Slavic 401K Presntation

QUALITY

Business Solutions, Inc.

401(k) PLAN

• Slavic401k.com is a Third Party Administrator,

Record-keeper, NASD Registered Broker Dealer, and

Registered Investment Advisor.

• The Quality Business Solutions 401k plan Trust

Account is established directly with the Mutual Fund companies that make up the investment platform:

Vanguard, Fidelity, T.Rowe Price, Federated,

American Funds etc.

• The funds in the plan are traded through the Fidelity

Institutional Funds Network.

CEFEX CERTIFICATION

How are you planning your retirement

Social Security

Social Security is now perceived as a fragile and inadequate solution which will have to be substantially supplemented.

Individual Savings Programs

Most people, despite their good intentions, do not save on a regular basis and their investments do not increase as projected.

Employer Sponsored Retirement Plans

These plans offer the most logical, efficient way for employees to save for the future.

Social Security

1950: 6.46 Workers Supporting each retiree.

2000: 4.48 Workers Supporting each retiree.

2030: 2.46 Workers Supporting each retiree.

2005 Budget: Inflows of $668 Billion with outflows of $534

Billion. The surplus of $134 Billion is spent elsewhere!

2014: There will be more outflows than inflows, and will create deficits of more than $600 billion per year.

Source: Cato Institute

Life Expectancy

2000 IRS Life Expectancy Table

Less Than

Less Than Average

Less Than Average

Average Life Expectancy at Age 65 = 20 Years

Average Life Expectancy

Above Average Life Expectancy

Above Average Life Expectancy

Above Average Life Expectancy

50%

Ave.

50%

65 70 75 80 85 90 95 100

You Have to Plan to Live

Longer Than Average

401(K) Plan Advantage

Payroll Deduction

Pre-Tax Contributions

Tax-Deferred Growth

“Uncle Sam doesn’t offer many gifts. This is one. If someone offered you free money, would you refuse it?

Probably not. But that’s just what your doing if you don’t contribute to your 401(k).”

CNN Money.com

The Math

After Tax Pre-Tax

Contribution

Taxes 28%

$ 1,000 $ 1,000

-280 0

Net Contribution 720 1,000

Account Growth 58 80

Tax on Interest

Net gain

Total Accumulated

-16

42

$ 762

0

80

$1,080

*Hypothetical Return for illustrative purposes only. Your actual return will vary and may be lower. You pay income taxes when you withdrawal funds at retirement.

Long Term Investment

RETIREMENT

At age 59½ you can take your money out without a 10% penalty

TERMINATE EMPLOYMENT

Cash-out with a 10% penalty or rollover to another qualified plan or IRA with no penalty

DEATH or DISABILITY

10% Penalty Waived

Participants Loans

Borrow 50% of Vested Account Balance

$1,000 Minimum

$50,000 Maximum

Repay Principal & Interest Thought Payroll Deduction

Continue Participation

Financial Hardship Withdrawals

Purchase Home

Avoid an Eviction or Foreclosure

Catastrophic Medical Expenses

College Education Expenses

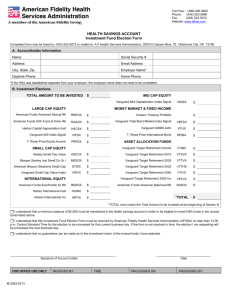

American Funds (R4)

Growth Fund of America

Reimbursed to

Participant

Expense Ratio

12(b)-1

Sub TA

.77%

.25%

.15%

Net Expense .37%

Substantially lower cost investment choices

Better overall performance

Advisor bias eliminated

Compliance

Participant Plan Fees

Annual Administration Fee: $39

Plan’s Assets

$0 – 1M

$1M – 2M

$2M – 3M

$Over 3M

Asset Fee

0.95%

0.60%

0.40%

0.30%

Managed Portfolios available for an additional 0.25% management fee

Mutual Funds the 401(k) plan Investment of

Choice

Mutual Fund - A professionally managed pool of money invested in a variety of stocks, bonds or other securities depending upon the funds objective.

The Quality Business Solutions 401(k) Plan

The investment line-up is open architecture and comprises no-load, mostly 4 and 5 star rated mutual funds.

The

Quality Business Solutions

401(k) Plan

The funds are reviewed annually for performance and suitability by the Quality Business Solutions

Investment Committee with the advice of the Plan’s

Registered Investment Advisor.

All mutual fund revenue is reimbursed to participants.

Aggressive, Moderate and Conservative participant portfolios.

Investment advice is available to all participants.

