Threadneedle Investments Threadneedle European Smaller

advertisement

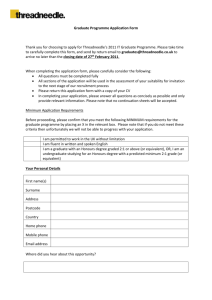

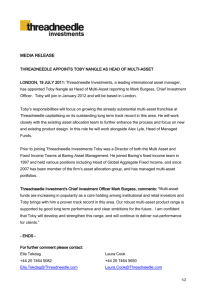

Threadneedle Investments Threadneedle European Smaller Companies Fund February 2006 Agenda • Threadneedle Investments • Threadneedle European Smaller Companies Fund • Investment Process • Key Buys and Sells • Quantitative Information • Appendices 2 Threadneedle Investments Threadneedle Investments Investment Team Chief Executive Officer Simon Davies Chief Investment Officer Sarah Arkle Robert Stirling Head of Fixed Interest & Treasury (29) Julian Thompson Head of Emerging Markets Cormac Weldon Head of US Dominic Rossi Head of International & Global Equities (20) Ed Gaunt Head of Japan • Over 120 London based investment professionals • Average investment experience of whole investment team over 14 years; excellent staff retention Malcolm Kemp Head of Quantitative and Risk Analysis (6) Michael Taylor Head of Equities & Head of UK (24) Alex Lyle Head of Managed Funds (12) Vanessa Donegan Head of Asia William Davies Head of Europe ex UK Danny Burton Cindy Larke Dealing & Stocklending Source: Threadneedle Investments As at December 2005 4 Threadneedle Investments European Equities Team William Davies Executive Director Head of European Equities Paul Doyle Executive Director Smaller Companies & Banks Darrell O’Dea Executive Director Fund Manager Dominic Baker Executive Director Telecoms & Autos Philip Cliff Fund Manager Support Services, Technology David Dudding, CFA Executive Director Smaller Companies & Healthcare Philip Dicken, CFA Fund Manager Smaller Companies Rob Jones Fund Manager Insurance, Food & Drug Retailers Sunita Goklaney Analyst Pharmaceuticals and Media Julie Thomas Analyst European Banks Danny Burton Executive Director Senior Dealer Nick Hawkes Smaller Company Dealer Source: Threadneedle Investments As at 30th December 2005 5 • Team of 31, of whom 20 conduct Pan-European research • 12 dedicated investment professionals, 3 of whom committed to small cap • Over €10.5 billion under management Threadneedle European Smaller Companies Fund Threadneedle European Smaller Cos Fund Philosophy and Objectives Philosophy “Seeks long-term growth of capital through active investment in small high quality and rapidly growing companies through the identification of under-researched, under-valued and niche opportunities, using rigorous selection criteria.” Objectives “To achieve above average returns over a market cycle with managed risk versus appropriate index.” 7 Threadneedle European Smaller Cos Fund Investable Market Max Prohibited from investing in Top 225 of FTSE World Europe ex UK Index Equates to a free float of approx €3.0 bn No minimum market value restriction Min Liquidity prevents many investments in companies below €100m market value Valuations 8 Threadneedle European Smaller Cos Fund Opportunity Drivers Growth Factors New products and services Sub-contracting phenomena Geographical widening of franchises Change Factors Valuations Privatisation/Outsourcing Technology - Media - Telecoms Restructuring Management Changes Demographics Responsive to industry and country factors 9 Investment Process Investment process Screening Opportunity Sources • Large cap managers • Large cap themes 4,000 companies Outside FTSE Top 225 • Small cap team • Regional and local brokers • IPO’s • Quantitative screening Selection Criteria • Strong franchises • Revenue growth Eligible Universe of 500-1,000 companies • Valuation screens (EV/EBITDA, P/E, P/CF, etc) • Margin and cash-flow trend • High visibility of revenues • Adequate disclosure • Under researched • Management interests aligned with those of shareholders Portfolio of 80-100 names Over 500 company visits per annum 11 Investment Process Stock Selection Ideas drive investment decisions Research-driven, bottom-up approach Decision making is bottom-up Stock selection focuses on individual company prospects Investment opportunities derived from growth and change Country and sector weightings result from stock selection process Strict valuation disciplines 12 Investment Process Sell Disciplines Margin trends Business Dynamics ROCE Competition