Amanda Crowe - icee.usm.edu

advertisement

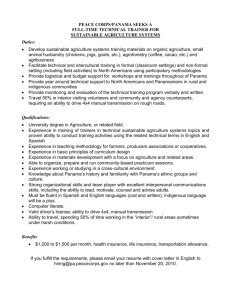

A Case Study: Comparing Nestlé’s International Marketing Strategy and Effects of Nutritional Differences in U.S. vs. Panama By: Amanda Crowe- amanda.crowe@eagles.usm.edu ABSTRACT Nestle is the world's leading nutrition, health and wellness company. Panama is located in Central America which poses major cultural differences between Panamanian consumers and consumers of the US. Therefore, an exploration of the differences in consumer behavior habits and effective marketing efforts were analyzed. The objective of this analysis was to provide a clear comparison of Nestlé’s overall business strategy to target American consumers versus Panamanian consumers. Whether there were significant differences in nutritional needs or habits between the consumers in each country and whether this affected the products, packaging, or marketing was also analyzed. Since Panama uses the US dollar as their currency, this provided an interesting outlook on the differences in demographics and psychographics targeted between these two countries. Interestingly, Panama’s national currency, the balboa, has the same valuation as the US dollar and items in-country are relatively cheaper than items in America. Data was retrieved from Internet research, first-hand analysis of consumption habits, and personal interviews with the company. This analysis is beneficial to companies looking to expand their business operations in Panama as well as students studying consumption habits of customers in different countries other than their home country. In summary, the preferences of consumers in the United States and Panama are very different. There are differences in nutritional needs worldwide and regulatory entities provide standards for Gerber products. 1- INTRODUCTION 1.1 Panama Panama’s total population consists of approximately 3,510,045 people as of 2012. The average age of their consumers is 27.8 years of age. The average age for women is 28.2 years of age versus men whose average age is 27.4 years of age. (Panama Demographic Profile , 2013).. (Panama Demographic Profile , 2013) Spanish is the official language of Panama. Also, average household income for Panamanians is relatively much lower than that of the United States. Panamanians average income is $14,500 dollars. (The World Factbook, 2013) 1.2 United States The total population for the United States is approximately 313,847,465 people as of 2012. The average age of their total consumers is 37.1 years of age. Average ages for men and women are much different than that of Panama. Men’s average age is 35.8 years of age and women’s average age is 38.5 years of age. (United States Demographic Profile, 2013) That poses almost a ten year age difference between consumer of Panama and the United States. The median 2 household income for residents of the United States is $52,768 dollars. (Commerce, 2013) English is the main language of the United States. 1.3 About Nestle Nestlé’s objectives are to be recognized as the world’s leader in Nutrition, Health and Wellness, trusted by all their stakeholders, and to be the reference for financial performance in their industry. They believe that leadership is not just about size; it is also about behavior. Trust is also about behavior which causes them to recognize that trust is earned over a long period of time by consistently delivering on promises. These objectives and behaviors are captured in the simple phrase, “Good Food, Good Life”. This slogan embodies Nestlé’s corporate vision. 1.4 Overall Business Model Nestlé’s overall business model includes the drivers of their competitive advantage, growth, as well as their operational pillars. The following model displays Nestlé’s key value drivers to a competitive advantage, their growth drivers, and their operational pillars. True competitive advantage comes from a combination of hard-to-copy advantages throughout the value chain, built up over decades. There are inherent links between great products and strong R&D, between the broadest geographic presence and an entrepreneurial spirit, between great people and strong values. These four areas provide particularly exciting prospects for growth. They are applicable across all of Nestlé’s categories and around the world. Nestle is driven by their Nutrition, Health and Wellness agenda and Good Food, Good Life, which seeks to offer consumer’s products with the best nutritional profile in their categories. (Nestle, 2013) Nestlé must excel at each of these four inter-related core competences. They drive product development, renewal and quality, operational performance, interactive relationships with consumers and other stakeholders and differentiation from their competitors. If Nestle excels in these areas, they will be consumercentric and will accelerate performance in all key areas in order to achieve excellence in execution. (Nestle, 2013) Overall, Nestle is seeking to achieve leadership and earn that trust by satisfying the expectations of consumers, whose daily choices drive performance of shareholders, of the communities in which they operate and of society as a whole. They