fundamentals of

Human Resource Management 4th

edition

by R.A. Noe, J.R. Hollenbeck, B. Gerhart, and P.M. Wright

CHAPTER 11

Establishing a Pay Structure

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All Rights Reserved.

11-1

Decisions About Pay

Job Structure

Pay Level

• The relative

pay for

different

jobs within

the

organization.

• The average

amount the

organization

pays for a

particular

job.

Pay Structure

• The pay

policy

resulting

from job

structure

and paylevel

decisions.

11-2

Figure 11.1:

Issues in Developing a Pay Structure

11-3

Legal Requirements for Pay

Equal employment opportunity

Minimum wages

Pay for overtime

Prevailing wages for federal contractors

11-4

Legal Requirements for Pay:

Equal Employment Opportunity

• Employers must not base differences in pay on

an employee’s age, sex, race, or other

protected status.

• Any differences in pay must be tied to such

business-related considerations as job

responsibilities or performance.

• The goal is for employers to provide equal pay

for equal work.

11-5

• Two employees who do the

same job cannot be paid

different wages because of

gender, race, or age.

• It would be illegal to pay

these two employees

differently because one is

male and the other is

female.

• Only if there are differences

in their experience, skills,

seniority, or job

performance are there legal

reasons why their pay might

be different.

11-6

Legal Requirements for Pay:

Minimum Wage

• Minimum wage – the

lowest amount that

employers may pay

under federal or state

law, stated as an

amount of pay per hour.

• Labor Code of the

Philippines– this

establishes a minimum

wage and requirements

for overtime pay and

child labor.

11-7

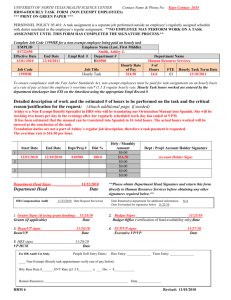

Legal Requirements for Pay:

Overtime Pay

• Normal work hours should not exceed 8 hours

a day. (Article 83 of the Labor Code of the

Philippines)

• OVERTIME PAY refers to the additional

compensation payable to employee for

services or work rendered beyond the normal

eight hours of work

• COVERAGE: This benefit applies to all except

for exempt employees

11-8

Legal Requirements for Pay:

Overtime Pay

• The overtime pay will vary if the overtime work is

rendered on a rest day, regular day, or special day

during the period between 10 pm and am of the

following day.

• For ordinary day, an additional compensation

equivalent to his regular hourly rate plus at least 25%

thereof.

• For rest day, regular day and overtime an additional

compensation equivalent to the rate for the first eight

hours on a holiday or rest day plus at least 30% thereof.

11-9

Legal Requirements for Pay:

Night Shift Differential

• NIGHT SHIFT DIFFERENTIAL: Article 86 of

the Labor Code or PD 442 provides that

every employee shall be paid a night shift

differential of not less than 10% of his

regular wage for each hour of work

performed between 10 pm and 6 am of

the following day.

11-10

Legal Requirements for Pay:

Exempt Employees

• government employees;

• managerial employees and officers or members of the

managerial staff;

• field personnel;

• members of the family of the employer who are dependent

on him for support;

• domestic helpers and persons in the personal service of

another; and

• employees who are paid by results, as determined by the

Secretary of the Philippine Department of Labor and

Employment (DOLE) in appropriate regulations.

11-11

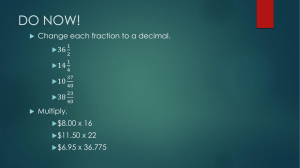

Computation of Overtime Pay

On Ordinary Day

Regular Hourly Rate = Minimum Wage Rate

divided by 8 hours

Overtime Rate = Regular Hourly Rate plus 25%

of Regular Hourly Rate

11-12

Computation of Overtime Pay

On Rest Day and Special Day

Hourly Rate = 130% of Regular Hourly Rate

Overtime Rate = Hourly Rate on Rest Day plus

30% Hourly Rate on Rest Day

11-13

Computation of Overtime Pay

On Rest Day which falls on a Special Day

Hourly Rate = 150% of Regular Hourly Rate

Overtime Rate = Hourly Rate plus 30% Hourly

Rate

11-14

Computation of Overtime Pay

On a Regular Holiday

Hourly Rate = 200% of Regular Hourly Rate

Overtime Rate = Hourly Rate plus 30% Hourly

Rate

11-15

Computation of Overtime Pay

On a Rest Day which falls on a Regular Holiday

Hourly Rate = 260% of Regular Hourly Rate

Overtime Rate = Hourly Rate plus 30% Hourly

Rate

11-16

Legal Requirements for Pay:

Child Labor

• Republic Act No. 9231 IS AN ACT PROVIDING FOR

THE ELIMINATION OF THE WORST FORMS OF CHILD

LABOR AND AFFORDING STRONGER PROTECTION

FOR THE WORKING CHILD, AMENDING FOR THIS

PURPOSE REPUBLIC ACTNO. 7610, AS AMENDED,

OTHERWISE KNOWN AS THE "SPECIAL PROTECTION

OF CHILDREN AGAINST CHILD ABUSE,

EXPLOITATION AND DISCRIMINATION ACT"

11-17

Economic Influences on Pay

Product Markets

Labor Markets

• The organization’s product

market includes

organizations that offer

competing goods and

services.