Management/strategy changes Sector outlook Valuation Changes Deterioration in risk/reward profiles Over € 2-3 billion free-float Wider ‘sell-side’ coverage Sentiment Factors Management reduces share holdings Opportunistic capital increases 13 Investment Process Outlook Small caps have a history of long term outperformance Market Currently valued at a premium, therefore short term outperformance unlikely Bottom up approach essential Fund Consistency of fund and team Threadneedle European Smaller Cos Fund Consistency of pragmatic approach Strong resources and team based methodology Long term approach 14 Key Buys and Sells Neopost Stock performance versus Index 5 years Performance 110 • World #2 in franking machines • 61% of sales are recurring ie: maintenance and consumables • Consistent margin increases • Diversified geographically • Sales driven by decertification programmes, not global GDP 100 90 80 Held Pre 2001 70 60 50 40 30 20 2001 NEOPOST (692552/WIEXUKE) 2002 2003 2004 2005 The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 16 April Group Stock performance versus Index 2 years Performance 40 • French insurance products broker/distributor • Main markets are health and life insurance • Only 2% market share in health insurance in France • Benefiting from reduction in state spending • Very little underwriting exposure • Earnings expected to grow by 18% CAGR 05-07e 35 30 Bought July 2004 25 20 15 10 J F M A M APRIL GROUP (879966/WIEXUKE) J J A S O N D J F M A M J J A S O N D The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 17 Lindt & Sprungli Stock performance versus Index 2 years Performance 2400 2200 2000 1800 Bought May 2004 • Global leader in luxury chocolates • Long term market growth 6 – 7% • 14% growth in the US, an under penetrated market • Excellent management team 1600 1400 1200 1000 800 J F M A M LINDT&SPRUNGLI 'P' (936420/WIEXUKE) J J A S O N D J F M A M J J A S O N D The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 18 Takkt Stock performance versus Index 2 years Performance 10.00 • Leading catalogue-based B2B mail order company • Over 100,000 product lines, specialising in office, safety and warehouse equipment • Low price pressure due to infrequent ordering, lack of price transparency and low average order value • High barriers to entry due to brands, supplier network and long period to breakeven in a new market • Attracted by cheap valuation, exposure to cyclical upswing and combination of cashflow and growth 9.50 9.00 8.50 Bought February 2004 8.00 7.50 7.00 6.50 6.00 5.50 J F M A M TAKKT (273293/WIEXUKE) J J A S O N D J F M A M J J A S O N D The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 19 Celesio Stock performance versus Index 2 years Performance • Europe’s biggest pharmacy retailer and wholesaler • Big beneficiary of generic drug penetration as margins are higher in generics • German wholesale margins recovering as competition diminishes • Potential for enormous upside if Germany allows retail pharmacy consolidation • Cash generative, good management, cheap 80 75 70 65 60 55 Bought April 2004 50 45 40 35 J F M A M CELESIO (951741/WIEXUKE) J J A S O N D J F M A M J J A S O N D The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 20 Wincor Nixdorf Stock performance versus Index • 2 years Performance 100 Leading manufacturer of banking and retail systems 90 – ATM’s 80 – Electronic points-of-sale 70 60 Bought May 2004 • Services represent >40% of sales, giving good visibility • Highly cash generative and to pay a 2.4% dividend yield • Earnings CAGR of 14% (04 – 07e) • Highly regarded management team 50 40 30 J F M A M WINCOR NIXDORF (28990K/WIEXUKE) J J A S O N D J F M A M J J A S O N D The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 21 Rafako Stock performance versus Index 1 years Performance Sold December 2005/ January 2006 22 20 Bought November 2005 18 16 14 12 10 J F RAFAKO (142290/WIEXUKE) M A M J J A S O N D The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 22 • Polish engineer active in boiler manufacture • Record order book driven by energy sector investments • Bought due to clearly cheap valuation • However, shares quickly reached our target price Vivacon Stock