believe that it is only possible to create longterm sustainable value for shareholders if their behavior, strategies, and operations are also creating value for the communities where they operate, for their business partners and for their consumers. They call this initiative “Creating Shared Value”. (Nestle, 2013) Competitive advantages Growth drivers Operational pillars • Unmatched product and brand portfolio • Unmatched R&D capability • Unmatched geographic presence • People, culture, values and attitude • Nutrition, Health and Wellness • Emerging markets and Popularly Positioned Products • Out-of-home • Premiumisation • Innovation & Renovation • Wherever, whenever, however • Consumer engagement • Operational efficiency Exhibit 1: Creating Shared Value Initiative 3 Pet Care Powdered and Liquid Beverages Confectionary Milk Products and Ice cream Water Prepared dishes and Cooking Aids Nutrition and Healthcare 11% 12% 16% 22% 8% 11% 20% Exhibit 2: Sales by Business Segment Americas Europe AOA 26% 45% 29% Exhibit 3: Sales by Region 4 Figure 1: Operations Division Strategy poster displayed at Nestle 1.5 Focus Topic The focus of this paper was comparing Nestlé’s international marketing strategy in the U.S. vs. Panama. More specifically, this report analyzed the differences in business practices of the products under the Gerber brand name and also similarities or differences in nutritional habits and needs. Gerber falls within the baby food product line. (Nestle, 2013) Gerber’s brand’s sales are amongst the highest of their entire product line which why this specific product category was chosen. There are specific differences in nutritional standards in Panama versus other countries. Figure 2 displays the Gerber logo. The four most prominent micronutrient deficiencies worldwide concern iron, vitamin A, iodine and zinc. (Nestle, 2011) Ideally, these essential nutrients should be obtained from a normal, varied diet. However, for a number of reasons many people do not consume a healthy balanced diet. While developing countries are most severely affected, the problem is widespread, and micronutrient deficiencies are also significant in certain populations within industrialized countries. (Nestle, 2011) It was very interesting to discover differences in consumption habits between American and Panamanian consumers. Figure 2: Gerber Logo 5 2- INFORMATION/DATA COLLECTION APPROACH(S) First, data was collected through two means: by internet search and interviews in Panama. When conducting the Internet search, the first website that was searched for information on Panama was indexmundi.com. The key word that was used when conducting this search was “Panama population” which was typed into the search engine Google. This search brought up a plethora of results but indexmundi.com was chosen because it contained valuable information such as total population, average age, and other information about the country. Next, the World Factbook was used to determine Panama’s average income. This is a credible source because it is derived from the CIA. The World Factbook contains information about every country. Specifically, it contains information about history, culture, demographics, and economic data. In order to collect the data, the researcher must narrow down the search to one specific country which was chosen by a dropdown box. For the United States, a similar approach was taken. The Google search engine was used again to search for “United States demographics”. Once the results were returned, the indexmundi.com website was a choice. In order to keep the results consistent, indexmundi.com was chosen to collect the total population, average age, and other useful information about the United States. Similarly, the World Factbook was used to gather the average income for the United States. Again, the United States was selected via the dropdown box to retrieve results. To find information about the population, the U.S. Census bureau website was used. The key term searched for through Google was “United States population”. This website is also credible since it is a reputable source. In order to find information about the company being researched, the website nestle.com was used. This website was known because it has been researched in previous classes. The website contains information about Nestlé’s financials, their business structure, their corporate environment, and their current standings. This website had many tabs that would allow a lot of information to be gathered about this particular company. Their core strengths were also listed under a PDF found on the website which was found to be very helpful. Table 1: Information Search Database URL Search term Index Mundi http://www.indexmundi.com/panama/demographics Panama’s population The World Factbook Index Mundi The World Factbook The Census Bureau Nestle _profile.html https://www.cia.gov/library/publications/the-worldfactbook/geos/pm.html http://www.indexmundi.com/united_states/demogra phics_profile.html https://www.cia.gov/library/publications/the-worldfactbook/geos/pm.html http://quickfacts.census.gov/qfd/states/00000.html http://www.nestle.com/aboutus/mediadocuments Known Site United