Your 403(b) Tax Sheltered Account Program

advertisement

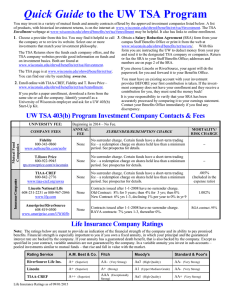

1 YOUR 403(B) TAX SHELTERED ACCOUNT PROGRAM Prepared for the Employees of Riverview Intermediate Unit #6 What is a 403(b) Tax Sheltered Account (TSA)? TSA’s are voluntary long-term retirement savings plans that allow all school employees to set aside money on a tax deferred basis for retirement. Section 403(b) of the IRS Code establishes and permits Tax Sheltered Accounts for all school employees. 2 Why you should take advantage of a 403(b) TSA program 3 Reduce current income taxes Provides taxdeferred growth* Supplements other retirement income *Income taxes paid at time of withdrawal How does a 403(b) Tax Sheltered Account (TSA) work? 4 2012 Taxable Income $100/pay in Bank $100/pay in TSA $50,000 $50,000 (Married filing jointly) TSA: $100/pay x 26 Adjusted Gross Income Income Tax -$2,600 $50,000 $47,400 $12,500 $11,850 -$650 Contributions of $2,600 per year could accumulate to $37,214 after 10 years, with an income tax savings of $6,500 *Assuming a 25% Federal Tax bracket and a 7% fixed annual interest rate How much can I elect to contribute to my 403(b)? 5 Employee Deferral Limits in 2012 2012 Normal Limit (or 100% of pay, if less) Aged 50+ “Catch up” Maximum Employee Contribution $17,000 $ 5,500 $22,500 When can I get my money out of my TSA? •No IRS penalty if age 55 and separated from service •In-Service withdrawals permitted at age 59 ½ Your 403(b) Plan permits: 6 Universal Availability (every employee can participate) Exchanges (between approved vendors) Transfers (from or to another school employer) Loans (if offered by the vendor) Hardship Distributions (if offered by the vendor) Roth 403(b) Contributions And, our IU offers employees the ability to contribute to a 457(b) Deferred Compensation Plan Roth 403(b) 7 What? Section of IRS Code that allows participants to make after-tax contributions, receive tax deferred growth, and make after-tax withdrawals after retirement Benefits Allows you to have tax-free assets after retirement Allows a combination of tax-free and taxable contributions during retirement Could be useful for employees with more time to save 457(b) Plan – Deferred Compensation 8 What? Section of IRS Code that allows participants to defer income until retirement, and shelter that income from current Federal Income Taxes Benefits Can be combined with a 403(b) to allow twice the amount of pre-tax savings per participant Ability to access the money prior to age 59 ½ if separated from service 9 Combined Contribution Limits for 403(b) and 457 Plans for 2012 Account Type Basic Contribution Limit (Under age 50) Age 50 or Older Catch Up Total Annual Contribution Limit (Age 50 or above) 403(b)(7) or Roth 403(b)(7) Tax Sheltered Program $17,000 $5,500 $22,500 457(b) Program $17,000 $5,500 $22,500 Combined 403(b)(7), Roth 403(b)(7) & 457(b) Total $34,000 $11,000 $45,000 The Time is Now The Benefit of 403(b) Contributions TSA Contributions with $30 per pay, per year Increase • Years $50 $100 $250 $500 5 $15,150 $22,300 $43,749 $79,498 10 $57,848 $75,026 $126,559 $212,447 20 $274,711 $325,679 $478,586 $702,546 30 $799,957 $911,436 $1,227,747 $1,668,311 Above Chart Assumes: • Contributions over 24 pays per year, 7% interest, and maximum $20,000 annual contribution • Assumes eligibility for age 50 Catch-up contributions • Illustrations are hypothetical and are not intended to serve as projections or prediction of performance for any specific investment Riverview Intermediate Unit #6 List of Approved Investment Providers 11 Ameriprise Financial Horace Mann Life Insurance Company Kades-Margolis Corporation MetLife Investors Insurance Company P&A Administrative Services, Inc. Security Benefit Symetra Life Insurance Company Complete contact information for all of the representatives of the above approved investment providers is included in the Summary Plan Description, which can be found at www.employeradmin.com Getting Started: 12 Go to www.employeradmin.com for more information about your 403(b) Plan Contact one of the investment provider representatives listed in the Summary Plan Description to open a TSA and/or 457 account Remove and complete the Salary Reduction Agreement in the Summary Plan Document or download a copy from the EAS website: www.employeradmin.com Turn the Salary Reduction Agreement into the payroll office Your 403(b) Tax Sheltered Account Program 13 Questions? The information in this presentation is for informational purposes only and should not be construed or relied upon as tax advice or legal advice. It was not intended to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code or promoting, marketing or recommending to another party any transaction or matter presented. If this presentation is used in the offer or sale of a variable annuity or mutual fund, it must be preceded or accompanied by the appropriate product prospectus. An investment in a mutual fund or variable annuity involves risk, including loss of principal, and is not a deposit or obligation of, or guaranteed by any bank. The investment return and principal value of an investment in a mutual fund or variable annuity will fluctuate so that you may have a gain or loss at redemption. Securities and Registered Investment Advisory Services Offered Through GWN Securities, Inc. 11440 Jog Road Palm Beach Gardens, FL 33418 (561) 472-2700 Member FINRA & SIPC For more information and to carefully consider the securities offered, including investment objectives, risks, charges, expenses and fees, please request a prospectus from you GWN Registered Representative. Please read it carefully before you invest or send money.