Enhancing eBusiness in the High Net Worth Client

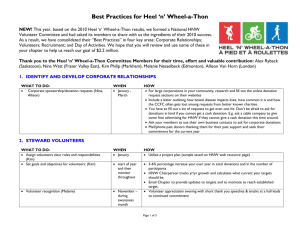

advertisement

Enhancing eBusiness in the High Net Worth Client Agenda Objectives Components of a Successful User Experience • • • Design & Brand Information Architecture Features & Functionality A Source of Competitive Advantage • • • • • • Personalization Channel Access Data Access Self Education and Service Collaboration Tools Analytic Tools Successful Execution for the User Experience • • • Successful Features and Functionality Site Development Driving Traffic and Adoption Illustrations in Differentiation • • Scenario #1: Competitive Advantage through Personalization Scenario #2: Competitive Advantage through Collaboration 1 Objectives Present perspectives around online best practices on the Web, in Financial Services, and with HNW clients 1. 2. 3. 4. 5. User Experience Look/Feel Navigation • Global • Workflow How do we change it? Moving from Product to Product Sub-site to sub-site Accessing research and (personal) information seamlessly and holistically Collaboration Client to Financial Advisor Financial Advisor to Financial Advisor “Client to Client” (explore) Drive traffic and adoption 2 Agenda Objectives Components of a Successful User Experience • • • Design & Brand Information Architecture Features & Functionality A Source of Competitive Advantage • • • • • • Personalization Channel Access Data Access Self Education and Service Collaboration Tools Analytic Tools Successful Execution for the User Experience • • • Successful Features and Functionality Site Development Driving Traffic and Adoption Illustrations in Differentiation • • Scenario #1: Competitive Advantage through Personalization Scenario #2: Competitive Advantage through Collaboration 3 Components of a successful User Experience Failure to find the right focus among the three pillars can result in “award winning” Websites that fail to deliver for the user Superior HNW Experience • • • • • • • Design & Brand • • • • • • Look & Feel Color Tone Palette Brand values … Investment Strategy Banking & Lending Concentrated Stock Management Tax Management Estate Planning/Trust Philanthropy Family Office Information Architecture • • • • • Global navigation Workflow Site Map Wire-frames … Cost of doing business - obtaining Web-based sustainable competitive advantage from these pillars is difficult Features & Functionality • • • • • • Personalization Channel Access Data Access Self Education and Service Collaboration Tools Analytic Tools Leading companies repeatedly deliver and drive adoption & loyalty across tools to heighten the user experience 4 Design/Brand and Information Architecture From our experience, companies address issues associated with design and IA but rarely do these lead to competitive advantage. However failure in this arena can reduce competitiveness – in some cases severely. Issues & Symptoms • Disjointed look & feel across BU Web presences • • Brand confusion for the customer Difficulty cross-selling between product-silos (e.g., brokerage and banking) • Different site architectures and multiple navigation schemes resulting in workflow confusion and frustration – Higher call center usage – Drop-off/abandonment • Inefficient Web development (design, IA, technology) due to repeated reinvention of site standards and lack of leverage (reuse) across the system. Solutions & Best Practices • Emphasis on ease of use • Centralized (as shared services) Web development – Efficient resource allocation – Standardized training – Hiring & career management – Facilitated standards supervision • Use a Web content management tool to manage content and workflow similarly across all sites • Publication of a robust Style Manual that includes defined standards around: – Design (e.g., palette, font, imagery) – Content (e.g., tone, nomenclature) – Information Architecture (e.g., Global Navigation, workflow) • Utilize Web tracking tools to monitor dropoff/abandonment and high usage pages • Conduct user testing periodically with live site and always with new modules/functionality 5 Agenda Objectives Components of a Successful User Experience • • • Design & Brand Information Architecture Features & Functionality A Source of Competitive Advantage • • • • • • Personalization Channel Access Data Access Self Education and Service Collaboration Tools Analytic Tools Successful Execution for the User Experience • • • Successful Features and Functionality Site Development Driving Traffic and Adoption Illustrations in Differentiation • • Scenario #1: Competitive Advantage through Personalization Scenario #2: Competitive Advantage through Collaboration 6 Competitive advantage Features & Functionality • Customer focused value added features and