• Organizations compete on

quality, service, and price.

• The cost of labor is a

significant part of an

organization’s costs.

• Organizations must

compete to obtain human

resources in labor markets.

• Competing for labor

establishes the minimum an

organization must pay to

hire an employee for a

particular job.

11-18

Pay Level: Deciding What to Pay

Pay at the rate set by the market

Pay at a rate above the market

Pay at a rate below the market

11-19

Gathering Information About Market Pay

• Benchmarking – a

procedure in which an

organization compares

its own practices

against those of

successful competitors

• Pay surveys

• Trade and industry

groups

• Professional groups

• Bureau of Labor

Statistics (BLS)

• Society for Human

Resource Management

(SHRM)

• WorldatWork

11-20

Employee Judgments About Pay Fairness

• Employees compare their pay and

contributions against three yardsticks:

1. What they think employees in other

organizations earn for doing the same job.

2. What they think other employees holding

different jobs within the organization earn for

doing work at the same or different levels.

3. What they think other employees in the

organization earn for doing the same job as

theirs.

11-21

Figure 11.3: Opinions About Fairness –

Pay Equity

11-22

Pay Equity (continued)

• If employees conclude that they are under-rewarded,

they are likely to make up the difference in one of

three ways:

1. They might put forth less effort (reducing their inputs).

2. They might find a way to increase their outcomes (e.g.,

stealing).

3. They might withdraw (by leaving the organization or

refusing to cooperate).

• Employees’ beliefs about fairness also influence their

willingness to accept transfers or promotions.

11-23

Test Your Knowledge

• Mariah found out that a friend of hers with a

similar job in the same town makes significantly

more money than she does. Which of the

following is probably not the cause of this?

a) Different cost-of-living

b) The companies are in different product markets

with different pay strategies

c) Mariah is a poor performer

d) Mariah’s job is non-exempt

11-24

Job Structure: Relative Value of Jobs

Job Evaluation

• An administrative

procedure for

measuring the relative

internal worth of the

organization’s jobs.

Compensable Factors

• The characteristics of a

job that the

organization values and

chooses to pay for.

–

–

–

–

–

Experience

Education

Complexity

Working conditions

Responsibility

11-25

Table 11.1: Job Evaluation of Three Jobs

with Three Compensable Factors

11-26

Job Structure: Defining Key Jobs

• Key Jobs – jobs that have relatively stable

content and are common among many

organizations.

• Organizations can make the process of

creating the job structure and the pay

structure more practical by defining key jobs.

• Research for creating the pay structure is

limited to the key jobs that play a significant

role in the organization.

11-27

Pay Structure: Putting It All Together

Job

Evaluation

Job

Structure

Define

Key Jobs

Pay Rates

Pay Policy

Line

Pay

Survey

Pay

Grades

Pay

Ranges

Pay

Structure

11-28

Pay Rates

Organization obtains pay survey data

for its key jobs.

Pay policy line is established.

Pay rates for non-key jobs are then

determined.

11-29

Pay Ranges

• Pay ranges – a set of

possible pay rates

defined by a minimum,

maximum, and

midpoint of pay for

employees holding a

particular job or a job

within a particular pay

grade.

• Red-circle rate – pay at

a rate that falls above

the pay range for the

job.

• Green-circle rate – pay

at a rate that falls below

the pay range for the

job.

11-30

Alternatives to Job-Based Pay

Delayering

• Reducing the number of

levels in the organization’s

job structure.

• More assignments are

combined into a single layer.

• These broader groupings

are called broad bands.

• More emphasis on

acquiring experience, rather

than promotions.

Skill-Based Pay Systems

• Pay structures that set pay

according to the employees’

levels of skill or knowledge

and what they are capable

of doing.

• This is appropriate in

organizations where

changing technology

requires employees to

continually widen and

deepen their knowledge.

11-31

Pay Structure and Actual Pay

• Pay structure represents the organization’s

policy.

• However, what the organization actually does

may be different.

• The HR department should compare actual

pay to the pay structure, making sure that

policies and practices match.

• Compa-ratio is the common way to do this.

11-32

Figure 11.7: Finding a Compa-Ratio

•

Compa-Ratio (CR) – the

ratio of average pay to the

midpoint of the pay range.

• If the average equals the

midpoint, CR is 1.

• If CR is greater than 1, the

average pay is above the

midpoint.

• IF CR is less than 1, the

average pay is below the

midpoint.

11-33