Cost of Attendance

advertisement

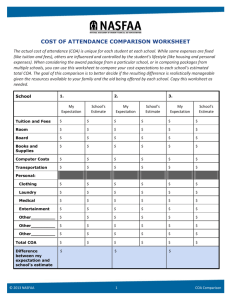

NYSFAAA Conference 2015 • Wednesday October 28, 2015 • 9:45am-10:45am Cost of Attendance Session • Welcome to Buffalo, New York; An All America City • If time allows, perhaps your interest may include: Chicken Wings; Pizza; Beef on Weck; Paula’s Donuts; Visit Niagara Falls; Albright Knox Art Gallery; Burchfield Penny Art Center; Frank Lloyd Wright House; Shea’s Theater; Naval Park & Canalside; Root for the Buffalo Sabres; Buffalo Bills; (Budget wisely and it will be a great visit to the Queen City.) Cost of Attendance • When developing the Cost of Attendance, the guiding principle is? • A. Time • B. Technical/Staffing Limitations • C. Reasonableness • D. All of the above C. Reasonableness • Student budgets are designed to provide students with an accurate projection of reasonable costs. Cost of Attendance • When costs are understated, students may encounter? • A. Financial Difficulties • B. Poor Academic Performance • C. Retention Issues • D. Higher Consumer Debt • E. All of the above E. All of the above • We want all students to be able to afford college and not experience financial difficulties. • We want all students to perform well academically. • We want to see all students progress and succeed. • We want to see students with low debt. • We want the best for our students, so they can learn, grow, and pursue the American Dream. Cost of Attendance Development, Research, and Finalizing • COAs should reflect reasonable and realistic costs that a typical student in a given set of circumstances will incur, within a moderate lifestyle, to attend an institution for a given period of time. • COA may only include expenses incurred during the period of enrollment. Enrollment period generally reflects 9 months for an academic year. • (NASFAA Monograph December 2014, Number 24) • Brent McEnroe, Assistant Director Quality Assurance & Funds Management • University at Buffalo (SUNY) The State University of New York Talking Points • Institution • Basic COA Components • Allowable COA Components • Helpful Hints • Resources • Disclaimer • Questions Institutions Responsibility Regarding Development & Documentation • 1. Policy and Procedure Manual-the development of the • • • • standard Cost of Attendance needs to be on file and accessible. (Careers: UGRD, GRAD, PHARM, LAW, Etc…) 2. Supporting documentation for standard COA construction. (Ex: survey’s, internet links, publications, local housing costs, etc…) 3. Maintain consistency within each division/across student population(s). (Careers.) 4. Maintain documentation for adjustments on a case by case basis. (PJ) 5. To ensure COA’s are comprehensive & adequate, periodic reviews of the COA research is necessary. Can you provide some Basic COA Components? Basic COA Components • Tuition & Fees • Books & Supplies • Transportation • Personal (Miscellaneous) • Room & Board • *Loan Fees (Required for Direct Loan borrower(s); Optional for nonfederal conventional loan) Tuition & Fees • Tuition & fee charges are allowed in a COA if the coursework is credited toward the student’s degree or educational program. • If institutions assess tuition & fees at different rates for full time, three-quarter time, half-time, and lessthan-half-time, the institution needs to have the tuition & fees of the COA applicable to the students enrollment. • Required fees that are billable should be part of the tuition & fees component of the COA. Tuition & Fees • Optional fees can be addressed on a case by case basis via PJ. (Example: health insurance, lab fees, etc…) • Build and have a positive relationship with Student Accounts/Bursar, Departments, etc…. Helps with consistency. • Tuition & Fees Approval via Board of Trustees/SUNY/CUNY, etc…. Books & Supplies FSA HANDBOOK • Rental or purchase of equipment, materials, or supplies can be in Tuition & Fees component of COA. (Mandated expenses for certain programs.) • Departments can provide itemized statements of required materials. • Books/Supplies is separate than items included in the Tuition & Fees. • You can develop separate Books/Supplies COA component for certain programs like Art, Architecture, Medicine, Nursing, Law, Engineering, etc…. Books & Supplies • Students who are ¾, ½, or less than ½ time, Books • • • • & Supplies will generally be proportionate to the student course load. Additional materials can be reviewed, approved or denied on a case by case basis using PJ. Supporting documentation for PJ is acceptable from Academic Support Services, Instructors, other designated campus staff. Institution bookstore, local bookstore, and online venues are avenues to help you reach the Books & Supplies figure. (Rent, Purchase, New, Used.) Prepare