Germany

advertisement

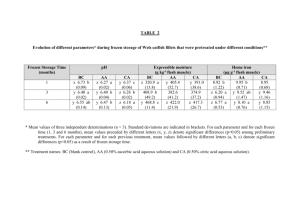

International Marketing Strategy Rachel Bauer, Pat Lynch, Sarah vonFischer, Erik Wright Smucker’s Uncrustables in Germany Uncrustables in Germany? Main Factors to Consider Assessment of potential market Distribution Segmentation and Targeting Marketing mix Uncrustables in Germany? Main Factors to Consider Assessment of potential market Distribution Segmentation and Targeting Marketing mix Assessment of Potential Market Eating Habits of Germans Lunch is the primary meal of the day in Germany. It is typically a warm meal served around noon. Recently consumers have begun to shift away from large main meals towards snacks and smaller dishes; this could lead to increased interest in a product like Uncrustables. Large family meals are still common at noontime on Saturdays and Sundays Assessment of Potential Market Frozen Food Market in Germany In 2003 the German Frozen food market reached a value of $6.84 billion This was an increase of 13.8% since 1999 The frozen food market includes frozen ready meals, frozen deserts, frozen bakery products, frozen fruit and vegetables, and frozen meats. Assessment of Potential Market Frozen Food Market in Germany Frozen ready meals was the leading segment of the market that contributed $3.3 billion of the total revenue, 48.6% of the of the market’s value. The German frozen food market is the largest in the European Union and Eastern Europe. Even though the market is mature, analysts expect the growth rate to be moderate and confirm Germany’s position as the largest in Europe. This is good news for Uncrustables in Germany. Assessment of Potential Market Frozen Food Market in Germany Year 1999 2000 2001 2002 2003 $ million 6,008.2 6,240.0 6,495.5 6,714.8 6,837.2 € million 5,319.7 5,524.9 5,751.1 5,945.2 6,053.7 % Growth 3.90% 4.10% 3.40% 1.80% Source: Datamonitor D A T A M O N I T O R This data shows the recent growth in the German frozen food market and the increasing net value of the market Assessment of Potential Market Frozen Food Market in Germany Geography Rest of Europe Germany UK France Total % Share 54.80% 16.10% 15.00% 14.10% 100.0% Source: Datamonitor D A T A M O N I T O R Compared to other European countries, Germany’s frozen food market holds a slight advantage in market share Assessment of Potential Market Future Market Expectations 2005 is predicted to have the highest future growth By 2008 analysts expect the frozen food market to reach a value of $7.9 billion, which is a stronger growth prediction than for the UK and Italian markets, and significantly higher than the growth of the French market. If Smucker’s was to enter this market it would be most beneficial to do it quickly. Assessment of Potential Market Ready Meal Market The German ready meal market has reached a net worth of $2.6 billion The market had a growth rate of 6.7% between 1999-2003 Germany is currently third in ready meal market size behind France and the United Kingdom Assessment of Potential Market Ready Meal Market The leading segment of the ready meal market is the frozen ready meal segment accounting for 81.7% of the market value. The expected growth rates for this market is expected to experience decline slightly By 2008 the ready meal market is predicted to reach a net value of $3.3 billion, which indicates growth of 5.1% in the 2003-2008 periods Assessment of Potential Market Germany’s Economic Prospects The GNP is around $1.864 billion. More relevantly, they have a per capita GNP of $22,740, making them one of the most affluent nations in Europe. GNP is $22,740 per capita, and the GDP is $27,600 per capita, once again proving that the average population should be able to afford our product. Germany’s western part of the country is more affluent than the former communist, eastern area. Assessment of Potential Market Germany’s Economic Prospects The total population of Germany is 82 million (more specifically, 82,531,700 at the end of 2003) Population growth has been slow since the 1960s, so no future change is expected There is sufficient income and population in Germany for Smucker’s to invest their product in Germany Assessment of Potential Market Competition Company market share Private label 21.2 Langnese-Iglo GmbH 13.8 Aldi GmbH & Co KG 12.5 Conditorei Coppenrath & Wiese GmbH & Co KG 9.4 Dr August Oetker Nahrungsmittel KG 7.4 Wagner Tiefkühlprodukte GmbH 6.1 Companies well established in the German frozen food industry are listed above. These are the main competitors for Smucker’s upon entering