Chap05

advertisement

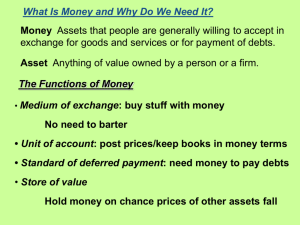

Chapter 5 CENTRAL BANKS AND THE CREATION OF MONEY The Federal Reserve System Board of Governors Federal Reserve Banks Member Banks Federal Open Market Committee Tools of Monetary Policy Reserve Requirements Open Market Operations Open Market Repurchase Agreements Discount Rate Reserve Requirements Fractional Reserve Banking System Required reserve ratio Demand deposits Time deposits Total reserves Required reserves Excess reserves Open Market Operations Fed purchases and sales of government securities Fed purchases Increase excess reserves Increase new loans Increase money supply Fed sales Decrease excess reserves Decrease loans Decrease money supply Open Market Repurchase Agreements Repurchase Agreement Fed buys securities from a seller who agrees to repurchase them at a higher price on a certain date in the future. (Temporary increase in excess reserves.) Reverse Repurchase Agreement Fed sells securities and agrees to repurchase them at a higher price on a certain date in the future. (Temporary decrease in excess reserves.) Discount Rate Rate charged on loans from the Fed’s discount window. Administratively set by Board of Governors An increase in the discount rate discourages banks from borrowing from the Fed A decrease in the discount rate encourages banks to borrow from the Fed Different Uses of Money Unit of Account Numeraire Medium of Exchange Currency and demand deposits Store of Value Time deposits Monetary Aggregates Monetary Base: Currency in circulation Currency and coins plus total reserves M1 Money Supply Currency plus demand deposits M2 Money Supply M1 plus short-term time deposits M3 Money Supply M2 plus long-term time deposits Money Multiplier Process by which changes in bank reserves generate larger changes in the money supply. Size of Multiplier Influenced by: Reserve requirement ratio Public’s demand for cash Banks’ willingness to make loans Level of interest Rates The Money Supply Process in an Open Economy Foreign Exchange Market Intervention The Fed’s purchase and sale of foreign currencies Purchase of foreign currencies Increases monetary base Reduces value of the U.S. currency Sale of foreign currencies Decreases monetary base Increases value of the U.S. currency Central Banks Around the World European Central Bank Bank of England Bank of Japan European Central Bank (ECB) Replaced central banks in the 11 countries participating in the European Economic Community Structure of ECB is decentralized Major Issues: Weakness of Euro Major Aspects: Transparency Policy objective: price stability England: Bank of England Primary Roles: Monetary Policy and Stability of Financial System Bank of England Act (1998) No longer under control of Exchequer Management of Government debt Policy objective: price stability Independence Transparency Japan: Bank of Japan Ministry of Finance Bank of Japan Law (1998) Independence Transparency Policy objective: price stability Policy Board TanKan Report