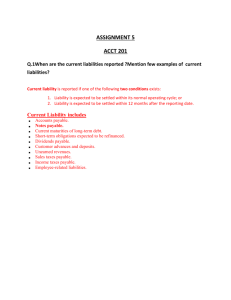

current liabilities

advertisement

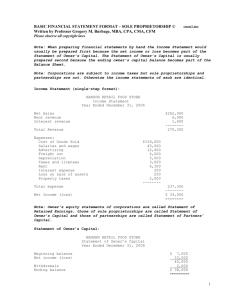

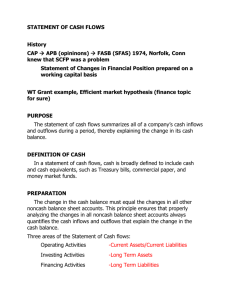

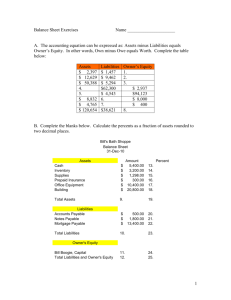

Current Liabilities and Contingencies I N T ERMEDIATE ACCOU N T I NG I I CHA PT ER 1 3 CHARACTERISTICS OF LIABILITIES A liability is a present obligation to sacrifice assets in the future because of something that already has occurred. A liability has three essential characteristics. Liabilities: 1. are probable, future sacrifices of economic benefits 2. arise from present obligations (to transfer goods or provide services) to other entities 3. result from past transactions or events Most liabilities obligate the debtor to pay cash at specified times and result from legally enforceable agreements. Some liabilities are not contractual obligations and may not be payable in cash. CURRENT LIABILITIES Classifying liabilities as either current or long-term helps investors and creditors assess the relative risk of a company’s liabilities. Generally, current liabilities are payable within one year. Current liabilities are expected to require current assets (or create current liabilities). Conceptually, liabilities should be recorded at their present values, but ordinarily are reported at their maturity amounts. SOME COMMON CURRENT LIABILITY ACCOUNTS Accounts Payable – obligations to suppliers of merchandise or services purchased on open account; generally payable within 30-60 days of the purchase Trade Notes Payable – similar to accounts payable but are formally recognized by a written promissory note Short-term Notes Payable – is created when a company borrows cash from a financial institution by signing a formal promissory note with a stated maturity date and interest charges; due within one year or less Interest Payable – an account used to record interest charges that have accrued but have not yet been paid Salaries/Wages Payable – an account used to record amounts earned by employees that not yet been paid; generally only used for adjusting entries at the end of the accounting period Sales Tax Payable – an account used to record amounts due to federal and state tax agencies but not yet paid ACCRUED LIABILITIES Liabilities accrue for expenses that are incurred, but not yet paid. Recorded by adjusting entries at the end of the reporting period, prior to preparing financial statements. Common examples are: salaries and wages payable, income taxes payable, and interest payable. LINE OF CREDIT A line of credit allows a company to borrow cash without having to follow formal loans procedures and fill out loan paperwork each time the cash is needed. Noncommitted Line of Credit – an informal agreement that permits a company to borrow up to a prearranged limit without having to follow formal loan procedures and paperwork. Committed Line of Credit – a more formal agreement that usually requires payment of a commitment fee to the bank Compensating Balance – a deposit kept by a company in an account at the bank; the required deposit is usually a small percentage of the line of credit limit. The establishment of a line of credit does not require a journal entry. However, a disclosure note should be included with the financial statements describing the details of the line of credit. COMMERCIAL PAPER Unsecured note Minimum denomination of $25,000 Fixed maturity between 30 and 270 days Lower-cost alternative to line of credit Only sold by blue-chip companies (large, highly-rated firms) Interest is often discounted at the issuance of the note Accounted for in the same manner as a note In this context, discounting interest means that the interest is paid “up front” when the note is issued. Brief Exercise 13–1, page 772 Date Oct 1 Account Cash Debit 60,000,000 Notes Payable Dec 31 Interest Expense 60,000,000 1,800,000 Interest Payable Jun 1 Credit Notes Payable 1,800,000 60,000,000 Interest Payable 1,800,000 Interest Expense 3,600,000 Cash 65,400,000 2013 interest expense ($60,000,000 x 12% x 3/12) = $1,800,000 2014 interest expense ($60,000,000 x 12% x 6/12) = $3,600,000 Brief Exercise 13–4, page 772 Date Mar 1 Account Cash Debit 11,190,000 Discount on Notes Payable 810,000 Notes Payable Nov 1 Interest Expense 12,000,000 810,000 Discount on Notes Payable Nov 1 Credit Notes Payable 810,000 12,000,000 Cash Discount ($12,000,000 x 9% x 9/12) = $810,000 12,000,000 EFFECTIVE INTEREST RATE Interest rate actually incurred on proceeds received from financing. When notes are discounted, the effective interest rate will be higher than the stated interest rate. For a discounted note, calculate as follows: Discount/Cash Proceeds = Effective Interest for Note Period Effective Interest for Note Period/Note Period X 12 = Annual Effective Interest Rate Effective Interest Calculation – Using Data From Brief Exercise 13–4, page 772 Date Mar 1 Account Cash Debit Credit 11,190,000 Discount on Notes Payable 810,000 Notes Payable $810,000/11,190,000 = .072386 / 9 X 12 = .0965136 9.65% (rounded) 12,000,000 CUSTOMER ADVANCES AND THIRD PARTY COLLECTIONS A customer advance produces an obligation that is satisfied when the product or service is provided. A customer advance occurs when a company collects cash from a customer as a