performance versus Index 1 years Performance Sold December 2005 35 30 Bought August 2005 25 20 15 10 5 J F VIVACON (14907P/WIEXUKE) M A M J J A S O N D The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 23 • Hybrid financial company in German real estate • Bought after positive meeting • Shares rose significantly • Do not believe business model deserves a high multiple valuation Carrere Group Stock performance versus Index 12 years Performance 21 Sold November 2005 Bought June 2005 20 19 18 • Media company in TV production • Increasing sales of back catalogue • Bought in placing • Clear undervaluation was corrected • High visibility of earnings undermined by 17 16 – Poor meeting with management 15 – Weak explanation of IFRS changes 14 13 J F CARRERE GROUP (259207/WIEXUKE) M A M J J A S O N D The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 24 Colruyt Stock performance versus Index 5 years Performance 200 180 • Belgium’s third largest food retailer • Rating became too expensive, both on absolute basis and vs peers • Uncertainty caused by management changes • Risk of price war, subsequently proved correct • Unsatisfactory meeting with company 160 140 120 100 Sold June 2005 80 60 40 Bought October 2002 20 2001 COLRUYT (950997/WIEXUKE) 2002 2003 2004 2005 The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 25 Mayr Melnhof Stock performance versus Index 2 years Performance 140 Sold February 2005 • Austrian carton board and cartons manufacturer • World leader in recycled cardboard • Sold due to increased European competition and reduction in capacity utilisation • Also, attempts to increase prices failed and resulted in some loss of market share 130 120 Bought May 2004 110 100 90 80 J F M A M J MAYR-MELNHOF KARTON (142344/WIEXUKE) J A S O N D J F M A M J J A S O N D The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 26 Credito Emiliano Stock performance versus Index 2 years Performance Sold May 2005 10.00 9.50 9.00 • Mid sized bank in more affluent north of Italy • Bought on cheap valuation • Unconsolidated market and founder’s death triggered M&A speculation • Sold due to high valuation and macro environment concerns 8.50 8.00 7.50 Bought May 2004 7.00 6.50 6.00 5.50 5.00 J F M A M CREDITO EMILIANO (945849/WIEXUKE) J J A S O N D J F M A M J J A S O N D The naming of any specific shares should not be taken as a recommendation to deal. Source: Datastream As at 4th January 2006 27 Quantitative Information Quantitative Information Top 10 Holdings Company Business Weighting % Aarhuskarlshamns Speciality Fats 2.7 Grafton Units Builders’ Merchant 2.4 Bergman & Beving Distributor of Industrial Equipment 2.2 Takkt Business Catalogues 2.1 Imerys Minerals 2.1 Acta Holdings Independent Financial Advisor 2.1 Subsea 7 Oil Services 2.1 Grenkeleasing April Group Small ticket leasing Insurance Broker 2.1 2.1 Rhon-Klinikum Hospital Operator 2.0 TOTAL TOP 10 21.9 The naming of any specific shares should not be taken as a recommendation to deal. Source: Threadneedle Investments As at 31ST December 2005 29 Quantitative Information Sector Weightings Portfolio in2,3 % Index* in % 0,0 Unclassified 4.4 0.0 Oil & Gas 4.1 4.4 Basic Materials 7.5 7.9 41.9 28.4 7.9 10.8 10.8 6.3 Consumer Services 4.2 14.4 Telecommunications 0.0 1.3 Utilities 2.7 1.1 12.8 18.6 4.6 -0.9 100.0 6.8 0.0 100.0 Industrials Consumer Goods Health Care Financials Technology Cash Total * HSBC Smaller Cos ex UK Index Source: Threadneedle Investments, as at 31st December 2005 30 Quantitative Information Risk Constraints Maximum holding (cost) in any stock 2% Maximum holding (market) in any stock 3% Minimum number of stocks 50 Minimum number of sectors 6 Minimum number of country positions 8 Creates a disciplined investment process Limits Volatility Diversifies by opportunity Encourages Creativity 31 Quantitative Information Risk Statistics Threadneedle European Smaller Companies Fund HSBC Smaller Europe ex UK UK Price Index FT World Europe ex UK Total Return Index Return per annum (%) 16.65% 11.06% 7.12% R-Squared (-v- FT Europe [ex UK] Index) 0.49 0.82 1.00 Inception to end December 2005 Returns are shown annualised. Source: Threadneedle, Thomson Financial Datastream and S&P. All data is shown on a total return basis in EUR. Fund returns are shown on a BidBid basis, with Gross Income re-invested but net of AMC. As at 31st December 2005 32 Quantitative Information Performance Cumulative Performance Europe ex-UK 1 Year 3 Years 5 Years 7 Years 10 Years Threadneedle European Select Fund Percentile Ranking** Median Fund* 26.9% 29 25.1% 63.3% 34 56.2% -4.3% 23 -15.2% 50.4% 10 11.0% 318.2% 3 146.2% Threadneedle European Fund Percentile Ranking** Median Fund* 27.1% 26 25.1% 64.4% 32 56.2% -0.4% 16 -15.2% 51.7% 9 11.0% 261. 