functionality that are easy to use and (typically) tied to personal and third party content - - Heighten relationships – for the high-touch, highly personalized relationships of HNW, these value added features can be even more important Leverage functionality – modules that exist in other areas of the bank (e.g. corporate banking) Introduce new concepts – demonstrate new opportunities not in the common vernacular yet Innovate continuously – features and functionality continually change so competitive advantage can be short-lived without an innovation mindset • Six main areas to investigate - Personalization Channel Access Data Access Self Education and Service Collaboration Tools Analytic Tools • Web 2.0 related capabilities have become a source of innovative offerings - Web 2.0 technologies move data and computing power off desktop PCs and onto the Internet, thus making it easier to collaborate and share information, either among close-knit teams or vast populations. - Information aggregation: digg, del.icio.us, Wikipedia Information management: salesforce.com's customer relationship management tools Connectivity: CarbonNYC (exclusivity), LinkedIn and MySpace (networking), GuideStar.org (philanthropy) New Media: YouTube, Second Life’s (virtual world) 7 Personalization HNW Lens Investment Strategy Banking & Lending Concentrated Stock Mgmt Tax Management Estate Planning/Trust Philanthropy Family Office Cross Industry Leading Practices • Customizable view of information based on user preferences and/or authorizations - Password protected areas to enable qualified investors to access and download paperwork, prospectuses, and memoranda on a variety of investment vehicles Dashboards – timely, personal investment data and statistics at the user’s convenience and available at different levels of authorization based on customizable business rules Customized alerts: alerts to an Financial Advisor and the HNW client for tax, stock, etc. • Personalized problem resolution rather than “canned” answers - Customized reports on trust, custody and investment management accounts Scenario planning tools to monitor market conditions based on personal assets, plans, and tax efficiency Financial planning tools • Intimate user experience through consistency in multi-channel interactions (live agent, online, etc.) - Private placement life insurance Donor advised fund and foundation counseling Personal trust services Lifestyle services • Targeted opportunities/advice/marketing driven off of user id/password and/or tracking tools (e.g., cookies) - Tied to customer level knowledge such as products owned, previous inquiries or issues, needs & attitudes, behavior analysis, etc. Provide alerts to the Financial Advisor as to what the client has been viewing on the site so the Financial Advisor can use that to engage them in discussions and potentially meet there needs 8 Channel access HNW Lens Investment Strategy • Banking & Lending • Concentrated Stock Mgmt • Tax Management • Estate Planning/Trust • Philanthropy Family Office Cross Industry Leading Practices • Cell/PDA push and pull – high-tech for convenience not the gee-whiz factor - Data access on demand - One-set of data supported by multiple presentation layers • Multi-channel consistency - Data/reporting - KYC – AUM versus credit requests (e.g. high value purchases on a credit card) • Messaging versus Browsing - Private email - SMS/MMS alerts and messaging - Single view across multiple channels - Web, CSR, Financial Advisor similarity and have access to historical interaction data - Customizable security as requested - Code word protected CSR; key fob code entry - Information security and privacy 9 Data access Cross Industry Leading Practices HNW Lens Investment Strategy Banking & Lending Concentrated Stock Mgmt Tax Management Estate Planning/Trust Philanthropy Family Office • Information Aggregation - The more complex the portfolio, the HNW customer expects a Private Bank to at least provide financial reports on all of their assets, if not manage them all - Information aggregation technologies like Yodlee (used by Smith Barney) and other more complex tools provide the ability to create this compiled view for personal and family office situations - Single view of customer – HNW customers tend to be less satisfied with their banks than the total population so need to identify and “aggregate” all deposit, credit and other accounts held by these high-net-worth individuals (both personal accounts as well as business related accounts) - Implications may include SSO (like) functionality, document management, content management, etc. • Other Investment Pursuits - Research – Some banks are realizing that they no longer can provide all the specialized services themselves