Title 32pt Times New Roman Italic with keyword highlighted red

advertisement

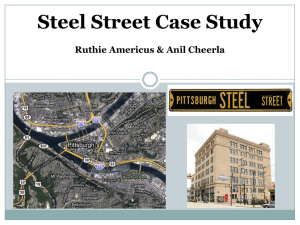

How the Private Sector Views Land/Buildings February 2016 There are numerous factors that determine where a business will relocate • “One size fits all” does not apply here. • Different key variables are important to different companies. 1 Just because you build it, they will not necessarily come… 2 What helps them decide to move to an area? Labor Availability Occupational Supply Current labor supply Prospective labor supply Labor competition Unemployment rate • • • • • Labor quality • • • • Knowledge skills and abilities Education Proximity to educational institutions Language skills Labor Costs Compensation, benefits, taxes Recruiting and training Termination liability and costs • • • Area Attributes • • • • • • Tax incentives Location to end user markets (drive time) Zoning restrictions Rental rates in market Infrastructure Etc. and more etc. 3 On Location… Where is the market? • • • • • • Varies a bit for asset class (industrial asset class can be very large) <30 minutes drive time, more often 10-15 minute drive time (or in metro 2-3 subway stops) Generally contiguous town/city Wright-Pat market does not include Dayton Knox market does not include Louisville O’Hare (BRAC 95) area was right outside O'Hare Airport and included Rosemont (casinos) Unless…the market is on the installation 4 What is the overall status of the U.S. market across asset classes? Multifamily Peaking market Falling market Rising market Bottoming market Hotel, Industrial CBD office Suburban office Retail Source: JLL Research 5 Q4 2015 U.S. overall office clock San Francisco Peninsula Houston Silicon Valley Dallas, San Francisco Austin, Fort Worth Peaking phase Falling phase Rising phase Bottoming phase Denver, Minneapolis, Seattle-Bellevue Los Angeles, San Diego New York, Pittsburgh, Portland, Tampa Boston Atlanta, Jacksonville, Miami, Orange County, Richmond, United States Chicago, Phoenix Charlotte, Fort Lauderdale, Kansas City Oakland-East Bay, Orlando Cleveland, Indianapolis, Raleigh-Durham, St. Louis Cincinnati, Fairfield County, Hampton Roads, Milwaukee Philadelphia New Jersey, Washington, DC Baltimore, Detroit, San Antonio, West Palm Beach, Westchester County Columbus, Sacramento Source: JLL Research Tenant-favorable market Neutral market Landlord-favorable market 6 Hampton Roads Market conditions • Three major influences have shifted demand away from new construction in Hampton Roads: the 33.3-percent premium for new construction over existing Class A rental rates, the increased popularity of teleworking in Hampton Roads and the numerous, but now less frequent, downsizes that occurred between 2009 and present. Additionally, growing demand from call centers created the largest active requirements in market, but focused solely on low-cost options with generous parking ratios. This criteria made the conversion of aging shopping malls to call center operation facilities an alternative to traditional office space. • The inherent risks from a market tied to defense spending and poor rental rate growth have been the most cited concerns to investors searching for yields in secondary and tertiary markets. While multifamily and retail investment sales remained strong in Hampton Roads, traditional office sales have struggled to gain ground. Supply 14.5% Total vacancy 287,858 s.f. Under construction Demand Pricing 2011 2017 18,570,507 s.f. Supply -40.2% Leasing activity 12-mo. % change 59,394 s.f. YTD net absorption -6.5% 12-month overall rent % change $20.64 p.s.f. Class A overall asking rent Hampton Roads overall property clock Outlook for tenants • Downtown Norfolk has been the epicenter of redevelopment in the Hampton Roads market. Most recently, 1 Commercial Place (Bank of America Center) was slated for multifamily conversion while 2 Commercial Place, a circa-1978, 287,858-square-foot office building, went under renovation and will absorb most tenants displaced by the conversion. Once complete, the redevelopment will remove a circa-1968 office building that has maintained an average vacancy rate of 52.0 percent (180,156 square feet) since 2010. • The latest delivery and with an asking rate of $26.00 per square foot, full service, Convergence Center V (200 Bendix Road), also delivered 55.1 percent preleased last quarter and is currently one of four Class A suburban space options larger than 20,000 square feet available for immediate occupancy. 2010 2016 12-month forecast Key market indicators Peaking market Rising market 2012 2018 2013 2019 Falling market Bottoming market 2014 2020 Source: JLL Research Tenant-favorable market Neutral market Landlord-favorable market 7 Silicon Valley Market conditions • Silicon Valley experienced yet another solid quarter of net absorption. Based on the level of touring activity, more tenants are expected to land in 2016. There are at least one million square feet of preleased, under construction space coming online in early 2016 to kick start the new year with positive occupancy gains. • With several major tech tenants finally planting their flag in North San Jose, the region will be well poised to be the next hot core submarket of the Valley. Given the steady decline in newer space availability combined with the current preleasing trend; tenants with future growth or relocation plans will consider targeting space options earlier to avoid missed opportunities. Supply 12.2% Total vacancy 3,276,660 s.f. Under construction Demand Pricing 2011 2017 68,545,489 s.f. Supply -16.5% Leasing activity 12-mo. % change 2,891,738 s.f. YTD net absorption 2.7% 12-month overall rent % change $44.87 p.s.f. Class A