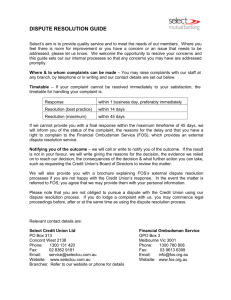

Complaint Reviews - Financial Counsellors

advertisement

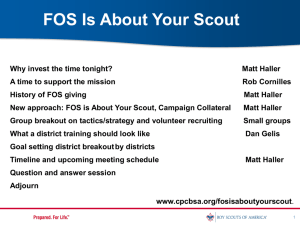

Presentation to FCAWA Anna Mandoki Case Manager, Financial Difficulty 29 September 2011 What we will cover Who is FOS? What’s new at FOS? FOS and its terms of reference (TOR) Dispute resolution process Financial difficulty and conciliations Case studies Resources Who is FOS? Financial Ombudsman Service FOS was created by the merger of the BFSO, FICS, IOS, CUDRC and IBD FOS is an ASIC approved External Dispute Resolution Scheme operating across the financial services sector, complying with ASIC RG 139, however we are not a regulator We handle up to 80% of banking, insurance and investment disputes in Australia We offer a free, fair and accessible service for consumers, however we do not advocate for consumers Membership is open to any financial services provider operating in Australia What’s new at FOS? Chief Ombudsman Shane Tregillis (replacing Colin Neave) Former ASIC Commissioner Before that, in a senior role at the Monetary Authority of Singapore where he was also Chair of the Financial Education Steering Committee Indigenous Liaison Team Aim to reduce barriers & improve access for Indigenous Australians to our complaint process A dispute process that is culturally sensitive Dispute form amended to ask about ATSI origin Disputes monitored by Indigenous Liaison Team Progress matters over the phone where possible Outreach to communities, build strong relationships with FCs and other stakeholders Help to identify issues with specific impact on Indigenous communities (e.g. CBA ATM issue) New Resources FOS Natural Disaster Hotline – 1800 337 444 Natural Disaster information on FOS website, including summary of bank assistance and contacts Financial Counsellors’ Toolkit (online & brochures) – – – Responsible lending & credit cards Insurance excesses Account suitability Feedback: amandoki@fos.org.au FOS Terms of Reference FOS Terms of Reference As part of the merger, FOS needed to develop uniform Terms of Reference The Terms of References came into effect on 1 January 2010, and apply to disputes lodged from that date The Terms of Reference were designed to accommodate the increased profile of EDR schemes in the new national credit regime Jurisdiction FOS may consider a dispute between a financial services provider (FSP)(who is a FOS member) and: – Individuals – A partnership comprised of individuals – The corporate trustee of a self managed superannuation fund – A small business (whether a sole trader or constituted as a company, partnership, trust or otherwise) – A club or incorporated association – A body corporate of a strata title or company title building; or – The policy holder of a group life or group general insurance policy Small business – if a manufacturing component, < 100 employees – otherwise, < 20 employees Jurisdiction We can consider disputes: – – – – – – where the value of the Applicant’s claim is $500,000 or less if the FSP is a member of FOS at the time that the dispute is lodged even if not a member at the time of the events giving rise to the dispute brought within 6 years of when the Applicant became aware (or should reasonably have become aware) that they suffered a loss, or within 2 years of receiving a final IDR response (note separate time limit for credit contract variations) Where the Applicant is seeking a variation to a consumer credit contract on the grounds of financial difficulty Where legal proceedings have commenced Further collection/recovery action will be placed on hold, but interest will usually continue to accrue under the contract Compensation caps We can award up to $280,000 in compensation for each claim This excludes compensation for costs or interest Non-financial loss is limited at $3,000 Consequential loss is limited at $3,000 Applicant’s costs are capped at $3,000 unless exceptional circumstances apply Applicants can abandon that part of their claim over $280,000 provided their claim does not exceed $500,000 Jurisdiction - Power to vary Where customer has made a reasonable request for a variation to a regulated credit contract, and that request has been declined by Financial Services Provider, FOS can require that the contract be varied Used as a last resort. FOS will consider: – – – Financial Services Provider’s response Whether customer has proposed a realistic repayment plan that