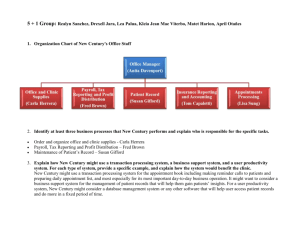

Online payments

advertisement

Online payments • How do we purchase on the web? • What choices of payment have we? 1 Online payments • Looking at …. – – – – – – – Credit Card Transactions Digital Currency E-Wallets Smart Cards Micropayments Business to Business (B2B) transactions E-Billing 2 Introduction • Secure electronic funds transfer is crucial to ecommerce • Examination of how individuals and organizations conduct monetary transactions on the Internet • Credit-card transactions, digital cash and ewallets, smart cards, micropayments and electronic bill presentment and payment • Electronic-payment enablers 3 Credit-Card Transactions • Popular form of payment for online purchases • Resistance due to security concerns • Many cards offer capabilities for online and offline purchases – MasterCard – Visa – American Express Blue 4 Anatomy of an Online CreditCard Transaction • To accept credit-card payments, a merchant must have a merchant account • Traditional merchant accounts accept only POS (point-of-sale) transactions – Transactions that occur when you present your credit card at a store • Card-not-present (CNP) transaction – Merchant does not see actual card being used in the purchase • Authentication – The person is, in fact, who they say they are 5 Anatomy of an Online CreditCard Transaction • Authorization – The money is available to complete the transaction • Acquiring bank – The bank with which the merchant holds an account • Issuing bank – The bank from which the buyer obtained the credit card, and the credit-card association • Verification • Money issued to merchant after product/service is distributed 6 Anatomy of an Online CreditCard Transaction • Step 1 – Consumer makes a purchase at an online store, credit card information received by e-store (merchant) • Step 2 – Credit card information is sent from the merchant to the acquiring bank • Step 3 and Step 4 – The credit card association and the issuing bank certify the transaction and the verification is sent to the acquiring bank • Step 5 – The merchant ships the product and payment is issued 7 Credit-Card Transaction Enablers • Credit-Card Transaction Enablers – Companies that have established business relationships with financial institutions that will accept online credit-card payments for merchant clients • • • • iCat Trintech Cybercash NextCard, Inc. 8 Online Credit-Card Fraud • Chargeback – When a credit-card holder claims a purchase was made by an unauthorized individual, or when a purchase was not received – The charges in question are not the responsibility of the credit-card holder – On the Internet, neither a scan of the card nor a signature is registered and the cost is incurred by the merchant • Visa – High-risk business models – “Best Practices” policy • Mastercard – Uses the three digit pin code on the back of the card 9 Digital Currency • Digital cash – Cash stored electronically, used to make online electronic payments – Similar to traditional bank accounts – Used with other payment technologies (digital wallets) – Alleviates some security fears online credit-card transactions – Allows those with no credit cards to shop online – Merchants accepting digital-cash payments avoid credit-card transaction fees – eCash Technologies, Inc. is a secure digital-cash provider that allows you to withdraw funds from your traditional bank account 10 Digital Currency • Gift cash, often sold as points, can be redeemed at leading shopping sites – An effective way of giving those without credit cards, the ability to make purchases on the Web • Points-based rewards – Points are acquired for completing specified tasks including visiting Web sites, registering or buying products – Points can then be redeemed 11 Digital Currency Using eCash on the Web. (Courtesy of eCash Technologies, Inc. and ©2000 eCash.) 12 E-Wallets • E-wallets – Keep track of your billing and shipping information so that it can be entered with one click at participating sites – Store e-checks, e-cash and credit-card information • Credit-card companies offer a variety of e-wallets – Visa e-wallets – MBNA e-wallet allows one-click shopping at member sites – Entrypoint.com offers a personalized desktop toolbar that includes an e-wallet • A group of e-wallet vendors have standardized technology with Electronic Commerce Modeling 13 Language (ECML) Smart Cards • Smart card – Card with computer chip embedded on its face, holds more information than ordinary credit card with magnetic strip – Contact smart cards • To read information on smart cards and update information, contact smart cards need to be placed in a smart card reader – Contactless smart cards • Have both a coiled antenna and a computer chip inside, enabling the cards to transmit information – Can require the user to have a password, giving the smart card a security advantage over credit cards • Information can be designated as "read only" or as "no access" • Possibility of personal identity theft 14 Micropayments • Merchants pay fee for each credit-card transaction • Micropayments – Payments that generally do not exceed $10, allows companies offering