LPCPA Engagement letter

advertisement

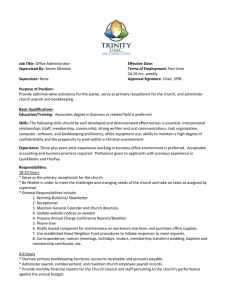

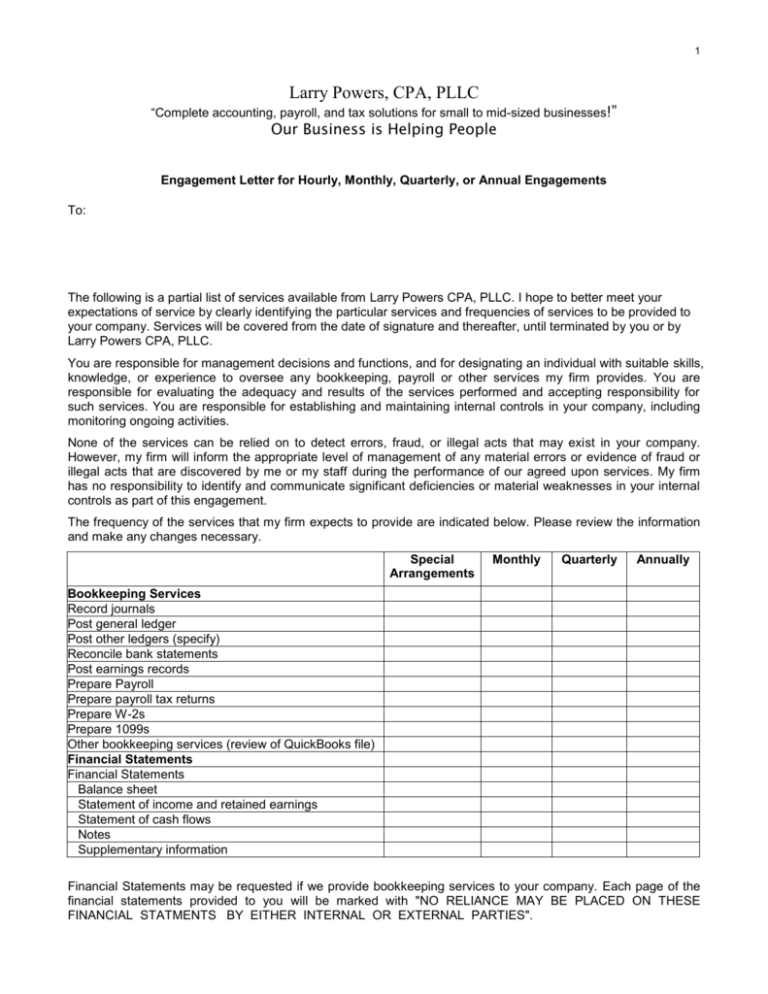

1 Larry Powers, CPA, PLLC “Complete accounting, payroll, and tax solutions for small to mid-sized businesses!” Our Business is Helping People Engagement Letter for Hourly, Monthly, Quarterly, or Annual Engagements To: The following is a partial list of services available from Larry Powers CPA, PLLC. I hope to better meet your expectations of service by clearly identifying the particular services and frequencies of services to be provided to your company. Services will be covered from the date of signature and thereafter, until terminated by you or by Larry Powers CPA, PLLC. You are responsible for management decisions and functions, and for designating an individual with suitable skills, knowledge, or experience to oversee any bookkeeping, payroll or other services my firm provides. You are responsible for evaluating the adequacy and results of the services performed and accepting responsibility for such services. You are responsible for establishing and maintaining internal controls in your company, including monitoring ongoing activities. None of the services can be relied on to detect errors, fraud, or illegal acts that may exist in your company. However, my firm will inform the appropriate level of management of any material errors or evidence of fraud or illegal acts that are discovered by me or my staff during the performance of our agreed upon services. My firm has no responsibility to identify and communicate significant deficiencies or material weaknesses in your internal controls as part of this engagement. The frequency of the services that my firm expects to provide are indicated below. Please review the information and make any changes necessary. Special Arrangements Monthly Quarterly Annually Bookkeeping Services Record journals Post general ledger Post other ledgers (specify) Reconcile bank statements Post earnings records Prepare Payroll Prepare payroll tax returns Prepare W-2s Prepare 1099s Other bookkeeping services (review of QuickBooks file) Financial Statements Financial Statements Balance sheet Statement of income and retained earnings Statement of cash flows Notes Supplementary information Financial Statements may be requested if we provide bookkeeping services to your company. Each page of the financial statements provided to you will be marked with "NO RELIANCE MAY BE PLACED ON THESE FINANCIAL STATMENTS BY EITHER INTERNAL OR EXTERNAL PARTIES". 2 Below are my firm's estimated fees effective for services at the date of this agreement. These fees may be changed at any time with written or verbal notification made to my firm's clients: $175.00 per month for the monthly bookkeeping services $300.00 for monthly bookkeeping and Accounts Payable transactions $400.00 per month for monthly bookkeeping, Accounts Payable and Accounts Receivable transaction (if the aforementioned process exceeds 10 hours per month, then any hours over 10 hours will be charged at an hourly rate of $100.00 per hour) $95.00 per month for payroll services plus $1.75 per check $10.00 for each Form W-2 $15.00 for each Form 1099 Any other consultation services will be at an hourly rate of $100.00 per hour Should any invoice not be paid within 30 days from the date of invoice, there will be a finance charge of 18.0 percent annum or 1 ½ percent per month. Should you request copies of documents that have already been provided to you, there will be a charge of $50.00 per copy (i.e. tax returns for previous). You will also be billed for out-of-pocket costs such as report production, word processing, postage, travel, etc. Additional expenses are estimated to be under $10.00 per month. The fee estimate is based on anticipated cooperation from your personnel and the assumption that unexpected circumstances will not be encountered during the work performed. If significant additional time is necessary, we will discuss it with you and arrive at a new fee estimate before we incur the additional costs. Our invoices for these fees will be rendered each month as work progresses and will be paid for at the time of delivery or they can drafted from a designated financial institution account. For existing clients with monthly contracts, the fees will be deducted during the first week of the month for work performed on the prior month’s information. I appreciate the opportunity to be of service to you and believe this letter accurately summarizes the significant terms of my firm's engagement with your company. If this letter accurately sets forth the terms and objectives of our engagement, please sign this copy and return it to my firm. Sincerely, Larry Powers, CPA Accepted by: _________________________________ Date:_________________________________________ )