyValley believes that the arrival of Allfornothing will be good for the local consumers who have been hard hit by the economic crisis. However, small farmers and labor unions in the vicinity of Happy Valley as well as other retailers throughout FairyLand are unhappy about the possible arrival of Allfornothing because it has a reputation of being ruthless in its negotiations with suppliers and employees and they demonstrate daily against the arrival of Allfornothing.The minister for groceries gives interviews expressing his doubts about the wisdom of the transaction and repeatedly call the Chairperson of the Competition Authority ( although the Authority is independent) 46 Question: as an antitrust authority what elements do you take into consideration Crucial issues in merger cases - What is the relevant market affected (product market and geographical market)? -Do the firms have market power ? - Potential or real anticompetitive effect (or object) on the relevant market? : unilateral effects ( will the merging firm be in a position to increase its price unilaterally after the merger?) : coordinated effects ( will the weakening of competition due to the disappearance of the merged firm give an incentive to all firms to increase their prices somewhat ?) -Possible efficiency benefits? 47 Coordinated effects Mergers that may increase the sustainability of collusion ( tacit or explicit) by: -Reducing the number of participants -increasing symetry -Elimination of « mavericks » -creating structural links -Reducing incentives to innovate -Increasing multi-market contacts -Vertical mergers which may increase transparency 48 Coordinated effects Imagine that there are four competitors A, B, C D each selling 24 units per day and that the price elasticity of demand for each of the competitors is equal to - 5 (when the price of the other competitors is 10). This means that if A increases his price by 5% (to 10.5) he will lose 25% of his customers ( 6 customers) and will sell only 18 units. Where will the 6 former customers of A go ? Each of B, C, D will have two more customers and will now sell 26 each. Because of his big loss in consumers A may not have an incentive to increase his price alone. But what happens if A acquires 100% of B? If A increases its price by 5% it will lose 6 customers but 2 of them will go to B which is now owned by A. So the group A+B will now lose only 4 customers if A increases its price by 5%. Thus, the group A+B may have more incentive to raise the price of A than firm A had before the merger. This may lead to a softening of the pressure of price competition throughout the industry. 49 Exclusion and Exploitation At the end of December 2012 the Competition Authority of FairyLand gives its approval to the merger between Mr Eh and Allfornothing and the grocery of Mr Eh is renamed the GreatBargain grocery. Mr Bee is very concerned about the new competition. However, Mr Bee also owns the electricity distribution company in HappyView called the SuddenFlash company. This electricity company has a local monopoly. You cannot operate a business without electricity as you need electricity for refrigeration, for the alarm system, for the cash register etc….. It just happens that the electricity contracts for the Eh and the Bee groceries have run out and must be renewed. The cost of producing 1000 KWH is equal to 1 with 0,6 of variable cost and 0,4 of fixed costs. In their previous contract the Eh and Bee groceries paid 1.1 per 1000 KWH. The Allfornothing company calls the Sudden Flash company in HappyView. The SuddenFlash Company announces to Allfor nothing that it has revised its pricing policy and that the price for 1000 KWH is now equal to 2. Simultaneously, the Bee grocery signs a contract with Sudden Flash for a price of 0.5 for 1000 KWH. The GreatBargain grocery complains to the Competition Authority. 50 Question How does the Competition Authority analyze the situation ? Abuse of dominance Mr Bee is concerned about the reference to the Competition Authority made by its competitor Allfornothing. Also he notes that the GreatBargain grocery not only has very competitive prices but also offers its customers deals which sound very attractive to them. As a result a lot of customers now shop for their Coca-cola at GreatBargain grocery and Mr Bee is left with 15 regular customers whereas GreatBargain has 45 regular customers shopping for Coca-Cola even though Mr Bee sells his Coca-cola cans at the same price as GreatBargain. Mr Bee notices that for a price of 9.50 (very slightly above the competitive price of Cocacola cans) GreatBargain offers customers the possibility to buy a can of Coca-cola and a glass. The reason GreatBargain is able to offer such a great bargain is that, since it sells a large number of Coca-colas cans in HappyValley, it can order a large number of glasses ( from abroad) and gets a huge discount on the price of glasses. Since Mr Bee is only selling a few Coca-cola cans everyday, he would not get the same discount on the price of glasses and he would be unable to duplicate the offer of GreatBargain. Mr Bee complains to the Competition Authority that the practice of GreatBargain is illegal. 51 How should the Compettion Authority look at this issue ? Thank you very much frederic.jenny@gmail.com 52