so work with other financial advisors which means a need for access to their research - Endowment management and consulting – views into compliance, governance, charitable grant making solutions, planned giving guidance and management • Automated Feeds (e.g., RSS, Atom) - Protocols that makes it easy for computer users to receive content from their favorite providers whenever the content is updated • Downloads - Data needs to be accessible for other platforms (e.g. Excel, Quicken, etc.) 10 Self education and service HNW Lens Investment Strategy Banking & Lending Concentrated Stock Mgmt Tax Management Estate Planning/Trust Philanthropy Family Office Cross Industry Leading Practices • Online/on-demand seminars - Canned or live discussions with celebrity financial personalities (Buffet, Trump, etc) - Life stage lessons around wealth management • Marriage, children, selling a business, retiring, gifting, estate planning, etc • “Pursuits of passion” - Podcasts – access to and dissemination of innovative ideas from business world to travel to lifestyle - Developed/mature countries – global research, trends and international affairs - BRIC and other emerging markets driving wealth creation - Airplanes - Luxury collectibles, wine, art, jewelry, coins, sports investments marketplaces • Ubiquitous Asset Management - Capability to move funds across all bank accounts - Eventually link bank assets to third party accounts • HNW “vault” 11 Collaboration tools HNW Lens Investment Strategy • Banking & Lending • Concentrated Stock Mgmt • Tax Management • Estate Planning/Trust Philanthropy Family Office Cross Industry Leading Practices • Collaboration tools should be considered across traditional as well as non-traditional relationships - Financial Advisor to Client - Financial Advisor to Financial Advisor - Client to Client • Traditional capabilities include instant message, chat rooms, live chat customer service • Blogs – A blog is a simple content Website created with inexpensive self-publishing tools. Blogs allow for HNW communication within a “family” as well as between HNW relationships. • Social Networking/Peer-to-Peer Networking/Social Media - Web-based tools that harness the power of collaboration and group interaction. This can take many forms, from the personal Web pages of MySpace to the virtual worlds of Second Life to the professional networking popular on LinkedIn • Collective Intelligence (e.g., wikis) - A dynamic Web document that allows users to add, change, or edit the content displayed on the page. The user-created Wikipedia online encyclopedia is the most famous example • Implications for Web services – emerging technology based on XBRL 12 HNW Lens Investment Strategy • Banking & Lending Concentrated Stock Mgmt • Tax Management • Estate Planning/Trust Philanthropy Family Office Analytic tools Cross Industry Leading Practices • Planning tools - Tax strategies - Tax advantaged credit/lending - Hedging strategies - Philanthropic strategies - Generation planning • Simulation tools - Monte Carlo analysis - What-if analysis and tax planning - Trust and estate planning • Mash-ups - Websites or applications that combine content from one or more sources. - e.g., Cellreception.com combines Google Maps with a database of 124,000 cell phone tower locations to help users determine where mobile coverage is strong — and where it isn't. 13 Agenda Objectives Components of a Successful User Experience • • • Design & Brand Information Architecture Features & Functionality A Source of Competitive Advantage • • • • • • Personalization Channel Access Data Access Self Education and Service Collaboration Tools Analytic Tools Successful Execution for the User Experience • • • Successful Features and Functionality Site Development Driving Traffic and Adoption Illustrations in Differentiation • • Scenario #1: Competitive Advantage through Personalization Scenario #2: Competitive Advantage through Collaboration 14 Successful features & functionality • Consider the ramifications on the Financial Advisor/HNW relationship with any piece planned functionality • Tie the tool into an application your customers already use and love - This approach lets the bank place the application into its customer’s hands while providing a familiar interface. • e.g., Zoho CRM is a widget that plugs into Microsoft Outlook, synchronizing contacts and customer-specific emails between Outlook and Zoho's Web-based customer-relations management tool. • Pre-configure the tool with basic templates or structures to guide new users - Applications that start out as a blank canvas can confuse customers instead of inspiring them. To encourage customers to sample the tools, look to pre-configure applications to be easily customized as