States demographics Known Site United States population Known Site Interviews were conducted with executives from Nestle while in Panama. Information gathered included information about the differences in marketing efforts between Panama and the United States. Amanda Crowe conducted the interviews. A series of interview questions were asked to 6 each interviewee. This was to gain valuable information about Nestle that couldn’t be otherwise gathered via the Internet or library. The interview topics were specific to Exhibits 4 and 5. Exhibit 4 displays business functions of interest of Nestle. Exhibit 5 reveals specific topical areas pertinent to the analysis of Nestlé’s business and international marketing strategy differences between the U.S. and Panama. Research & Development Marketing Efforts Sales Production Distribution Exhibit 4: Business Functions of Interest Marketing Campaigns Reasoning Difference Between Demographics Target Markets Regulations Exhibit 5: Specific Topical Areas The interview instrument was designed prior to the Panama trip. A series of questions were formulated in order to retrieve the most information about the specific focus topic. These interview questions also pertained within the limits of the business functions of Nestle and the topical areas above. There were eight questions asked during the interview. The interview instrument is displayed in Exhibit 6 below. 7 Interview Questions 1. What is Nestle's current marketing strategy to target Panamanian consumers? 2. What is your strategy to target consumers of the U.S.? 3. How many stores carry the Gerber line in Panama? 4. How do you distribute the products to each store? 5. How do you guage production? Is it by sales or forecasts? 6. I noticed that you are changing your product's nutritional value in Central America, what changes are you making to the Gerber line? 7. Any specific changes just for Panamanian consumers? 8. Does governmental regulation differences play a major role in R&D? Exhibit 6: Specific Interview Question The person interviewed was Gloria Reyes, the Director for Demand, Supply Chain, and Exporting Planning for Nestle, displayed in Figure 3. She revealed information about the company such as that they have been doing business in Panama for seventy-five years. There are two factories located in Panama known as NATA and Los Santos. NATA is dedicated to milk products which contribute to 60% of the sales of products in Panama in volumes. (Reyes, 2013) They have an important social responsibility since they constantly deal with farmers. Los Santos produces tomato products such as salsa’s and sauces. They have important contact with the farmers who produce the vegetables that Nestle uses. The Nestle office in Panama is responsible for six countries in the Central American region. Other factories reside in other countries in Central America. Gerber is produced in Costa Rica and imported into Panama. Nestle also receives imports from Mexico and Chile. (Reyes, 2013) Figure 3: Gloria Reyes, Director of Demand, Supply Chain, and Exporting Planning for Nestle 8 Figure 4: Display of 75th Anniversary Brand Names including Gerber 3- CASE STUDY 3.1 Panama Nestle is located in Pueblo Nuevo of Panama. Pueblo Nuevo is city within Panama. The total population for this area is 813,100 residents. Nestlé’s address is as follows: Figure 5 displays Nestle’s location in Panama. Corporate Office: Nestlé Panama S.A. Urbanizacion (La Loma) Calle 69 Oeste 74D Apartado 0834-00368 Panamá 9A Panama Nestlé Panama Figure 5: Nestle Panama location within interior of Panama City 9 As the role of nutrition has evolved, so has Nestlé. They have adjusted their offerings to be in line with or to anticipate the needs of their consumers, while staying true to their core business of food, beverage and nutrition. Nestlé’s nutrition, health and wellness strategy has three aspects. All of their food and beverage brands, regardless of category or eating occasion, offer consumers not just the best taste and pleasure but also the best nutritional profile in their category, as part of a healthy diet. They are targeting particular nutritional needs through Nestlé Nutrition, with their Infant, Performance and Weight management divisions. Through Nestlé Health Science (NHSc) and the Nestlé Institute of Health Sciences, which was inaugurated in 2012, they are pioneering science-based personalized nutritional solutions to prevent and treat medical conditions. Therefore, nutrition is Nestlé’s core. That core was enhanced in 2012 by acquisitions for both Nestlé Nutrition and NHSc. NHSc acquired a stake in Accera, whose key brand is intended for the clinical dietary management of Alzheimer’s disease. (Nestle, 2013) NHSc also created a joint venture with Chi-Med, Nutrition Science Partners (NSP), to research and bring to market nutritional and medicinal products derived from plants with an initial focus on gastrointestinal health. NSP will get access to one of the leading traditional Chinese medicine libraries. Nestlé Nutrition’s global leadership in infant nutrition was enhanced in November with the acquisition of the Wyeth Nutrition business from Pfizer. This business, with 