Sample Title

advertisement

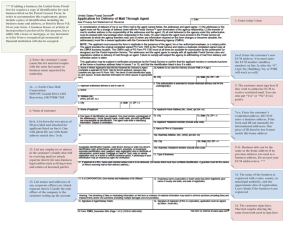

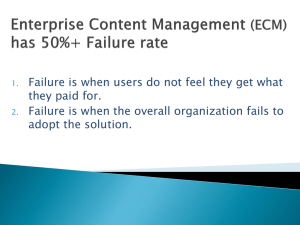

ECM Market Trends 2005 & Industry Best Practices Prepared by Edward Dabran, Doculabs October 2005 ECM Trends and Best Practices Table of Content • • • • • • • 2 Key Business Drivers for ECM Key Market Trends Current Technology Challenges ECM Maturity at the End-User Level Developing an Effective ECM Strategy Lesson Learned, Potential Pitfalls, and Traps to Avoid But first…A little about Doculabs © Doculabs 2005 About Doculabs 3 © Doculabs 2005 Who is Doculabs? Definition Doculabs is a consulting firm focusing exclusively on document and content-based applications. Our services lower the business risk of investment decisions through client specific recommendations, objective analysis and in-depth research. This approach is based on our fundamental belief that in order to protect a client’s long-term interest, advisors shouldn’t be service providers. Quick Facts 4 • • • • Founded in 1993 Headquartered in Chicago Privately held Served over 400 customers © Doculabs 2005 About Doculabs Our Key Differentiators Analysis without the bias of integration services or vendor preferences Research of suppliers’ capabilities and financial service customers’ best practices (operational and financial metrics) Recommendations based on the needs of your firm, not the industry at large (actionable deliverables and emphasis on knowledge transfer) 5 © Doculabs 2005 What actually is ECM… 6 © Doculabs 2005 ECM, the AIIM definition • Enterprise Content Management (ECM) is the technologies, tools, strategies, and methods used to capture, manage, store, preserve, and deliver content and documents related to organizational processes across an enterprise • ECM is not a technology but a concept which incorporates a variety of core technologies 7 © Doculabs 2005 ECM Business Drivers 8 © Doculabs 2005 ECM Business Drivers Key Statistics Organizational Information 20% structured 80% unstructured • “7.5% of documents are lost forever” • “U.S. managers spend an average of 4 weeks a year searching for or waiting on misfiled, mislabeled, untracked, or ‘lost’ papers” • “Large organizations lose a documents every 12 seconds” Unmanaged information is growing at roughly 36% annually 27% of ECM users are highly disappointed in their ECM Implementations Source – Cuadra Associates 90% Source – Jupiter Research There is a 10x cost of compliance by taking a one-off versus an integrated approach to compliance projects A conservative failure rate estimate of ECM technologies within large organizations is 50% remains unmanaged Unstructured Information The global market for compliance information management will grow at 22% a year thru 2009 and will pass the $20 billion mark that year Source – Jupiter Research Source – Gartner Group 9 © Doculabs 2005 ECM Business Drivers Why You Do It: Business Drivers for ECM Offense: • Operational efficiencies, Cost reduction and productivity improvement • Customer demands: servicing and satisfaction requirements, personalized communication, self service Defense: • Compliance and litigation: risk and cost reduction • Other risk reduction: business continuity, security requirements, etc. Offense Defense • Customer demands • Operational efficiency • Compliance and litigation • Other risk reduction IT • Effectiveness • Efficiency IT: – 10 IT effectiveness and efficiency through resource consolidation, cost reduction, and strategic enabling for future strategic initiatives © Doculabs 2005 ECM Business Drivers Why Companies Buy ECM Technologies? 2003-2004 2004-2005 56% 45% – Improve Efficiency 32% 26% – Reduce Costs 17% 11% – Increase profits or improve performance 7% 8% 29% 31% – Better Customer Service 16% 15% – Leadership, competitive advantage 7% 8% – Faster turnaround, improved response 6% 8% 15% 24% – Compliance 11% 19% – Risk Management / Business Continuity 4% 5% What is your most significant business driver for acquiring an ECM solution? Cost-Driven Users Customer Driven Users Risk-Driven Users Source: AIIM User Survey: The Practical Application of ECM Technologies 11 © Doculabs 2005 Key Market Trends 12 © Doculabs 2005 Key Market Trends Increasing Complexity • Increasing complexity in a quickly growing market • Migration from niche applications to infrastructure platforms • Applications are getting more complex and providers are expanding their products to match these needs 