Long Term Performance

1 Year Return

Dow Jones Industrial Average (INDEX)

Long Term Performance

All Data

Dow Jones Industrial Average (INDEX)

Long Term Performance

1 Year

Nasdaq Composite Index (NASDAQ GM)

Long Term Performance

All Data

Nasdaq Composite Index (NASDAQ GM)

Long Term Performance

1 Year

Dow Jones Wilshire 5000 Composite Index (INDEX)

Long Term Performance

All Data

Dow Jones Wilshire 5000 Composite Index (INDEX)

The basic principle of risk and return

Greater return potential= greater risk

The longer the time frame, the more risk you can take

Diversify to reduce risk

Very conservative investments have the risk that they may not keep up with inflation

When planning for your retirement, a good rule of thumb is that the more growth you want to achieve, the more risk you must generally assume.

Controlling Risk

Investment Strategy

A study by Gibson Capital Management found that a diversified portfolio split evenly among four different asset types did better over the long run with less risk than any one of the assets classes separately. The diversified portfolio had 25% allocated to each asset class and covered the 26 years between 1972 and 1997(Sun Sentinel 5/23/99).

Number of years with

The biggest return

Number of years

With a loss

Number of years with

Return over 20%

Standard deviation

(risk measure)

Average compounded

Return

S&P 500

4

5

11

16

13%

International

7

6

10

22

13%

Reits

10

4

10

16

14%

Commodities

5

6

10

23

12%

Diversified

Portfolio

0

6

11

10

14%

Some realities of investing…

No one knows which sector will be the best (or worst) performer in the coming years.

Trying to time the market is usually futile.

By the time many individual investors decide to overweight one sector, it is often too late.

Best strategy is to use asset allocation: a balanced mix of all different asset classes, and rebalance annually.

Take the mystery and emotion out of investing, stay focused on the long term.

The slavic401k Market Horizon

Specialty

Investments

Foreign

Global

Small/Med

Domestic

High Risk

Bonds

Money Market

Large

Domestic

Low Risk

T. Rowe Price New Era

American Funds Capital World G & I R4

T. Rowe Price Mid Cap Growth

North Track NYSE ArcaTech 100

Fidelity Adv Diversified International A

Vanguard Mid Cap Index

BlackRock Health Sciences Svc

Hancock Classic Value

Third Avenue Value

Vanguard Total International Stock Index

Vanguard European Stock Index

TCW Value Opportunities I

Vanguard Total Stock Market Index

Vanguard Small Cap Growth Index

SSgA S&P Index 500

Bridgeway Ultra-Small Company Market

Vanguard Total Bond Market Index

Vanguard Short-Term Fed.

Vanguard Prime Money Market

Vanguard Inflation Protected Securities

Fund Returns

Trailing Period Returns 12/31/2006

Fund Name

BlackRock Health Sciences Svc

T. Rowe Price New Era

Vanguard REIT Index

North Track NYSE Arca Tech 100 Index A

Vanguard European Stock Index

Vanguard Total International Stock Index

Fidelity Adv Diversified International A

American Funds Capital World G & I R4

American Funds New Perspective R4

FundID YTD

SHISX 8.31%

1yr

8.31%

3yr

0.00%

5yr

0.00%

10yr

0.00%

Category

Specialty-Health

PRNEX 17.00% 17.00% 25.50% 19.79% 13.16% Specialty-Natural Res

VGSIX 35.07% 35.07% 25.49% 22.70% 14.18% Specialty-Real Estate

PPTIX 4.14% 4.14% 7.22% 4.22% 12.89% Specialty-Technology

VEURX 33.12% 33.12% 20.69% 14.88% 10.58%

VGTSX 26.64% 26.64% 20.93% 16.08% 7.78%

FDVAX 16.60% 16.60% 18.20% 16.16% 0.00%

RWIEX 22.23% 22.23% 18.69% 0.00% 0.00%

RNPEX 19.87% 19.87% 15.08% 11.84% 11.91%

Europe Stock

Foreign Large Blend

Foreign Large Growth

World Stock

World Stock

Bridgeway Ultra-Small Company Market

Vanguard Small Cap Growth Index

TCW Value Opportunities I

Third Avenue Value

Vanguard Mid Cap Index

T. Rowe Price Mid Cap Growth

BRSIX 11.48% 11.48% 11.70% 21.27% 0.00%

VISGX 11.95% 11.95% 12.18% 11.28% 0.00%

TGVOX 12.90% 12.90% 9.94% 7.57% 0.00%

TAVFX 14.69% 14.69% 19.15% 14.49% 13.50%

VIMSX 13.60% 13.60% 15.92% 12.28% 0.00%

RPMGX 6.79% 6.79% 13.23% 9.59% 11.63%

Neuberger Berman Partners Adv

SSgA S&P Index 500

NBPBX 12.84% 12.84% 16.34% 9.82% 8.42%

SVSPX 15.60% 15.60% 10.26% 6.01% 8.24%

Vanguard Total Stock Market Index VTSMX 15.51% 15.51% 11.26% 7.42% 8.57%

American Funds Growth Fund of America R4 RGAEX 10.94% 10.94% 12.37% 8.01% 12.94%

Hancock Classic Value PZFVX 16.54% 16.54% 13.16% 13.08% 12.84%

Vanguard Inflation Protected Securities

Vanguard Intermediate Bond Index

Vanguard Total Bond Market Index

Vanguard Short-Term Fed.

