Italian Cooperative Finance

advertisement

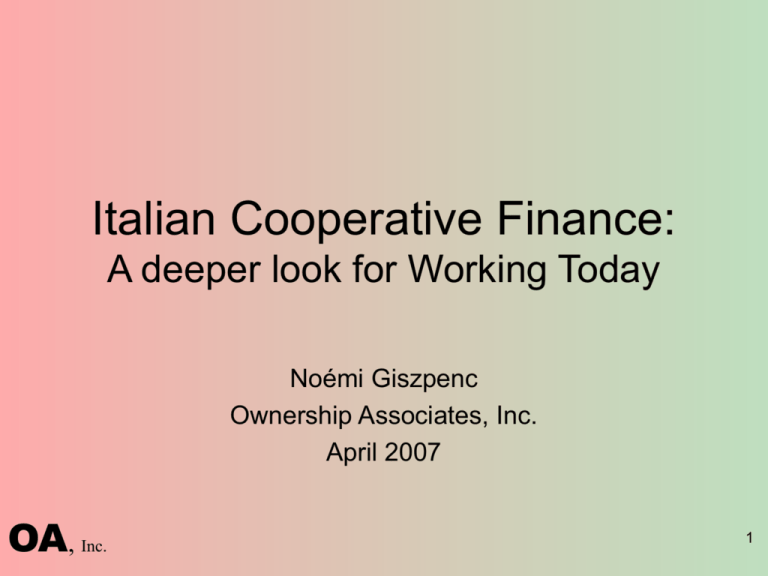

Italian Cooperative Finance: A deeper look for Working Today Noémi Giszpenc Ownership Associates, Inc. April 2007 OA, Inc. 1 Follow-Up to Questions 1. Fees paid to National Federations: – – Other federations are similar to Legacoop, i.e., ask for a fraction of a percent of sales annually In regions where the consumer Coop is strong (as in Liguria), it represents about half of payments to the Legacoop federation • Overall, it represents about a quarter 2. Indivisible reserves: what are they and how do they function? – – OA, Inc. After paying interests, patronage, dividends, taxes, etc., the rest goes into indivisible reserves. Often this does not amount to much, especially in early years, necessitating other sources of 2 Follow-up to Questions (cont.) 2. Indivisible reserves: (cont.) – – – The percentage of profit going to indivisible reserves can vary. (About 87% on average.) Historically, Italian coops have paid very little patronage, putting most profits into reserves. Profits put in indivisible reserves were 100% taxfree from 1977 until 2002. • • – OA, Inc. Now 70% of profits can go tax-free into indivisible reserves for prevalently mutual cooperatives 30% can go for non-prevalently mutual coops At present and in the future, the accumulated indivisible reserves are not sufficient for investment in growth. 3 Follow-up to Questions (cont.) 3. What are the typical terms of Coopfond? – Typically a little more favorable than those of a bank--on average below Euribor rates • However, there are more controls, which can be burdensome – Banks rarely take an equity position in coops, as the Coopfond does • • While Coopfond is an investor, it asks that profits be returned to indivisible reserves When the coop buys back the shares from Coopfond, the conditions are concessionary, usually anchored to the rate of inflation. – This is similar to how the other 3% coop development funds function OA, Inc. 4 Whence Coop Financing? • Accumulated indivisible reserves (retained earnings), largely untaxed • Reinvested patronage & dividends • Member loans • Credit from banks: debt. (short-term = 85%) – Special consortia help coops interface with banks • Credit from suppliers • CCFS: reallocates excess liquid capital Since 1992 law: • 3% of profits to development funds, • and “supporting” (non-mutual) members OA, Inc. 5 Italian Coop Finance: Historical Moments • 50s and 60s: Financing Troubles. Legacoop coops: – wanted to pursue regional and national strategies for growth • Whereas Confcooperative coops were more focused on small landholders and businesses – But they were unfairly denied credit by banks – Not to mention cash-strapped by late-paying public entities – Turned to self-financing • This and short-term debt mainstays of coop investment – Confcoop had mutual banks, but Legacoop was denied authorization to constitute credit bodies • 1962: Group of Bologna coops buys Unipol insurance • 1993: “Watershed moment” for promoting coops – Before law founding 3% funds, promotion pursued through real, nonfinancial services (consultation, training, and , Inc. assistance). There was little financing, only in special cases. OA 6 Italian Coop Finance: Member Loans • “most efficient” instrument for Legacoop coops • Supported development of consumer Coop, housing coops, worker coops, etc. • Service to members: better return on small savings than from bank • Favored loyalty-building of member-client • But only really useful for coops w/ many, many members, which are exceptional OA, Inc. 7 Coopfond Areas of Activity: Two "characteristic" areas 1. "Promotion": providing risk capital to new coops & new companies controlled by coops. • • Other allies are: Unipol