and provide a survey to students. Transportation • 1. Transportation allowance may include the cost of • • • • • • • travel between the student’s residence and the institution. TRUE 2. Transportation allowance may include travel necessary to complete a course of study. TRUE 3. Transportation allowance may include the payment for the purchase of a vehicle or lease of a car. FALSE 4. Transportation allowance may include the cost of operating and maintaining a car (gas, oil, license, insurance, repair). TRUE Transportation • You can survey commuter students to determine an average distance & frequency; Survey distance, method, and frequency for on campus students traveling home during the school year. • You can use the IRS Daily mileage rate times the number of miles per week, times the number of weeks in the semester or year. • Cost, frequency, distance can be applicable for public transportation to help determine the transportation figure. • Unusual, unanticipated, & emergency travel expenses can be reviewed/determined on a case by case basis. (PJ) Personal/Miscellaneous • Can Recreational Activities be included in this • • • • category? YES (As long as they are not already included in the tuition & fees portion of the COA.) P/M includes Laundry, cleaning, personal hygiene and grooming. For the student to live at a reasonable cost, surveys & or governmental data can be utilized. Meals not covered by the board plan should not be part of this category, rather part of the board section. (Budget increase if allowable via PJ.) Room & Board • If Room & Board is supplied at no charge, then • • • • COA for this item must be $0. If Room & Board is charged & in COA, the charge is waived, then Room & Board waiver is a financial aid resource. Room costs include rent, insurance, internet, and utilities. Board cost includes meal expenses. For students who live Off Campus or Commute, you can include a Living Allowance to capture Room & Board costs. (Terminology.) Room & Board • Build a positive rapport with some or all of the following places to assist with Room & Board COA development: • Campus Housing & Dining • Local rental agencies • Local grocery stores & food suppliers • Nutrition stores • Local utility companies Loan Fees • Institutions can use an average amount or actual amount. • An institution must include a loan fee allowance if the student actually borrows a Direct Sub/Unsub Loan. • PLUS is dependent upon when the application is on file, awarding of loans, and if PLUS is the only form of aid. • Conventional student loan fees can be included, not home equity. Loan Fees 3 Options for calculating Loan Fees: • 1. Average loan amount for all students multiplied by the loan fee percentage. • 2. Calculate separate loan fee averages for UGRD and GRAD students. (More accurate.) • 3. Calculate an average loan fee amount for each annual loan limit. • If institutions package with ‘estimated’ Direct Loan(s), the COA may include loan fees, even if not accepted or applied for the loan. Additional Allowable Costs • Disability-related expenses: COA for disabled student can include • • • • reasonable costs associated with the disability, if not already covered. Dependent Care: Student with one or more dependents during class time, study time, field work, research, internships, commuting, and other educational endeavors. Study Abroad: Additional transportation costs, Administrative fees/charges; Documentation/vaccination requirements, etc…. Cooperative Education Program: Commuting/transportation costs, meals away from home, other expenses related to the work experience. Professional Credential: One time cost of obtaining the first professional credential for a student in a field requiring professional license/certification (application & exam cost, travel for interviews, etc….). Additional Allowable Costs • Personal Computer: Students enrolled at least ½ time, rental or purchase documentation. Institution policy and procedures should include the conditions for the allowance, amount, and supporting documentation requirements. • Military On Base Housing: Students living on base or in housing the military provides an allowance, COA can only include board, not the room. Cannot PJ to add back in the room. Online Only Programs • Students enrolled in an online program with no coursework taken in a traditional classroom setting are allowed the same cost of attendance as students in all other programs. • If an FAA determines via PJ that distant education results in a substantially reduced COA, a reduction is allowable with solid documentable reasoning. (similar to commuter versus on campus/off campus) Include the reduction process in the institutions Policy and Procedure