Germany. Assessment of Potential Market Competition Langnese-Iglo has products such as frozen pizzas, hamburgers, chicken sandwiches, fish sticks, pasta, and baguettes. Coppenrath & Wiese specializes mostly in breakfast rolls and desserts Dr Oetker is mostly in the business of frozen pizza. Wagner Tiefkühlprodukte GmbH offers a variety of pizzas, bruchettas and wraps Assessment of Potential Market Competition Findus has come out with a product called Crispy Pancakes Flavors include: 3 cheese Beef Sweet corn, bacon, and chicken Assessment of potential market Direct Competition Dr. Oetker has come out with frozen sandwiches They microwave in 2 minutes Flavors include Chicken BBQ Hot Peppers Pizza Style Tomato Feta Hawaii Uncrustables in Germany? Main Factors to Consider Assessment of potential market Distribution Segmentation and Targeting Marketing mix Distribution The distribution of Uncrustables in Germany depends on many different variables including the following: Surface Transportation Geography (large cities and surrounding countries) Current sales and production facilities in Germany Current suppliers and distributors in Germany German legislation pertaining to foreign direct investments, tariffs, and taxes Distribution Surface Transportation The western states of Germany have a more advanced transportation infrastructure, but government spending is closing the gap. Ease of travel in different parts of the country is something to consider when deciding on the placement of different facilities in Germany. In 2005, a new system is supposed to be implemented to charge lorries (trucks) 12.4 euro cents per kilometer. This makes truck travel a more expensive option. Distribution Surface Transportation The railway system for passenger travel has recently become more expensive and has lost a lot of customers due to an economic downturn in 2003. Railways are still commonly used for freight services, with annual goods totaling 285 tons. A problem with this source of transportation could be problems with monopolistic pricing for the DB (the federally sponsored company). Distribution Surface Transportation The use of sea-going merchant vessels for transportation of goods is on the downturn, totaling 246 tons in 2003 (less than the railway’s 285 tons). The most important port for Germany is Rotterdam in the Netherlands, and the most used domestic port is in Hamburg (accounting for 35% of all freight shipped to German ports). Distribution Surface Transportation Other main ports in Germany are Wilhelmshave, Bremerhave, Bremen, Rostock, and Lubeck. If transportation using seagoing merchant vessels was chosen to be used by Smucker’s for Uncrustables, it would be important to consider the implications of locating Uncrustables facilities by one of these major cities. Distribution Surface Transportation The most used airport for freight and passenger travel is Rhein-Main Airport near Frankfort. Cologne-Bonn is the second most used for freight traffic. Again, if using airport for freight transportation, it would be important to consider a distribution facility near one of these two cities. Distribution Surface Transportation Roads: 226,000 km in 1992 (11,000 km of these roads are at least four lanes) Railroads: 40,000 km in 1994 (16,000 km of which are electrified) Airports: 660 total (12 civilian airports provide passenger and cargo service within the country and to the rest of the world) Distribution Surface Transportation Ports: several dozen large, well-equipped ocean and inland ports Inland Waterways: 6,900 km of navigable inland waterways, including extensive canal systems (inland waterways account for about 20% of freight shipping) Distribution Geography Germany shares boundaries with nine other countries: Denmark Poland The Czech Republic Austria Switzerland France Luxembourg Belgium The Netherlands This is important to consider when choosing where to put production and distribution facilities. Putting a facility in a neighboring country could be the most cost-efficient. Distribution Geography The three largest cities are Berlin (3.4 million), Hamburg (1.7 million), and Munich (1.2 million). Concentration of population The most densely populated cities are Berlin (3,898 persons per sq. km), Hamburg (2,236 persons per sq. km), and Bremen (1,697 persons per sq. km). 