Vanguard Prime Money Market

Small Blend

Small Growth

Mid-Cap Blend

Mid-Cap Blend

Mid-Cap Blend

Mid-Cap Growth

Large Blend

Large Blend

Large Blend

Large Growth

Large Value

VIPSX 0.43% 0.43% 3.71% 7.04% 0.00% Inflation-Protected Bond

VBIIX 3.91% 3.91% 3.62% 5.43% 6.49% Intermediate-Term Bond

VBMFX 4.27% 4.27% 3.63% 4.61% 5.96% Intermediate-Term Bond

VSGBX 4.32% 4.32% 2.48% 3.39% 5.02%

VMMXX 4.88% 4.88% 2.99% 2.30% 3.77%

Short Government

Net Expense Ratio

1.64%

0.69%

0.24%

0.69%

0.27%

0.31%

1.02%

0.50%

0.47%

0.57%

0.23%

0.92%

0.85%

0.22%

0.80%

1.00%

0.09%

0.19%

0.35%

0.96%

0.20%

0.18%

0.20%

0.20%

0.30%

Optional Pre-Allocated Portfolios available to make investing easy

Aggressive Portfolio

Moderate Portfolio

Conservative Portfolio

Pre-Allocated Portfolios

AGGRESSIVE

2007

Allocation

Vanguard Total Stock Market Index

Fidelity Diversified International

Vanguard Short Term Federal

T. Rowe Price New Asia

35%

20%

20%

10%

Money Market

T. Rowe Price New Era

Vanguard REIT

0%

15%

0%

Weighted Return 100%

S&P 500

MODERATE

2007

Allocation

Vanguard Total Stock Market Index

Fidelity Diversified International

Vanguard Short Term Federal

T. Rowe Price New Asia

25%

20%

35%

10%

Money Market

T. Rowe Price New Era

Vanguard REIT

0%

10%

0%

Weighted Return 100%

S&P 500

CONSERVATIVE

Vanguard Total Stock Market Index

Fidelity Diversified International

Vanguard Short Term Federal

T. Rowe Price New Asia

Money Market

T. Rowe Price New Era

Vanguard REIT

2007

Allocation

15%

15%

30%

5%

30%

5%

0%

Weighted Return 100%

S&P 500

2006

3.90%

3.27%

1.08%

5.42%

0.00%

2.55%

0.00%

15.97%

15.80%

2006

3.12%

3.27%

1.72%

3.61%

0.00%

1.70%

0.00%

13.18%

15.80%

2006

2.34%

2.46%

1.29%

1.81%

1.46%

0.85%

0.00%

9.96%

15.80%

2005 2004 2003 2002

1.65%

5.70%

0.46%

0.00%

4.30%

5.60%

0.33%

0.00%

12.87% -10.04%

12.92% -6.72%

0.13%

0.00%

0.60%

0.00%

0.00%

2.99%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00% 3.74% 5.14% 0.99%

10.55% 13.72% 30.80% -15.42%

4.91% 10.88% 28.67% -22.10%

Net

Expense

0.03%

0.20%

0.04%

0.11%

0.00%

0.10%

0.00%

0.48%

2005 2004 2003 2002

Net

Expense

2005

0.71%

2.85%

0.55%

0.00%

0.90%

1.49%

0.59%

6.84%

4.91%

0.94%

4.75%

0.64%

0.00%

2.15%

4.67%

0.58%

0.00%

11.44% -8.92%

10.77% -5.60%

0.32%

0.00%

1.50%

0.00%

0.00%

4.48%

0.00%

2.36%

0.00%

0.00%

0.00%

0.00%

0.59% 3.74% 3.43% 0.66%

11.15% 13.25% 25.71% -12.61%

4.91% 10.88% 28.67% -22.10%

0.02%

0.20%

0.07%

0.11%

0.00%

0.07%

0.00%

0.47%

2004 2003 2002

2.15%

2.80%

0.66%

0.00%

0.14%

0.00%

2.62%

5.72%

8.61%

0.36%

0.00%

0.14%

0.00%

2.40%

-4.46%

-4.48%

1.68%

0.00%

0.20%

0.00%

0.46%

8.12% 16.98% -6.85%

10.88% 28.67% -22.10%

Net

Expense

0.01%

0.15%

0.06%

0.05%

0.09%

0.03%

0.00%

0.40%

Internet Enabled

The Employers Resource 401(k) Plan

A weekly Friday e-mail is sent to participants with account balances as of Thursday night and a brief description of the week’s market activities.

Enrolling In The Plan

•

Complete the Enrollment Form

Personal Information

Indicate Contribution Percentage

Select Investments

Name a Beneficiary

Sign the Form

You may call slavic401k.com or speak to your

Investment Advisor if you need help. Fund prospectuses are also available at www.slavic401k.com.