Chapter 17

Property Transactions:

§1231 and Recapture

Provisions

Individual Income Taxes

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

1

The Big Picture (slide 1 of 2)

• Hazel Brown owns and operates a retail arts and

crafts store.

– She is a sole proprietor and files a Form 1040, Schedule C.

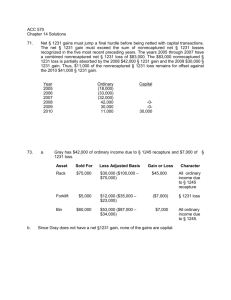

• In 2008, she remodeled the store and replaced the

store equipment (counters, display racks, etc.) at a

cost of $450,000.

– All of the equipment was used (she bought it from a

competitor that was going out of business).

– The equipment is 7 year MACRS property.

– She took $250,000 of § 179 expense on it and depreciated

the balance.

2

The Big Picture (slide 2 of 2)

• As of June 30, 2011, the equipment has an adjusted

basis of $74,960.

– $450,000 cost - $250,000 § 179 expense - $125,040 of

MACRS depreciation.

• Now, Hazel is again planning on replacing the store

equipment.

– She can sell all of the existing equipment for $128,000.

• If Hazel completes this transaction, what will be the

impact on her 2011 tax return?

– Read the chapter and formulate your response.

3

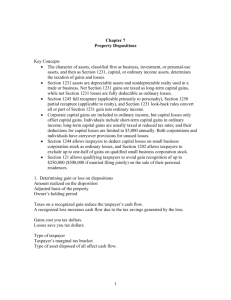

§1231 Assets

(slide 1 of 4)

• §1231 assets defined

– Depreciable and real property used in a business or

for production of income and held >1 year

– Includes timber, coal, iron, livestock, unharvested

crops

– Certain purchased intangibles

4

§1231 Assets

(slide 2 of 4)

• §1231 property does not include the following:

– Property not held for the long-term holding period

– Nonpersonal use property where casualty losses exceed

casualty gains for the taxable year

– Inventory and property held primarily for sale to customers

– Copyrights, literary, musical, or artistic compositions and

certain U.S. government publications

– Accounts receivable and notes receivable arising in the

ordinary course of a trade or business

5

§1231 Assets

(slide 3 of 4)

• If transactions involving §1231 assets result in:

– Net §1231 loss = ordinary loss

– Net §1231 gain = long-term capital gain

6

§1231 Assets

(slide 4 of 4)

• Provides the best of potential results for the

taxpayer

– Ordinary loss that is fully deductible for AGI

– Gains subject to the lower capital gains tax rates

7

The Big Picture - Example 1

§ 1231 Assets

• Return to the facts of The Big Picture on p. 17-2.

• If Hazel sells the store equipment, she will have

disposed of a § 1231 asset because it was depreciable

property used in a trade or business and held for more

than 12 months.

• Her gain will be $53,040.

– $128,000 selling price - $74,960 adjusted basis.

– Part of the gain may be treated as a long-term capital gain

under § 1231.

• Recapture rules may apply (discussed later in this chapter).

8

Special Rules For

Certain §1231 Assets (slide 1 of 4)

• Timber-Taxpayer can elect to treat the cutting

of timber held for sale or for use in business as

a sale or exchange

• If elected, transaction qualifies under §1231

• Recognized §1231 gain or loss is determined at the time

the timber is cut

– Equal to difference between timber's FMV as of first day of tax

year and the adjusted basis for depletion

– If sold for more or less than FMV as of first day of tax year in

which it is cut, difference is ordinary income or loss

9

Special Rules For

Certain §1231 Assets (slide 2 of 4)

• Livestock

– Cattle and horses must be held 24 months or more

and other livestock must be held 12 months or

more to qualify under §1231

10

Special Rules For

Certain §1231 Assets (slide 3 of 4)

• Casualty gains and losses from §1231 assets

and from long-term nonpersonal use capital

assets are determined and netted together

• If a net loss, items are treated separately

– §1231 casualty gains and nonpersonal use capital asset

casualty gains are treated as ordinary gains

– §1231 casualty losses are deductible for AGI

– Nonpersonal use capital asset casualty losses are deductible

from AGI subject to the 2% of AGI limitation

• If a net gain, treat as §1231 gain

11

Special Rules For

Certain §1231 Assets (slide 4 of 4)

