execution

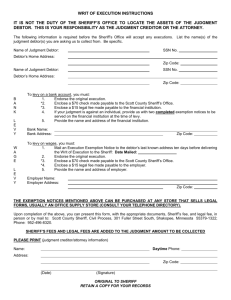

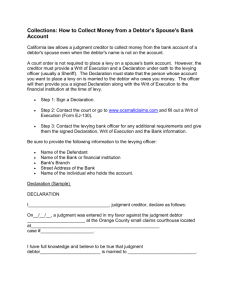

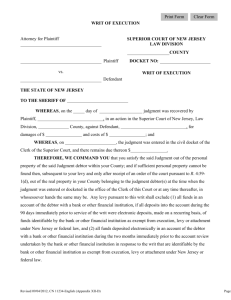

advertisement

2: Judicial Collection – Introduction, Execution © Charles Tabb 2010 Sheriff, get me the money Basic premise • “first in time is first in right” • The race of diligence Get a LIEN • Creditor’s rights are fixed when gets a lien against property of the debtor – Either up front (e.g., Art. 9 security interest, mortgage) – Or in process of collecting (e.g., execution lien) Secured vs Unsecured • Secured creditors can collect just by foreclosing on collateral • i.e., apply the collateral to payment of debt Unsecured? • Unsecured creditor by definition does not enjoy any collateral to secure its debt • Cannot just seize debtor’s property to enforce debt – would be conversion • So how collect? judgment • Unsecured creditor has to get a judgment first • Then can try to collect by enforcing the judgment • Enforcing judgment: state assists creditor in collecting from debtor Called “execution” • The process of enforcing a judgment with the aid of the state is called “execution” • Derived from common law writ:“fieri facias” --> Known as fi fa — Steps in Execution • One: final money judgment Steps in Execution • Two: issuance of writ of execution Steps in Execution • Three: delivery of writ of execution to the sheriff important in a minority of states (such as Illinois), because this is point in time at which execution lien arises (even though still contingent or “inchoate”) Steps in Execution • Four: sheriff levies on debtor’s property, makes return majority rule: this is time that execution lien arises And in minority states is when contingency is removed What is “levy”? • Levy is the sheriff’s assertion of dominion and control over the property Steps in Execution • Five: sale of assets levied on Steps in Execution • Six: distribution of sale proceeds Problem 1.6 * April 1: Creditor obtains a final money judgment against Debtor for $5,000. * May 1: The clerk issues a writ of execution, with a return date of 90 days. * September 1: the sheriff levies on Debtor’s prize pig Porky. -> What are the legal consequences? Answer to Problem 1.6 • Since return date passed before levy, sheriff had no legal authority to levy • September 1 > 90 days after May 1 Return date passes I think of the sheriff’s power under a execution writ like the message in Mission Impossible – it just goes up in smoke when the return date passes SHERIFF’S POWER TO LEVY Consequences of late levy • 1st – sheriff is liable to Debtor in conversion • 2nd – Creditor has nothing – the levy is ineffective, so no execution lien, no right to continue execution process on pig What can Creditor do? • Get a new execution writ and try again Problem 1.7 • April 1: Creditor obtains a final money judgment against Debtor for $5,000. • May 1: clerk issues a writ of execution, with a return date of 90 days. • June 1, the sheriff returns the writ “nulla bona.” • The next day, the judgment creditor discovers assets of the Debtor that are subject to levy. What should the Creditor do? Effect of nulla bona return? • Kills off sheriff’s power under that writ NULLA BONA RETURN -> • Doesn’t matter that return date has not passed – the writ is now dead Now what? • Creditor simply gets a new writ issued • Delivers to sheriff with specific instructions on what asset to levy on – see, e.g., Vitale Problem 1.8 • April 1: Creditor obtains a final money judgment against Debtor for $5,000. • May 1: clerk issues a writ of execution, with a return date of 90 days. • May 2: writ is delivered to the sheriff • May 10, Debtor sells his prize pig Porky to Purchaser. Purchaser leaves Porky with Debtor, saying he will pick the pig up on May 15. • May 12, sheriff levies on Porky pursuant to Creditor’s writ of execution. Priority Battle • There’s only one pig Porky – who gets it? • Purchaser vs Creditor How decide priority battles? • five basic principles • 1st – property principle of “nemo dat” (can’t give what you don’t have) –So, when assessing rights of parties who have dealt with the debtor, what rights did the debtor have in the property at the key moment in time? 2nd priority principle • What date did each party’s rights versus Debtor’s property 1st arise? • Look to whatever the operative law is (e.g., laws regarding sales of goods, laws of execution liens, etc.) 3rd priority principle • Did that party ever LOSE their priority? • i.e., did they do what they had to do (if anything) to keep their priority alive? 