Insurance Powerpoint

advertisement

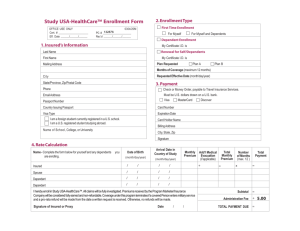

Household Insurance Distinguish between Insurance Protection against a loss you hope will not happen. Eg. car accident. Assurance Protection against a loss you know will happen. Eg. death. Two reasons for adequate insurance You must cover all possible risks. Eg. In household insurance: fire, theft, flood and accidental damage. You must insure enough to cover full amount of loss. Eg. If your house is worth €200,00 you must insure it for that value. The basis for insurance is sharing the risk. Large number of small premiums Ins. co. expenses Insurance pool/fund Ins. co. profit Compensation Distinguish between Insurable risk Things that can be insured. Eg. Houshold insurance; fire theft, damage. Personal accident for a farmer. Non-insurable risk Things that cannot be insured against. Eg. Damage to car used in crash testing. Personal accident for a bungee jumper. Insurance Terms Exclusion Clause: Situations that cannot be insured. Eg. Household insurance: A house situated near a river that is known to flood every year. Insurance Terms Policy Excess/Excess Clause: The insured person may have to pay the first €100 of the compensation themselves. This is to reduce the number of small claims being made. To make people more careful. Insurance Terms Proximate Cause: What is the exact cause of the loss. Eg. was it fire or theft or flood? ie. what actually happened? This helps the insurer decide if compensation is due. Insurance Terms Compensation: Is the money you get when you make a claim. Principles of insurance Insurable Interest Utmost Good Faith Indemnity Contribution Subrogation Insurable Interest In order to insure something you must benefit from its existence & suffer from its loss. Eg. You can insure your own house but you cannot insure your neighbours’s house. Utmost Good Faith You must tell all relevant information when filling out an application for insurance. Eg. If you have an illness you must tell the ins. co. as they may want to charge a higher premium or not insure you at all. Indemnity You cannot make a profit from insurance. There is no point in insuring your house for more than it is worth as the ins. co. will only compensate you for the actual value of the house. Contribution If a risk is insured with two insurance companies each will pay half of the compensation. Eg: A ring insured with two ins. co.’s. for €1,000 Both will give ?? €500 each. Subrogation Passes the legal right of the insured over to the insurer to claim from a third party who caused the loss. Eg. Whirlpool oven causes house to go on fire. Ins. co. pays compensation to insured and then seeks their own compensation from whirlpool. Average Clause Related to underinsurance and partial loss. If you only insure an item for a fraction of the value, you only get the same fraction compensation. Formula SUM INSURED x CLAIM = COMPENSATION ACTUAL VALUE EXAMPLE 1. Mary insured her house for €200,000. The market value is €250,000. A fire causes €10,000 worth of damage. How much compensation will she receive??? Solution 1 200,000 x 10,000 = 8,000 250,000 Documents used in insurance Proposal Form Application form for insurance Policy Contract of insurance Gives full details of cover Must be filled away safely Cover Note Temporary policy Used in car insurance, while you are waiting for insuracne disc Certificate of Insurance Proof of insurance Claim Form Form you fill out when a loss occurrs and you want compensation People in insurance Broker Gives advice on insurance Sells insurance on behalf of lots of companies. Eg: Agent Sell insurance for only one co. Eg: FBD, Quinn Direct…….. Actuary Calculates insurance premiums Loss Adjuster Calculates the value of the loss Works for the insurance co. Loss Assessor Calculates the value of the loss Represents the insured Steps involved in taking out insurance 1. Decide what risks you want covered. (ask a broker) 2. Fill out proposal form. (ugf) 3. Pay your premium. 4. File your policy in a safe place. Steps involved in making a claim. 1. 2. 3. 4. Contact guards & ins. co. Obtain estimates of lost/stolen items. Fill out claim form. (ugf) Talk to assessor and agree on compenstaion. Terms relating to premium calculation Premium The cost of insurance Money you pay to be insured The higher the risk the higher the premium Risk Effect Things that cause premiums to be high or low Eg: In car insurance No car accidents = lower premium Under 25 male = higher premium Loading Extra premium for higher risk Eg: A smoker will have a higher premium for life assurance than a non smoker Discount Money taken off premium for a lower risk Eg: In house insurance you get a discount for having an alarm No Claims Bonus In car insurance you get a discount if you do not claim for any accidents the previous year It encourages people not to claim for small amounts Renewal Date The date you must have your premium paid by. Eg : 1/10/08 Days of Grace You may be given a few extra days to pay your premium Not allowed in motor insurance Premium Calculation Questions Types of Personal Insurance PRSI Pay Related Social Insurance. Statutory Deduction from you salary. You will receive an income if you are out of work due to illness, disabiity, maternity leave… Medical Insurance In case you get sick or need an operation Eg: VHI Voluntary Health Insurance Personal Accident Covers people who are injured due to an accident. Lump sum payment for loss of finger, sight, hearing etc. Salary Protection Provides an income in case you can’t work due to illness. Will provide you with a higher income than PRSI only. Pension Plan Provides you with lump sum and income for your retirement. Holiday Insurance Provides you with health care if you get sick on holidays. Risk Effects for Personal Insurance Loading Older, smoker, risky job Discount Younger, non-smoker, low risk job