1/5 of the nation’s total population is in North Rhine-Westphalia (the state who’s cities include Berlin, Bremen, and Hamburg. Distribution Current Sales in Germany There are currently no sales offices or production facilities in Germany. Also, there are no Smucker’s products on store shelves in Germany. Smucker’s products can be bought from online groceries. Distribution Current Distributors and Suppliers in Germany Smucker’s does not own its suppliers or distributors. It does not grow its own fruit, nor does it manufacture its own labels or storage containers. When going into Germany, one would need to decide what suppliers and distributors are available and the best to use. Distribution Production in Germany Smucker’s Uncrustables are currently produced in a manufacturing facility in Scottsville, KY. It would be important to decide whether to produce Uncrustables in Germany or to import them from Kentucky. Distribution Production in Germany Many factors were at play in Smucker’s decision to close some plants. A strike affected the Woodburn facility last year, though local sources say the workforce included many second-generation employees who were willing to work with the company to improve efficiencies. When considering where to have a production facility in Germany, it will be important to look at factors such as the worker’s demographics and attitudes in addition to factors such as cost. Distribution Foreign Direct Investments Germans and Americans regularly make investments in each other’s countries. Germany is the United State’s largest European trading partner and fifth largest partner in the world. France, the Netherlands, and the United States led the list of Germany’s foreign investors during 2003. Distribution Foreign Direct Investments The profit rate of US direct investment in Germany was 5.1% in 2003, compared with 3.7% a year earlier. This is showing that US investments in Germany are becoming more and more profitable. Distribution Foreign Direct Investments German government officials, and the population in general welcome foreign investment that provide new jobs. There are no serious limitations on new projects. Foreign investors encounter the same conditions as their German counterparts in obtaining licenses, securing building permits, and gaining approval for investment incentives. However, the German government often opposes hostile takeovers. The next slide shows an example… Distribution Squeeze-out example A provision of the take-over law concerning squeeze-outs has been used frequently. According to the law, an investor who holds at least 95% of equity can force the remaining shareholders to sell their shares in the company. Since the first quarter of 2003, however, when Procter & Gamble of the US unsuccessfully tried to use the squeezeout provision to take over all of Walla, a German hair-care company, investors have rarely been able to reach the necessary 95% threshold. Minority shareholders will deliberately increase their stakes to force the investor to make a higher offer. Uncrustables in Germany? Main Factors to Consider Assessment of potential market Distribution Segmentation and Targeting Marketing mix Segmentation and Targeting Demographics: targeted towards moms across the United States—most likely people of middle- or upperrange incomes (because it is definitely cheaper for a mom to make her own peanut-butter and jelly sandwiches). This is also mostly targeted toward working mothers. Geographic: not necessarily specific geographically, although the main focus now is in the United States— not the international market. Smucker’s may consider entering Uncrustables in the wealthier, western half of the country for easier penetration of the market Segmentation and Targeting The Average Family “Our research shows that the average family doesn’t know what they’re going to have for dinner until 4 p.m., and probably the most popular category of food is handheld products you can take in the car,” Smucker’s says. Segmentation and Targeting Children and Schools (although children are not directly targeted) “We continue to focus on Uncrustables, our line of crustless, thaw-and-serve peanut butter and jelly sandwiches. Within the school foodservice market, sales of Uncrustables have increased substantially over last year, yet to date we are in fewer than 20 percent of school districts nationally.” “Reaching a later percentage of children with a branded food item, served as a meal or nutritious snack, is a most exciting prospect for our Company.” Segmentation and Targeting Amusement Parks and Ball Parks The Uncrustables line was also successful this year in traditional foodservice outlets, especially in the recreation category where initial placements have included Walt Disney World and