MGMT227-Class-3-4-2011 - UCLA Anderson School of

advertisement

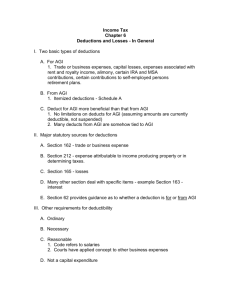

MGMT 227 CLASSES THREE & FOUR – Spring 2011 DEDUCTIONS I. FOR A.G.I. DEDUCTIONS A. FOR AGI = Set forth in Section 62 (all others are from) – These are the preferred expenses, it makes your Tax Return “SHARPER” S Self Employed/Rental Property deductions (SE Tax, Health Insurance & Schedule C or E Losses) H Health Savings Accounts A Alimony R Retirement Plans (IRA, Keogh, etc.) P Penalty for Early Withdrawal E Education (Student Loan Interest, Higher Ed Tuition) R Relocation or Moving Expenses B. Advantages: If from AGI – can only use these itemized deductions if they exceed standard deductions Sets the AGI threshold for medical, casualty, other deductions Lowers AGI so TP’s AGI does not exceed phase-out levels on some deductions II. BUSINESS EXPENSES – Criteria to be used: A. CRITERIA at a glance…. 1. 2. 3. 4. 5. 6. 7. Related to Business/Investment Activity… Ordinary Necessary Reasonable amount NOT a capital expenditure Documented Incurred by TP (not someone else) 1 8. For Profit (rather than…say…a hobby) B. Some Miscellaneous Deductions… 1. Expenses related to Exempt Income: No deduction is allowed because the income is exempt (e.g foreign income exemption, Municipal Bond related, etc.). 2. Expenses against Public Policy: NOT deductible… a. Bribes Whether foreign or domestic NOTE: Illegal rebates from purchase price are excludable from income by the business owner b. Kickbacks for Medicare c. Fines & penalties d. Treble damages under antitrust (lookout Bill Gates) 3. Political Activity: No expenses allowed for political contributions or lobbying. However, lobbying at the local level is deductible if directly related to business. 4. Business Start Up Expenses: Three scenarios…. a. TP Already in that Business: Fully deductible FOR AGI. b. TP Starts Up a New Business: Must be capitalized if incurred before commencement of the business activity itself (over 5 years). c. TP investigates New Business But Decides Against It: No deduction at all may be taken. 5. HOBBIES: When will losses related to hobbies be considered “personal” (and not deductible) vs. business (and therefore deductible): a. Depends on circumstances: History, profits, efforts, etc. 2 b. Three year Rule: If in a 5-year period (tax year and 4 previous), in 3 of those years, TP showed profit – presumption that it is a “business related” activity. (this is a PRESUMPTION – even if this doesn’t exist, you can still prove FACTUALLY that it is a business & not a hobby). c. If deemed “personal” – you CAN deduct expenses up to the extent of any income realized from the hobby. III. RENTAL PROPERTY vs. VACATION HOME: A. Rental Property Income & Losses: 1. Reported in Schedule E 2. Losses reported out to Form 1040 3. BUT…cannot use losses to offset Ordinary or Active Income (we will discuss in a later chapter) B. What about if property owned is part rental and part personal use? Then, there are 3 scenarios: 1. Personal: Rented fewer than 15 days per year, then… a. Exclude rental from gross income b. No deductions/depreciation allowed other than regular mortgage interest deduction on your own home (see section on itemized deductions below). 2. Rental: Rented >14 days and is NOT USED for personal purposes more than…THE GREATER OF 14 days --OR— 10% of the number of days house is rented during the year THEN….deduct related expenses BUT must allocate between Business use and personal use. Losses can be taken if expenses exceeds income. 3. Hybrid – Rental/Personal: Rented >14 days AND used more than the 14 days/10% period, THEN two things apply: 3 a. Allocate personal/rental days for purposes of taxation b. Expenses can only be used to offset income (no loss allowed) IV. MOVING EXPENSES A. 75 miles or more from current home B. Move required by employer C. Stay there 9 months D. Only direct moving expenses are deductible (not house-hunting costs) V. PENSION PLANS: A. IRA: Individuals can deduct FOR AGI up to $ 5,000 per year put into an IRA. 1. If H & W – Can put away $ 10,000 per year (even if one spouse doesn’t work). 2. When money is withdrawn upon retirement, then it will be taxable income at that time. 3. If TP has higher income, however, per year AND has a pension plan at work, then they cannot take the $ 5,000 per year (phased out). 4. If TP only works part time, cannot put away more than his or her earned income (up to the $ 5,000 of course). 5. 10% penalty for early withdrawal 6. Income (P + I) taxed as gross income when withdrawn at age 59½ B. Roth IRA: Can also put away $ 5,000 per year per individual, but it is NOT deductible at all. BENEFIT: When principal and interest is withdrawn upon retirement, then NONE of it is taxable. C. Plans for Self Employed: Keogh: In 2010, usually maximum of 1. 