• The special netting process for casualties & thefts

does not include condemnation gains and losses

– A § 1231 asset disposed of by condemnation receives

§ 1231 treatment

• Personal use property condemnation gains and losses

are not subject to the § 1231 rules

– Gains are capital gains

• Personal use property is a capital asset

– Losses are nondeductible

• They arise from the disposition of personal use property

12

General Procedure for

§ 1231 Computation (slide 1 of 3)

• Step 1: Casualty Netting

– Net all recognized long-term gains & losses from casualties

of § 1231 assets and nonpersonal use capital assets

• If casualty gains exceed casualty losses, add the excess to the other

§ 1231 gains for the taxable year

• If casualty losses exceed casualty gains, exclude all casualty losses

and gains from further § 1231 computation

– All casualty gains are ordinary income

– Section 1231 asset casualty losses are deductible for AGI

– Other casualty losses are deductible from AGI

13

General Procedure for

§ 1231 Computation (slide 2 of 3)

• Step 2: § 1231 Netting

– After adding any net casualty gain from previous step to

the other § 1231 gains and losses, net all § 1231 gains and

losses

• If gains exceed the losses, net gain is offset by the ‘‘lookback’’

nonrecaptured § 1231 losses from the 5 prior tax years

– To the extent of this offset, the net § 1231 gain is classified as

ordinary gain

– Any remaining gain is long-term capital gain

• If the losses exceed the gains, all gains are ordinary income

– Section 1231 asset losses are deductible for AGI

– Other casualty losses are deductible from AGI

14

General Procedure for

§ 1231 Computation (slide 3 of 3)

• Step 3: § 1231 Lookback Provision

– The net § 1231 gain from the previous step is

offset by the nonrecaptured net § 1231 losses for

the five preceding taxable years

• To the extent of the nonrecaptured net § 1231 loss, the

current-year net § 1231 gain is ordinary income

– The nonrecaptured net § 1231 losses are those that have not

already been used to offset net § 1231 gains

• Only the net § 1231 gain exceeding this net § 1231 loss

carryforward is given long-term capital gain treatment

15

Lookback Provision Example

• Taxpayer had the following net §1231 gains

and losses:

2009

2010

2011

$ 4,000 loss

$10,000 loss

$16,000 gain

– In 2011, taxpayer’s net §1231 gain of $16,000

will be treated as $14,000 of ordinary income

and $2,000 of long-term capital gain

16

Section 1231 Netting Procedure

17

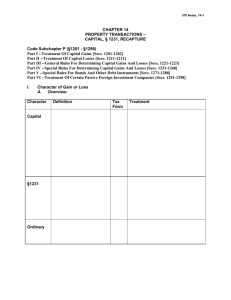

Depreciation Recapture

(slide 1 of 3)

• Assets subject to depreciation or cost recovery

may be subject to depreciation recapture when

disposed of at a gain

– Losses on depreciable assets receive §1231

treatment

• No recapture occurs in loss situations

18

Depreciation Recapture

(slide 2 of 3)

• Depreciation recapture characterizes gains that

would appear to be §1231 as ordinary gain

– The Code contains two major recapture provisions

• §1245

• §1250

19

Depreciation Recapture

(slide 3 of 3)

• Depreciation recapture provisions generally

override all other Code Sections

– There are exceptions to depreciation recapture

rules, for example:

• In dispositions where all gain is not recognized

– e.g., like-kind exchanges, involuntary conversions

• Where gain is not recognized at all

– e.g., gifts and inheritances

20

§1245 Recapture

(slide 1 of 3)

• Depreciation recapture for §1245 property

– Applies to tangible and intangible personalty, and

nonresidential realty using accelerated methods of

ACRS (placed in service 1981-86)

• Recapture potential is entire amount of accumulated

depreciation for asset

• Method of depreciation does not matter

21

§1245 Recapture

(slide 2 of 3)

• When gain on the disposition of a §1245 asset

is less than the total amount of accumulated

depreciation:

– The total gain will be treated as depreciation

recapture (i.e., ordinary income)

22

§1245 Recapture

(slide 3 of 3)

• When the gain on the disposition of a §1245

asset is greater than the total amount of

accumulated depreciation:

– Total accumulated depreciation will be recaptured

(as ordinary income), and

– The gain in excess of depreciation recapture will

be §1231 gain or capital gain

23

§1245 Recapture Example

(slide 1 of 2)

• On January 1, 2011, Jake sold for $26,000 a machine

acquired several years ago for $24,000. He had taken

$20,000 of depreciation on the machine.