users gain experience and familiarity. • e.g., Enterprise-grade wiki tools from BrainKeeper offer a variety of standard templates as well as the ability to make custom ones. • Provide a human being who can help with tech support - There's nothing worse for the user experience of a HNW customer or Financial Advisor than being in the middle of an important task and being told to search through pages of forum questions to find solutions to a technical problem. • e.g., At Inkling, the maker of prediction-market tools, the staff personally answers all emails. The company also maintains a private wiki for clients and publishes its phone number so anyone can call to ask a question 15 Site development Approach • Design en masse but develop the site in efficient increments - Piggy back development on the back of standard maintenance • Group development across like modules - Avoid incremental changes across the breadth of the site (unless using a CMS) - Roll out new development/redesigns in a modular fashion Governance • Drive toward a shared services-like development model for leveragable and non-core competency tasks - Develop a responsibilities matrix • Business requirements are owned by the business • Implementation is owned by the eBusiness group (e.g., shared services) • Validation (testing) is owned by both • Define an authoritative Style Manual and mechanism for enforcement • Pilot (live test) concepts/offerings/design changes at the Financial Advisor level first before rolling out to clients • Leverage a common Web platform between Financial Advisor’s and clients - Basically the same site 16 Driving traffic and adoption The breadth of traffic and adoption strategies will likely differ dramatically across emerging HNW, HNW, and UHNW segments • Segment within the client population - Emerging HNW vs HNW/UHNW New to the bank vs Existing to the bank Financial Advisor vs Client • Drive messaging developed from a tactical understanding of the client where possible - Leverage user-id/password and/or cookie technology to understand needs/attitudinal based segments • Driving Traffic - Search engine marketing Search engine optimization Online affiliate/partnerships Cross-sell within current product relationships (e.g., in the “account center”) • Driving Awareness - Focus on brand development for segments less likely to be transaction oriented • Driving Adoption – approach as a standard marketing campaign • • • Define a compelling concept Communicate frequently and effectively Fulfill on the promise 17 Agenda Objectives Components of a Successful User Experience • • • Design & Brand Information Architecture Features & Functionality A Source of Competitive Advantage • • • • • • Personalization Channel Access Data Access Self Education and Service Collaboration Tools Analytic Tools Successful Execution for the User Experience • • • Successful Features and Functionality Site Development Driving Traffic and Adoption Illustrations in Differentiation • • Scenario #1: Competitive Advantage through Personalization Scenario #2: Competitive Advantage through Collaboration 18 Excelsior Card: Overview The Excelsior Card is a web driven finance transaction tool (not just a credit card) that exceeds the market parity attempted by cards like the Citi Chairman AMEX Card and includes the ultimate in personalization and unique service features meant to compete with and excel over the AMEX Centurion Card • • • Target Segment(s): - Emerging HNW - Newly HNW Competitive Advantage - Personalization to drive loyalty - Deepened relationship: Ability for the bank to understand what members are searching upon for investment ideas to help guide future discussions/ideas Needs Addressed - HNW Client • Public demonstration of uniqueness and success • Ultimate personalization of primary purchase instrument - Bank • Share of Wallet through hyper loyalty obtained through personalization and esprit d'corps • ‘Buzz’ around first to market personalization instrument – perfect match of product to customer need • Increased client information and client understanding • Once established the platform can extend to mass card marketing to drive bank card competitiveness in the broader consumer business. 19 Excelsior Card: Strategic Story Strategic Story If… Tomorrow’s HNW Bank will compete through market leading personalization …and… Dan Reiro is a recently minted multi-millionaire with $7 million in assets and some personal need for recognition 1. Based on patterns in his account and buying behaviors Dan Reiro is notified through a targeted marketing email to link to his account center for an exclusive “invitation only” offer: The Excelsior Card ”Like no other” 2. On entering the his account center the other targeted messages Dan normally receives are masked by a flash pop-up informing him of his eligibility for a highly exclusive, invitation only card offer. The pop-up directs Dan to the Excelsior Card micro-site. 3. The micro-site provides further information on the Excelsior Card and its truly one of a kind attributes. On Dan’s request it initiates the uniquely personalized product design process. 