4th priority principle • Default rule for determining the winner • Race – 1st in time wins • E.g., compare the operative dates for each party (from 1st 3 principles) – and party with earliest date wins 5th priority principle • See if there is an EXCEPTION to the default rule • For example – A “purchase money” lender may trump earlier parties – Ditto (sometimes) a BFP (bona fide purchaser) Answer to 1.8 – majority rule • What are the relative priorities of the parties with regard to Porky if the state follows the majority rule on execution liens? • Majority rule: Creditor’s execution lien arises on LEVY Application of majority rule • PURCHASER wins • Why? Nemo dat (principle 1) – –Creditor got nothing on levy –as of date of levy, it wasn’t Debtor’s pig! Sheriff? • Liable to Purchaser for conversion • Purchaser can either get money damages from sheriff • Or get Porky back Answer to 1.8 – minority rule • What are the relative priorities of the parties with regard to Porky if the state follows the minority rule on execution liens? • What is minority rule? – Creditor’s “inchoate” execution lien arises on delivery of writ to sheriff – Contingent on sheriff levying before return date Application of minority rule • Creditor wins under “1st in time” principle • Why? – Under nemo dat, what did Purchase get when he bought Porky from Debtor? – > a slab of breathing bacon subject to Creditor’s inchoate execution lien – and Creditor did perfect the lien – got levy Practical consequence • Porky is sold at execution to satisfy Creditor’s judgment • IF any proceeds are left, they go to Purchaser – Remember, Purchaser does have a property interest in Porky – It’s just junior to Creditor’s execution lien Possible exception in 1.8 • Purchaser MIGHT win IF the state has an exception (see principle 5) that protects a BFP (bona fide purchaser) – Rationale: how could P have known? Chill pig sales without protection • Of course, P has to qualify as BFP – Gave fair value – Without notice of any funny business • May wonder why left Porky with Debtor? A really, really short primer on Art. 9 • Governs security interests in personal property Art 9 primer • Creditor (Secured Party) has rights in specific Collateral (debtor’s property) to secure an obligation Art 9 primer • When does SP get rights against Collateral? • Upon ATTACHMENT • “ATTACHMENT” means, simply, that the SP has a right as against the debtor with regard to the covered collateral • Attachment has nothing to say about SP’s rights versus third parties – except, with no attachment, SP has nothing at all! Art 9 primer • For attachment, need: • (1) agreement of debtor • Usually in a signed security agreement • (2) debtor has rights in collateral • (3) SP gives value • Usually a loan or extension of credit Art. 9 primer • For rights against THIRD PARTIES, the Art. 9 concept of PERFECTION comes into play • In a priority fight vs 3rd party, an Art. 9 SP almost always dates the time of its rights from the date of perfection – not attachment • Date of perfection – usually when SP files a “financing statement” (or a “UCC-1”) The Art. 9 priority rule vs judicial liens • UCC § 9-317(a)(2): “A security interest … is subordinate to the rights of: … (2) except as otherwise provided in subsection (e), a person that becomes a lien creditor before the earlier of the time: (A) the security interest …is perfected. Summary of SP v LC rule • Winner is 1st party to “perfect” or “levy” – i.e., did SP perfect its security interest before creditor became a lien creditor by levy – Stated otherwise, even if SP has a security interest, if it is still unperfected, general creditor can trump SP by getting sheriff to levy on collateral – Justification: Race-Notice Art. 9 priority rule • How does competing creditor “become[] a lien creditor” for purposes of 9-317(a)(2)? – This is critical because it determines the relevant date for the creditor versus the SP, under the normal “1st in time wins” rule • Answer: 9-102(a)(52): "Lien creditor" means: (A) a creditor that has acquired a lien on the property involved by attachment, levy, or the like “Lien creditor” under Art. 9 • Under the Art. 9 “lien cr” definition – requires “attachment, levy or the like” • Reason: consistent with the public notice premise of Art. 9 for resolving priority fights • Which suggests that getting an execution lien by delivering a writ to a sheriff (rule in minority states) probably won’t be enough – i.e. delivery of a writ is