Presentation Title

MASFAA 2013

October 6 th – 9 th , 2013

Indianapolis, Indiana

Building Student Cost of

Attendance: Issues and

Ideas

Diane Fleming, Financial Aid Professional

Emerita

Sarah Soper, Director of Financial Aid, Indiana

University East

2

AGENDA

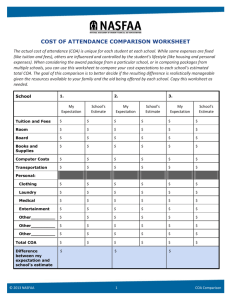

Overview of Cost of Attendance

Components

Professional Judgment – Could ‘ya? Would

‘ya? Should ‘ya?

Scenarios: What some schools do – and questions some schools have

COA: the 2 nd component of FM to determine financial aid eligibility

COA: Determined by law (HEA, Sec. 472); not subject to regulation by ED

FAA must determine what is reasonable & appropriate

FM uses the COA – EFC to determine eligibility for various need-based financial aid programs

FAAs must create a systematic method of developing COAs

COA must be included in the institution’s

Consumer Information publications

4

COA Components

Allowable costs in general

•

•

◊ Same for all FSA programs

Based on enrollment status

Sum of the following:

•

Tuition & fees

•

•

•

•

•

Books & supplies

Transportation

Room & board

Miscellaneous/personal expenses

Loan fees

5

ADDITIONAL ALLOWABLE COA

Dependent care

Study abroad expenses

One time cost for professional license or certificate

Student disability expenses

Employment expenses for co-op study

Less than half-time enrollment, room and board for a limited duration

Independent student or dependent student living with parent who receives BAH – COA can only include board – not room & board

6

TUITION AND FEES

Average vs. individual enrollment

Separate averages for various categories of students, e.g., undergraduate vs. graduate, in-state vs. out-of-state, program of study, dependent vs. independent, etc.

Fees: Must be required for student’s course of study OR be required of all students, e.g. equipment rental, required health insurance

7

BOOKS & SUPPLIES

FAA must determine a book allowance; can differentiate between undergraduate vs. graduate, academic discipline, etc.

Supplies: Incudes a reasonable amount as determined by your institution for documented rental/purchase of a computer; mandatory expenses associated with an academic program, e.g., musical instrument, medical supplies, mechanic’s tools, cosmetology kits/supplies, etc.

TRANSPORTATION

8

Different costs for residential, off-campus, commuter or on-line only students

Payment for purchase/lease of a car is not allowed

Study-abroad costs

9

ROOM & BOARD

Categorize student’s (without dependents) place of residence:

◊

◊

Living with parent(s)

Living in institutionally-owned housing

◊

◊

Living off-campus, must be based on reasonable expenses for student’s room & board: cannot exclude R&B for student’s enrolled in on-line only programs (Sec. 472 (10)

Living in on-base military housing (must exclude allowance for room)

PERSONAL/MISCELLANEOUS

10

Personal: includes clothing, laundry & cleaning, personal hygiene/grooming and recreation necessary to maintain living at a

reasonable

standard

Miscellaneous:

◊

◊

◊

One-time purchase of a computer/musical instrument

Dependent care costs

Disability-related expenses

11

LOAN FEES

Must be included if student actually borrows a Direct Loan

Can be an actual loan fee amount or an average based on the same type of loan borrowed for attendance at the school

Optional to include loan fees for nonfederal conventional alternative or private student loan

12

COA RESTRICTIONS

Incarcerated students: tuition, fees, books & supplies only

Correspondence study: Actual tuition, fees, book, supplies; transportation, room & board costs incurred specifically while fulfilling a required period of residential training

Less than half-time students: tuition, fees, books, supplies, transportation, dependent care expenses, room & board (but for not more than 3 semesters, of which not more than 2 semesters may be consecutive

13

PJ: COULD ‘YA, WOULD ‘YA,

SHOULD ‘YA?

Sec. 479A(a): Discretion of Student FAAs with adequate documentation: Ability to make adjustments on a case-bycase basis to the COA….can include, but not limited to:

◊

◊

◊

◊

◊

◊

◊

◊

Unusually high child care or dependent care costs

Professional wardrobe

Study-abroad costs

Enrollment “overloads”

Unusual transportation costs for emergency travel, e.g. death of immediate family member

Increased R&B for internships, medical rotations, study abroad, cooperative education, etc.

Special dietary needs

Student mortgage and other expenses associated with home ownership

14

SCENARIOS: WHAT SOME SCHOOLS DO AND

QUESTIONS SOME SCHOOLS HAVE

Establish the COA but only package to direct costs

Exclude additional unsub eligibility

Delay disbursement until academic activity has been initiated

Prorate disbursement in modular programs

Delay disbursement and adjust COA to actual enrollment at census date

Make no PJ adjustments to COA

Exclude R&B for on-line programs – NOT

PERMISSIBLE!!

Establish a national R&B rate for on-line programs

Other scenarios??

15

SCHOOL QUESTIONS

Can you do PJ for: X,Y, or Z??

What can you do with COA to help improve the institutions cohort default rate?

Is there a minimum R&B COA for on-line only programs?

Must you include transportation for on-line only programs?

Other questions??