nominally priced products to profit • To offer micropayments, some companies form strategic partnerships with utility companies – eCharge uses ANI (Automatic Number Identification) to verify the identity of the customer and the purchases they make 15 Millicent Feature • Millicent is a micropayment technology provider • Companies using Millicent payment technology allow customers to make micropayments using credit or debit cards, prepaid purchasing cards or by adding purchases to a monthly Internet Service Provider bill or phone bill • Millicent handles all payment processing needed for the operation of an e-business, customer support and distribution services 16 Business-to-Business (B2B) Transactions • Business-to-business (B2B) transactions – Fastest growing sector of e-commerce payments – Payments are often larger than B2C transactions and involve complex business accounting systems • PaymentechTM – Payment solution provider for Internet point-of-sale transactions – Electronic merchants choose from transactionprocessing options including debit cards, credit cards, checks and EBT authorization and settlement 17 Business-to-Business (B2B) Transactions • eCredit provides real-time, credit-transaction capabilities of B2B size • Clareon facilitates B2B transactions by providing digital payment and settlement services – Payment is digitally signed, secured and authenticated via digital payment authentication (DPA) – Compatible with all enterprise resource planning (ERP) systems and can adapt electronic records for companies, banks and each member of a given transaction 18 Business-to-Business (B2B) Transactions • Electronic consolidation and reconciliation of the business transaction process – Companies can keep track of a transaction from orderto-cash settlement while reducing administrative costs, errors, waste and complexity in the supply chain • Order-fulfillment providers – Companies attempting to bring supply chain expertise and logistical services to Internet businesses • Internet-based electronic B2B transactions will augment, but not replace, traditional Electronic Data Interchange (EDI) systems 19 B2B Transactions PAYTRUST SmartBalance™ screen shot. (Courtesy of Paytrust, Inc.) 20 TradeCard Feature • Provides a global B2B e-commerce infrastructure – Cross-border data management and payment • Buyer creates pre-formatted electronic purchase order and presents document to seller • Purchase order data stored electronically in TradeCard database, and electronic invoices and packing slips are produced from data • Uses a patented "data compliance engine" to check documents against original purchase order – If discrepancies are found, concerned parties are notified immediately and can negotiate to resolve the conflict 21 TradeCard Feature • TradeCard awaits delivery confirmation from a third-party logistics services provider (3PL) – Industry terminology for a shipping company • When confirmation is received and compliance met, TradeCard completes the financial transaction by sending request for payment to the buyer’s financial institution • TradeCard enables large-scale and large-dollar commerce without credit-card payment through direct interaction with existing financial institutions 22 4.10 TradeCard Feature 23 E-Billing • Electronic Bill Presentment and Payment (EBPP) – Offers ability to present a company’s bill on multiple platforms online and actual payment processes – Payments are generally electronic transfers from consumer checking accounts, conducted through the ACH (Automated Clearing House) • Current method for processing electronic monetary transfers – Paytrust • Users send bills directly to Paytrust which scans them and places them online • E-mails customers about newly arrived bills and payment-due dates • Makes automatic payments on any bill up to a threshold amount 24 E-Billing • Services to enable EBPP on a company’s site – Derivion • Provides billers with electronic capabilities in conjunction with Paytrust’s service • Offers billing companies the technology and expertise needed to transfer from paper to electronic billing through iNetBillerSM – Encirq • Partners with banks that issue credit cards, presenting the consumer with an illuminated statement (interactive statement, placing special offers from retail merchants to correspond with the itemized charges on a credit-card statement) • Builds highly specific consumer profiles each time charges is received 25 CheckFree Feature • CheckFree is a consolidation service – Can service any biller and present consumers with all their bills in one interactive online environment • If the company or person you wish to pay does not offer electronic billing, you can still set up payment to them from any bank account using the pay everyone service • For billers, the e-billing option adds convenience and lower costs • All payments and outstanding bills can be tracked online and consumers have interactive access to their entire payment histories 26 Summary • We have looked at: – – – – – – – Credit Card Transactions Digital Currency E-Wallets Smart Cards Micropayments Business to Business (B2B) transactions E-Billing 27