How do we calculate Graduated State Income Tax?

advertisement

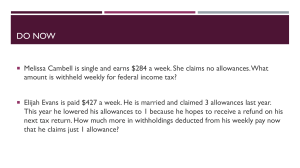

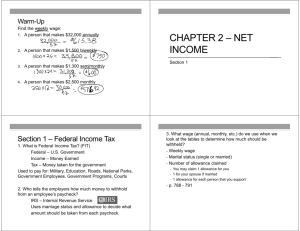

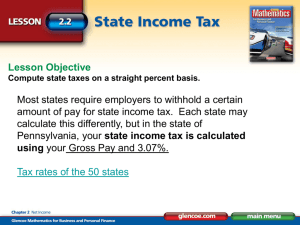

CHAPTER 2-NET INCOME 1 CHAPTER 2 GOALS • How do we calculate Federal Income Tax? • How do we calculate State Income Tax? • How do we calculate Graduated State Income Tax? • How do we calculate Social Security & Medicare Taxes? • How do we calculate Group Insurance? • How do we calculate Net Pay from an Earnings Statement? 2 CHAPTER 2 BUSINESS MATH STANDARD(S) Achievement Standard: Use mathematical procedures to analyze and solve business problems for such areas as taxation; savings and investment; payroll records; cash management; financial statements; credit management; purchases; sales; inventory records; depreciation, cost recovery, and depletion. 3 DEFINITIONS to KNOW • Federal Income Tax • Withholding Allowances • Personal Exemptions • Graduated Income Tax • Social Security Tax • Medicare Tax • Group Insurance • Net Pay 4 2-1 HOW DO WE CALCULATE F.I.T.? 1.Employers are required by law to withhold a certain amount of your pay for federal income tax (FIT). 2.The amount withheld depends on your income, marital status, and withholding allowances. 3.You may claim additional allowances for any others you support (dependents). 5 LET’s PRACTICE WEEKLY PAYROLL -SINGLE Velma’s gross pay for this week is $221.85. She is married and claims 2 allowances, herself and her husband. What amount will be withheld from Velma’s pay for federal income tax? 1)Find the income range from the table. WAGES AT LEAST BUT LESS THAN 0 1 2 3 195 200 210 220 230 200 210 220 230 240 26 27 29 30 32 20 21 22 24 25 14 15 16 18 19 7 9 10 12 13 240 250 260 270 280 250 260 270 280 290 33 35 36 38 39 27 28 30 31 33 21 22 24 25 27 15 16 18 19 21. WEEKLY PAYROLL -MARRIED 220 to 230 2)Find the column for 2 allowances 3)Find the amount of income to be held. FIT Withheld is $11.00 ALLOWANCES WAGES ALLOWANCES AT LEAST BUT LESS THAN 0 1 2 3 190 195 200 210 220 195 200 210 220 230 19 19 21 22 24 12 13 14 16 17 6 7 8 10 11 0 1 2 3 5 230 240 250 260 270 240 250 260 270 280 25 27 28 30 31 19 20 22 23 25 13 14 16 17 19 6 8 9 11 12 6 PLEASE DO NOW…………. WEEKLY PAYROLL -SINGLE 1.How much is withheld from the weekly wage of a married person earning $198 with 1 withholding allowance? 2.How much is withheld from the weekly wage of a single person earning $234 with 2 allowances? WAGES ALLOWANCES AT LEAST BUT LESS THAN 0 1 2 3 195 200 210 220 230 200 210 220 230 240 26 27 29 30 32 20 21 22 24 25 14 15 16 18 19 7 9 10 12 13 240 250 260 270 280 250 260 270 280 290 33 35 36 38 39 27 28 30 31 33 21 22 24 25 27 15 16 18 19 21. WEEKLY PAYROLL -MARRIED WAGES ALLOWANCES AT LEAST BUT LESS THAN 0 1 2 3 190 195 200 210 220 195 200 210 220 230 19 19 21 22 24 12 13 14 16 17 6 7 8 10 11 0 1 2 3 5 230 240 250 260 270 240 250 260 270 280 25 27 28 30 31 19 20 22 23 25 13 14 16 17 19 6 8 9 11 12 7 ANSWERS…………. WEEKLY PAYROLL -SINGLE 1.How much is withheld from the weekly wage of a married person earning $198 with 1 withholding allowance? $13 2.How much is withheld from the weekly wage of a single person earning $234 with 2 allowances? $19 WAGES ALLOWANCES AT LEAST BUT LESS THAN 0 1 2 3 195 200 210 220 230 200 210 220 230 240 26 27 29 30 32 20 21 22 24 25 14 15 16 18 19 7 9 10 12 13 240 250 260 270 280 250 260 270 280 290 33 35 36 38 39 27 28 30 31 33 21 22 24 25 27 15 16 18 19 21. WEEKLY PAYROLL -MARRIED WAGES ALLOWANCES AT LEAST BUT LESS THAN 0 1 2 3 190 195 200 210 220 195 200 210 220 230 19 19 21 22 24 12 13 14 16 17 6 7 8 10 11 0 1 2 3 5 230 240 250 260 270 240 250 260 270 280 25 27 28 30 31 19 20 22 23 25 13 14 16 17 19 6 8 9 11 12 8 QUESTIONS??? COMPLETE P.100-101 #1-20 in your textbook. 