Financialisation in

advertisement

Financialisation in a long-run

perspective:

an evolutionary approach

Alessandro Vercelli

DEPS (University of Siena)

SOAS (University of London)

1

Three basic approaches

-specific historical episode

3 main options { -recurring phenomenon

-stage of a long-run process (or tendency)

In my opinion the three options do not exclude each other:

my suggested vision combines the three approaches within an evolutionary paradigm

2

Preliminary definition

I start from a broad definition that may accommodate all the stages of the process

Financialisation:

process of evolution of «money» (money/credit/finance) that increases its importance

and thus the influence of financial markets, institutions and élites

While we analyse the processes of financialisation we should keep in mind the crucial

money as quantity that is created, multiplied, hoarded and utilized

distinction {

money as structure shaping the forms of exchange / accumulation

3

Financialisation as a recurring phenomenon

significant analogies

recurring phenomenon in a broad sense {

significant differences

1st financialisation (about 1880-1929)

Since the industrial revolution {

2nd financialisation (about 1980-2014 → ?)

Under which conditions? Main answer: phase of long-term fluctuations:

long waves (e.g. Arrighi, 1994; Kevin Phillips, 2006)

within a theory of {

recurring technological upsurges (Perez, 2002)

4

Financialisation and decline (1)

a) economic

Nexus between financialisation and {

decline

b) political

a) A declining rate of profit in the real economy encourages the search of higher profits in

finance

b) The declining hegemonic power tries to defend its supremacy by turning to finance :

vent for accumulated capital

influence on who does what

crucial support to colonialism and imperialism

Arrighi (1994): the First financialisation is related to the decline of the British Empire

while the Second financialisation is related to the decline of American hegemony

5

Financialisation and decline (2)

Braudel (1982) detects two waves of financialisation before the industrial revolution:

A first wave when the Genoese withdrew from commerce and specialized in finance

establishing a symbiotic relation with the kingdom of Spain: military protection in

exchange of credit for their exploration of new commercial routes

A second wave after 1740 when the Dutch withdrew from commerce to become the

“bankers of Europe”

Analogously Marx in his analysis of primitive accumulation (1867) reconstructs an

historical sequence showing that the declining commercial power typically becomes

the principal lender to the emerging commercial power:

Venice to Holland → Holland to England → England to the USA

6

The first and the second financialisation

7

Financialisation, globalisation, crises and technology

The long-run fluctuations of financialisation are correlated with:

-» long-run fluctuations of globalisation following phases of systematic liberalisation

-» technological trajectories: installation of a new technological paradigm

(Perez, 2003) → financialisation provides the necessary structural flexibility

FIRST: trajectory based on oil, automobile, and mass production

financialisation {

SECOND: ICT trajectory

-» great crises: the excessive and unfettered flexibility leads to

1° financialisation → Great Depression

great crises {

2° financialisation → Great Recession

8

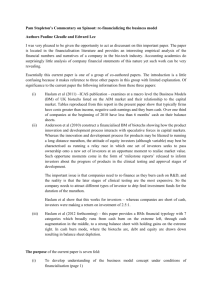

The first and the second globalisation

Ratio between world export of goods and world GDP

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

0.0

1820

1870

1913

1929

1950

1973

1990

2000

EXP/GDP

9

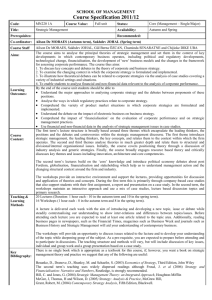

Technological trajectories and development trajectories

Perez technological trajectory A

Installation

20-30 years

Great

Crisis

Perez technological trajectory B

Deployment

Installation

20-30 years

20-30 years

Creative destruction

Creative construction

Productive capital leads

Dev. traject.A

Deployment

20-30 years

Creative destruction

Financial capital leads

Financial capital leads

Big bang

Great

Crisis

Gestation

Creative construction

productive capital leads

Big bang

Development trajectory B

Gestation

Dev. traject. C

Source: Perez 2002 modified and integrated by the author (Vercelli, 2011)

10

Secular tendency towards financialisation (1)

Long-term fluctuations of financialisation along a secular trend?

I claim that there is a secular tendency towards financialisation that is intrinsic in the

development of market relations

This tendency progressed very slowly because, since the ancient civilizations, it was

repressed for different reasons (religious, political, ethical, social protection) :

deceleration (sometimes even decline) when the repression became tougher

(e.g. in the Bretton Woods period)

alternation {

acceleration when repression was relaxed → phases of financialisation

(neoliberal era: 1980s-today)

11

Financialisation after the Industrial Revolution:

the main stages

1st phase until about 1850: mercantilist financial repression slows down financialisation

notwithstanding the progressive development of market relations

2nd phase since about 1850 accelerating since 1980: systematic introduction of freetrade policies progressively relaxing financial repression → 1st financialisation

3d phase since the Great Depression (1933: US banking act): new phase of financial

repression slowing down financialisation

4th phase since about 1980: neo liberal policies → progressive relaxation of financial

repression to an unprecedented level → 2nd financialisation

12

Why a tendency towards financialisation? (1)

