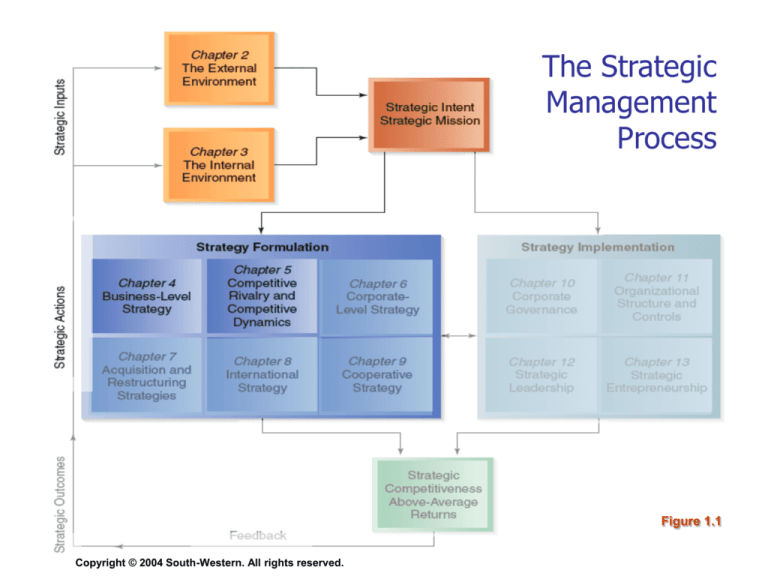

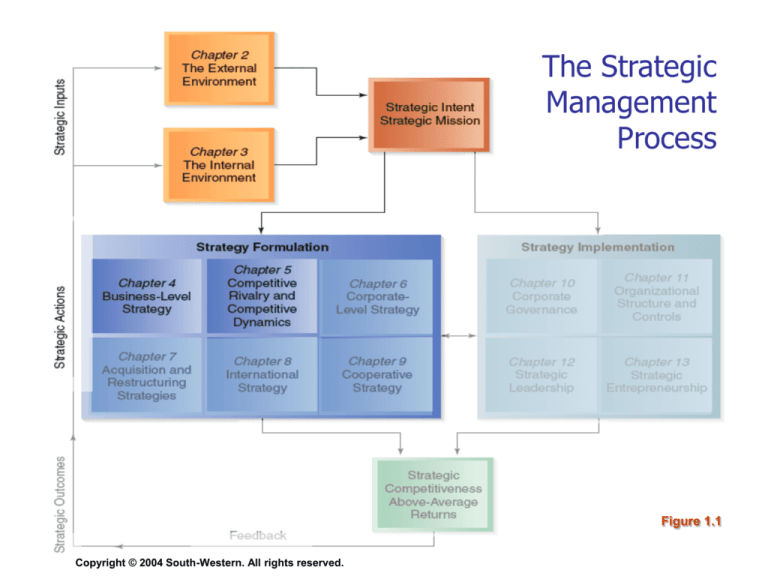

The Strategic

Management

Process

Figure 1.1

Copyright © 2004 South-Western. All rights reserved.

Copyright © 2004 South-Western. All rights reserved.

5–1

Chapter 5: Competitive Rivalry

• Competitive rivalry

• Multi-market (“multi-point”) competition

• Competitive dynamics

• Factors that increase the likelihood of

competitive response (or attack)

• First movers; second movers; late movers

• Strategic actions; tactical actions

• Fast cycle; slow cycle; standard cycle

markets

• Offensive moves; defensive moves

Copyright © 2004 South-Western. All rights reserved.

5–2

Effective Strategies . . . .

• address external trends

• pursue concrete opportunities

• acknowledge external threats

• rely on core capabilities

• do not rely on weaknesses

• are conscientiously implemented

• are continually fine-tuned

• outsmart rivals

Copyright © 2004 South-Western. All rights reserved.

5–3

Competitive Rivalry =

the ongoing set of competitive actions

and competitive responses

occurring between competitors.

One interesting result is that

competing firms are mutually interdependent,

especially when

“multi-market competition”

is present.

Copyright © 2004 South-Western. All rights reserved.

5–4

Multi-market Competition =

firms competing against each other in several

product areas, and/or

several geographic markets.