refundable deposit or as an advance payment for productions or services. A third-party collection occurs when the business collects funds on behalf of another agency. CUSTOMER ADVANCES AND THIRD PARTY COLLECTIONS Customer Advances Unearned revenue • Record unearned revenue liability when pre-payment is received • Reduce the liability and recognize the revenue as the product is provided or service is rendered Gift Cards/Certificates • Record gift card liability when the card is sold • Reduce the liability and recognize the revenue when the gift card is redeemed or expires • Reduce the liability and recognize the revenue if the probability of redemption is viewed as remote Collections for third parties Sales taxes collected from customers represent liabilities until remitted Payroll-related deductions such as withholding taxes are liabilities until remitted • Record a liability (payable) when the collection occurs • Reduce the liability when payment is remitted to the appropriate agency Example – Customer Advances Tomorrow Publications collects magazine subscriptions from customers at the time subscriptions are sold. Subscription revenue is recognized over the term of the subscription. On October 1,Tomorrow collected $20 million in subscription sales. At December 31, the average subscription was one-fourth expired. Date Oct 1 Account Cash Debit 20,000,000 Unearned Subscriptions Revenue Dec 31 Unearned Subscriptions Revenue Subscriptions Revenue Credit 20,000,000 5,000,000 5,000,000 Subscriptions Revenue Earned: ($20,000,000 x 3/12) = $5,000,000 Example – Third Party Collections Pet Depot sold goods for $6,000 cash on August 1. The sale was subject to a 10% state sales tax. On October 15, Pet Depot remitted the sales tax collected to the state revenue agency. Date Aug 1 Account Cash Debit Credit 6,600 Sales Revenue 6,000 Sales Tax Payable Oct 15 Sales Tax Payable 600 600 Cash Only the revenue portion of the August 1 sale was recorded; Cost of Goods sold was ignored for purposes of this example. 600 CONTINGENCIES When an uncertainty exists as to whether an obligation actually exists that will be resolved only when some future event or outcome occurs (or not). CONTINGENCY STANDARDS Probable – likely to occur Reasonably possible – more than remote but less than probably Remote – unlikely or slight chance LOSS CONTINGENCIES A loss contingency involves an existing uncertainty as to whether a loss really exists, where the uncertainty will be resolved only when some future event occurs. The cause of the uncertainty must occur before the statement date; otherwise, regardless of the likelihood of the eventual outcome, no liability could have existed at the statement date. Contingent liabilities deemed to be reasonably possible or probable but the amount is not reasonably estimable should be disclosed in a note to the financial statements. Contingent liabilities deemed to be remote do not require any disclosure. A liability is accrued if it is both (a) probable that the confirming event will occur and (b) the amount can be at least reasonably estimated: Loss (or expense) Liability x,xxx x,xxx GAIN CONTINGENCIES Uncertain situations that might result in a gain. Gain contingencies are not accrued. Desirable to anticipate losses, but recognizing gains should await their realization. Should be disclosed in notes to the financial statements. Care should be taken that the disclosure note not give "misleading implications as to the likelihood of realization." UNASSERTED CLAIMS A claim has not yet been made or a lawsuit has not yet been filed. First, determine if the claim is probable. If not probable, no accrual or disclosure is required. If the claim is probable, evaluate the likelihood of an unfavorable outcome and whether the dollar amount can be estimated. Must meet the probable/reasonably estimable criteria. If both criteria are met, a liability should be accrued. If one of the criteria are met and there is a reasonable possibility that the loss will occur, a disclosure note should describe the contingency. PRODUCT WARRANTIES A written guarantee, issued to the purchaser of an article by its manufacturer, promising to repair or replace it if necessary within a specified period of time. The contingent liability for product warranties is almost always accrued. Warranty estimates are often based on past experience. The liability is recognized in the period in which the product associated with the warranty is sold. Brief Exercise 13–12, page 773 Exercise adjustment: Assume a one-year rather than five-year warranty period Date Account Warranty Expense Debit Credit 150,000 Estimated Warranty Liability 150,000 (15,000,000 X 1%) To record estimated warranty liability. Nov 1 Estimated Warranty Liability Cash (etc) 20,000 20,000 Based on the exercise assumption, an estimated warranty liability of $130,000 will appear as a current liability on the balance sheet for the current period. If the warranty were recorded for the original five-year period, the “expected cash flow approach” reporting the present value of the expected cash flows as the liability would provide the most reliable accounting information. Current Liabilities and Contingencies I N T ERMEDIATE ACCOU N T I NG I I - CHA PT ER 1 3 E N D OF P R ESENTATION