13 © Doculabs 2005 Key Market Trends The ECM Technology Stack EDMS ERM/COLD Digital Asset Management Portals Taxonomy and Search Collaborate Collaboration Content Integration Web Content Management Organize Security (Document, Perimeter) (Imaging, Workflow, Document Management) Process Management Forms Records Management Store and Distribute Archival and Storage Print and Distribute 14 © Doculabs 2005 Key Market Trends Industry Consolidation: M & A Activity (As of Dec 2004) FileNet Watermark, Saros, Greenbar, eGrail, Shana, Yaletown 1995/96, 2002/03 Eastman Software Wang Software 1997 iManage FrontOffice 1997 2001 2001-04 EMC Legato, Documentum 2003/04 Open Text Gauss, IXOS, Artesia, Quest Documentum Box Car, eRoom, BullDog, TrueArc, AskOnce IBM Tarian, Green Pastures, Venetica 2002-03 Global 360 (eiStream) Eastman Software, Viewstar, Keyfile, Identitech (BPM) 2001-04 Stellent InfoAccess, INSO, Kinecta, Ancept, Optika 1999-2004 2004 Veritas KVS 2004 Oracle Collaxa 2005 15 Interwoven iManage, Software Intelligence 2003/04 Microsoft NCompass Labs Adobe Q-Link Vignette Epicentric, Intraspect, TOWER 2003 Hummingbird PC DOCS, EDUCOM 1999 2004 2003/04 2004 2004 Mobius eManage HP Persist 2004 Captaris IMR MSFT- Groove Networks, EMC-Captiva Next 3 to 5 years… © Doculabs 2005 Key Market Trends Some Perspective on IT Market Giants But first… a three dimensional vendor “risk analysis methodology 1. Vendor risk 2. Product risk 3. Implementation risk Like the old analogy… Do you want it Faster, Cheaper or Better? You can normally get two but not all three. 16 © Doculabs 2005 Key Market Trends Some Perspective on IT Market Giants • EMC – Combines EMC dominance in storage management with Documentum dominance in content management for “ILM” – ApplicationXtender significant contender for mid-market – Directly faces key ECM issues of the day: how to do ILM, how to do mid-scale ECM • IBM – Current positioning: provides ECM capabilities tied to WebSphere, DB2 – Strengths include dominant IT presence, WebSphere centrism, great ECM potential, content integration to other data sources, global reach – Most implementations are highly customized 17 © Doculabs 2005 Key Market Trends Some Perspective on IT Market Giants • Microsoft – Addressing ECM challenge with operating environment (Longhorn), Office, SharePoint and Content Manager – Will address enterprise ECM, with “small time” ECM solution– and be a disruptor for the rest • Oracle – Not just Metadata, but also the unstructured content physically resides in a structured store – The basis of their position is that all data is better off being stored in a structured store, i.e. “the database” – They are not trying to win the feature war, rather trying to compete on simplicity and scalability 18 © Doculabs 2005 Technology Challenges 19 © Doculabs 2005 ECM Technology Challenges Technology Challenges 2005 • Information Lifecycle Management – ILM = “proactive management of storage/archive that is business-centric, unified, policy-based, heterogeneous, and aligns storage resources with data value” (ECM) – Easier to describe in marketing-speak than actually implement • Enterprise Content Integration (ECI) – Complex integration is required up or downstream from content repositories – Effort is perceived as too high to consolidate into a single repository, while ECI integration is perceived as acceptable • Taxonomy Development – It’s a significant undertaking… and can pull you under if you’re not careful – Few automated tools exist to assist with this effort • Email Management – Implementations and vendor capabilities continue to improve – Primary requirements: • 1) scalability, 2) archival, and 3) advanced records management capabilities for e-mail – Few vendors adequately address all three 20 © Doculabs 2005 ECM Technology Challenges Technology Challenges 2005 • Electronic Forms – Significant confusion exists within the market…Adobe…IBM (PureEdge)….Exstream…all coming from different directions to solve the same problem – Correspondence systems, requiring interaction, have been slow to adopt more advanced forms capabilities • Document Composition – Most system generated documents are born out of applications / tools that are 10+yrs. old – The “average” financial service firm has 6-9 different publishing and document composition utilities in production – typically from 5+ different vendors – Conversion costs are falling, via the use of offshore service