Multi-market competition creates

a more complex form of rivalry,

which can actually reduce aggressive

competitive attacks between the rivals.

Copyright © 2004 South-Western. All rights reserved.

5–5

From Competitors to Competitive Dynamics

SOURCE: Adapted from M.-J. Chen, 1996, Competitor analysis and interfirm rivalry:

Toward a theoretical integration, Academy of Management Review, 21: 100–134.

Copyright © 2004 South-Western. All rights reserved.

Figure 5.1

5–6

Competitive Dynamics . . .

• Actions taken by one firm elicit responses

from competitors.

• Competitive responses lead to additional

actions from the firm that acted originally.

• Actions and responses shape the

competitive positions of each firm’s

business-level strategy.

• Strategies are not fully pre-planned, but are

dynamic and evolving in response to

competition and other factors.

Copyright © 2004 South-Western. All rights reserved.

5–7

Success of a strategy is determined by:

The firm’s initial competitive actions

How well it anticipates competitors’ responses to

them

How well the firm anticipates and responds to its

competitors’ initial actions

Copyright © 2004 South-Western. All rights reserved.

5–8

A Model of Competitive Rivalry

SOURCE: Adapted from M.-J. Chen, 1996, Competitor

analysis and interfirm rivalry:Toward a theoretical integration,

Academy of Management Review, 21: 100–134.

Copyright © 2004 South-Western. All rights reserved.

Figure 5.2

5–9

Competitor Analysis (=

)

• Competitor analysis is used to help a firm

understand its competitors

• The firm studies competitors’ future

objectives, current strategies, assumptions,

and capabilities

• With the analysis, a firm is better able to

predict competitors’ behaviors when

forming its competitive actions and

responses

Copyright © 2004 South-Western. All rights reserved.

5–10

Market Commonality

• Market commonality is concerned with:

The number of markets with which a firm and a

competitor are jointly involved

The degree of importance of the individual

markets to each competitor

• Firms competing against one another in

several or many markets engage in

multimarket competition

A firm with greater multimarket contact is less

likely to initiate an attack, but more likely to more

respond aggressively when attacked

Copyright © 2004 South-Western. All rights reserved.

5–11

Resource Similarity

• Resource Similarity

How comparable the firm’s tangible and

intangible resources are to a competitor’s in

terms of both types and amounts

• Firms with similar types and amounts of

resources are likely to:

Have similar strengths and weaknesses

Use similar strategies

• Assessing resource similarity can be

difficult if critical resources are intangible

rather than tangible

Copyright © 2004 South-Western. All rights reserved.

5–12

A Framework of Competitor Analysis

Figure 5.3

Copyright © 2004 South-Western. All rights reserved.

5–13

Market Commonality

and Resource Similarity –

So what? Who cares?

Rivals with market commonality

and resource similarity are

highly likely to respond to the competitive

actions of each other.

Copyright © 2004 South-Western. All rights reserved.

5–14

A Model of Competitive Rivalry

SOURCE: Adapted from M.-J. Chen, 1996, Competitor

analysis and interfirm rivalry:Toward a theoretical integration,

Academy of Management Review, 21: 100–134.

Copyright © 2004 South-Western. All rights reserved.

Figure 5.2

5–15

Drivers of Competitive Behavior

Awareness

• Awareness is

the extent to which

organizations recognize

the degree of their

mutual interdependence

and the potential threat

from their competitive

rivalry

Copyright © 2004 South-Western. All rights reserved.

5–16

Drivers of Competitive Behavior (cont’d)

Awareness

Motivation

Copyright © 2004 South-Western. All rights reserved.

• Motivation

the intensity of a

firm’s inclination to

take action or to

respond to a

competitor’s attack

relates to perceived

gains and losses

may involve egos

5–17

Drivers of Competitive Behavior (cont’d)

Awareness

Motivation

Ability

• Ability relates to

each firm’s resources

the flexibility these

resources provide

• Without available

resources the firm

lacks the ability to

attack a competitor

respond to the

competitor’s actions

Copyright © 2004 South-Western. All rights reserved.

5–18

Drivers of Competitive Behavior (cont’d)

Awareness

• A firm is more likely to attack

the rival with whom it has

low market commonality

Motivation

Ability

Market

Commonality

Copyright © 2004 South-Western. All rights reserved.

