COMPANY PRESENTATION

advertisement

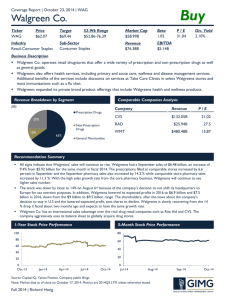

COMPANY PRESENTATION Walgreen Company An Overview Agenda Walgreen Company is a national drugstore chain with 3,619 drugstores in 43 states and Puerto Rico. The drugstores are engaged in the retail sale of prescription and nonprescription drugs, and carry additional product lines such as general merchandise, cosmetics, toiletries, household items, food and beverages. Customer prescription purchases can be made at the drugstores as well as through the mail, by telephone and on the Internet. Business Description Industry Comparison Highlights 5 Forces Analysis Quantitative Analysis Stock Performance Future Problems / Concerns DCF Sensitivity Analysis Recommendation Industry Comparison Key Comparison Factors Walgreens CVS Rite-Aid Market Capitalization 32.5 Billion 9.67 Billion 1.04 Billion Shares outstanding 1.02 Billion 392.6 Million 515.1 Million Cash on hand (MRQ) 286 Million 333.3 Million 270.9 Million 32.1 30.1 N/A 0 0.27 N/A 0.5 0.59 0.29 ROE (TTM) 18.20% 7.41% N/A Profit Margin (TTM) 3.60% 1.50% -3.10% Institutional Ownership 59% 84% 36% # of Stores 3619 4191 3497 P/E Ratio (TTM) Debt to Equity Ratio (TTM) Beta Industry Comp. Details Walgreens sees CVS pharmacy as its biggest competitor. While both are huge pharmacy/convenience stores Walgreens has an advantage in that we feel its stores are better laid out and more customer friendly. From an operating standpoint Walgreen has more efficient operations as can be seen from profit margin and Return on Equity. Other positive notes about Walgreens are that its institutional ownership is lower then CVS which means that there is more room for additional buyers to bid up the stock price. Furthermore, Walgreens does not have a long-term debt burden and finances most growth with cash and short term debt. It is not assumed that they will need to take on a large amount of debt in the future. Negatives, which will be discussed in further detail, include a high P/E ratio and a question of whether past growth is sustainable. On the following slide a breakdown of ROE illustrates why Walgreen has a higher ROE then CVS even though there are many more shares outstanding. Breakdown of ROE 2001 CVS 2001 WAG ROE(Net Income/Equity) #1 (Tax Burden ratio) Net Profits over Pretax Profits #2 (Interest Burden ratio) Pretax Profits over EBIT #3 (Return on Sales) EBIT over Sales #4 (Asset turnover) Sales over Assets #5 (Leverage ratio) Assets over Equity #3 times #4 = ROA #6 (compound leverage) which is #2 times #5 413.2 709.6 58.23% 884.87 1,421.97 62% 709.6 770.6 0.92 1,421.97 1397.57 1.02 770.6 22241 3.46% 1397.57 24,623.00 6% 22241 8628.2 2.58 24,623.00 4393.9 5.60 8628.2 4566.9 1.89 4393.9 5207.2 0.84 8.93% 32% 1.74 0.86 HIGHLIGHTS HIGHLIGHTS CONTINUED Discussion Of Highlights The previous figures came from Waglreen’s annual reports and illustrate their success. One thing to note is that Walgreens has a steady growth in all areas, which is a positive. Therefore, there is no reason to think their past growth will not be sustainable into the future. Everything management mentions in past annual reports has been completed, which allows shareholders to place a great amount of trust in promises made by management. 5 Forces Analysis Entry of New Competitors New competitors would have to compete with major players already in the industry. Threat of new competitors is low. Threat of Substitutes Threat of substitutes is high since there are many competitors selling the same product. Convenience is most important. Bargaining Power of Buyers Low because people are not going to shop around to save a few pennies, once again convenience is most important. Bargaining Power of Sellers Low because Waglreens purchases large amounts of goods and is a very large account for a firm. Rivalry Among Existing Competitors High, you can get prescription drugs at many stores, which make up 58% of Wagreens’ annual sales, also you can get other goods Walgreens sells at any corner store. Convenience is key factor. Qualitative Analysis How is Walgreen Co. obtaining and executing its competitive advantage? Cost Leadership Differentiation Focus Stuck in the Middle Walgreens will continue selling the same type of products with an increasing portion of their revenue coming from prescriptions. They do not plan on entering other markets when it comes to items sold. Pursuit of more than one Strategy Sustainability Generic Strategies and Organizational Structure Generic Strategies and Strategic Planning Stock Performance Stock Performance As can be seen from the five year chart, Walgreens has done very well. One thing to note over the past year is the resistance seen around $40. The stock has been unable to break through that price range and most likely will not do so until the overall market picks up. With a company as widely held and followed, the stock price will move a great deal with the market. Therefore, one issue in judging the stock price as of today has to take into account what the market is doing. Future… • Distribution Centers under construction in Da0llas, Northern Ohio, and Florida. • 2004 – Will open new Distribution Center in Southern California ($140M). • Will Spend $1.3B in 2002 on new stores, distribution centers etc. • Expecting 40% prescription sales increase by 2006. • 6000 Stores by 2010. *All above information came from the 2001 Annual Report Problems / Concerns A little pricey- Walgreens does have a high P/E ratio Is expansion sustainable? – It is believed that expansion is sustainable Expectation of aging baby-boomers already priced into share price? – To an extent, however if Walgreens meets prescription sales expectations there will not be a large effect to the stock price DCF (See Excel) Sensitivity Analysis • Growth In Sales + - 5% • • Growth at 21.40% Growth at 12.4% • Cost of Goods Sold + - 5% change, holding Growth at 17.40% • • 78% of Sales 68% of Sales • WACC + - 3% • • WACC at 15% WACC at 9% $45.96 $34.40 $21.62 $59.22 $30.67 $62.04 Recommendation Walgreens is a great company that has met expectations for years, and been able to grow very succesfully. It is an all-star company and the market has priced the stock this way. One problem will be if Walgreens ever does dissapoint investors. Since investors are paying more for this company any dissapointing news could have a drastically negative effect on the stock price. The company has a great business plan, room to expand into other locations and has met all promises made by management. However, in terms of competition, a consumer is going to choose whether to go to CVS or Walgreens based on convenience. Even if one store has cheaper prices a person will want to save time by going to the most convenient (and closest) location. Therefore, there is room for Walgreens to expand and gain more market share while increasing growth. In terms of the current stock price in relation to the valuation, Walgreens should be held at this moment. A sensitivity analysis shows that a slight change in growth will not drastically change things. A change in the cost of goods sold, however, would change things. However, Walgreens will continue selling the same product mix so there is no reason to believe that their cost of goods sold will change. At its current price, given market conditions and the high P/E of the stock our recommendation is the following: Hold and take another look at the stock at a level above $37.