providers and conversion utilities • Web Content Management – Usage has grown beyond initial design – Confusion over tools and approaches – logical segmentation of source code management, site deployment, design tools, and content management, etc. 21 © Doculabs 2005 ECM & Service-Oriented Architectures (SOA) 22 © Doculabs 2005 ECM Market Trends Understanding the Evolution of ECM Inception Phases Chaos B Rationalization Stabilization C Performance Surplus Functionality Customers’ capacity to ingest functionality 1990 • Market definition 23 A Point at which industrywide standards reached adequate maturity, e.g. XML, Web services, SOA Performance Deficit Point where customer requirements have been met by vendor functionality developed in a nonmodular approach Modular functional development Supply-side functional development Redirect this investment toward modular architectures Time 1995 • First round of consolidation begins • Budgets still remain at the departmental level 2000 2005 Component object model initiatives undertaken, but failures persisted due to standards not being practical enough 2010 • SOA goes mainstream • ECM is an enterprise architecture-based decision • DB vendor market share now at risk Partial Source: Innovator’s Solution by Clayton Christianson and Michael Reynor © Doculabs 2005 ECM Market Trends ECM Market Evolution Rich Clients Portals Presentation and Interface Doculabs’ Organizational Readiness Framework Portals Taxonomy and Search Collaborate Collaboration Taxonomy and Search Digital Asset Management ERM/COLD EDMS Data Management Records Management Archival and Storage Event Aggregation Presentation Manager Portlet Programmatic Interface text Thick Client Instrumentation Presentation Interface Thin Client Management Mobile Device Process Business Services Event Sequencing Data Services Archival and Storage Current State Application Services Print and Distribute Forms Process Access Interface Business Monitoring Business Intelligence / Reporting Process Automation Workflow Application and Data Systems Future State © Doculabs 2005 Infrastructure Management/ Instrumentation Application Services Event Services Content Middleware Metadata Repository Web Content Management Print and Distribute 24 Autoclassification Engines Content Integration Business Process Mgmt Records Management Store and Distribute text Security Applications / Data Systems Data Access Interface Real-time Analysis text Rules Engines Business / Instrumentation Translation Engine Automated Business Response Universal Abstraction Layer Data Services Digital Asset Management Forms Business Services Event Correlation ERM/COLD Process Management Real-Time Event Processing Web Content Management Content Integration Organize Process and Collaborative Services Enterprise Application and Data Systems (Imaging, Workflow, Document Management) Security (Document, Perimeter) EDMS Presentation/ Interface Services Doculabs’ Enterprise Reference Architecture Collaboration Design/ Modeling Browsers Assembly/ Development Content creation/ presentation/ access Integration Interaction Services Transformation Globalization / Language Services Translation Enterprise Lifecycle Services Creative Desktop Productivity Page Navigation Manager Data View Manager Messaging Personalization Engine Data / Interface Transcoding Content / Directory Services text Directory (User / Content / Resources / Metadata) Repository (User / Content / Resources / Metadata) Grid Computing Resource Mgr Application Services Deployment Services Development Support Resource Management Persistence Services Load Balancing Security Scheduling Caching Failover Adapters Web Services Legacy RDBMS Custom API Legacy Data Abstraction Data Modeling Deployment/ Maintenance Evolving Components Component Grid Computing Resources Servers Application Servers / Clusters Edge Servers Storage Workstations DASD RAID SAN NAS Optical/ Tape Peripherals Network Devices Routers Hubs Firewalls Load Balancer Printers Switches System Monitor Mobility Services IVR/ Telephony Scanners Analysis/ Optimization Today’s Components Current ECM Stack Primary ECM Primary Enterprise Reference Reference Architecture Layers Architecture Layers Enterprise Reference Architecture ECM Market Trends Content Management Reference Architecture Content Presentation/Access Services Capture Event Aggregation Delivery Optical Character Recognition Imaging Protocol Tnanslation Navigation Content