9 PLEASE DO NOW…………. Write as decimals: 1. 9% 2. 4 ½% 3. 2 ¼% 4. 7.24% 10 ANSWERS…………. Write as decimals: 1. 9% .09 2. 4 ½% .045 3. 2 ¼% .0225 4. 7.24% .0724 11 12 13 14 15 2-2 HOW DO WE CALCULATE STATE INCOME TAX? 1.Most states require employers to withhold a certain amount of your pay for state income tax. 2.In some states, the tax withheld is a percent of your taxable wages. 3.Your taxable wages depend on personal exemptions, or withholding allowances. Taxable Wages= Annual Gross Pay – Personal Exemptions Annual Tax Withheld= Taxable Wages x Tax Rate 16 LET’s PRACTICE John’s gross pay is $18,800 a year. The state income tax rate is 3% of taxable wages. John takes a married exemption for himself and his wife and 2 personal exemptions for his 2 children. How much is withheld a year from his gross earnings for state income tax? Solution: Find the taxable wages. Taxable Wages= Annual Gross Pay – Personal Exemptions $18,800 - ($3,000 + $700 + $700) = $14,400 Find the annual tax withheld. Annual Tax Withheld= Taxable Wages x Tax Rate PERSONAL EXEMPTIONS Single---$1500 Married---$3000 Each Dependent---$700 $14,400 x 3% = $432 state income tax withheld 17 2-3 HOW DO WE CALCULATE GRADUATED STATE INCOME TAX? 1.Graduated income tax involves a different tax rate for each of several levels of income. 2.The tax rate increases as income increases. 3.The tax rate on low incomes is usually 1% to 3% and as much as 20% on high incomes. Tax Withheld per Pay Period= Annual Tax Withheld/ Number of Pay Periods per Year 18 LET’s PRACTICE Lou’s annual salary is $24,800. He is paid semimonthly. His personal exemptions total $1500. How much does his employer deduct from each of Lou’s semimonthly paychecks for state income tax? Solution: Find the taxable wages. $24,800 - $1500 = $23,300 Find the annual tax withheld. STATE TAX First $1,000: 1.5% of $1,000 = $15.00 Annual Gross Pay Tax Rate Next $2,000: 3.0% of $2,000 = $60.00 First $1000 1.5% Next $2000 3.0% Next $2,000: 4.5% of $2,000 = $90.00 Next $2000 4.5% Over $5,000: 5.0% of ($23,300 - $5,000) = $915.00 Over $5,000 5.0% Total = $15 + $60 + $90 + $915 = $1,080 Find the tax withheld per pay period $1,080/24 = $45.00 state income tax withheld semimonthly 19 QUESTIONS??? COMPLETE P.105-106 #1-21 in your textbook. 20 PLEASE DO NOW…………. Write the smaller amount: 1. $55,980 or $62,700 2. $64,100 or $62,700 Compute: 1. 7.65% of $600 2. 6.2% of $11,000 3. 1.45% of $27,500 21 ANSWERS…………. Write the smaller amount: 1. $55,980 or $62,700 $55,980 2. $64,100 or $62,700 $62,700 Compute: 1. 7.65% of $600 $45.90 2. 6.2% of $11,000 $682.00 3. 1.45% of $27,500 $398.75 22 2-4 HOW DO WE CALCULATE SOCIAL SECURITY & MEDICARE TAXES? 1.The Federal Insurance Contributions Act (FICA) requires employers to deduct 7.65% of your income for social security and medicare taxes. 2.Social security (6.2%) is deducted on the first $62,700 of income, but medicare (1.45%) is paid on all your earnings. 