Paddy Gunnigle

advertisement

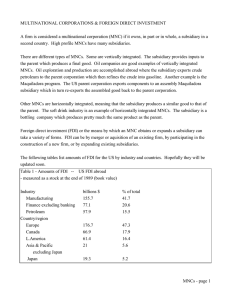

Varieties of Americanness?: The management of industrial relations in US multinational subsidiaries Paddy Gunnigle University of Limerick THE BIG PICTURE: WHY EXAMINE MNCs/US MNCs Key role as channels for the international spread of HR/IR policies & practices 1. Influence: increasing impact of MNCs as actors in the world economy 2. Incentive: competition in the in the global economy on the basis of competitive advantages deriving from their parent business system incentive to transfer practices 3. Capacity: increased ability to transfer because of changes in technology and corporate structure MNCs, A Profile • Huge Economic (& Political) influence 29 of the top 100 economic entities are MNCs not countries 54m employed in foreign affiliates Top 10 employed 2m abroad (at least 150,000 each) World sales of foreign affiliates $18tn / 11% of world GDP • Uneven distribution: top 30 hosts: 95% of inward FDI; top 30 homes – 99% of outward FDI • US MNCs employ approx.7m worldwide and 2.5m in Europe • Key drivers in the internationalisation of business • Europe a key region: W. Europe responsible for 1/3 - 1/2 all FDI outflows & inflows in 80s & 90s MNCs in Ireland • Different phases • Public Policy Change in late 50s • Among most dependent on FDI in EU % of Manufacturing Employment in Foreign Subsidiaries Austria 27.9 Fra 22.7 Ger 16.5 Irl 36.8 Neth 24.1 UK 18.0 US 15.1 • Highly globalised economy: 55% of manuf. output, 70% of indus. exports from MNCs • Huge growth in FDI in 90s: U.S. the major source….85% • 1990-98: In EU – Ireland got 25% of all US Manuf. investment, 14% of all FDI • Electronics, pharma/healthcare, software, ‘teleservices’ Absolute FDI Flows ($m) & as % of Gross Capital Formation 1999 2001 2002 Ireland Inward FDI % GCF 18,500 81% 15,681 66% 19,033 71% Germany Inward FDI % GCF 55,797 12% 33,918 9% 38,033 10% UK Inward FDI % GCF 84,238 34% 61,958 26% 24,945 10% Table 2: FDI Inflows 1993-2002 ($ Million) 1993 Total Ireland 1069 1996 1999 2616 18500 2000 26452 2001 2002 15681 19033 Table 1: FDI by Sector 2001 No. of firms Electronics & Engineering 341 (28%) Pharma & Healthcare 130 (10.5%) Misc. Industry 104 (8.5%) Textile & Clothing 23 (2%) Internat. & Fin Services 627 (51%) Employment 62,987 20,854 7,363 2,690 44,115 Table 2: FDI by Ownership 2001 US Germany UK Rest of Europe Rest of World 518 164 162 274 107 (42.3%) (13.4%) (13.2%) (22.4%) (8.7%) Table 3: US FDI Inflows to Ireland (IR£ Million) 1990 1991 1992 1993 1994 1995 1996 1997 1998 U.S. Inflow 65 113 135 192 153 184 300 323 324 1990* 100 174 *Base Year = 100 208 295 235 283 461 497 498 Research Issues How far the influence of the US Business System shapes HRM/IR in foreign subsidiaries…the example of Ireland? (cf. Ferner 1997, 2000, Edwards & Ferner 2002; Muller Camen et al 2001) Embededdeness in home country business system? … extent to which the HR/IR practices in subsids reflect the distinctive characteristics of the American business system/form of capitalism (cf. Whitley 1999, Hall & Soskice 2001 ) Limited role of State in regulating business/employment matters Flexible labour market model Short termism/Financial Markets Conflictual IR evolution Anti-unionism & ‘welfare capitalism’ (Jacoby 1999, Ferner/Edwards) Imposition V adaption? Factors encouraging transfer of HR/IR practices a. nationality effects Innovate in areas of national competitive advantage..JIT Behave differently…US MNCs more formalised, centralised – use use international coordination / Japanese MNCs more likely to exert ‘personal control’ through expatriate managers (Harzing 1999) b. increasing production/marketing coordination/ integration: Interdependence increases centralisation/imposition c. regional integration: standardisation, common polices (SEM)…imposition d. greenfield-brownfield: brownfield adapt, greenfield impose e. HR/IR Issues: Adaption..local IR/employee repn/non managerial, Imposition… strategic