overall asking rent Silicon Valley overall property clock Outlook for tenants • Although vacancy rates have yet to reach single digit levels, the market for tenants in need of 100,000 square feet and larger has become much tighter when compared to 12 months ago. The aggressive expansion of large tech companies in core submarkets continues to push leasing activity further along 101 through Santa Clara into North San Jose. • While there are still some Class A under construction options available, rents for new development are rising in response to demand. For this reason, renovated secondgeneration space is becoming more attractive as it offers similar Class A finishes at relatively less expensive rents. Several tenants with larger requirements have yet to land. It is expected that North San Jose will capture some of this activity and help to push overall vacancy levels closer to single-digit levels. 2010 2016 12-month forecast Key market indicators Peaking market Rising market 2012 2018 2013 2019 Falling market Bottoming market 2014 2020 Source: JLL Research Tenant-favorable market Neutral market Landlord-favorable market 8 Seattle-Bellevue Market conditions • For the third consecutive year, net absorption has surpassed 2.0 million square feet. In Q4, 551,591 square feet of space was taken down, bringing the 2015 total to nearly 2.5 million square feet. Total vacancy in Seattle-Bellevue remains at 10.2 percent and is as low as the market has seen in the last 10 years. Subsequently, average asking rents are up 7.5 percent year-over-year and have hit a 10-year peak. Fourth quarter leasing activity was driven primarily by technology tenants; however, Safeco’s deal at Safeco Plaza was far and away the largest. Other tenants that signed major leases include Intellectual Ventures, DocuSign, Salesforce and Juno Therapeutics. • More than $4.4 billion in office investment transactions has occurred in Puget Sound this year. This represents a 152.5 percent increase over all of 2014. The most active submarkets for sales have been the Seattle CBD and Lake Union, with year-to-date volumes of $1.3 billion and $849.9 million, respectively. Supply 10.2% Total vacancy 5,912,171 s.f. Under construction Demand Pricing 2011 2017 91,830,292 s.f. Supply 43.8% Leasing activity 12-mo. % change 2,461,440 s.f. YTD net absorption 7.5% 12-month overall rent % change $38.99 p.s.f. Class A overall asking rent Seattle-Bellevue overall property clock Outlook for tenants • Seven major office projects delivered this year; totaling more than 2.2 million square feet. This makes 2015 the most active year for development since prior to the recession. The largest project, 929 Office Tower, is the first office building to be delivered in downtown Bellevue since 2009. With more than 5.9 million square feet scheduled to deliver in the next two years, construction activity will continue to dominate the conversation. • Tenants will have ample opportunity to acquire premier space and continue migrating to and growing in Puget Sound as just 35.1 percent of the space is currently preleased. Average asking rents for new construction space being marketed stand at $48.50 per square foot, full service, and represent a 42.7 percent premium over the regional average. 2010 2016 12-month forecast Key market indicators Peaking market Rising market 2012 2018 2013 2019 Falling market Bottoming market 2014 2020 Source: JLL Research Tenant-favorable market Neutral market Landlord-favorable market 9 Atlanta Market conditions • Declines in the metro unemployment rate, meaningful population increases, a growing GDP and strong corporate cash positions all pointed to substantial increases in annual demand for Atlanta office space. On the contrary, 2015 net absorption figures totaled less than in 2014. Actual figures fell short of analysts’ projections of 3.0 million square feet by about 400,000 square feet. Diversification trends also moved counter to expectations as demand failed to broaden further into the Class B segment as one would expect in a supply-constrained market with positive tenant demand. • Increasingly active are deals smaller than 25,000 square feet, which make up the bedrock of Atlanta’s office market demand. When compared to this time last year, smaller deals are making up a larger percentage of total leasing activity. As this smaller segment continues to expand, so too will overall net absorption. Supply 17.5% Total vacancy 885,000 s.f. Under construction Demand Pricing 2011 2017 133,555,157 s.f. Supply 12.2% Leasing activity YTD % change 2,578,651 s.f. YTD net absorption 10.2% 12-month overall rent % change $25.94 p.s.f. Class A overall asking rent Atlanta overall property clock Outlook for tenants • Over the final months of 2015, landlords seemed to be less aggressive relative to previous quarters. On the whole, average asking rates of large, contiguous blocks of Class A space (those 50,000 square feet and larger) increased by only $1.13 per square foot, much less than in previous quarters. Even more telling is how few blocks actually increased in price over the same period: landlords of only eight blocks pushed rates. • Without a substantial anchor tenant to occupy 50.0 percent or more of a building, lending for new construction is somewhat of an aberration at the moment. This offers owners of Trophy assets some degree of protection against any threat of competition from new supply. 2010 2016 12-month forecast Key market indicators Peaking market Rising market 2012 2018 2013 2019 Falling market Bottoming market 2014 2020 Source: JLL Research Tenant-favorable market Neutral market Landlord-favorable market 10 Marketing a location - Take a tour: The 2020 Tokyo Olympic venues 11