several major league baseball parks. Segmentation and Targeting In the United States retail market the Company’s products are sold through brokers to food retailers food wholesalers club stores mass merchandisers military commissaries. Segmentation and Targeting Psychographics: for people with interests that keep them on the go Behavior: this product is most likely for the loyal buyer. Smucker’s is hoping to convince mothers that this product is convenient enough to keep handy around the house. Also, Smucker’s is most likely hoping that once a mother buys the Uncrustables the first time, the kids will be hooked and create a demand for the mother to continue buying the product. Benefits: convenience Segmentation and Targeting Age Distribution in Germany Age Male Female Male (%) Female (%) 0-4 1,924 1,825 51.3% 48.7% 5-9 2,061 1,953 51.3% 48.7% 10-14 2,328 2,210 51.3% 48.7% 15-19 2,403 2,277 51.3% 48.7% 20-24 2,418 2,298 51.3% 48.7% 25-29 2,353 2,227 51.4% 48.6% 30-34 3,023 2,851 51.5% 48.5% 35-39 3,743 3,504 51.6% 48.4% 40-44 3,542 3,360 51.3% 48.7% Segmentation and Targeting The previous graph displays the Target Market for Uncrustables, which consists of 14,697 million males and 13,878 million females, which includes parents and children If Smucker’s can tap into this vast population in their target market, Uncrustables could be very profitable Uncrustables in Germany? Main Factors to Consider Assessment of potential market Distribution Segmentation and Targeting Marketing mix Marketing Mix Product Uncrustables are a sandwich made up of white bread, and with no crust It come in three flavors, Grape, Strawberry and Grilled Cheese The idea of new flavors and even seasonal ones is something that has been successful in the German market Germans do eat peanut butter but not necessarily peanut butter and jelly sandwiches. This may be something to consider pertaining to flavor. Marketing Mix Product Most get their food from both supermarkets and specialty shops (like bakeries, butcher shops, etc.) Germans tend to shop more frequently than Americans, usually 2-4 times per week The typical German household has a significantly smaller refrigerators than Americans and have a separate larger freezer in the basement This all indicates that Germans may not be as interested in the larger packages of Uncrustables (such as the 10 and 18 pack). A pack of 4 may be more appealing to Germans. Marketing Mix Packaging Uncrustables are packaged in a cardboard box with each sandwich individually wrapped. The individually wrapped sandwiches would also be easy to store in the freezer outside of the box. The design has a picnic feel to it and the colors of the box vary with the different flavors. The package looks “All-American” which is not necessarily a good thing. Marketing Mix Packaging The packages are produced in English and Smucker’s name is prominently displayed on the front of the box along with the Uncrustables name. The nutritional facts and ingredients are listed on the sides of the box, and an explanation of what Uncrustables are (including pictures) is on the back. Marketing Mix Packaging The Germans have recently installed new laws regarding waste disposal. In responses, companies are making more environment friendly packaging. Green dots are starting to appear on packages that are recyclable, and while it is not required, it makes packages more acceptable. Marketing Mix Place The Industrial Investment Council offers consulting free of charge for investors in eastern Germany. This includes: Market research Identification of partners Permit applications Advice on financial incentives The investment allowance law provides for additional incentives for the acquisition of buildings, plants, and equipment in eastern Germany. Regular incentives are 12.5% of investment cost; for small and medium-sized companies, the rate is 25%, and it is increased by 2.5% in regions close to the Polish and Czech borders. Marketing Mix Place One thing to remember when analyzing the best location for a production facility is not necessarily the place that costs the least. Smucker’s realized this when they decided to close optimize their supply chain and consolidate manufacturing facilities. Smucker’s closed plants in Watsonville, California, Woodburn, Oregon, and West Fargo, North Dakota allowing for more efficient product production and distribution. Marketing Mix Promotion/Message “Our first priority was to serve our loyal existing customers. We’ve continued to pursue new customers, but (we’re) really targeting the fall, back