25% of earned income -OR2. $ 49,000 IX. NET OPERATING LOSSES: A. Losses resulting from the operation of a business. 4 1. Can be the loss from operation of a trade or business. 2. Losses from casualty. B. CARRYBACK & CARRY FORWARD: 1. Business NOL: Carryback 2 years or forward 20 years… a. FIRST: Carry back 2 previous tax years (2nd year, then 1st year) b. SECOND: Carry forward to future years up to 20 (must start with year immediately following the NOL). C. ELECTING NO CARRYBACK: TP can irrevocably elect not to carry back & then he/she can only carry forward. X. EDUCATION EXPENSES: 3 areas… A. Educator Expenses (for Teachers K-12): $ 250 (STP) or $ 500 (MFJ) B. Higher Education Tuition 1. Max of $ 4,000 2. Need not be related to employment 3. Phases out at $ 65K AGI C. Student Loan Interest: Max 2,500. XI. Health Savings Accounts: A. For workers with high deductibles (at least $ 1K) B. Can deduct pre-tax up to $ 3,000. XII. Self Employment… A. Health Insurance: 100% deductible B. SE Tax: 50% (this is the FICA equivalent – 15.3% tax) XIII. Penalty on Early Withdrawal (when withdrawn from CD early) 5 XIV. ALIMONY: Remember the basics…(see Gross Income chart) 1. 2. 3. 4. 5. Per Divorce Agreement/Decree Live Apart Will end at death In Cash Apply payments FIRST to Child Support XV. EMPLOYEE vs. SELF-EMPLOYED A. Employee vs. Independent Contractor 1. Depends on such factors as… a. Right to discharge b. Furnishing tools/workplace c. Pay based on time vs. task 2. Tax effects: a. Employee: Must deduct most unreimbursed expenses from AGI = Itemized Deduction (subject to 2% AGI limitation). b. Independent Contractor: Can deduct expenses for AGI (above the line) in a Schedule C as “business expenses”. B. Some Expenses: 1. Automobile: Two alternatives a. Actual Operating Expenses (including depreciation) --OR— b. Automatic Mileage Method (currently 50 cents per mile) 2. Travel: Fully deductible if “temporarily away from home” (<1 year) 3. Education: Several issues… a. Fully Deductible (from AGI as Miscellaneous Itemized Deduction) if to improve/maintain existing skill. 6 b. Not Deductible if for new career or to meet minimum educational requirement of existing job. 4. Meals & Entertainment: 50% deductible 5. Club Dues: Not deductible (unless a community service club) 6. Home Office: Deductible only if portion of house is used exclusively for business use & no other place of business for TP. VI. STANDARD DEDUCTION: A. 2010: STP - $ 5,700 and MFJ - $ 11,400 B. Additional Standard Deduction (seniors or blind) STP - $ 1,400 MFJ - $ 1,100 (each spouse) C. Dependents – HIGHER OF … $ 900 -OR- $ 300 + earned income (but not > $ 5,700) VII. ITEMIZED DEDUCTIONS A. OVERVIEW – Itemized Deductions are generally personal in nature…a TP will “COMMITT” to them: C – Charitable Contributions (50% AGI Max) O – Other Deductions (e.g. Gambling Losses) M – Medical (7.5% AGI Min.) M – Miscellaneous Itemized Deductions (2% AGI Min.) I – Interest (Home Mortgage or Investment) T – Taxes (Local only) T – Theft or Casualty (10% AGI Min.) 7 B. MEDICAL EXPENSES: 1. Three Step Process: STEP ONE: Total Qualified Expenses STEP TWO: Minus Insurance Reimbursement STEP THREE: Minus 7.5% AGI 2. Who can claim? a. TP on behalf of self OR Dependent b. Divorced TP who actually pays the expense (even if child not the TP’s legal dependent) 3. Qualified Medical Expenses: 1. Must be for “medical care”…… diagnosis, treatment, etc. affecting the body (e.g. glasses, therapy) Transportation necessary for treatment Long Term care Insurance premiums and related costs 2. Non-prescription drugs & health remedies not deductible 3. Capital Expenditures for Medical: a. Fully Deductible: Related to sick individual personally (doesn’t improve their property/home) Removal of structural barriers due to handicap b. Partially Deductible: If exp. improves TP’s property, only deductible in excess of the increase to property’s FMV 8 c. Ins. Premiums: Fully deductible unless part of comprehensive ins. policy that provides other coverages in which case we deduct only the portion of the policy premiums attributable to health care. C. THEFT/CASUALTY LOSSES -- OVERVIEW (Basic Formula) – 4 Easy Steps: Step One: Calculate the amount of loss (see below) Step Two: Minus any insurance reimbursement Step Three: Minus $ 500 per event Step Four: Minus 10% of AGI 1. Defined: Loss from an identifiable event that was sudden, unexpected or unusual. a. Identifiable: A specific event caused the loss as opposed to just losing or misplacing something. b. Sudden = swift, not gradual Unexpected = unanticipated, not intended Unusual = not day to day, or normal part of TP’s business 2. Limitations: As we know, there are two for PERSONAL losses a. $ 100 statutory reduction per casualty b. Can only claim losses in excess of 10% of AGI c. BUSINESS LOSSES: Fully deductible for AGI. 3. If a gain is recognized from the losses (e.g. insurance proceeds exceed actual recognized loss, not counting the 10% AGI threshhold) then it is treated as a Capital Gain/Loss. 4. When deductible? In the same year as suffered…..EXCEPTIONS: 9 a. Theft: In year discovered b. Insurance Proceeds Pending: Can wait to receive to see if some portion of the loss will still be deductible. (fully reimbursed losses are not deductible, if money coming) c. Declared Disasters: Deduct in previous year if return not yet filed. (e.g. Northridge Quake – TP’s deducted on ‘93 Return) D. TAXES: 1. You CAN deduct…. Local Real Property Taxes Local Personal Property Taxes Non-federal (local) income taxes –OR- Sales taxes Business related taxes (deduct as FOR AGI!!) 2. You CANNOT deduct… Car or Pet registration fees Tolls Special Assessments for sidewalks, etc. Federal Taxes (all but one exception: don’t have 2 know) Social Security taxes State inheritance & gift taxes 3. Different Types: a. Local Income Tax -- Deduct year paid (regardless of what tax year the taxes are for) b. Personal Property Taxes – Must meet two tests: (1) Determined by property’s value (not other attributes like model or weight) “Ad Valorem Tax” -- so DMV fees may not be deductible (2) Imposed on an annual basis c. Real Estate Taxes: Deductible year paid...but if property sold must be allocated between buyer and seller. 10 E. INTEREST: compensation for the use of money (everything but bank charges & finance charges) 1. Classifications: Trade or Business related (For AGI) Investment (Itemized – From AGI Personal (Not deductible) Qualified Residence (Itemized – From AGI) Student Loan (For AGI) 2. Investment Interest: What you need to know… a. Only deductible against net investment income. (cannot use to offset other income or as a “loss”) b. Net Investment Income: Investment Income minus other investment expenses (broker’s fees, publications, etc.). Investment interest is NOT considered a deductible expense to arrive at Net Investment Income. 3. Personal Interest: No deduction (except: personal residence) 4. Qualified Residence Interest: May be deducted a. Interest payment must be for either…. Acquisition Indebtedness --OR— Home Equity Indebtedness b. Acquisition Ind.: Secured to buy, construct or substantially improve a qualified residence. c. HOME EQUITY: Limited to the lesser of… Equity in the house (FMV of Q. Residence > indebtedness) --or- $ 100,000 OF LOAN VALUE d. Points: Must be amortized (as prepaid interest) UNLESS used to acquire TP’s personal residence…then can fully deduct 11 e. What is a Qualified Residence: TP’s principal residence 1 other residence (personal use > 14 days or 10% of days rented) F. CHARITABLE CONTRIBUTIONS: 1. Deductible if paid to qualified organizations 2. What is a Qualified Organization? a. Government entity, corporation, foundation, trust, society (not individuals) b. Can be Public Charity (churches, schools, government, hospitals, and certain foundations) or Private Foundation Private = < 1/3 income from public Private can be Operating or Non-Operating 3. What counts as a “Contribution”? a. Cash – deduct amount of cash b. Property – Types of donated assets: (1) Appreciated Capital: Capital Asset held > 1 year (LT) (2) Ordinary: Short Term Capital, Inventory, Self Made Work (3) Use FMV usually (unless: Appreciated Capital Gain to Private Non-Operating Foundation or Personal Property not put to related use – for those 2 use basis of property) 4. Limitations: a. 50% Limitation: Individuals contributing cash or ordinary asset to PUBLIC CHARITY (@ FMV). b. 30% Limitation: Applies to (a) Cash or ordinary property donated to a private nonoperating foundation AND (b) Appreciated Capital Gain property donated to a PUBLIC Charity. 12 c. 20% Limitation: Capital Gain property to a private nonoperating foundations limited to 20% of TP AGI usually 5. SUMMARY Public Charity or Private Operating Foundation 50% AGI Cash or Non-Capital Property 30% AGI Appreciated LT Capital Property Charitable Contribution 30% AGI Private NonOperating Foundation 20% AGI Cash or Non-Capital Property Appreciated LT Capital Property H. MISCELLANEOUS ITEMIZED DECUTIONS: 2% - in excess of AGI for Miscellaneous: Main categories… 1. Unreimbursed employee expenses – Includes… a. b. c. d. Education Travel Entertainment (50%) Supplies/Tools 2. Investment Expenses 3. Tax Preparation or Income Collection Professional Fees (e.g. hiring a lawyer to sue for alimony or repayment of loan interest) 4. NOTE: AMT takes these away (including your MBA deduction) 13