will result in repayment of the debt, including arrears, within a reasonable timeframe Customer’s current financial circumstances and whether they will improve – does Applicant have capacity to meet payments if variation is granted? Centrelink recipients FOS Circular 2 (April 2010): – Centrelink income, no assets – debtor can’t be compelled to make payments – Creditors are not obliged to waive the debt – Creditor is still entitled to seek recovery e.g. by obtaining judgment, but this may be a hollow exercise particularly where circumstances are unlikely to change – FOS would not exercise its power to vary Our dispute resolution process Financial Difficulty and Conciliations Jurisdiction Paragraph 5.1(c) of the Terms of Reference preserves the ability to consider: – – maladministration in lending, loan management or security matters; and financial difficulty disputes Applies to Consumers and Small Business – – – 25.2 of Code of Banking Practice sets the obligation FSP must give genuine consideration to a customer in financial difficulty Genuine consideration reflects a process of engagement 900 The last 2 years – trending up 2011 average = 627 (3 month average = 743) 800 700 600 500 400 2009 average = 174 300 200 100 0 Financial Difficulty disputes received monthly by FOS Information FOS needs We ask for information to: – – – – Identify the issues in dispute Understand the actions of the parties Assist in finding mutually agreeable outcomes Decide on the dispute Common information requests for financial difficulty include: – – – Current Statement of Financial Position Are your client’s circumstances likely to change? How does your client propose to repay the debt? Telephone conciliation conferences Effective process to attempt to resolve 75% disputes resolve at conciliation – – – Ideally all borrowers should attend Be prepared Be flexible Outcomes owned by participants Provide certainty More flexible outcomes 25% 75% Not resolved Resolved Telephone conciliation conferences 45% 40% 35% 30% 25% Majority of outcomes relate to repayment arrangements Agreed timeframes – 20% – 15% Sale of asset Refinance of debt 10% 5% 0% Repayment Timeframe Repayment Repayment arrangement for sale / arrangement arrangement with variation refinance of with debt and asset waiver timeframe Timeframe for sale or refinance with partial waiver APRA release Debt waiver Other commercial decision Case Studies Case Study 1: Credit Card Debt US Citizen (64), sole income a US pension of $450 per month, but has home with substantial equity No repayments on credit card for 18 months FSP commenced legal action Original debt $2,500, now $8,000 Conciliation conference held – – – What were the issues? What is FOS approach? What was the outcome? Case Study 2: Home Loan Home Loan, Applicant affected by GFC, then took 12 months Parental Leave No repayments for 8 months, returns to work in 4 months Loan (incl arrears) $360k, bank valuation $355-$370k, monthly repayments $2,700 Conciliation conference: – – – What were the issues? FOS approach? What was the outcome? Resources Relevant information A library of relevant information available Old Terms of Reference publications: – Bulletin 46 – Bulletin 53 – UCCC vs CoBP Financial Difficulty Approach, Decisions and Loss Information requests Multiple debts and reduced repayment requests Repeat requests for assistance Dealing with one debtor about a joint debt Bulletin 60 (financial difficulty, maladminstration secured lending) Relevant information New Terms of Reference publications – The Circular 2 – The Circular 3 – Small business financial difficulty Debt collection and social security recipients Secured debts and shortfall issues Lender’s mortgage insurance and financial difficulty Debt recovery legal proceedings and financial difficulty The Circular 5 Information, varying a contract and responsible lending Preserving assets Repayment arrangements Relevant information Fact sheets – – – Other tools – – – – Information for consumers and representatives Small business financial difficulty Natural Disasters Statement of financial position Guide to conciliation conferences Financial Counsellors Toolkit (in development) E-learning sessions All available at www.fos.org.au How to contact the Financial Ombudsman Service Telephone: Internet: E-mail: Mail: Indigenous Liaison Team: ilt@fos.org.au 1300 78 08 08 www.fos.org.au info@fos.org.au GPO Box 3 Melbourne Victoria 3001