Amount Realized

$26,000

Adj. Basis-Cost

$24,000

Acc. Depr.

-20,000

4,000

Realized Gain

$22,000

Sec. 1245 – Ordinary Income

20,000

Sec. 1231 Gain

$ 2,000

24

§1245 Recapture Example

(slide 2 of 2)

Same as previous example except Jake sold

the machine for $18,000.

Amount Realized

Adj. Basis-Cost

$24,000

Acc. Depr.

-20,000

Realized Gain

Sec. 1245 – Ordinary Income

Sec. 1231 Gain

$18,000

4,000

$14,000

14,000

$ -0-

• The § 1231 gain is $0 because the selling price ($18,000) does

not exceed the original purchase price ($24,000).

25

Observations on § 1245

(slide 1 of 3)

• Usually total depreciation taken will exceed

the recognized gain

– Therefore, disposition of § 1245 property usually

results in ordinary income rather than § 1231 gain

– Thus, generally, no § 1231 gain will occur unless

the § 1245 property is disposed of for more than

its original cost

26

Observations on § 1245

(slide 2 of 3)

• Recapture applies to the total amount of

depreciation allowed or allowable regardless

of

– The depreciation method used

– The holding period of the property

• If held for < the long-term holding period the entire

recognized gain is ordinary income because § 1231 does

not apply

27

Observations on § 1245

(slide 3 of 3)

• Section 1245 does not apply to losses which

receive § 1231 treatment

• Gains from the disposition of § 1245 assets

may also be treated as passive activity gains

28

§1250 Recapture

(slide 1 of 3)

• Depreciation recapture for §1250 property

– Applies to depreciable real property

• Exception: Nonresidential realty classified as §1245

property (i.e., placed in service after 1980 and before

1987, and accelerated depreciation used)

– Intangible real property, such as leaseholds of

§ 1250 property, is also included

29

§1250 Recapture

(slide 2 of 3)

• Section 1250 recapture rarely applies since only the

amount of additional depreciation is subject to

recapture

– To have additional depreciation, accelerated depreciation

must have been taken on the asset

• Straight-line depreciation is not recaptured (except for property

held one year or less)

– Depreciable real property placed in service after 1986 can

generally only be depreciated using the straight-line

method

• Therefore, no depreciation recapture potential for such property

– § 1250 does not apply if the real property is sold at a loss

30

§1250 Recapture

(slide 3 of 3)

• The § 1250 recapture rules also apply to the

following property for which accelerated depreciation

was used:

– Additional first-year depreciation [§ 168(k)] exceeding

straight-line depreciation taken on leasehold improvements,

qualified restaurant property, and qualified retail

improvement property.

– Immediate expense deduction [§ 179(f)] exceeding straightline depreciation taken on leasehold improvements,

qualified restaurant property, and qualified retail

improvement property.

31

Real Estate 25% Gain

(slide 1 of 4)

• Also called unrecaptured §1250 gain or 25%

gain

– 25% gain is some or all of the §1231 gain treated

as long-term capital gain

– Used in the alternative tax computation for net

capital gain

32

Real Estate 25% Gain

(slide 2 of 4)

• Maximum amount of 25% gain is depreciation

taken on real property sold at a recognized

gain reduced by:

– Certain §1250 and §1245 depreciation recapture

– Losses from other §1231 assets

– §1231 lookback losses

• Limited to recognized gain when total gain is

less than depreciation taken

33

Real Estate 25% Gain

(slide 3 of 4)

• Special 25% Gain Netting Rules

– Where there is a § 1231 gain from real estate and that gain

includes both potential 25% gain and potential 0%/15%

gain, any § 1231 loss from disposition of other § 1231

assets

• First offsets the 0%/15% portion of the § 1231 gain

• Then offsets the 25% portion of the § 1231 gain

– Also, any § 1231 lookback loss

• First recharacterizes the 25% portion of the § 1231 gain

• Then recharacterizes the 0%/15% portion of the § 1231 gain as

ordinary income

34

Real Estate 25% Gain

(slide 4 of 4)

• Net § 1231 Gain Limitation

– The amount of unrecaptured § 1250 gain may not exceed

the net § 1231 gain that is eligible to be treated as longterm capital gain

– The unrecaptured § 1250 gain is the lesser of

• The unrecaptured § 1250 gain, or

• The net § 1231 gain that is treated as capital gain

– Thus, if there is a net § 1231 gain, but it is all recaptured by

the 5 year § 1231 lookback loss provision, there is no

surviving § 1231 gain or unrecaptured § 1250 gain

35

Related Effects of Recapture

(slide 1 of 8)