Delivery Encoder Document Syndication Rights Management Presentation Renditioning Process and Collaborative Services Event Sequencing Workflow Document Process Management Word Processing Computer Aided Design Presentation Charting Spreadsheet Forms Collaboration Rules Engine Analytics Prioritization Content Retention Event Analysis Packaging Routing Content Lifecycle Content Lifecycle Escalation Escalation General General Messaging Publication (Push/Pull) File Sharing Whiteboard Web Content Style Sheet XML Content and Process Event Services Schema Design Taxonomy Content Middleware Services Security Perimeter Security Identity Management Firewall Encryption Anti-Virus Authentication Virtual Private Network Authorization Directory Taxonomy User Auto-Categorization Ontology Metadata Metadata Utility Services Storage Federated Retrieval Data Integration Unstructured Content Structured Content Adapters Adapters Abstraction Interface Extract,Transform, Load Translation Aggregation Electronic Forms Print Composition Version Control Deployment Search Indexing Translation Natural Language Infrastructure Management Data Management Services Integrated Development Environment Repositories Event Correlation Real-Time Event Processing Storage Structured Unstructured Management Location Relational Database Object Relational DB File System E-Mail Migration Primary OLAP Metadata Document Collaboration Backup Near Line Recovery Distributed Cache Process / Workflow Design Optimization Simulation Report Design 25 © Doculabs 2005 Content Creation and Management Services Enterprise Approval Management Desktop Publishing ECM Market Trends Summary of Trends and Implications • Organizations are evolving their IT strategies in two ways: – – • The ECM market has historically been defined by types or categories of products – but this is changing – • Organizations (and the vendors that serve them) are beginning to think about the “layers” of services required to address application requirements This market evolution will take time – – – 26 Developing standards-based enterprise reference architecture (ERA) and service-oriented architecture (SOA) strategies – To provide a roadmap for IT technology decisions (including ECM) – Which simplifies re-use of services across applications, improves flexibility, etc. Embracing additional strategic concepts, such as: – Infrastructure consolidation – Integrating structured and unstructured information – Information lifecycle management (ILM) Service-oriented architectures are just starting to become important for large enterprises It will take a few more years before this is truly important for the mid-market Vendors are trying to stay ahead of the curve – Vendors beginning to offer frameworks, some modules, or both – This is also what OEM partners will look for © Doculabs 2005 ECM Market Maturity 27 © Doculabs 2005 ECM Market Maturity ECM Market Maturity Levels • Most firms has invested and implemented some ECM capabilities – • Many original systems intended as simple point solutions – – – • Over half have quickly become mission critical and transactional in nature Both user populations and volumes have grown The number of LOB applications requiring “electronic document capabilities” continues to create a backlog for IT Many ECM implementations remain unsatisfactory – 28 Ranging in age from 3-10 years, many 2nd generation when compared to other primary application environments © Doculabs 2005 ECM Market Maturity Some Lessons Learned • Requirements are not mapped to vendor capability – • Integration effort is underestimated – • Must maximize Participation and Accuracy Effective enterprise roll-outs are rare – – 29 Clean-up, Taxonomy, Capture, Indexing User frustration level is high because of complexity of usability of ECM systems – • Generally 30% of IT costs Ingesting content is harder than you think – • There is no single clear vendor winner Excel at smaller first phase: plan big but implement small Be excessively proactive © Doculabs 2005 ECM Market Maturity ECM: How do you compare? Characteristics Strategic Tactical § No vision or strategy for ECM’s role within the enterprise § Have over six content technologies that are independent and nonintegrated § Don’t have records management capabilities § Rely on the file system for content management Laggards § Have departmental strategy for ECM related technology § Strategy is driven by tactical reactionary application