8 2015-8 Deadweight Loss and Taxes

advertisement

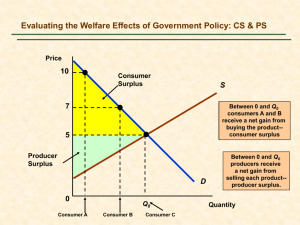

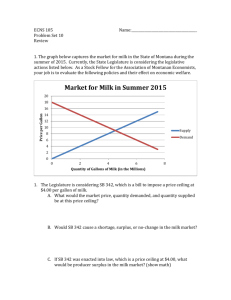

Deadweight Loss and Taxes Governments have many powers to affect welfare but each power involves choices about who wins and who looses as a result. Taxes tend to spread the losses across society in general through the “social climate”. Prescriptions have direct effects on specific sectors and as such deal with the “business climate”. Taxes are a distortion • Taxes and subsidies distort the market and produce what is called deadweight loss because it removes from the market economic surplus that would otherwise benefit consumers and employ resources for production. • The deadweight loss depends on the elasticities of supply and demand and therefore as to whether or consumers or producers “win” or “loose”. • However Suppliers also win or loose and it is the relative impact on suppliers that may have the most profound economic impact. Deadweight Loss • Deadweight Loss is calculated as Surplus Before less Surplus After for Producers and for Consumers in total. This is economic surplus that cannot be recovered after the tax. Suppliers also loose but it is assumed that they are able to find markets in other sectors and are not part of the deadweight loss. Price Consumer Surplus After Supply Consumer Surplus Before Price with tax Producer Surplus Before Price before tax Producer Surplus After Supplier Surplus Before Supplier Surplus After Quantity with tax Quantity without tax Demand Quantity Elasticities Determine “winners” and “losers”. As demand becomes more inelastic CS falls and taxes are ineffective because consumers substitute out of the market and suppliers follow. As supply becomes more elastic PS rises and taxes are ineffective because producers cannot change production and suppliers are cut out of the market. Only when demand and supply are measurably elastic will there be a long term deadweight loss. Price Measurably Elastic Demand Perfectly Elastic Demand Measurably Elastic Supply Perfectly Inelastic Demand Perfectly Elastic Supply Quantity Perfectly Inelastic Supply Governments Perspective on Deadweight Losses • Tax revenue may “capture” the deadweight loss and the government can then redistribute the wealth in a socially responsible way which the market would not. • Deadweight losses are dependent on elasticities and the government may be able to change the elasticity of demand by: – Education and public awareness making demand more inelastic. – Research and development efforts making supply more inelastic. – Using prescriptions to “block out” a market. Making Demand Inelastic • • When demand is relatively inelastic the deadweight loss of a tax is relatively small. When demand is relatively elastic the deadweight loss of a tax is relatively Large. Deadweight Loss Is relatively small Supply Deadweight Loss Is relatively large Demand Demand Inelastic Demand Supply Elastic Demand Making Supply Inelastic • • When supply is relatively inelastic the deadweight loss of a tax is relatively small. When supply is relatively elastic the deadweight loss of a tax is relatively Large. Deadweight Loss Is relatively small Deadweight Loss Is relatively large Supply Supply Demand Demand Inelastic Supply Elastic Supply Blocking Out a Market • When Demand and Supply are inelastic the market is blocked out, as would be done by a benevolent social planner so taxes would not be needed and Total Revenue is fixed for all markets including supply markets Inlastic Demand Total Revenue is fixed. Inelastic Supply The Public Policy Debate • Taxes force consumers to prioritize expenditure and in the long run this may lead to abandoning a market entirely. As tax rates increase the deadweight loss increases at an increasing arte. As the tax rate increases though the revenue increases and then decreases. There is a tax rate and level of welfare loss beyond which deadweight losses are not recoverable. Tax Revenue Deadweight Loss $ Deadweight Loss Redistribution Level Tax Revenue Tax Size Percentage Tax Burden Rate Tax Limits • There are limits to taxation that will preserve a market. Governments generally view this as the level above which they cannot redistribute welfare losses caused by taxation. • The business climate in a free market economy with democratic freedoms allow for information to be widely understood by all members of society. • Even though surpluses may be manipulated they are never eliminated and when taxes are removed or government prescriptions are relaxed the surpluses are re-instated.