AP Macro 3-0 Basic Macro Relationships v3

advertisement

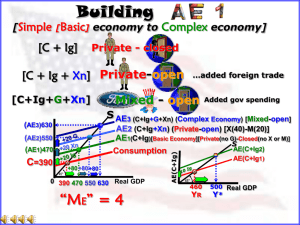

Basic Macroeconomics Relationships Business, Computers, & Information Technology Unit 3 Chapter 27 1 Remember Growth, Business Cycle, Recession, and Inflation? Macroeconomic Relationships help us explain these events. 1. Income, Consumption, and Saving 2. Interest Rates, Expected Rate of Return, and Investment. 3. Changes in Spending, and Real GDP LO1 27-2 1. Income, Consumption, and Saving Remember… Personal Income – Taxes = Disposable Income How many things can you do with your DI? • • • • • • LO1 DI = Consumption + Savings Direct relationship 45○ line C = DI Points below are C Difference is Savings HHs spend a larger proportion of a small income than of a large income. 27-4 Savings and Consumption Schedule Consumption (billions of dollars) Dissavings occur at low income levels. What do people do if Consumption > DI? 500 C 475 450 425 Saving $5 billion Consumption schedule 400 375 Dissaving $5 billion 45° 370 390 410 430 450 470 490 510 530 550 LO1 27-6 Average Propensities Average propensity to consume (APC) • Fraction of total income consumed Average propensity to save (APS) • Fraction of total income saved consumption APC = income APS = saving income APC + APS = 1 LO1 (4) (5) Average Propensity to Consume (APC), Average Propensity to Save (APS), (2)/(1) (3)/(1) (1) $370 1.01 -.01 (2) 390 1.00 .00 (3) 410 .99 .01 (4) 430 .98 .02 (5) 450 .97 .03 (6) 470 .96 .04 (7) 490 .95 .05 (8) 510 .94 .06 (9) 530 .93 .07 .93 .07 (1) Level of Output and Income GDP=DI (10) 550 Example: DI = $1B. and C = $96M: APC = .96 APS = .04 27-8 Global Perspective LO1 27-10 Marginal propensity to consume (MPC) • Proportion of a change in income consumed Marginal propensity to save (MPS) • Proportion of a change in income saved MPS = change in saving change in income C ($15) DI ($20) change in consumption change in income C 15 MPC = 20 = .75 MPS = 5 = .25 20 Saving MPC = Consumption Marginal Propensities S S ($5) DI ($20) Disposable income So, MPC + MPS = 1 Ex: .75 + .25 = 1 LO1 27-11 2. Interest-Rate-Investment Relationship First, what is the Expected Rate of Return? Example: • A new robot costs $1,000. Expected net revenue = • $1,100. Expected profit = $100. Expected Rate of Return (r) = Profit/Cost x 100 r = $100/$1,000 x 100 r = 10% The real interest rate If the interest rate (i) to borrow capital is 7%, r = 3% -2% What if i = 12%? r = _______ Businesses will invest in projects for which r > i LO3 27-13 (r) and (i) 16% Investment (billions of dollars) $0 14 5 12 10 10 15 8 20 6 25 4 30 2 35 0 40 Expected rate of return, r and real interest rate, i (percents) Investment Demand Curve 16 14 A Investment demand curve 12 10 8 6 4 2 0 ID 5 10 15 20 25 30 35 40 Investment (billions of dollars) There is an inverse relationship between r and Quantity of Investments Demanded. Example: At point A, $10B “quantity” of investments will be demanded at a “price” of 12% i and a r of 12% or HIGHER. In other words, at an interest rate of 12%, investment will be $10 billion, because these are projects with expected rates of return between 12% and 13.99%. 27-15 LO3 Investment Volatility Compared to GDP Source: Bureau of Economic Analysis, http://www.bea.gov. LO4 27-17 3. Spending Changes-RGDP The Multiplier Effect Consider this…If spending increases and GDP is at its potential, what will happen? Remember this? If GDP has room to grow… • A change in spending changes real GDP more than the initial change in spending (Multiplier Effect) Multiplier = change in real GDP initial change in spending Change in GDP = multiplier x initial change in spending LO5 27-18 The Multiplier Effect (1) Change in Income (2) Change in Consumption (MPC = .75) (3) Change in Saving (MPS = .25) $5.00 $3.75 $1.25 Second round 3.75 2.81 .94 Third round 2.81 2.11 .70 Fourth round 2.11 1.58 .53 Fifth round 1.58 1.19 .39 All other rounds 4.75 3.56 1.19 $20.00 $15.00 $5.00 Increase in investment of $5.00 Total Cumulative income, GDP (billions of dollars) 20.00 $4.75 15.25 13.67 Multiplier = change in real GDP initial change in spending $1.58 $2.11 11.56 $2.81 8.75 Multiplier = $3.75 $20 B =4 $5 B 5.00 $5.00 1 LO5 2 3 4 5 All others What if MPC = .90? 27-20 Multiplier and Marginal Propensities Multiplier and MPC are directly related • Large MPC results in larger increases in spending Multiplier and MPS inversely related • Large MPS results in smaller increases in spending Multiplier = 1 1 - MPC = 1 1 - .90 1 = .1 = 10 Remember, MPC + MPS = 1 MPS = 1-MPC Multiplier = LO5 1 MPS = 1 .1 MPC .9 Multiplier 10 .8 5 .75 1 = 10 = 1/10 .67 .5 4 3 2 27-22 Let’s Practice… • • • • Consumers initiate a $7B increase in spending. Businesses increase investment by $4B. Government initiates a $3B expenditures. If the MPC is currently .60, what is the overall increase to RGDP? Step 1: Calculate the multiplier. Multiplier = 1 1 - MPC = 1 MPS = 1 .4 = 1 2/5 = 2.5 Step 1: Calculate Change in GDP. Change in GDP = Multiplier x initial change in spending = 2.5 x $14B = $35B 27-24 The Actual Multiplier Effect? • Actual multiplier is lower than the model • • • • LO5 assumes Consumers buy imported products Households pay income taxes Inflation Multiplier may be 0 (U.S. estimate is between 2.5 and 0) 27-26