requirements § Have integrated one or more content solutions to each other or with a structured data source in an application § Have some for of records management capability Majority § Have a complete enterprise vision and strategy for ECM technologies across the information lifecycle § Strategy is driven by an utility computing approach § Have integrated structured and unstructured data into a unified access layer driven by metadata § Have a comprehensive and integrated records management system Leaders ECM is becoming a platform decision within organizations. Since unstructured information comprises of over 80% of an organization’s information assets on average, ECM has become one of the top three priorities for a vast majority of CIO according to surveys conducted by Doculabs, industry groups, and publications . Most organizations are developing strategic plans and roadmaps related to ECM technologies. 30 © Doculabs 2005 ECM Market Maturity ECM Project Challenges 2003-2004 2004-2005 Understanding / specifying requirements 32% 15% Planning / managing implementation 21% 28% Justifying the investment 20% 23% Employee commitment 10% 16% Content control, data migration 9% 12% Selecting products, suppliers 7% 6% What is your most challenging aspect of content management? Source: AIIM User Survey: The Practical Application of ECM Technologies 31 © Doculabs 2005 ECM Best Practices and Benchmarks 32 © Doculabs 2005 ECM Best Practices and Benchmarks ECM ROI Expectations When does your organization expect a full return on investment for its ECM investment? Within 3 months of completion 2% Within 6 months of completion 9% Within 12 months of completion 34% Within 18 months of completion 54% Source: AIIM Industry Watch: ECM Implementation Trends 2005 33 © Doculabs 2005 45% ECM Best Practices and Benchmarks Measurement of ROI When does your organization measure the return on investment for ECM projects? 1 - 12 months of completion 28% 57% 13 - 24 months of completion 29% 25+ months of completion 7% ROI is not measured 36% Source: AIIM Industry Watch: ECM Implementation Trends 2005 34 © Doculabs 2005 ECM Best Practices and Benchmarks Overall ECM ROI Experiences Overall, summarize the return on investment of your organization’s ECM implementations? Fell far short of expectations 6% Fell short of expectations 21% Met expectations 51% Exceeded expectations 17% Greatly exceeded expectations 4% Source: AIIM Industry Watch: ECM Implementation Trends 2005 35 © Doculabs 2005 72% ECM Best Practices and Benchmarks Financials – Industry Benchmarks • Most ECM Cost/Benefit Analysis is a one-time event, – – • 9 out of 10 firms over-invest in software/hardware, and under-invest in support staff (use Capital Exp. and minimize operating costs ) – 36 Normally based on the initiation of a project But, the responsibility for continued monitoring is unclear, and this not done Why?...Keeping headcount low is key for most IT organizations, and few have “bench” staff with the specialized knowledge to address detailed ECM requirements • Attributing benefits back to specific ECM investments is difficult, but not a justification for the lack of any level of financial visibility • Successfully “selling” business unit managers requires a systematic approach of monitoring and re-forecasting, typically above and beyond what is required for annual budgeting • The “credibility” of financial estimates is driven primarily by the frequency of measurement and reporting rather than the magnitude of impact © Doculabs 2005 ECM Best Practices and Benchmarks Process – Industry Benchmarks • Begin with a metrics-based diagnosis of current processes – manual or automated - in terms of complexity and risk – Most clients fail to understand the growth in complexity as they scale-up operating and support diverse processes 37 © Doculabs 2005 Generalized Process – Front End Capture 38 © Doculabs 2005 Example: Complexity and Failure Points Legend C Complexity 39 © Doculabs 2005 F Failure ECM Best Practices and Benchmarks Process – Industry Benchmarks • Begin with a metrics-based diagnosis of current processes – manual or automated - in terms of complexity and risk – Most clients fail to understand the growth in complexity as they scale-up operating and support diverse processes • Understand the business economics driving a process and anticipate the associated costs of document processing tasks – Taking an accurate inventory is the