• Given the high stakes of

competition under market

commonality, there is a high

probability that the attacked

firm will respond to its

competitor’s action in an

effort to protect its position

5–19

Drivers of Competitive Behavior (cont’d)

Awareness

Motivation

• The greater the resource

imbalance between the firms,

the greater will be the delay in

response by the firm with a

resource disadvantage

Ability

Market

Commonality

Resource

Dissimilarity

Copyright © 2004 South-Western. All rights reserved.

• When facing competitors with

greater resources or more

attractive market positions,

firms should eventually

respond, no matter how

challenging the response

5–20

Drivers of Competitive Behavior –

So what? Who cares?

Organizations are highly likely to respond to

competitive actions when the following

conditions are present:

• Market commonality

• Resource similarity

• Awareness of the competitive threat

• Motivation to respond

• High ego involvement in the rivalry

• Available resources to respond

Copyright © 2004 South-Western. All rights reserved.

5–21

A Model of Competitive Rivalry

SOURCE: Adapted from M.-J. Chen, 1996, Competitor

analysis and interfirm rivalry:Toward a theoretical integration,

Academy of Management Review, 21: 100–134.

Copyright © 2004 South-Western. All rights reserved.

Figure 5.2

5–22

Factors Affecting Likelihood of Attack

First Mover

•

First movers allocate

funds for:

Product innovation and

development, aggressive

advertising, advanced

research and development

• First mover incentives =

?

?

• First mover hazards =

?

?

Copyright © 2004 South-Western. All rights reserved.

5–23

Factors Affecting Likelihood of Attack (cont’d)

First Mover

Second Mover

Copyright © 2004 South-Western. All rights reserved.

• Second mover responds to the

first mover’s competitive action,

typically through imitation:

Studies customers’ reactions to

product innovations

Tries to find and avoid any

mistakes the first mover made

Also avoids the huge

product/market development

spending of the first-movers

May develop more efficient

processes and technologies

5–24

Factors Affecting Likelihood of Attack (cont’d)

First Mover

Second Mover

Late Mover

Copyright © 2004 South-Western. All rights reserved.

• Late mover responds to a

competitive action only after

considerable time has elapsed

• Any success achieved will be

slow in coming and much less

than that achieved by first and

second movers

• Late mover’s competitive action

allows it to earn only average

returns and delays its

understanding of how to create

value for customers

5–25

Factors Affecting Likelihood of Attack (cont’d)

First Mover

Second Mover

• Small firms are more likely:

To launch offensive competitive

actions

To be quicker in doing so

• Small firms are perceived as:

Late Mover

Nimble and flexible competitors

Organizational

Size

Having the flexibility needed to

launch a greater variety of

competitive actions

Copyright © 2004 South-Western. All rights reserved.

Relying on speed and surprise

5–26

Factors Affecting Likelihood of Attack (cont’d)

First Mover

Second Mover

Late Mover

Organizational

Size

• Large organizations

commonly have the slack

resources required to

launch a larger number of

total competitive actions

• “Think and act big and

we’ll get smaller. Think and

act small and we’ll get

bigger.”

Herb Kelleher

Former CEO, Southwest

Airlines

Copyright © 2004 South-Western. All rights reserved.

5–27

Factors Affecting Likelihood of Attack (cont’d)

First Mover

Second Mover

Late Mover

Organizational

Size

Quality

(Product)

Copyright © 2004 South-Western. All rights reserved.

• Firms with higher quality

are more likely to attack

• Product quality can

involve performance,

features, durability,

consistency,image, etc.

• Service quality can

involve timeliness,

courtesy, convenience,

accuracy, completeness,

etc.

5–28

Summary – Factors that Increase the

Likelihood of Competitive Attack

• first mover incentives

• active first movers

• small firms

• firms with high “quality”

Copyright © 2004 South-Western. All rights reserved.

5–29

A Model of Competitive Rivalry

SOURCE: Adapted from M.-J. Chen, 1996, Competitor

analysis and interfirm rivalry:Toward a theoretical integration,

Academy of Management Review, 21: 100–134.

Copyright © 2004 South-Western. All rights reserved.

Figure 5.2

5–30

Strategic and Tactical Actions

• Strategic action or a strategic response =

• Tactical action or a tactical response =

Copyright © 2004 South-Western. All rights reserved.