4. Dan views an application pre-populated with his account information. The design process begins by asking Dan to choose the four most important features of a card according to his personal set of needs criteria. 5. The four core features (representing key needs) drives a web based conjoint analysis which helps Dan prioritize over 30 card design features through dynamically generated trade-off questions. The questions are rapidly presented and binary in nature and thus can be completed in less than 5 minutes. 6. Once completed, the Web based application presents Dan a draft Excelsior Card through a menu of prioritized features driven by his personal value criteria. 7. Dan can refine his Excelsior Card’s features to include those features having dependencies (e.g., high rewards may mean higher fees). Web application logic will adjust other card features as appropriate based on Dan’s needs analysis (from the conjoint exercise) and bank business requirements (economics, risk, etc). …how… Can the credit card, as the most frequently used financial product in a highly mature market, break from its traditional models to new means of competitive differentiation through personalization? 20 Excelsior Card: Strategic Story Where most HNW cards fall under a “one size fits all model” that, the Excelsior Card will be one of a kind and first of its kind. Additional Commentary 1. 2. 3. 4. 5. 6. 7. Once designed the one-of-a-kind card is printed on a gold embossed white titanium card. If features and functionality of the card are found to be deficient or circumstances change the Web application can be used to modify the Excelsior Card’s features at any time over any Web terminal. The Excelsior Card offers One Card functionality in that it can be used as both a personal card as well as business card (thus not forcing the member to choose). Each month the member (or their family office) receives an email that links them to a site allowing quick categorization of transactions. The Excelsior Card can be accepted across two networks (it carries two magnetic stripes) of the Client’s choice so that it almost never encounters a merchant out of network (e.g., Visa and AMEX) Accompanying the Excelsior Card will be a key fob that provides the ultimate in security to online HNW client information. For those with stricter security needs, the Excelsior Card may be swiped through the fob to obtain randomly generated access codes for full access to the site. For the active lifestyle, a chip in the Excelsior Card can carry important personal information such as medical records and emergency contact information. The Excelsior Card is actually a test bed using a relatively defined, small segment to test and perfect the “card configurator” concept. Once done the capability can be rolled out to the mass bank consumer base as a step change differentiator in the card space. Illustrative Feature Choices Basic Complex • Card Network • 24/7 Concierge • Security/Protection • Rewards program type • Payment Terms • Payment Timing • Annual Fee • Rate • Form (phone, key card, etc) • Visual (graphics, color) (air, hotel, cash, etc) • Elite status across hotels and airlines • Themes (travel, entertainment, etc) • Key fob • Multiple Networks • Stored information • One Card functionality • EBPP • Affiliate donation program (e.g., Green Card) 21 ExcluNet: Overview An invitation only online network from the HNW bank where criteria for membership include achievement in life, a demonstrated passion for your pursuits, and a desire to influence the business world. As a member of the bank’s exclusive online network, high net worth individuals are provided a safe, secure and reliable means to research and interact with others. As an exclusive club, privacy is the utmost and as such the bank is vouching for the reliability of the networking between individuals. • • • Sample Segment: Advised Determiner – Informed investor with ideas, but values advisory input and informed feedback. Works with their advisor, however, makes all final decisions. Competitive Advantage - Enhanced collaboration for information and decision making - Esprit d'corps through belonging to a truly exclusive and empowering community Needs Addressed - HNW Client • Trusted advisor: First “source” turned to when investigating potential ideas/business investments - The Bank • Deepened relationship: Ability for