Agenda 2-22 - Haas School of Business

advertisement

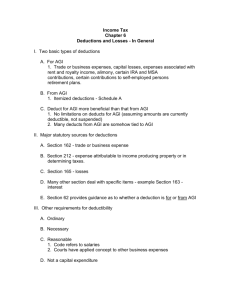

BA 128A -Agenda 2-22 • Questions from lecture • Answers on the web Ch1-6, Ch7 will be posted after section • Review Section - Wednesday 5-6:30? • Office hours change - Thursday 8-9:30am or 5-6:30pm • Review • Assignment - I7-39,45,48 • Additional - I7-36,37,46,47 Itemized deductions • Deduct only if it exceeds standard deduction • Subject to phase out - 3% of amount exceeds threshold. Phase out amount cannot be > 80% of total itemized deductions other than medical, investment interest, casualty losses, and wagering losses. • Qualified medical expenses • Taxes • Qualified interest • Casualty and theft losses • Miscellaneous deductions • Charitable Contributions Qualified Medical Expenses • • • • • Deduct the amount that exceed 7.5% of AGI No deduction it it is reimbursed Include taxpayer, taxpayer’s spouse and dependent Support test OK even if gross income test is not Parent who paid for the child’s medical expenses are deductible regardless of the claiming of dependency exemption • Self employed - can deduct 45% as for AGI, rest from AGI Qualified Medical Expenses • Diagnosis, cure, mitigation, treatment and prevention of disease - for special ailment • Medical procedures involving function or structure of body - except cosmetic surgery unless for deformity correction • Transportation for medical reasons - lodging limit $50 a night, $0.1 a mile, 50% of meals • Long term care • Capital expenditures for medical care - add a swimming pool, remove physical barriers • Medical insurance premiums Timing of medical payments and reimbursements • Deduct when paid • Prepayment - deduction has to be deferred until the year the care is rendered unless prepayment is a requirement • Medical insurance reimbursement - reduced expenses in the year of payment. For reimbursements in in subsequent year need to include in income the taxable benefit derived from previous years Taxes • Deductible - state and local income, real property, personal property taxes, fees not deductible • Personal property taxes - based on value and imposed on annual basis • Real property taxes - apportion based of time of ownership instead of the paying party • Nondeductible - Federal taxes, state and local sales taxes, employee social security taxes • Usually deduct when paid • State income tax refund is included in income to the extent of tax benefit • Self-employement tax - deduct 1/2 as for AGI Classification of interest • Active trade and business - for AGI • Passive activity - e.g. rental activity - for AGI - Chapter 8 • Investment interest - offset investment income - from AGI • Personal interest - not deductible • Qualified residence - from AGI • Student loan - for AGI Borrowed funds • Interest deductibility depends on use of funds • Deposit in bank - investment interest • If loan was applied to a variety of uses and is partially repaid - order of reallocation of interest expenses is 1) personal expenditures 2) investment expenditures 2) passive activity expenditure on real estate 4) trade or business expenditure Investment Interest • Investments - generates portfolio of income such as interest, dividends, annuities and royalties, not personal or business, not passive and not tax exempt securities • Net investment income = Investment income investment expenses. Investment income include net gain to the extent that net gain exceeds net capital gain • Taxpayer can elect to include net capital gain in investment income that will be subject to regular tax rates • Investment expenses only deductible to the extent that it is >2% of AGI - ie this is the amount used to calculate net investment income Qualified residence interest • • • • Principal + secondary residence Secured by home Acquisition indebtedness - up to $1,000,000 Home equity interest - can only deduct the amount applied to the lesser of FMV of qualified residence in excess of acquisition indebtedness or $100,000 • Points are like prepaid interest - can automatically deduct all points for only principal residence • Qualified residence - personally used the property for the greater of 14days or 10% of rental days during the year Student loan interest • For higher education expenses • FOR AGI deduction • Maximum deductible amount = $1000 in 1998. • Phased out ratably for AGI between 40,000 and 50,000 Miscellaneous Itemized deduction • Allowed to deduct in excess of 2% of AGI • Non reimbursed employee expenses • Investment expenses - subject to 2% of AGI limitation • Cost of tax advice Other timing and deduction issues • Discount notes • Related party transactions