to school time period for implementing that new business.” Marketing Mix Promotion/Message Uncrustables are a great time saving product for those parents on the go. With more and more two parent working families, the idea of a easy to serve, ready to go product is always a good one. The idea of a convenient, low cost and also good tasting product can be seen with Uncrustables Lastly, the flavors of the product are what some would call trademark American products; a good old fashion PB&J and the Grilled Cheese. Something that children will associate with Marketing Mix Promotion/Message With capacity shortcomings, Smucker’s pulled most of its advertising and promotion for the Uncrustables line. Richard Smucker, co-CEO and CFO had this to say, “As a result, growth and sales projections for the brand have been difficult to ascertain. We have pulled quite a bit of support for the brand, but once we get back up to full support, then we’ll have a better feel for growth” Marketing Mix Promotion/Media In Germany print media holds a 48% share of advertising and is the leading medium for advertisement Television is the most popular medium of communication and entertainment. Today some 30 stations compete fiercely for audience ratings. Each of the 16 Landers (states) are solely responsible for their television broadcast activities. Marketing Mix Promotion/Message Uncrustables received free advertising when Liz Crenshaw of NBC4 did a segment on the product. Currently, Uncrustable ads can be seen regularly on television and coupons are available in local newspapers. However, the most buzz about Uncrustables can be found on the internet. Individual store promotion: samples and displays Marketing Mix Promotion/Media The Uncrustables brand name has not been the sponsor of any major event, but Smucker’s on the other hand has been the main contributor to an iceskating event and a special episode of Family Feud has featured some the Smucker’s Ice-Skating stars. In Germany over 27 million people belong to sports club and the most popular sport in Germany is Fussball (Soccer). Event and team sponsorship is a major player in advertising in Germany as well as player endorsement. Marketing Mix Price As we said before, pricing would not be a major issue in Germany because the per capita GNP is relatively high ($22,740). The price would depend on the extra expense of either importing the goods from the United States or producing them in Germany. There are high tariffs on goods imported to the EU from the United States, particularly on processed foods containing added sugar, flour, starch, and milk. Marketing Mix Price/Tax The effective rate for trade tax varies by location from just under 12-20%. It is around 18% for most larger cities. This tax is deductible as an expense for corporation tax. German business profits are subject to 2 taxes; corporation tax which is levied at 25% and subject to a surcharge of 5.5%. The surcharge does not apply to companies with headquarter and management outside of Germany. A foreign company’s German branch would be charged both corporation tax and trade tax. Marketing Mix Price/Tax There is a 7% sales tax on food. This is charged to the manufacturer, not the consumer. All these factors could ad to the price of selling Uncrustables in Germany. Marketing Mix Positioning Against Competition Intermezzo Intermezzo are sold at a cost of .99 euro. With the current exchange rate of $1/1.32 Euro, the cost of one Intermezzo is about $1.31 (this includes tax). In the U.S. Uncrustables cost about $.75 per sandwich and usually come in packages of 4, 10, or 18. Marketing Mix Positioning Against Competition Uncrustables needs to consider the price of their competitors to decide if they want to position themselves based on price. A leader in the German frozen food industry, Frosta, decided to position themselves on quality rather than low cost. They suffered a large drop in sales. Marketing Mix Positioning Against Competition Crispy Pancakes Crispy pancakes were developed “for kids by kids.” Unlike Crispy pancakes, Smucker’s does not directly target children in Uncrustables promotion. Crispy pancakes are served in many schools in Germany. Smucker’s has recently been promoting Uncrustables the same way by putting them within the school foodservice market. Smucker’s needs to consider this direct competition for the grilled cheese flavor in schools. Uncrustables in Germany? Main Factors to Consider Assessment of potential market Distribution Segmentation and Targeting Marketing mix Questions?