the bank to understand what members are searching upon for investment ideas to help guide future discussions/ideas • Lead generation: The bank as the network enabler provides referral opportunities to other HNW customers currently not supported by the bank • Improved servicing: Begins the process of improving competitive positioning on important servicing areas such as research information and delivery as well as communication and collaboration 22 ExcluNet: Strategic Story Strategic Story If… The bank needs to compete through market leading service …and… Mr. Longmuir is the patriarch of a $50 million family with $40mm in personal assets and two children each with $5mm searching for local opportunities to invest in a high growth market …how… can the bank HNW team utilize its trusted advisor status to introduce individuals in a private, discreet manner and provide differentiation through service and networking? 1. Mr. Longmuir is looking to invest in a high-growth industry and has asked his daughter to do some research. 2. Sara Longmuir has lunch with her father and he asks her to come back with ideas around investments in a high-growth industry. 3. To quickly get connected to the appropriate sub-segment in the highgrowth industry locally, she turns to ExcluNet to provide guidance. 4. On entering the online network from her bank HNW account, she notices something different than the other online networks she’s seen. 5. ExcluNet isn’t about jumping between people in other community based networks. Instead ExcluNet deals with the privacy of its members by utilizing the financial advisor/private banker as a proxy for the HNW clients represented by the bank. 6. The bank’s private bankers and financial advisors have filled out attributes/interest areas for each of their opted in clients. 7. By searching the attributes, Sara quickly realizes that there are at least 10 bank touchpoints for information that may be of interest. 8. Through a discreet contact feature, Sara and her Private Banker can reach out to other Financial Advisors/Private Bankers to uncover research/ideas that might be of interest. 9. If things work out during the research, the bank’s Private Bankers may coordinate a discussion where the bank serves as the network connector and enabler. 23 ExcluNet: Strategic Story Beyond FA facilitated collaboration the bank’s HNW community can be brought together in three other ways. Additional Functionality Additional collaboration functionality can be added over time: 1. 2. ExcluConnect – A secure business oriented social networking site used for professional networking. The main purpose of the site is to allow registered users to maintain a list of contact details of people they know and trust in business. The people in the list are called Exclusive Connections. Users can invite anyone in the bank’s HNW community to become an ExcluNet Connection. A contact network is built up consisting of their direct connections, each of their connections' connections (called 2nd degree connections) and so on. This can be used, for example, to gain an introduction to someone you wish to know through a mutual, trusted contact. ExcluFolio – A secure social networking website offering an interactive, user-submitted network of acquaintances, personal profiles, blogs, groups, and interests (hobbies, passions, etc). Profiles contain two standard components "About Me" and “With Whom I’d Like to Network“ which appear in a sanitized fashion (anonymous facts) to clients until they are invited by the poster. Profiles also contain an “Interests" section and a "Details" section. Similar offerings exist in aSmallWorld.net and DiamondLounge.com. 3. FindFriends – Each HNW member will have access to an ‘on call’ networking system. Should an individual be found with time on their hands (e.g., at the Red Carpet Club at LGA for a few hours) they can text the bank’s HNW FindFriends system to identify similarly disposed members. A list of available members and associated interest briefs is presented (pulled from ExcluFolio) and a request for contact can be sent. Members can gauge communication to their respective comfort level with options ranging from SMS, to anonymous cell connection, to personal contact at their discretion. FindMe - Cell based location services can be used to notify members that they are in the vicinity of other members (within 3-5 miles). Additionally, the Excelsior Card key fob will be enabled with “always on” blue tooth functionality tied to the Client’s cell. Once in the vicinity of another ExcluNet member (50-100 meters) the fob notifies the Client. A masked collaboration request can be sent to the other ExcluNet member and an anonymous dialogue can begin by SMS, sanitized email or phone call. 24