Manual. COA Tidbits • Incarcerated Students: Can only include books and supplies if • • • • required, and tuition and fees. Distance Education (television, audio, computer transmission): Distance Education courses do not have COA restrictions. Correspondence Study: (A school provides instructional materials & exams, but students don’t physically attend classes at the institution.) You can include the contractual tuition/fees, books/supplies; transportation/room/board figures while fulfilling the required training. Less than half time: tuition/fees, books/supplies, transportation, dependent care. Room/board is the institutions option not more than 3 semesters or not more than 2 consecutive semesters. No monitoring of attendance at other institutions. Finance Charges: Students and families who choose to pay their bill over time incur finance charges. The finance charges are not educational expenses and cannot be part of the student’s cost of attendance. COA Tidbits • True or False: • The law does not specify what documentation you must collect for expenses. • TRUE: You can document these expenses in a reasonable way-interview, written statement, source…. • Awards for each of the Federal Student Aid (FSA) programs are based on some form of financial need, beginning with the cost of attendance (COA). • TRUE Helpful Hints • Develop a calendar for the year (meetings, • • • • construction, finalization, updates to technical, run simulations, deadlines, website, etc..) Minimally 13 Departmental COA’s (times 2 or 3 =‘s need to streamline processes) Make notes during the process, so at the end you can update Policy & Procedures Train staff and provide updates Before moving forward and or providing update to technical, pull together a few staff members to discuss/finalize the process Helpful Hints • Partnership: Contact each department & meet with • • • • • • them; request they survey/research/prepare books/supplies/items specific to their students educational expenses Collaborate with Student Accounts Collaborate with Athletics Collaborate with Admissions Collaborate with Departments Keep in mind ‘Reasonableness’ Before publication in College Catalogue, ask to review a copy Resources • 2015-2016 Federal Student Aid Handbook • Volume 3 Calculating Awards & Packaging, Chapter 2 Cost of Attendance: • http://ifap.ed.gov/fsahandbook/attachments/1415FS AHbkVol3Ch2.pdf • NASFAA Monograph December 2014, Number 24 • http://www.nasfaa.org/uploads/documents/ektron/aa ba2f1c-e0d0-4ff0-bd11b75cf0beeb43/de0499b7954e491b8db81895834a0 61012.pdf Resources • IRS (Internal Revenue Service) Standard Mileage • • • • • • • • Rates: https://www.irs.gov/Tax-Professionals/StandardMileage-Rates/ Bureau of Labor Statistics: http://www.bls.gov/ Example: Bureau of Labor Statistics Consumer Expenditure Survey, 2012: http://www.bls.gov/cex/2012/combined/age.pdf Institution Housing & Dining Departments Campus & Local Book Store(s) Online Vendors for Materials 5 Volunteers to Answer a Question • 1. The Cost of Attendance can be a political hot • • • • • issue on your campus. (True or False) TRUE 2. The purpose of the COA is to determine realistically how much money it will take to get the student through the enrollment period. (True or False) TRUE 3. One way to judge if your COA budgets are realistic is to track the requests from students asking for more funds for the semester/year. (True or False) TRUE 5 Volunteers to Answer a Question • 4. Your policy should state how often a student may receive funds for a new computer. (True or False) • TRUE • 5. The location for Cost of Attendance information within the Federal Student Aid Handbook is: 20152016; Volume 3 Calculating Awards & Packaging; Chapter 2 – Cost of Attendance (Budget). (True or False) • TRUE Disclaimer • *Information is subject to change without notice due to changes in federal, state, and/or institutional rules and regulations. Students must complete a FAFSA every year. Students must be making satisfactory academic progress to continue to receive financial aid. • Disclaimer good to advise students & for website. • **All photos within this presentation are via google photos. Closing • The goal of this presentation is to provide you some additional information to assist with the construction of annual Cost of Attendance. My goal is that you learn at least one new item/aspect from this session. • This presentation supplies you with items for development, research avenues, and allows for you to finalize COA(s). Good luck! Cost of Attendance Questions? Thank you!!!! • Brent McEnroe, Assistant Director Quality Assurance & • • • • Funds Management bmcenroe@buffalo.edu 716-645-8101 (SUNY) University at Buffalo The State University of New York