import/managerial/ HQ influence more likely to be high in areas seen as critical for international competitive advantage e.g. US MNCs may see individualised relationship with employees + employee commitment in a ‘union-free’ environment, as key to competitive advantage Why should US MNCs be innovators? • early development of sophisticated ‘organisational capabilities’ • economic dominance…. of US model globally.. ‘legitimacy’ Areas of innovation (general) • long history of innovation by US MNCs • Taylorised mass production • pay systems and performance management /coll bargaining • workforce “diversity”: gender, ethnicity, disability, sexuality, etc. • Employee representation: hostility to unions or strict codification of collective bargaining Methodology 4 countries, 7 Univs, Detailed cases Ireland – 5 cases Pharmaco: V. High Fortune 500, Revenue $30bn +, 90,000 + (1400 in Irl @ 7 sites), late 1960s. Healthco: High Fortune 500, Revenue $16bn, 71000 (1800 in Ire @ 8 sites), Mid 1970s (manuf). Itco: V. High Fortune 500, Revenue $85bn, 300,000+ (3500+ in Ire @ 5 facilities), 1950s (Sales & Serv) Compuco: Fortune 500, Revenue $40bn, 50,000 (3000 in Ire @ 4 sites), early 1990s. Logistico: Fortune 500, Revenue $30bn, 370,000 (1000 in Ire @ 3 ‘operations’…more sites), early 1990s. Interviews: semi-structured, cross section, all top mgt team, repeat visits. Findings Union Recognition and Collective Bargaining • Pharmaco & Healthco – union recognition and plant level CB in all sites initially, (departure/ conformist), all operator & craft categories (codified)/procedures). • ICT Firms (Itco & Compuco): non union ab initio…deep set ideological opposition to unions but differing approaches… welfare capitalism and union suppression. • Logistico: tradition of unionisation in US but non union initially….recently conceded limited union recognition Pay Issues • Pharmaco & Healthco – Above the norm local deals but recent change of tack. Competitive pressures and HQ control • ICT Firms (Itco & Compuco): Individualised, PBR • Logistico: non union & ‘limited union sites’. Individual representation only but national level accords (CB) influential. Recent Developments • …. ‘double-breasting’..Healthco & Pharmaco • Also Logistico…international example but some union success • Local-corporate decision? • Why - Confident of success, Flexibility in decision making, Occupational categories Conclusions Case evidence demonstrates: 1. [specific] capacity of US MNCs to implement IR policies (s.a. union avoidance) which align with corporate preference has increased over time (unions squeezed out of MNC sector) FDI & Trade Union Recognition, 1994-95, 2001-2003 (IRN). New firms Expanding firms Yes No Yes No 1994-1995 2 (6%) 30 (94%) 10 (56%) 8 (44%) (n = 50) 2001-2003 1 (6%) 16 (94%) 4 (18%) 18 (82%) (n = 39) Greenfield avoidance well established by mid 90s but brownfield only now taking hold (note change in FDI strategy) 2. [general] significant U.S. influence on Irish business sytem (public policy, AmCham, IR practice) …competition for FDI on basis of low tax, ‘pro-business’, comparatively light labour regulation…Changed political and economic context: EI Comm of Inquiry 1969: Incoming companies should recognise the industrial relations of this country and the inevitability of union recognition Minister for Ent & Employ 1996 The IDA ..is not there to press one particular way of dealing with industrial relations. I don’t see that as part of the IDA agenda. Some companies have an approach..which doesn’t involve unions…We can’t set preconditions. Country of origin effects have overiden country of operation effects and changed the characteristics of the ‘system’ ..but….pluralism may bite back (2004 Right to Bargain Changes). Logistico….Pragmatism of the MNC. ‘All managers are unitarists’ and pluralism will only take hold where pressures are brought to bear (Fox 1966, 68) ….Possibility of EU imposed formula to deal with collective representation (TD?)