not “like” levy Special rule for “PMSI” • One major exception to race-notice rule of 9-317(2)(a) • For a “purchase money security interest” (PMSI) • PMSI is where the very obligation secured enabled the debtor to purchase the collateral. See 9-103(a) 2 basic types of PMSI • (1) Seller of goods on credit retains security interest to secure the balance of price due • (2) Lender loans Debtor money to enable Debtor to buy collateral, debtor does so, and lender gets security interest in collateral to secure the loan Justification for PMSI rule • Debtor would not have had the collateral in the 1st place but for the credit/loan from the PM-SP • Necessary to encourage PM credit/loans Special PMSI rule vs LC • UCC § 9-317(e): “… if a person files a financing statement with respect to a purchase-money security interest before or within 20 days after the debtor receives delivery of the collateral, the security interest takes priority over the rights of a buyer, lessee, or lien creditor which arise between the time the security interest attaches and the time of filing” Summary of PMSI rule • PM-SP gets a 20-day grace period (dated from when debtor receives delivery of collateral) to perfect • If files within that 20 days, still wins even against an LC who levied in the interim • In essence, PMSI rule allows for relation back of PM-SP from date of perfection to date of attachment Problem 1.9(a) • Feb 1: SP’s security interest in Porky attached, secures debt of $5K - SP’s security interest perfected • April 1: Creditor obtains a final money judgment against Debtor for $5,000. • May 1: clerk issues 90-day writ of execution • May 2: writ is delivered to the sheriff • May 10, the sheriff levies on Debtor’s prize pig Porky, who is worth $5,000, pursuant to Creditor’s writ of execution. 1.9(a) • What are the relative priorities of the parties with regard to Porky, assuming the state follows the majority rule on execution liens? Answer to 1.9(a) [majority rule state] • SP wins • Security interest attached and was perfected before C got levy 1.9(a) – minority rule state? • Would the result change if in a minority rule state, which dates C’s execution lien from delivery of the writ to the sheriff? Answer – minority state, 1.9(a) • Result would not change – SP still was perfected before C did anything Problem 1.9(b) • Feb 1: SP’s security interest in Porky attached, secures debt of $5K • April 1: Creditor obtains a final money judgment against Debtor for $5,000. • May 1: clerk issues 90-day writ of execution • May 2: writ is delivered to the sheriff • May 5: SP perfects • May 10, the sheriff levies on Debtor’s prize pig Porky, who is worth $5,000, pursuant to Creditor’s writ of execution 1.9(b) b. what are the relative priorities of the parties with regard to Porky, assuming the state follows the majority rule on execution liens? Answer to 1.9(b) – majority rule state • SP wins • Perfected (May 5) before C’s levy (May 10) Answer to 1.9(b) – minority rule state • Depends • On what? – Is C considered a “lien creditor” for Art. 9 purposes when writ delivered to sheriff (May 2 – before SP perfected) and inchoate lien arose, or only on actual levy (May 10 – after SP perfected)? – Remember that Art. 9 “lien cr” dfn. Requires that creditor obtain lien “by attachment, levy, or the like”. Better view is thus that SP wins Problem 1.9(c) • Feb 1: SP’s security interest in Porky attached, secures debt of $5K • April 1: Creditor obtains a final money judgment against Debtor for $5,000. • May 1: clerk issues 90-day writ of execution • May 2: writ is delivered to the sheriff • May 10, the sheriff levies on Debtor’s prize pig Porky, who is worth $5,000, pursuant to Creditor’s writ of execution 1.9(c) c. what are the relative priorities of the parties with regard to Porky, assuming the state follows the majority rule on execution liens? Answer to 1.9(c) – majority state • Creditor wins • Got execution lien by levy on May 10, which was before SP perfected (on May 15) 1.9(c) – minority rule state • No change in result – Creditor still wins • Latest execution lien arose (even for Article 9 purposes) was May 10, which is before May 15 Vitale v Hotel California • how do you think plaintiff's attorney found out about the debtor's liquor license in "The Fast Lane“? Vitale • what did Israelow (plaintiff’s lawyer) do vis-a-vis the sheriff to enhance the likelihood of successful execution? Vitale • Why did the sheriff get amerced? Illi • Necessary preliminary points about an “ABC” - assignment