Publication 527 - Residential Rental Property If you own residential

advertisement

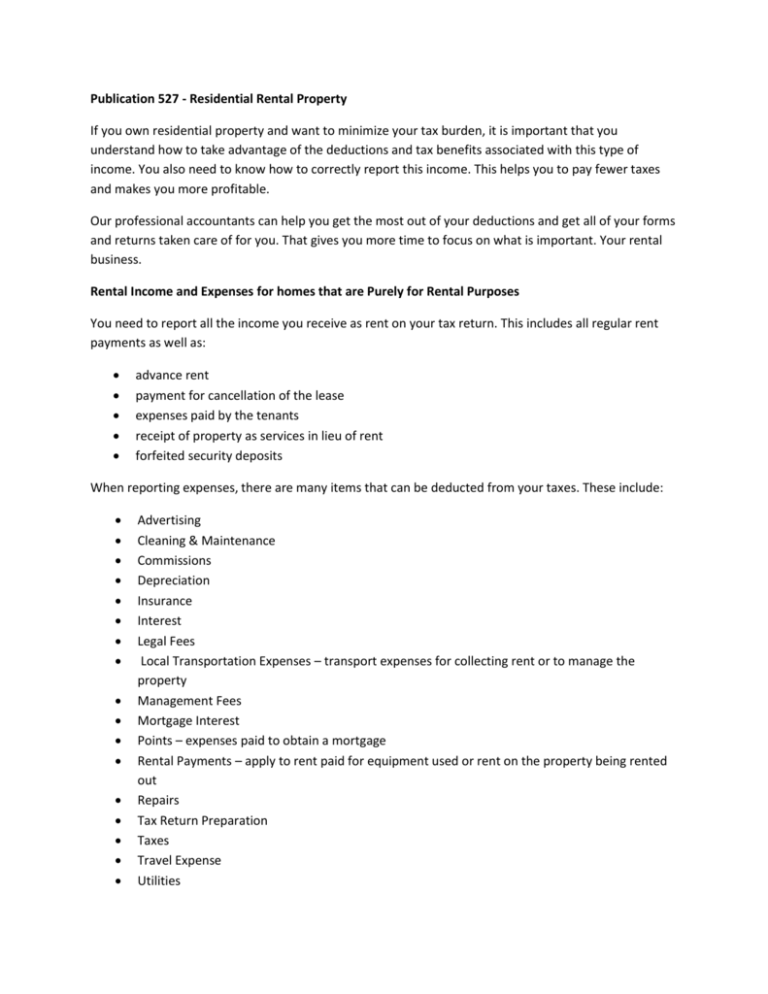

Publication 527 - Residential Rental Property If you own residential property and want to minimize your tax burden, it is important that you understand how to take advantage of the deductions and tax benefits associated with this type of income. You also need to know how to correctly report this income. This helps you to pay fewer taxes and makes you more profitable. Our professional accountants can help you get the most out of your deductions and get all of your forms and returns taken care of for you. That gives you more time to focus on what is important. Your rental business. Rental Income and Expenses for homes that are Purely for Rental Purposes You need to report all the income you receive as rent on your tax return. This includes all regular rent payments as well as: advance rent payment for cancellation of the lease expenses paid by the tenants receipt of property as services in lieu of rent forfeited security deposits When reporting expenses, there are many items that can be deducted from your taxes. These include: Advertising Cleaning & Maintenance Commissions Depreciation Insurance Interest Legal Fees Local Transportation Expenses – transport expenses for collecting rent or to manage the property Management Fees Mortgage Interest Points – expenses paid to obtain a mortgage Rental Payments – apply to rent paid for equipment used or rent on the property being rented out Repairs Tax Return Preparation Taxes Travel Expense Utilities Loss due to casualty or theft on rental property can be also be deducted. You will want to keep detailed records of all of your expenses so that your accountant can help you maximize your deductions. There are also property types that limit what you can deduct. These are called special situations. These properties types are condominiums, cooperatives, property converted for rental use, and renting part of a property. For these properties, the rule that applies is that only income and expenses directly related to the rental activity should be reported /deducted. Finally, the IRS places limits on rental losses. These are covered by the passive activity limit. Any losses from passive rental activities will be carried forward to the next year and not deducted or offset against other income in the Income Tax Return unless you actively participate in the management and rental activity. Understanding Depreciation Depreciation is the decrease in the value of assets over time. In light of residential rental property it applies to the property itself. You can deduct a certain portion of the cost of the property as an expense on your tax forms. To do this your property must meet the following guidelines: You own the property It generates income Has a determinable useful life – ( land is not depreciable) Useful life is more than 1 year There are many factors to consider when computing depreciation values. You need to decide on a depreciation method – the method used for properties is almost always the Modified Accelerated Cost Recovery System (MACRS) or the General Depreciation System (GDS). Under the GDS, the recovery period is 27.5 years. You also need to know the cost or value of the property when it was put into service, as well as what the useful life of the property is. Once these factors have been determined you can claim depreciation of your property as a deduction. Part Time Rentals and Renting Part of Your Home. Many people rent out a home for the time that they aren’t living in it. It is also common to have a rental unit within your house. There are special rules for dealing with these situations. If you use a rental property as a personal dwelling unit and rent out a portion of it, then you report the income and expenses that pertain to only that room, and only for the time it is being rented. If you own a property that you live in part of the time and rent out the rest of the time, then you calculate the income and expenses for the time period that the property is rented out. You don’t count any of the days that the property was used by you or your family in your expense reports. These are called days of personal use. Personal use days cover a variety of circumstances. Your property is considered to have been used for personal use if you donate the use of the property, if it is used by a party with an interest (or coownership) of the property, you rent it out for less than fair rental price. Days used for repair or maintenance of the property are not considered personal use days. In addition to these rules a property must be rented out for more than 14 days in a year or more than 10% of personal use days in order to qualify for deductions. When you are using a residence for both personal use and a rental you calculate your expenses by dividing them between the rental use and personal use days. It is important to keep very good records if you are going to use your property this way. Owning rental properties can be a great way to produce income, but it is important to be familiar with the rules of reporting both income and expenses for these properties. When you work with our tax accountants we can advise you on how to track your expenses and income and how to maximize your deductions and reduce your tax liability, while complying with the law.