85% of its sales in emerging markets, is a wonderful fit with existing business, even after the required divestitures. (Nestle, 2013) Panama’s nutritional profile states that of the total population, there are approximately 345,000 people under the age of five in 2008. The total number of births was 70,000. There were approximately 2,000 deaths for children under five. There are 22,000 children in Panama that are underweight. And, there are 74,000 children who are stunted in which Panama ranks 90th as compared to other countries. Fifty-three percent of children under the age of two have anemia. “To increase children's chances of survival, improve development and prevent stunting, nutrition interventions need to be delivered during the mother's pregnancy and the first two years of the child's life.” (Panama's Nutrition Profile, 2008) Figure 6: Nestle Headquarters in Panama 10 3.2 The United States In the United States, Nestlé’s procurement office is located in Glendale, California. The following picture displays its location in California. This office is responsible for activities that include: Packaging, Ingredients, Raw Materials, Capital/Construction and Engineering, Maintenance, Repair Services and Operations, Legal and Real Estate, Human Resources, Security Services and Office Products, Telecommunications and IT, Marketing, Printing and Promotions, and Transportation. Figure 7 displays Nestlé’s location in North America. Nestlé - North America Procurement 800 N. Brand Blvd. Glendale, CA 91203 Nestlé U.S. Figure 7: Geographic location of Nestle U.S. in California Nestlé’s baby food brand Gerber has launched a new initiative with the local government in the American state of Michigan to help reduce childhood obesity rates. (Nestle, 2012) The main goal of this initiative is to educate parents and caregivers about nutritional information and healthy eating. It aims to target children from toddlers to teenagers. Statistics from a national survey revealed that nearly 14% of children ages two to five years from low-income families in Michigan are obese. Additionally, nearly a fifth of all teenagers in the state are overweight and more than 12% have been diagnosed with obesity. Program members will also work with hospitals and medical schools to provide nutritional information and training for the medical community. Therefore, Gerber will extend its nutritional expertise as the state hopes to launch a new website bringing all the information together for parents with young families. The program is based on the findings of Nestlé’s Feeding Infants and Toddlers Study (FITS). (Nestle, 2012) More than 3,200 children were included in the first survey in 2002. It is the largest, most comprehensive study of the diets and eating habits of infants, toddlers and preschoolers in the United States. 11 The research revealed that most children have poor eating habits from an early age. For example French fries were the most commonly eaten vegetable by toddlers. The study was expanded six years later to find out whether eating habits had changed. So in 2008, the study revealed fruit and vegetables were still lacking in children’s diets. “The Nestlé Feeding Infants and Toddlers Study have shown that within the first 24 months dietary patterns are established,” said Ms Holton. “We want to establish healthy eating as a long-term habit,” she added. (Nestle, 2012). Today, the company has a range of products fortified with micronutrients such as iron and vitamin A, to help improve the nutritional status of consumers around the world. (Nestle, 2011) 4- RESULTS AND RESULTS IMPACT Nestlé’s international marketing strategy in the U.S. vs. Panama was analyzed. More specifically, this report analyzed the differences in effective marketing efforts of the products under the Gerber brand name as well as any nutritional similarities or differences. Nestle has two factories in Panama. Panama also houses Nestlé’s headquarters. There is an office dedicated to support the sales and commercial operations in Panama. This is the main office for all of the Central American operations. Gerber products are manufactured in Costa Rica and imported into Panama. Marketing for Gerber in Panama is also located in Costa Rica. Nestle business practices are divided globally, regionally, and locally. Therefore, the nutrition business is managed by a specific team. The government laws and Nestle guidelines regulate the standards of the Gerber products because of the fact that some contain milk. These entities are known as AUPSA and the Health Department and are responsible for issuing the initial permits for sanitary permission. They review all of the standards in order to give the permit. Then, the sanitary permission in the form of a license is attained through AUPSA. The capacity of the consumers to make claims in the U.S. is higher than in Panama. The four most prominent micronutrient deficiencies worldwide concern iron, vitamin A, iodine and zinc. (Nestle, 2011) Ideally, these essential nutrients should be obtained from a normal, varied diet. However, many people do not consume a healthy balanced diet. While developing countries are most severely affected, the problem