for the benefit of creditors –1st – a collective proceeding (state law alternative to chapter 7 bankruptcy) … may be used by a corporation, which doesn’t care about a bankruptcy discharge ABC • 2nd – “trustee” (or “assignee”) takes title to Debtor’s assets, and holds in trust for the benefit of all debtor’s creditors • Pretty much the same as a bankruptcy trustee ABC • 3rd – priority status of creditors’ claims is determined as of the moment of the assignment • The assignment freezes creditors’ rights vs. debtor, and vs. each other • Again, this mirrors the bankruptcy approach ABC • 4th – Nemo dat • i.e., the trustee take title to the debtor’s property, as of the moment of the assignment, exactly as it is • That is, however the debtor’s title is limited, ditto the trustee’s title • And again, this presages the bankruptcy approach ABC • 5th: distribution of property to pay claims – 1st – parties holding valid liens against property are paid in full out of that collateral – 2nd – next are some statutory priorities (e.g., fed govt income taxes) – 3rd – sharing pro rata – all the general unsecured creditors – Again – similar to bankruptcy approach ABC • The trustee (assignee) has the status of a “lien creditor” • And thus generally will beat an unperfected lien or security interest • Just like the bankruptcy rule Application: vs Brookfield & Youngs • Chronology: –Fi fa issued & delivered to sheriff –Sheriff levied –B & Y entered into payment schedule with DR, suspended execution sale –ABC made B & Y’s priority status • Held: have valid execution lien against the property levied on, which is enforceable in the ABC • Which means that the property they levied on will be paid entirely to them, to the exclusion of all other creditors Rationale as to B & Y • Got a choate (perfected) execution lien by delivery of the writ to the sheriff AND levy before the ABC • That perfected lien is good against the trustee (and thus all general unsecured creditors) B&Y • Only issue was whether they abandoned their execution liens by holding off on execution sale while accepting payments • Court held no (reversing lower court) – they still were proceeding toward goal of collecting judgment, not just sitting on their rights The other 5 (i.e, those with the dumb lawyer) • Chronology: – November 2: writs delivered to sheriff – November 4: ABC made – November 6: Dumb lawyer asks sheriff to return writs “in custodia legis” – Sheriff returns “nulla bona” – Dumb lawyer does not object to return Priority Status of the Unlucky 5 • They lose • Impact – relegated to general unsecured status • Will share the dregs of whatever is left with everybody else who does not have a lien or priority Rationale as to Unlucky 5 • Originally had an inchoate execution lien prior to the ABC -- because writ delivered to sheriff before -- and Maryland is a minority state But they LOST the lien when the sheriff returned the writ “nulla bona” (and no objection was filed) So what would a SMART lawyer have done? • One clue: Nemo dat • i.e., What was state of debtor’s title to its property vis-à-vis the Gang of 5 as of Nov 4, the moment of the ABC? Nemo dat? • Debtor’s interest in property was subject to Gang of 5’s inchoate execution lien at the moment of the ABC • i.e., the Gang of 5 had the right (as of the moment of the ABC) to make their inchoate lien perfected, or choate, by levy before the return date • So, trustee’s title was likewise limited What should Gang of 5 done? • Levy • Could have instructed sheriff to make levy on debtor’s property in the hands of the assignee prior to the return date on the writ – Can have a “constructive” levy Perfect after ABC?? • You may wonder how Gang of 5 could have perfected after the ABC was made • Have to ask – under state law (Maryland), who would have priority in a lien cr vs. lien cr fight, where chronology was: – one LC (# 1) had writ delivered to sheriff – Other LC got Levy (or equivalent – this is the ABC) – LC # 1 got levy (continued) • Answer: in Maryland, as a minority rule state, LC # 1 would win – got the 1st lien (albeit inchoate) upon delivery of writ to sheriff, and can make choate and still win, with relation back effect • So – Trustee of the ABC (who has LC status) would likewise lose to a prior LC Unperfected SP vs ABC? • What is SP had a security interest that was unperfected at the time of the ABC? • It would LOSE under UCC 9-317(a)(2) – Because Trustee of ABC is considered a “lien creditor” – And recall that LC beats unperfected SP