8% 10 146.2% Threadneedle European Smaller Cos Fund Percentile Ranking** Median Fund* 36.2% 38 33.9% 131.4% 15 106.9% 44.9% 6 -0.1% 182.6% 4 90.1% Threadneedle Pan European Accelerando Fund Percentile Ranking** Median Fund* 32.8% 7 251% Consistent outperformance * Median Sample – German Universe ** Percentile Rankings range from 0% (top performing fund) to 100% (bottom performing fund) Source: S&P WorkstationSector: European Select Growth, European Growth & Pan European Growth - Offshore Territories : Equity Europe ex UK & Equity Europe combined, European Sm Cos - Offshore Territories : Europe Smaller Cos. & Smllr Companies Europe ex UK combined,Performance data is quoted in Euros (prev. DM), on a Nav-to-Nav basis with gross income reinvested. (Data for periods greater than 1yr is cumulative.) As at 31st December 2005 33 Appendix Biographies David Dudding CFA graduated from Wadham College, Oxford University, in 1993 with a degree in Modern History (First Class). He then spent three years working for a British conglomerate in Hong Kong. Upon his return to the United Kingdom, he worked as a financial journalist with a leading magazine for private investors, before returning to Oxford, gaining a Masters degree in European Politics. He joined Threadneedle Asset Management in September 1999 and worked on the European team as the Smaller Companies Equity Analyst before taking over the Threadneedle Smaller Companies Fund on 1st September 2002. He is a regular member of the CFA Institute and is a member of the UK Society of Investment Professionals (UKSIP). Philip Dicken CFA joined the European Equities team at Threadneedle in 2004 and was appointed deputy Fund Manager to the European Smaller Companies fund in July 2004. He graduated with a Master of Mechanical Engineering with French degree (First Class) from the University of Bristol in 1997. Philip worked in Corporate Finance / M&A with Merrill Lynch, then covered UK and European mid and small caps for five years with Active Value, a corporate governance / activist fund management group. He is a regular member of the CFA Institute and is a member of the UK Society of Investment Professionals (UKSIP) 35 Quantitative Information Country Weightings Within the context of Growth and Change, Country Boundaries are less relevant in % 25 Portfolio Index 20 15 10 5 * HSBC Smaller Cos ex UK Index Source: Threadneedle Investments, as at 31st December 2005 36 Turkey Switzerland Sweden Spain Portugal Norway Netherlands Luxembourg Italy Ireland Iceland Hungary Greece Germany France 0 Finland 3.0 3.2 5.1 6.6 12.5 13.6 4.6 0.0 0.0 2.7 11.5 0.4 7.6 5.8 0.7 5.6 9.6 7.7 0.0 Denmark 4.0 0.2 2.2 4.8 15.9 19.7 5.4 0.5 0.3 5.7 4.0 0.0 5.9 6.3 0.4 3.6 8.5 11.9 1.1 Belguim Austria Belguim Denmark Finland France Germany Greece Hungary Iceland Ireland Italy Luxembourg Netherlands Norway Portugal Spain Sweden Switzerland Turkey Threadneedle European Smaller Cos Growth Fund Index* Austria Portfolio Threadneedle’s European Equity Funds Fund Outline 1 Threadneedle European Fund Size No. Holdings Top 10 Holdings UBS Total EUR10 Novartis Allianz ENI EUR1 Roche Holdings Nestle SA Sanofi Aventis Axa EUR2.29 Credit Suisse Source: Threadneedle Investments As at 31st December 2005 € 1,099.3m 84 3.8 3.6 3.6 3.2 3 2.8 2.7 2.5 2.2 2.1 Threadneedle European Select Fund € 1,682.4m 59 Size No. Holdings Top 10 Holdings UBS E. ON AG ENI EUR1 Novartis Total EUR10 Unicredito Roche Holding Allianz Air Liquide 4.9 4.0 3.9 3.8 3.5 3.3 3.1 2.9 2.8 2.8 The naming of any specific shares should not be taken as a recommendation to deal. 37 Threadneedle European Smaller Cos Fund Size No. Holdings Top 10 Holdings