is widespread, and micronutrient deficiencies are also significant in certain populations within industrialized countries. (Nestle, 2011) Since nutrition plays such an important role in the Gerber line, Nestle has created initiatives to solve nutritional deficiencies. Nestlé Lactogen with Gentle Start/Gentle Plus/Gentle Grow containing a proprietary active culture, Comfortis, achieved GRAS (Generally Recognized as Safe) status from the US Food and Drug administration for use in newborns. This infant formula has been successfully rolled out in nearly 50 countries globally. In the USA it is sold as Gerber Good Start Soothe. Nestlé signed a five-year global partnership agreement with the International Association of Athletics Federations to align IAAF Kids’ Athletics with the Nestlé Healthy Kids Program. The partnership with IAAF enhances the program, which aims to raise the Nutrition, Health and Wellness awareness of school children around the world. Brazil, Chile, Mexico and Argentina have benefited from this partnership with activities in 2012 that included government representatives, sports groups and community based organizations. This program will help expand sporting activities throughout Zone Americas, increase sports participation in schools and promote a balanced and healthy lifestyle. In 2013, it will be expanded to Jamaica, Trinidad and Tobago, USA, Colombia, Ecuador, Panama and Peru. (Nestle, 2013) Tables 2 and 3 display the 12 similarities and differences that were gathered between the United States and Panama. Figure 8 displays an example of a billboard advertisement from Panama. Figure 9 shows Nestle’s products on display in the corporate headquarters in Panama. These results are important because to show that cultural differences exist between countries which may affect the way products are made, packaged, and marketed. Ideally situated in the middle of Latin America, the Republic of Panama offers the best environment for any multinational company establishing a regional headquarters. As of January 1, 2012, 63 international companies have already established regional branches in Panama, including Samsung Electronics, LG, DHL, Dell, Hutchison Port Holding Group, HSBC, Maersk, Scotia Bank, Assicurazioni Generali, Tetrapack, Nestle, PSA Peugeot Citroen, General Electric, Johnson and Johnson, Caterpillar, Procter & Gamble, Unilever and McDonalds. (Molina, 2013) There are many reasons why these, and a growing number of other multinational companies, have chosen to set up shop in Panama. Some of the prime attractions for these organizations include Panama's sustainable, prospering economy, and the largest financial center in Latin America, in conjunction with the nation's deep commitment to democratic values and the availability of talented professionals who readily embrace the challenges these companies may confront (Marketing & Distribution in Panama, 2000). Additionally, the use of the US dollar as the national currency offers great stability. Business tends to be straightforward. On average, Panama City accounts for 65% of total national sales of consumer goods, the remaining 35% is distributed among the principal cities of David, Santiago, Chitre and Colon. Generally, the marketing channel structure in Panama is simple. Direct importers act as wholesalers and in some cases also as retailers. This situation is common in the case of apparel, automotive parts and hardware products. In the case of consumer goods, food and medicines, the retail operation is separate from the wholesale operation. In the industrial goods sector, sales are normally handled by local exclusive agents or distributors. In other cases, local firms order directly from foreign brokers or the manufacturer. Some of Panama's major importers are also regional distributors located in the Colon Free Zone (CFZ) (Marketing & Distribution in Panama, 2000). Generally, CFZ importers/distributors have affiliated stores in Panama City for retail sale to the local market. Key factors for market success in Panama are: high quality, customer service, brand-name recognition and attractive packaging. Foreign products targeting the middle to upper-middle income market are usually competitive. Panamanians have a desire for high quality foreign products. Those with high disposable income follow sophisticated U.S. and European consumption patterns. Most high-end foreign brand names are represented in Panama. An aggressive marketing strategy is usually necessary to succeed in this trend-conscious market. Panama has the highest per capita income in Central America. The majority of income is skewed to a small, consumer goods oriented economic class (Marketing & Distribution in Panama, 2000). These upper-middle and upper-class families have high levels of disposable income. They are interested in purchasing high quality, trend-setting goods. Price is less of a factor in purchasing decisions made by this class than for the middle and lower income classes. The majority of Panamanians are interested in quality but price plays a more important role in the purchase decision. The use of the U.S. dollar as legal currency and consumer preference for high quality 13 