3.The employer must contribute an amount that equals your contribution. Tax Withheld= Gross Pay x Tax Rate 23 LET’s PRACTICE Carl’s gross weekly pay is $232.00. His earnings to date for the year total $11,136. What amount is deducted from his pay this week for social security taxes? For medicare taxes? Solution: His earnings to date are less than $62,700 Find the social security tax withheld Gross Pay x Tax Rate $232 x 6.2% = $14.38 social security tax Find the medicare tax withheld Gross Pay x Tax Rate $232 x 1.45% = $3.36 medicare tax 24 QUESTIONS??? COMPLETE P.107 #1-21 in your textbook. 25 PLEASE DO NOW…………. Write as Decimals: 1. 80% 2. 75% 3. 78 ½% 4. $1100 x 70% 5. $580/12 6. $780 x 25% 26 ANSWERS…………. Write as Decimals: 1. 80% 0.80 2. 75% 0.75 3. 78 ½% 0.785 4. $1100 x 70% $770 5. $580/12 $48.33 6. $780 x 25% $195 27 2-5 HOW DO WE CALCULATE GROUP INSURANCE? 1.Many businesses offer group insurance plans to their employees. 2.You can purchase group insurance for a lower cost than individual insurance. 3.Businesses often pay part of the cost of the insurance. Deduction per Pay Period= Total Annual Amount Paid by Employee/Number of Pay Periods per Year 28 LET’s PRACTICE Nikki is a carpenter for Houck Construction Co. She has family medical coverage through the group medical plan that Houck provides for its employees. The annual cost of Nikki’s family membership is $4,200. The company pays 80% of the cost. How much is deducted from her weekly paycheck for medical insurance? Solution: Find the percent paid by employee 100% - 80% = 20% Find the total amount paid by employee $4,200 x 20% = $840 Find the deduction per pay period Deduction per Pay Period= Total Annual Amount Paid by Employee/Number of Pay Periods per Year $840/52 = $16.15 deducted per pay period 29 QUESTIONS??? COMPLETE P.109-110 #1-19 in your textbook. 30 PLEASE DO NOW…………. 1. $28.91 + 17.79 + 9.18 = 2. $10.31 + 11.20 + 20.00 + 5.00 = 3. $456.78 - $56.19 = 4. $45.23 + $41.50 = 31 ANSWERS…………. 1. $28.91 + 17.79 + 9.18 = $55.88 2. $10.31 + 11.20 + 20.00 + 5.00 = $46.51 3. $456.78 - $56.19 = $400.59 4. $45.23 + $41.50 = $86.73 32 2-6 HOW DO WE CALCULATE NET PAY FROM AN EARNINGS STATEMENT? The earnings statement attached to your paycheck lists all your deductions, your gross pay, and your net pay for the pay period. Net Pay= Gross Pay – Total Deductions 33 LET’s PRACTICE Juan’s gross weekly salary is $400. He is married and claims 2 allowances. The social security tax is 6.2% of the first $62,700. The medicare tax is 1.45% of gross pay. The state tax is 1.5% of gross pay. Each week he pays $10.40 for medical insurance and $2.50 for charity. Is Juan’s earnings statement correct? (Use P.643 in text for FIT) Dept. Employee 04 Check # WEEK ENDING 20566 4/16/04 Teijeiro,J. TAX DEDUCTIONS FIT SOC. SEC. 38.00 24.80 MEDICARE 5.80 STATE 6.00 LOCAL ------ NET PAY 312.50 PERSONAL DEDUCTIONS MEDICAL 10.40 UNION DUES ----- OTHERS 2.50 Solution: Find the total deductions Federal Withholding: (From P.643)……………………..$38.00 Social Security: 6.2% of $400……………………………...24.80 Medicare: 1.45% of $400……………………………………5.80 State tax: 1.5% of $400…………………………………….....6.00 Medical insurance: …………………………………………10.40 Charity: ……………………………………………………….2.50 Net Pay is Gross Pay minus Total Deductions or $400 - $87.50 = $312.50 34 QUESTIONS??? COMPLETE P.111-113 #1-9 in your textbook. 35