Aarhuskarlshamns Grafton Bergman & Beving Takkt Imerys Acta Holding Subsea 7 Grenkeleasing April Group Rhon-Klinikum € 985.1m 126 2.7 2.4 2.2 2.1 2.1 2.1 2.1 2.1 2.1 2.0 Important Information Past performance is not a guide to future returns. The value of investments and any income from them is not guaranteed and may fall as well as rise and the investor may not get back the original investment. Exchange rate movements could increase or decrease the value of underlying investments/holdings. The dealing price of the funds may include a dilution adjustment, further details are available in the Prospectus. Threadneedle Investment Funds ICVC (“TIF”) is an open-ended investment company (OEIC) with variable capital and limited liability incorporated in England and Wales under registered No. IC000002 and authorised by the Financial Services Authority (FSA) with effect from 18. June 1997. TIF complies with the UCITS Directive 85/611/ EEC (as amended by directives 2001/107/EC and 2001/108/EC). TIF is structured as an umbrella company, in that different funds may be established from time to time by Threadneedle Investment Services Limited with the approval of the FSA and the agreement of the Depositary (J.P. Morgan Trustee and Depositary Company Limited). The assets of each fund will be treated as separate from those of every other fund and will be invested in accordance with the investment objective and investment policy applicable to that fund. The investment manager is Threadneedle Asset Management Limited. References in this document to any fund do not constitute an offer or invitation to subscribe to shares in such a fund. We recommend you get detailed information before the purchase of shares. Subscriptions to a fund may only be made on the basis of the current Prospectus or Simplified Prospectus as well as the annual or interim report. Copies can be obtained free of charge on request from your financial adviser or our paying agents in Germany: JP Morgan AG, Junghofstr. 14, D-60311 Frankfurt, Tel.: +49- (0)69-7124 4207, and Austria: RZB (Raiffeisen Zentralbank Österreich AG), Am Stadtpark 9, A-1030 Wien, Tel.: +43-(0)1-71707 1730. The naming of any specific shares should not be taken as a recommendation to deal and anyone considering purchasing the securities mentioned should consult a stockbroker or financial adviser. The research and analysis included in this document has been produced by Threadneedle for its own investment management activities; it might have been acted upon prior to publication and is made available here only incidentally. In some instances the information contained in this publication, other than statements of fact, was obtained from external sources believed to be reliable but its accuracy or completeness cannot be guaranteed. Any opinions expressed are made as at the date of publication but are subject to change without notice. The information provided in this presentation is for the sole use of those intermediaries attending the presentation. It may not be reproduced in any form without the express permission of Threadneedle and to the extent that it is passed on care must be taken to ensure that this is in a form which accurately reflects the information presented here. The Select and Smaller Companies Funds are more actively managed and have more concentrated portfolios. They can, therefore, carry more risk. As such, they are aimed at the more experienced investor. Index returns assume reinvestment of dividends and capital gains and unlike fund returns do not reflect fees or expenses. The index is unmanaged and cannot be invested in directly. Threadneedle Portfolio Services Limited Registered in England and Wales, No. 285988. Registered Office: 60 St Mary Axe, London EC3A 8JQ. Authorised and regulated in the UK by the Financial Services Authority. Threadneedle Investments is a brand name, and both the Threadneedle name and logo are trademarks or registered trademarks of the Threadneedle group of companies. The Threadneedle Investment Funds ICVC are registered for public offer in Austria and Germany. 38 For Investment profession use only (not for onward distribution to, or to be relied upon by private investors)