International Finance *An Overview

advertisement

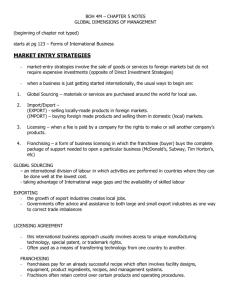

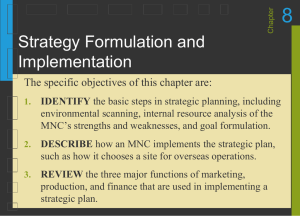

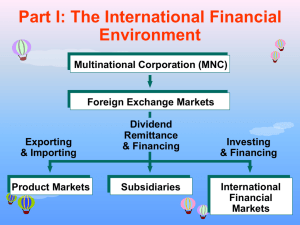

MBA (Finance specialisation) & MBA – Banking and Finance (Trimester) Term VI Module : – International Financial Management Unit I: Introduction to International Financial Management Lesson 1.1 International Finance –An Overview International Financial Management - Meaning The Management of Financial resources in the context of International Business transactions is referred to Management. as International Financial International Finance –An Overview Introduction International business are expansion of sales, acquiring resources, minimizing competitive risk and diversification of sources of sales and supplies. Besides these, there are other few factors like economic factors, cultural technological factors, and social factors which have factors, influence to a greater extent. However , the rapid expansion and diversification of international transactions during recent years have necessitated a separate and distinct focus on the financial aspects of International transactions. Managers now require special skills to understand the complexities of International finance. Accordingly, International financial management evolved into a separate discipline of study. International Finance –An Overview MNCs and TNC A Multi National Corporation (MNC) A Multi National Corporation (MNC) is a corporation with extensive ties international operations in more than one foreign country. in A MNC has its facilities and other assets in at least one country other than its home country. A Transnational Corporation (TNC) A Transnational Corporation (TNC) is a MNC that operates worldwide without being identified with a national home base. It is said to operate on a borderless basis. International Finance –An Overview The Scope of International Finance International Finance is crucial for MNCs in two important ways. It helps the companies and financial managers to decide how international events will affect the firm and what steps can be taken to gain from positive developments and insulate from harmful ones. It helps the companies to recognise how the firm will be affected by movements in exchange rates, interest rates, inflation rates and asset values. International Finance –An Overview Objective of the MNCs If the managers of MNCs are to achieve their objective of maximising the value of their firms or the rate of return from foreign operations, they have to understand the environment in which they function. The environment consists of: 1. The international financial system 2. The foreign exchange market 3. The host country’s environment International Finance –An Overview International Business Activities 1. Foreign Direct Investments (FDI) are investments made for the purpose of actively controlling property assets or companies located in host countries. 2. Foreign Portfolio Investments are purchases of foreign financial assets for a purpose other than control. International Financial Management Vs Domestic Financial Management 1.Foreign Exchange Risk: An understanding of foreign exchange risk is essential for managers and investors dealing with international transactions whereas in domestic financial transactions , this risk is ignored because single national currency serves as the main medium of exchange within a country. International Financial Management Vs Domestic Financial Management 2.Political Risk: In case of International Financial management, political risk ranges from the risk of loss from unforeseen government actions to outright expropriation of assets held by foreigners. Political risk associated with international operations is generally greater than that associated with domestic operations and is generally more complicated. International Financial Management Vs Domestic Financial Management 3.Expanded Opportunity sets: In case of International Financial management, the managers tend to benefit from expanded opportunities which are available to them. They can raise funds in capital markets from where cost of capital is lowest. Firms can also gain from greater economies of scale when they operate on a global basis. International Financial Management Vs Domestic Financial Management 4.Market Imperfections: The world markets today are highly imperfect. There are significant differences among nation’s laws, tax systems, business practices and general cultural environment. Though there are risks and costs in coping with these market imperfections , they also offer managers of international firms abundant opportunities. Issues in the functioning of Multinational Corporations A Multinational corporation is a corporation with extensive ties in international operations in more than one foreign country. A MNC has its facilities and other assets in at least one country other than its home country. Example – Nokia, Coca-Cola, Walmart,etc. Issues in the functioning of Multinational Corporations MNC have subsidiaries or joint ventures in each national market. Their lines of business are heavily influenced by socio-cultural, political, global, economic and legal environments of each country. International treaties such as Basel Accords, norms stated by WTO, etc. provide a uniform framework . The responsibilities of finance manager working in MNC can be understood by examining the principal challenges they are required to cope with. Five key categories of emerging challenges that can be identified are : Issues in the functioning of Multinational Corporations 1. To keep up-to-date with significant environment changes and analyse their implications for the firm. 2. To understand and analyse the complex interrelationships between relevant environmental variables and corporate responses. 3. To be able to adapt the finance function to significant changes in the firm’s own strategic posture. 4. To take in stride past failures and mistakes to minimize their adverse impact. 5. To design and implement effective solutions to take advantage of the opportunities offered by the markets and advances in financial theory. Self Assessment questions 1.Explain the objective of multinational financial management? What are various aspects of world economy which have given rise to international financial management? 2. “In globalised era the functions of finance executives of an MNC have become complexed”. In your view what are the factors responsible for decision making in international financial management? 3. Discuss the nature and scope of international financial management by a multinational firm. 4. How is international financial management different from financial management at domestic level? 5. Why is international financial management important for a globalised firm?