EGR 403 Presentation #6: Chapter 4

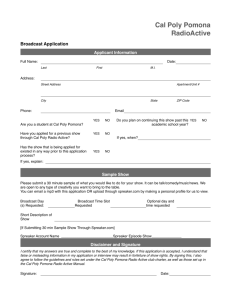

advertisement

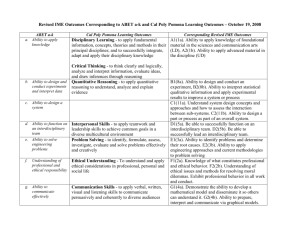

Chapter 4 More Interest Formulas Click here for Streaming Audio To Accompany Presentation (optional) EGR 403 Capital Allocation Theory Dr. Phillip R. Rosenkrantz Industrial & Manufacturing Engineering Department Cal Poly Pomona EGR 403 - The Big Picture • Framework: Accounting & Breakeven Analysis • “Time-value of money” concepts - Ch. 3, 4 • Analysis methods – – – – Ch. 5 - Present Worth Ch. 6 - Annual Worth Ch. 7, 8 - Rate of Return (incremental analysis) Ch. 9 - Benefit Cost Ratio & other techniques • Refining the analysis – Ch. 10, 11 - Depreciation & Taxes – Ch. 12 - Replacement Analysis EGR 403 - Cal Poly Pomona - SA6 2 Components of Engineering Economic Analysis • Calculation of P and F are fundamental. • Some problems are more complex and require an understanding of added components: – Uniform series. – Arithmetic or geometric gradients. – Nominal and effective interest rates (covered in presentation #5 on Chapter 3). – Continuous compounding. EGR 403 - Cal Poly Pomona - SA6 3 Uniform Payment Series Capital Recovery Factor • The series of uniform payments that will recover an initial investment. A = P(A/P, i, n) EGR 403 - Cal Poly Pomona - SA6 4 Uniform Payment Series Compound Amount Factor F • The future value of an investment based on periodic, constant payments and a constant interest rate. F = A(F/A, i, n) EGR 403 - Cal Poly Pomona - SA6 5 Example 4-1 1000 At 5%/year Year Cash in 0 0 1 $500 2 $500 3 $500 4 $500 5 $500 Cash out 0 500 1 500 2 500 3 500 4 500 5 0 1 2 3 4 5 0 -1000 -2000 -2763 -3000 Year Cash In Cash Out -$2763 F = $500(F/A, 5%, 5) = $500(5.526) = $2763 EGR 403 - Cal Poly Pomona - SA6 6 Uniform Payment Series Sinking Fund Factor • The constant periodic amount, at a constant interest rate that must be deposited to accumulate a future value. A = F(A/F, i, n) EGR 403 - Cal Poly Pomona - SA6 7 Uniform Payment Series Present Worth Factor The present value of a series of uniform future payments. P = A(P/A, i, n) EGR 403 - Cal Poly Pomona - SA6 8 Example 4-6 F’ = $100(F/A, 15%, 3) = $347.25 F’’ = $347.25(F/P, 15%, 2) = $459.24 Year Cash flow 1 $100 2 $100 3 $100 4 $0 5 F EGR 403 - Cal Poly Pomona - SA6 9 Example 4-7 Finding the Present Value (P) for each cash flow is sometimes the easiest way to find the equivalent P. Year Cash flow 0 P 1 0 2 $ 20 3 $ 30 4 $ 20 P = $20(P/F, 15%, 2) + $30(P/F, 15%, 3) + $20(P/F, 15%, 4) = $46.28 EGR 403 - Cal Poly Pomona - SA6 10 Arithmetic Gradient • A uniform increasing amount. • The first cash flow is always equal to zero. • G = the difference between each cash amount. EGR 403 - Cal Poly Pomona - SA6 G = $10 11 Arithmetic Gradient combined with a Uniform Series • Decompose the cash flows into a uniform series and a pure gradient. Then add or subtract the Present Value of the gradient to the Present Value of the Uniform series • Example 4-8: Use P/G factor to find present value of the pure gradient portion of the cash flow EGR 403 - Cal Poly Pomona - SA6 12 Arithmetic Gradient Uniform Series Factor A pure gradient (uniformly increasing amount) can also be converted into the equivalent present value of uniform series: AG = G(A/G, i, n) See Example 4-9: Notice that the uniform series portion of the cash flow was subtracted to separate the pure gradient. EGR 403 - Cal Poly Pomona - SA6 13 Geometric Series Present Worth Factor Sometimes cash flows increase at a constant rate rather than a constant amount. Inflation, for example, could be reflected in a cash flow diagram that way. The equivalent present value of a geometrically increasing amount. g = the rate of increase (e.g., .05) P = A(P/A, g, i, n) where (P/A, g, i, n) must be computed from equation 4-30 or 4-31 • Example 4-12 uses g = .10 and i = .08 EGR 403 - Cal Poly Pomona - SA6 14