5–31

Likelihood of Response

Type of

Competitive

Action

• Strategic actions generally

require strategic responses

The time and resources needed

to assess and implement a

strategic action delays or even

reduces potential response

• Tactical responses are taken

to counter the effects of

tactical actions

Competitor likely will respond

quickly to a tactical actions

Copyright © 2004 South-Western. All rights reserved.

5–32

Factors Affecting Strategic Response (cont’d)

Type of

Competitive

Action

Actor’s

Reputation

• An actor is the firm taking an

action or response

• Reputable firms are more

likely to elicit a response

• Market leaders are more

likely to be copied

• Firms that are not well

regarded, or price-predators,

are less likely to be copied or

elicit a response

Copyright © 2004 South-Western. All rights reserved.

5–33

Factors Affecting Strategic Response (cont’d)

Type of

Competitive

Action

Actor’s

Reputation

Dependence

on the market

Copyright © 2004 South-Western. All rights reserved.

• Market dependence is the

extent to which a firm’s

revenues or profits are

derived from a particular

market

• In general, firms can predict

that competitors with high

market dependence are likely

to respond strongly to

attacks threatening their

market position

5–34

Summary – Factors that Increase the

Likelihood of Competitive Response

• Actions that are tactical rather than strategic

• The organization initiating the original

competitive action is reputable

• High dependency on the market involved

Copyright © 2004 South-Western. All rights reserved.

5–35

A Model of Competitive Rivalry

SOURCE: Adapted from M.-J. Chen, 1996, Competitor

analysis and interfirm rivalry:Toward a theoretical integration,

Academy of Management Review, 21: 100–134.

Copyright © 2004 South-Western. All rights reserved.

Figure 5.2

5–36

Competitive Dynamics

Slow-Cycle

Markets

• Competitive advantages are

shielded from imitation for

long periods of time and

imitation is costly

• Competitive advantages are

sustainable in slow-cycle

markets

• Firms concentrate on

competitive actions and

responses to protect, maintain

and extend proprietary

competitive advantage

Copyright © 2004 South-Western. All rights reserved.

5–37

Gradual Erosion of a Sustained Competitive Advantage

SOURCE: Adapted from I. C. MacMillan, 1988, Controlling competitive dynamics

by taking strategic initiative, Academy of Management Executive, 11(2): 111–118.

Copyright © 2004 South-Western. All rights reserved.

Figure 5.4

5–38

Competitive Dynamics (cont’d)

Slow-Cycle

Markets

Fast-Cycle

Markets

“Hypercompetition”

• The firm’s competitive

advantages are not sustainable

• Non-proprietary technology is

diffused rapidly, reverse

engineering is used to

duplicate proprietary

technology

• Competitive “oneupsmanship” is rampant

• Firms may need to practice

product cannibalism in selfdefense

Copyright © 2004 South-Western. All rights reserved.

5–39

Obtaining Temporary Advantages to Create

Sustained Advantage

SOURCE: Adapted from I. C. MacMillan, 1988, Controlling competitive dynamics

by taking strategic initiative, Academy of Management Executive, 11(2): 111–118.

Copyright © 2004 South-Western. All rights reserved.

Figure 5.5

5–40

Competitive Dynamics (cont’d)

Slow-Cycle

Markets

• Moderate cost of imitation may

shield competitive advantages.

Fast-Cycle

Markets

• Competitive advantages are

partially sustainable if their

quality is continuously

upgraded

Standard-Cycle

Markets

• Firms

Seek large market shares

Gain customer loyalty through

brand names

Carefully control operations

Copyright © 2004 South-Western. All rights reserved.

5–41

Competitive Rivalry = continuous “play” of

offensive and defensive moves

Offensive Moves

• To establish a position

• To reposition

Defensive Moves

• To protect an existing

position

• Less frequent than defensive

moves

• Attacking rivals’ weaknesses

is usually more successful

• Attacking rival’s strengths –

especially head-on – carries

more risk and takes more

resources and capabilities

Common approaches =

• Increase structural barriers

(fill positioning gaps,

increase switching costs,

increase scale economies,

block supplies or channel . .)

• Increase expected retaliation

• Lower inducements for

attack

Copyright © 2004 South-Western. All rights reserved.

5–42