Merchant for complex operations (M&A, IPO, etc.), local and sectoral funds. For small and medium worker coops and social coops there is CFI, a source of private equity 2. "Development": providing credit to disadvantaged areas (mostly the South) & existing social coops. OA, Inc. • Other instruments: P.I.CO Leasing for leasing real estate and Fondo Unipol Banca for 8 Coopfond Areas of Activity: Other Areas 3. "Stable participation": support for institutions that sustain coop activity – local and national public financing – Consorzi Fidi (Confidi): networks that improve the credit profile of cooperatives vis-a-vis banks • these consortia provide guarantees for a certain percentage of the amount loaned to members, and negotiate better terms for members from banks. 4. "4% fund": financing for studies and research on coop themes, training and communication on coop culture. OA, Inc. 9 Coopfond Investment Process • Coopfond does not assume entrepreneurial responsibility directly; assumes only minority positions. • Preliminary investigation of projects: proponents arrive after having obtained a first approval from local associations. – Nevertheless on average only 1 in 4 proposals are approved. – Often during the first technical interviews the proponents themselves withdraw their projects, due to a better idea of the risks involved. OA, Inc. 10 Coopfond Process: Evaluation • Every project evaluated based on the history of the proponents – because at the center of a cooperative project there are always people. • Then SWOT analysis: of the market (opportunities/threats) and of the positioning of the new initiative (strengths/weaknesses) – Michael Porter-style merchant banking analysis. • Then evaluation of the cooperative interest – Mix between competitive advantage possible with the internal cooperative market and the social relevance of the initiative. OA, Inc. 11 Coopfond: Project Phases 1. 1st contact: preliminary evaluation of entrepreneurial idea 2. pre-evaluation: phase of analytic evaluation of the documentation provided by proponent 3. evaluation: phase of checking and validating the project. All projects brought to the Board of Directors are given an evaluation rating. 4. contract: phase of formalizing of financing and agreements among members. OA, Inc. 12 Coopfond: Project Phases 5. management and conclusion: phase of monitoring the agreed upon business plan until the end of the participation or the definitive payback of the financing. • • OA, Inc. After the disbursement, the life of the financed cooperative is followed by monitoring and annually it gets assigned a rating. In difficult cases an inspection function seeks to correct the management errors of the project leaders. 13 Coopfond in Detail • Coopfond is a non-speculative, non-profit seeking organization. – Therefore rate of return on capital is not relevant – Operationally, aims to contain costs and maintain the integrity of the cumulated 3% fund • €261 million accumulated 1993-2005. About 2/3 of the contributions come from the 50 biggest cooperatives, from about 15,000 Legacoop member coops. – Of 430 accepted projects, 42 were abandoned – So far projects that have paid back are: • 49 (of 183 total) equity projects for 20.9 million euro • 22 (of 136 total) credit projects for 40.9 million euro • 8 (of 69 total) “stable” projects for 28.8 million euro OA, Inc.– Pure start-ups have the greatest failure rate. 14 Coopfond: Leverage • On average risk capital investments by Coopfond have mobilized investments of about 5 times the value – I.e., have mobilized 1,500 million euro with direct financing of 300 million euro • Beside investing in Confidi, public financing, and CCFS (it’s a member), Coopfond has BIG investment in Unipol – has invested 30% of its total endowment in the Unipol group – with the objective of having a big banking and insurance group to work with OA, Inc.