first step – sources and destinations of documents by “role” or user – Measuring at a high-level, the costs of document processing tasks • Map out “future state” process scenarios and supporting systems – By documenting processes, organizations can quickly recognize latency points and redundant activities – Systems architecture is the last step, and typically many components already exist • Ultimately all this effort culminates in a credible ROI 40 © Doculabs 2005 ECM Best Practices and Benchmarks Quality – Industry Benchmarks • Process design has the single biggest impact on quality – Many firms over-engineer a process, adding complexity, and undermine process-level quality objectives • Setting baseline quality expectations is critical – During tests, “acceptable” ranges are set for character, field, document and process level quality levels • Comparison of samples is key to early detection of problems – and should be done by vendor and buyer independently • Root cause analysis is a continuous process • Recognize quality and productivity, at the operator level, are tied to compensation, and improving one variable (such as quality) can result in negative effects on productivity – Without adjusting compensation formulas, implementing changes is difficult 41 © Doculabs 2005 Doculabs’ Methodology 42 © Doculabs 2005 ECM Strategy Methodology Doculabs ECM Strategy Development Methodology Conceptual Design, Reference Architecture Future State Definition Enterprise Requirements Current State Definition ECM Methodology 43 1 and Recommendation Consolidation Strategy Analysis 2 3 4 5 Taxonomy Development Selection and Deployment Strategy Business Case Assessment Candidate Solution Analysis Metadata 6 7 © Doculabs 2005 8 ECM Strategy Methodology Keys for Actionable Strategy • Determine needs of the business – IT can’t do it alone • The decisions made in the strategy must have executive management commitment for follow-through • Develop measurements early in the process • Think long term • Develop a post implementation plan and budget for ongoing costs • Realization the end result of the strategy will not include any direct savings 44 © Doculabs 2005 ECM Strategy Methodology Potential Pitfalls and Traps to Avoid • Lack of a good strategy and reference architecture results in higher costs and lack of cohesiveness • Mapping your business requirements to a single vendor’s capability – Objectively judge the benefits of a good sales relationship vs. choosing a vendor serving your long-term needs • Integration effort is underestimated • Ingesting content is harder than you think • User frustration level is high because of complexity of usability of ECM systems • Adoption psychology during roll-out is not considered 45 © Doculabs 2005 Conclusion 46 © Doculabs 2005 Conclusions • The implementation of ECM technologies requires detailed operational, IT, organizational and procurement approaches to REMAIN successful over time • Most customers focus on the technology or functionality, but neglect operational metrics and process improvement issues – “Fixing” problems after implementation can dramatically increase costs • Doculabs augments internal teams by providing strategy development and periodic independent assessments, grounded in industry data and benchmarks 47 © Doculabs 2005 Some final thoughts about Doculabs Service Offerrings…. 48 © Doculabs 2005 Doculabs Service Offerings Doculabs ECM Strategy Development Methodology Conceptual Design, Reference Architecture Future State Definition Enterprise Requirements Current State Definition ECM Methodology 49 1 and Recommendation Consolidation Strategy Analysis 2 3 4 5 Taxonomy Development Selection and Deployment Strategy Business Case Assessment Candidate Solution Analysis Metadata 6 7 © Doculabs 2005 8 Doculabs Service Offerings Additional Service Offerings Analysis Measurement Model Development Contract Negotiation Assistance Scenario Development Preliminary Reference Architecture Development Implementation Deployment Options Assessment Content and Process Technology Portfolio Management Current Process Mapping Vendor Facilitation Change Management Communications Planning 50 Design Implementation & Rollout Adoption Services Communications Plan Project Management Services PMO Definition Rollout and Change Management Definition Measurement Analysis © Doculabs 2005 Thank You Contact Info: Edward Dabran Doculabs, Inc. 760-414-9888 51 © Doculabs 2005