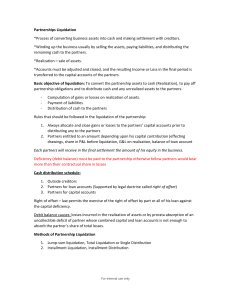

Partnership Liquidation

advertisement

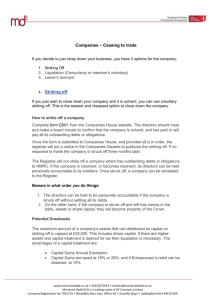

Partnership Liquidation Dissolution with Liquidation • A partnership is liquidated when its business operations are completely terminated or ended. The partnership assets are sold, the partnership creditors are paid, and the remaining assets, if any, are distributed to the partners as a return of their investments. Partnership dissolution with liquidation may be caused by any of the following factors: • The accomplishment of the purpose for which the partnership was organized. • The termination of the term/period covered by the partnership contract. • The bankruptcy of the firm. • The mutual agreement among the partners to close the business. Marshaling of assets -involves the order of creditors’ rights against the partnership’s assets and the personal assets of the individual partners. The order in which claims against the partnership’s assets will be marshaled is as follows: 1. 2. Partnership creditors other than partners Partner’s claims other than capital and profits, such as loans payable and accrued interest payable. 3. Partner’s claim to capital or profits, to the extent of credit balances in capital accounts. The order of claims against the personal assets of the individual partners is as follows: 1. Personal creditors of individual partners 2. Partnership creditors on unpaid partnership liabilities regardless of a partner’s capital balance in the partnership. Right of offset – involves offsetting a deficit in a partner’s capital (debit balance in the capital account of a partner) against the loan payable to that partner. The loan payable to a partner has a higher priority in liquidation than a partner’s capital balance but a lower priority than liabilities to outside creditors. Definition of Terms • Dissolution – the termination of a partnership as a going concern; it is the termination of the life of a partnership. • Winding up – the process of settling the business or partnership affairs; it is synonymous to liquidation. • Termination – the point in time when all partnership affairs are ended. • Liquidation – the interval of time between dissolution and termination of partnership affairs. • Realization – the process of converting non-cash assets into cash. • Gain on realization – the excess of the selling price over the cost or book value of the assets disposed or sold through realization. Definition of Terms • Loss on realization – the excess of the cost or book value over the selling price of the assets disposed or sold through realization. • Capital deficiency – the excess of a partner’s share on losses over his capital. • Deficient partner – a partner with a debit balance in his capital account after receiving his share on the loss on realization. • Right of offset – the legal right to apply part or all the amount owing to a partner on a loan balance against deficiency in his capital account resulting from losses in the process of liquidation. • Partner’s interest – the sum of a partner’s capital, loan balance and advances to the partnership. Types of Liquidation • Lump-sum Liquidation – this is a process whereby the distribution of cash to the partner is done only after all the non-cash assets have been realized, the total amount of gain or loss on realization is known and all liabilities have been paid. • Liquidation by installment or piecemeal liquidation – this is a process whereby assets are realized on a piecemeal basis and cash is distributed to partners on a periodic basis as it becomes available; even before converting all non-assets into cash. Statement of Liquidation • The Statement of liquidation is a statement prepared to summarize the liquidation process. It is the basis of the journal entries made to record liquidation. This statement presents in working paper form the effect of the liquidation on the Statement of Financial Position. It shows the conversion of assets into cash, the allocation of gain or loss on realization, and the distribution of cash to creditors and partners.