Why there is a secular tendency towards financialisation?

process driven by financial innovations introduced whenever at the micro level they are

profitable and are not repressed

general tendency because financial innovations have something in common:

increase choice flexibility →↑ returns for the innovators

The increasing flexibility of the choice set is realized by increasing the liquidity and

mobility of assets and capital:

-joint-stock companies (Keynes, 12th Chapter GT)

-securitisation (Minsky, 1987)

-shadow banking (Gorton, 2008 and 2009)

13

Financialisation and sustainability

Flexibility-enhancing innovations very often have negative macro externalities

In particular a micro increase of efficiency is often accompanied by more systemic

instability that may jeopardise systemic efficiency

→ trade-off between micro efficiency and systemic stability:

after a certain threshold systemic instability makes the system unsustainable

In what follows I try to substantiate my working hypothesis with the help of history

of analysis

15

Financialisation in (neo-)classical economics

barter economy

In classical and neoclassical theory basic distinction {

monetary economy

A monetary economy is believed to be much more efficient than a barter economy

as it relaxes the strictures of “double coincidence of wants” →↑ flexibility

The trade-off between efficiency and stability (QTM) is “solved” by forcing a

monetary economy to behave as a barter economy anchoring it to

•

•

•

the gold standard

and/or to an orthodox budget policy

and/or to strict monetary policy rules

a barter economy never existed (Graeber, 2012)

Serious problems{

evolution of monetary economies disregarded

16

Reaction to the 1st financialization

The process of financialisation that spread and intensified in the second half of the 19°

century until WWI progressively changed the functioning of capitalism giving a

growing importance to credit:

the increasingly endogenous process of money creation on the part of the banking system

was inconsistent with the QTM but this passed unnoticed with most classical

economists

We find significant exceptions only with a few perceptive neoclassical economists in the

most heterodox part of their contributions who modified standard theory to take

account of the role of credit:

Wicksell (cumulative process)

Fisher (debt-deflation)

Schumpeter (theory of economic development)

17

The role of credit: reaction to 1st financialization

The compromise with classical theory was sought through an institutional dichotomy:

Wicksell (1898) monetary economy-pure credit economy: in a credit economy circulating

money crucially depends on the interest rate rather than on the general price index

Schumpeter (1934 [1917]) circular flow-development: emphasizes the crucial role of

credit to innovative entrepreneurs in promoting the process of capitalist development

escaping the stationary routine of circular flow

Fisher (1932, 1933) ordinary crises-great depressions: the development of a credit

economy may lead to over-indebtedness of economic units and this to deflation

triggering a vicious circle that may degenerate in a great crisis

18

Money and financialisation in Marx

Marx was the first to develop a radical critique of the QTM since it ignores the

essence of circulation of goods in a monetary economy:

“The illusion that it is […] prices which are determined by the quantity of

circulating medium […] has its roots in the absurd hypothesis…that

commodities enter into the process of circulation without a price, and that

money enter without a value…”

(Marx, 1976, pp.217-8)

This sharp criticism of the TQM also clarifies why many interpreters and

followers of Marx reached the conclusion that money is not important

However, this conclusion does not take into account money as technological

and institutional structure that plays a crucial role in capital circulation in

identifying different forms and phases of capitalism characterized by

different functioning rules

19

Money as structure and financialisation: Marx

emblematic circulation forms (extremely simplified version: more details in

Vercelli, 1973):

•

•

•

•

•

•

•

U–U

Immediate exchange of use values (occasional barter)

C–C

Immediate exchange of commodities

C–M– C

Simple circulation of commodities

C ─ M ─ C’ Petty commodity production (“simple commodity production”)

M ─ C ─ M’ Circulation of commercial capital

C …. P …. C’ Circulation of commodities in industrial capitalism

M ─ C …. P …. C’ ─ M’ Circulation of money capital

long-term tendency towards an increasing role of money as structure and

institution encompassing production and any aspect of social life and culture

20

Marx: long-term tendency towards financialisation

Money as structure plays a crucial role by enhancing the flexibility of exchanges

that become increasingly independent of time, space and utility content

→ higher degree of abstraction of exchange value

from use value →

{

↑ instability

↑ fetishism

↑ alienation

→ increasing short-termism:

a decision is taken if max the value of the portfolio whatever is the costs for

society and nature (externalities not considered) → unsustainability

21

The first financialisation: Marx and followers

Marx also started the analysis of the emerging First financialisation focusing on the

ongoing process of concentration and centralisation of capital and on the ensuing

“tendential fall in the general rate of profit” (1867)

The reaction leads to further concentration and centralisation of capital to increase the

mass of profits, and so on → monopoly capital

Hilferding (1910) many decades later focused on other two interlinked reaction strategies:

-the alliance between monopoly capital, big banks and the state to support colonialist and

imperialist policies

-a growing role of strategic co-ordination and planning played by big investment banks

exploiting the mobility and flexibility of finance capital → finance capitalism as new stage

of capitalism (the “ultimate stage” according to Lenin (1917))

Monthly Review: from Monopoly capital (Sweezy) taking account of de-financialisation to

“monopoly-finance capital” (Bellamy Foster) unstable metamorphosis of monopoly cap.