– Also, dividends allow the fund to stay in the black 15 More on CCFS – From 1960s. 2004: Fincooper was merged into CCFS • Consorzio Cooperativo Finanziario per lo Sviluppo – Excess liquidity from coops used to fund development projects of other coops – Working capital – Advantageous credit for social coops • often in partnership with Coopfond – Pooling credit with other banks for medium term (3-7 year) loans – Medium to long-term mortgages – Project financing • a way for coops to get more public contracts – Loan guarantees OA, Inc.– Consultation for Financing 16 More on Unipol • Got its start in the 60s. “Red” coops had limited access to credit and insurance – Wanted insurance because understood that it would be great to use reserves for investment – Finally bought a spin-off car insurance agency of troubled car company in 1962 – Grew rapidly, during Italy’s “golden age” • Has invested in the coop movement as well as associations of workers and unions and small business associations – Now offers members of these associations discounts on insurance products OA, Inc. 17 More on Unipol (cont.) • Suffered a setback in the summer of 2005 when attempted a takeover of BNL (Banca Nazionale di Lavoro) with improper methods. – But negotiated a deal with Gruppo BNP Paribas for it to buy BNL and for Unipol to become BNP’s privileged Italian partner for selling insurance • BNP also bought 4.5% of FINSOE from Holmo – And Unipol still on the lookout for ways to expand into the banking sector. • Coopfond considers this important for financing coops OA, Inc. 18 Unipol Ownership Structure Strategic members: Holmo 71.1% MPS 13% HOPA 5.4% BNP P&V 4.5% JP Morgan 4.6% 1.4% FINSOE MARKET 100% of preferred stock 49.8% of ordinary stock preferred stock (38% of total capital) OA, Inc. 50.2% of ordinary stock (32% of total capital) ordinary stock (62% of total capital) 19 Just for Information: Italian Cooperative Laws • 1947: Basevi Law – No dividend payments on capital over a legal limit – No distribution of reserves to members – Devolution of assets in case of liquidation • 1971: “Little Reform” – No transforming coops into ordinary companies • 1977: no taxation of indivisible reserves OA, Inc. 20 More Laws • 1985: Marcora Law – Creation of Foncooper at the BNL for modernizing coops – Founding of a fund for job-saving (buying businesses in difficulty or making new ones) • Combined Confcooperative, Lega, Agci, and 3 major labor unions to form CFI (Compagnia Finanziaria Industriale) • 1991: creation of social cooperatives – Enterprises without profit motive, for social purposes, similar to our non-profits • 1992: 3% profit contribution to dev’t funds OA, Inc. 21 Yet More Laws • 1992: creation of “supporting members” who can invest money in coops – Have right of pre-emption during liquidation – Have right of up to 5 votes, but collectively not more than 1/3 of all votes – OR coops could emit preferred stock. – Supporting members/preferred stock cannot earn more than 2% more than other members • 2002: Distinction between prevalently mutual and non – I.e. most business conducted with members or not – Non-prevalently mutual only can put aside 30% of OA, Inc. profits into tax-free reserve. Prevalent 70%. 22 Sources Used • La promozione cooperativa, M. Bulgarelli and M. Viviani, eds. 2006 • 2004-2005 Bilancio sociale: Relazione dell’Amministratore Delegato Marco Bulgarelli, Coopfond, February 2006. • Verso una nuova teoria economica della cooperazione, E. Mazzoli and S. Zamagni, eds. 2005. • Primo rapporto sulle imprese cooperative, Unioncamere and Istituto Tagliacarne, February 2005. • www.unipol.it • www.ccfs.it • www.cfi.it OA, Inc. 23