products at a good price are two reasons for high acceptance of U.S. products in Panama. Overall, foreign products are well accepted in the market and are considered of good quality. Television and newspaper advertising are the promotion tools of choice for the majority of distributors of foreign products. Panama has a very competitive advertising market, with standard prices and very good production quality. Additionally, trade shows and exhibitions have proven to be effective tools for trade promotion. Special sale prices are usually advertised in newspapers during weekends. (Panama Demographic Profile , 2013) Most foreign manufacturers of consumer products maintain a high profile presence in the country through newspaper ads, large billboards, sponsored sports events, and T.V. advertising. Radio advertising is mainly utilized outside of Metropolitan Panama City. From personal experience, people in Panama engage in and use their personal relationships in order to do business. Table 2: Similarities Panama trades the US dollar freely Both Panama and the United States have high standards on quality, customer service, brandname recognition and appealing packaging Both have strict guidelines/standards to follow from Nestle and government agencies. The four most prominent micronutrient deficiencies worldwide concern iron, vitamin A, iodine and zinc. Both countries do not consume health balanced diets. Both have a competitive advertising market. Foreign products are accepted in both countries. Table 3: Differences Panama has the Colon Free Trade Zone which is the 2nd largest free trade zone in the world. United States does not. Simple marketing structure in Panama vs. U.S. Marketing for Nestle US products is done in the US whereas marketing for Nestle’s Gerber brand in Panama is done in Costa Rica. Panama population is 3,510,045 people. More populated in U.S. at 313,847,465 people. An aggressive marketing strategy is usually necessary to succeed in Panama when considering high-priced goods. Average age in Panama is 27.8 whereas U.S. is 37.1. Spanish is the official language in Panama whereas English is official language in U.S. Average income for Panamanians is $14,500 whereas U.S. is $52,768. 14 Figure 8: Example of Billboard advertisement in Panama Figure 9: Products displayed at Nestlé’s Headquarters 5- SUMMARY The objective of this analysis was to provide a clear comparison of Nestlé’s overall marketing strategy to target American consumers versus Panamanian consumers. Also, nutritional differences were analyzed. All countries have different dietary habits which lead to different nutritional needs. Data was collected using two forms of research including internet search and personal interviews conducted with Nestle employees. There are specific differences in nutritional standards in all countries with the four most prominent micronutrient deficiencies worldwide being iron, vitamin A, iodine and zinc. Products are made to uphold standards set by Nestle corporate and by governmental agencies such as AUPSA and the FDA. Business is done quite differently in Panama versus the United States. This analysis is important to show that differences exist between countries which may affect the way products are made, packaged, and marketed. If this project was studied further, more detail of Panama’s specific nutritional data could be gathered. This would be more helpful to strengthen the results of the paper since only worldwide data was found. 15 REFERENCES Panama's Nutrition Profile. (2008). Retrieved 2013, from Childinfo: http://www.childinfo.org/files/nutrition/DI%20Profile%20-%20Panama.pdf Panama Demographic Profile . (2013, Feburary 21). Retrieved April 11, 2013, from Index Mundi: http://www.indexmundi.com/panama/demographics_profile.html The World Factbook. (2013). Retrieved April 12, 2013, from Central Intelligence Agency: https://www.cia.gov/library/publications/the-world-factbook/geos/pm.html United States Demographic Profile. (2013). Retrieved April 11, 2013, from Index Mundi: http://www.indexmundi.com/united_states/demographics_profile.html Commerce, U. D. (2013). Quick Facts. Retrieved 2013, from United States Census Bureau: http://quickfacts.census.gov/qfd/states/00000.html Marketing & distribution in Panama. (2000). Panama Economic Studies, 55. Molina, J. (2013). The advantage of establishing regional headquarters in Panama. International Financial Law Review, 32(3), 83. Nestle. (2011, March 21). Nestlé Nutrition Institute workshop focuses on micronutrient deficiencies. Retrieved May 16, 2013, from http://www.nestle.com/media/newsandfeatures/nestle-nutrition-institute-workshopmicronutrient-deficiencies Nestle. (2012, Feburary 1). Gerber launches joint programme to combat child obesity. Retrieved May 16, 2013, from http://www.nestle.com/media/newsandfeatures/gerber-programmechild-obesity Nestle. (2013). Company. Retrieved April 11, 2013, from Nestle.com: http://www.nestle.com/aboutus/mediadocuments Aeruz, Marrissa. (2013) Tour Guide-Panama Study Abroad Program, personal interview by Amanda Crowe Reyes, Gloria. (2013) Nestle, Director for Demand, Supply Chain, and Exporting Planning, personal interview by Amanda Crowe