22

Long-term financialisation in Keynes

Keynes in the GT resumes the traditional distinction between barter economy and

monetary economy but shows that the second cannot be forced to work as a barter

economy just through monetary means

“barter economy” in the sense of C-M-C : money is not the end but the means

In the GT {

the trouble with (neo)classical economics is that it assumes axioms fit for a

barter economy (C-M-C) rather than for a monetary economy (M-C-M’)

23

Financialisation in Minsky

Minsky builds on Keynes, Kalecki and Fisher (debt deflation) to show that we have to

distinguish different stages of a monetary economy:

his FIH refers not to a generic monetary economy but to a

“sophisticated monetary economy”: a mature stage in the evolution of capitalism

where credit and finance play a crucial role

even a “sophisticated monetary economy” undergoes an evolution:

the last stage examined by Minsky (1987) is the “money manager capitalism”:

an economic system characterized by highly leveraged funds seeking maximum

returns in an environment that systematically underestimates risk

→ money and finance play a more crucial role and become more uncontrollable

24

Differences between First and Second financialisation (1)

Second stage of the analysis: specific features of each episode of financialisation that

vary with time and space because of different material, cultural and political conditions

→ variegated financialisation

Significant differences between the ideal-type of the First and Second financialisation:

First: extrinsic influence of banks reaching an unprecedented systemic role

A)

Second: intrinsic influence to an unprecedented level in the logic of choice

First: bank-based financialisation →direct influence on boards and governments

B)

Second: market-based financialisation → indirect influence through the markets

25

Differences between First and Second financialisation (2)

First: territorial expansion of capitalism → imperialism

C) {

Second: expansion in the public sector (education, welfare, security, etc.)

First: weak central banks mainly focused on monetary policy

D) {

Bretton Woods era: instrument of mild financial

Second: central bank {

Neoliberal era: instrument of financialisation: progressive

removal of controls and weakening of supervision

The “asymmetric monetarism” inaugurated by Greenspan (1987) and pursued by

Bernanke and most central bankers distorted the relative profitability of investment in

finance (implicit insurance) and in the real economy (austerity)

Financialisation cannot be seen simply as a symptom of the tendency towards

stagnation of monopoly capital but as a crucial determinant of capitalist evolution

26

Policy implications (1)

The different views on financialisation lead to different policy implications

(Neo- or New) Classical mainstream: physiological stage of evolution of capitalism

spontaneously led by the market to increase its efficiency → laissez faire

Keynesian mainstream: stage of evolution of capitalism having physiological and

pathological aspects → repress e.g. excessive speculation (e.g.: separation

between commercial banking and investment banking, Tobin tax, etc.)

Heterodox economics: pathological stage of evolution of capitalism that requires

either a radical reform of capitalism or its superseding → different views

27

Policy implications (2)

Financialisation as long-run tendency is an intrinsically contradictory process

It aims to increase decision freedom: this in principle sounds fine and could be used

to improve the well-being of people

However, in the absence of suitable institutional and policy constraints, the

advantages of enhanced freedom are reaped by a small minority of financiers,

rentiers, and complacent politicians

The market trickle-down mechanisms are too weak to avoid increasing inequality

(Stiglitz, 2012) → social unsustainability

The growing dominance of max. of exchange value within an increasingly short time

horizon distorts investment against the real economy → economic unsustainability

environmental sustainability requires a focus on long-term use values and the

compliance with basic ethical principles → environmental unsustainability

28

The “irresistible” ascent of the second financialisation

In the second financialisation the pathological aspects by far exceeded the alleged

advantages: systemic negative externalities much bigger than micro advantages

→ unprecedented concentration of wealth, income and power → vicious circle with a

parallel concentration of power

economic (unemployment)

that undermines sustainability { social (poverty and inequality)

environmental

→ultimate cause of the recent crisis

In addition the recent process of financialisation, undermines democracy:

without democracy we cannot hope that all the other problems may be solved

29

Financialisation and sustainability

I have to conclude that sustainable financialisation is an oximoron

because financialisation is about removing and relaxing al possible constraints on

economic decisions

while sustainability is about putting constraints on economic decisions to safeguard

sustainability

Sustainable finance, however, is not necessarily a utopian perspective provided that

finance is not seen as an end in itself but as an instrument to support sustainable

development

This requires a radical transformation of the financial system

30

Concluding remarks

We have to recover a democratic control of finance

To this end a very tough financial repression is necessary although it is very unlikely in

the near future

In the meantime we may try:

-to solicit a greater awareness of the nature and dimensions of the unsustainability of

unfettered financialisation

-to advocate measures that try to restore the role of financialisation as support of the

real economy in the direction of sustainable development

These issues will be discussed in the following presentations

31

Thank you for the attention

32