Chapter 10 REVIEW

advertisement

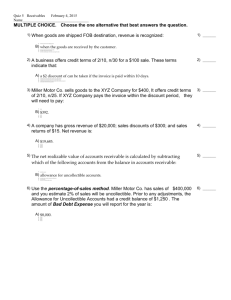

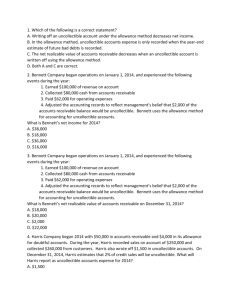

Chapter 9 True/False Review The following are the two methods of accounting for uncollectible receivables: The allowance method and the liability method. The two methods for estimating uncollectible receivables is aging of accounts receivable and percent of sales method. One day’s sales is the numerator of days' sales in receivables. FIND 5 TRUE OR 5 FALSE STATEMENTS IN A ROW (Change font color/or shade box) To record a dishonored note, the following entries would be required: debit to accounts receivable; a credit to notes receivable; and a credit to interest revenue. The Acid Test Ratio is a more stringent measure than the current ratio to measure a company's ability to pay its current liabilities. A discounted note results if a maker of a promissory note fails to pay the note on the due date. Loans to employees are considered an example of Other Receivables. Handling cash receipts would best be handled by the credit department. FREE Interest rates are generally stated as a monthly rate. The percent of sales method is the incomestatement approach to estimating bad debts. The direct write-off method requires an entry with a credit to accounts receivable to record the uncollectible accounts expense. Paying a credit card discount expense is NOT avoided by a company that accepts national credit cards. The direct write-off method is the balance sheet approach to estimating bad debts. A disadvantage of selling on credit is that some customers do not pay, creating an expense. College Accounting The principal amount of a $30,000, 12%, 1 year note is $30,000. The following entries would be used to account for uncollectible receivables using the direct write-off method: Uncollectible accounts expense is debited and accounts receivable is credited. The allowance for uncollectible accounts currently has a credit balance of $900. After analyzing the accounts in the accounts receivable subsidiary ledger, the company's management estimates that uncollectible accounts will be $15,000. $14,100 will be the amount of uncollectible-account expense reported on the income statement. The date of maturity of a 90day note dated August 26 is November 24. If a company uses the direct write-off method to account for uncollectible receivables, no entry is made to the customer’s accounts receivable. The maturity value of a 90day, 12% note, for $20,000 is $20,600 The allowance for uncollectible accounts currently has a credit balance of $200. The company's management estimates that 2.5% of net credit sales will be uncollectible. Net credit sales are $115,000. $2,875 is the amount of uncollectible-account expense reported on the income statement. Accounts receivable has a balance of $5,000 and the allowance for uncollectible accounts has a credit balance of $440. $4400 is the net accounts receivable balance after a $160 account receivable is written off. Interest revenue must be reported for a note receivable that is outstanding at the end of the accounting period. The acid-test ratio is computed as current assets divided by current liabilities.