• Gifts

– The carryover basis of gifts, from donor to donee,

also carries over depreciation recapture potential

associated with asset

– That is, donee steps into shoes of donor with

regard to depreciation recapture potential

36

Related Effects of Recapture

(slide 2 of 8)

• Inheritance

– Death is only way to eliminate recapture potential

– That is, depreciation recapture potential does not

carry over from decedent to heir

37

Related Effects of Recapture

(slide 3 of 8)

• Charitable contributions

– Recapture potential reduces the amount of

charitable contribution deductions that are based

on FMV

38

The Big Picture - Example 20

Depreciation Recapture and Charitable Transfers

• Return to the facts of The Big Picture on p. 17-2.

• If instead of selling the old equipment Hazel

gives it to a charity, her charitable contribution

is limited to zero.

– The potential § 1245 recapture on the equipment is

$375,040 (the depreciation taken).

– When that amount is subtracted from the

equipment’s $128,000 fair market value, the result

is zero.

39

Related Effects of Recapture

(slide 4 of 8)

• Nontaxable transactions

– When the transferee carries over the basis of the transferor,

the recapture potential also carries over

• Included in this category are transfers of property pursuant to the

following:

–

–

–

–

Nontaxable incorporations under § 351

Certain liquidations of subsidiary companies under § 332

Nontaxable contributions to a partnership under § 721

Nontaxable reorganizations

– Gain may be recognized in these transactions if boot is

received

• If gain is recognized, it is treated as ordinary income to the extent

of the recapture potential or recognized gain, whichever is lower

40

Related Effects of Recapture

(slide 5 of 8)

• Like-kind exchanges and involuntary

conversions

– Property received in these transactions have a

substituted basis

• Basis of former property and its recapture potential is

substituted for basis of new property

– Any gain recognized on the transaction will first be

treated as depreciation recapture, then as §1231 or

capital gain

• Any remaining recapture potential carries over

41

Related Effects of Recapture

(slide 6 of 8)

• Installment sales

– Recapture gain is recognized in year of sale

regardless of whether gain is otherwise recognized

under the installment method

42

The Big Picture - Example 22

Depreciation Recapture and Installment Sales

• Return to the facts of The Big Picture on p. 17-2.

• Assume Hazel could sell the used equipment for

$28,000 down and the balance in five yearly

installments of $20,000 plus interest.

• She would have to recognize her entire $53,040 gain

($128,000 sale price - $74,960 adjusted basis) in

2011.

– All of the gain is § 1245 depreciation recapture gain

because the $375,040 depreciation taken exceeds the

$53,040 recognized gain.

43

Related Effects of Recapture

(slide 7 of 8)

• Property Dividends

– A corporation generally recognizes gain on the

distribution of appreciated property to shareholders

– Recapture applies to the extent of the lower of the

recapture potential or the excess of the property’s

FMV over its adjusted basis

44

Related Effects of Recapture

(slide 8 of 8)

• Sales between related parties

– Sales of depreciable assets between related parties

can cause the total gain to be recognized as

ordinary income

• Applies to related party sales or exchanges of property

that is depreciable in hands of transferee

45

Refocus On The Big Picture (slide 1 of 2)

• Hazel maximized her depreciation deductions when

she acquired the store equipment in 2008.

• When she sells the equipment in 2011, however, she

has a gain because of the low adjusted basis resulting

from the § 179 immediate expensing and the rapid

seven-year MACRS depreciation.

– Section 1245 ‘‘recaptures’’ this gain as ordinary income.

46

Refocus On The Big Picture (slide 2 of 2)

• One way Hazel could avoid recognizing the $53,040

($128,000 - $74,960) gain would be to do a like-kind

exchange.

– Trade the 2008 equipment for the new equipment.

– She would likely have to give up the 2008 equipment plus

cash to acquire the replacement equipment.

– Thus, there would be no ‘‘boot received’’ and, therefore,

no current gain recognized.

• However, the depreciation recapture potential on the

2008 equipment would carry over to the replacement

equipment.

47

If you have any comments or suggestions concerning this

PowerPoint Presentation for South-Western Federal

Taxation, please contact:

Dr. Donald R. Trippeer, CPA

trippedr@oneonta.edu

SUNY Oneonta

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

48