Behind the Demand Curve: Consumer choice

advertisement

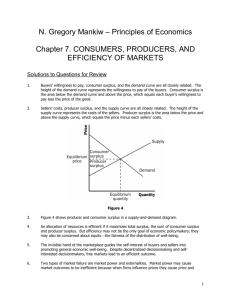

Consumer and Producter Surplus Microeconomics Consumer Surplus Consumer Surplus is …. when a consumer pays of price LESS than their maximum willingness to pay. Willingness to pay is ….. Maximum price a consumer would pay for a particular good or service. Consumer Surplus Consumer Surplus is …. Amount would have paid – amount did pay The area below the D curve and above P CS = ½ BH (area of a triangle) CS = ½ P*Qd Calculate Consumer Surplus Consumer Willingness to Pay (WPT) P = $40 CS = WTP - P A $100 $40 $60 B $80 $40 $40 C $60 $40 $20 D $40 $40 $0 E $20 $40 Will not buy TOTAL CS = $120 Consumer Surplus Calculations Problem: The D curve for a product is P = 40 -2Qd. The current price is $20. Compute Total Consumer Surplus. Draw the D curve with P and Qd. Shade CS. CS = ½((20)(10) = $100 ∆P Affects CS Consumer Willingness to Pay (WPT) P = $60 CS = WTP - P A $100 $60 $40 B $80 $60 $20 C $60 $60 $0 D $40 $60 Will not buy E $20 $60 Will not buy TOTAL CS = $60 Graph the new CS. ∆P Affects CS CS when P . CS when P . Producer Surplus Producer Surplus is …. when a producer receives a price HIGHER than their cost. Cost is the minimum price the seller must receive to offer the product on the market. Producer Surplus Producer Surplus is …. Price received - cost The area above the S curve (cost) and below P CS = ½ BH (area of a triangle) CS = ½ P*Qs Producer Surplus Units Supplied Cost P = $40. Will it be supplied? $30. Will it be supplied? 1 $10 yes yes 2 $20 yes yes 3 $30 yes yes 4 $40 yes no 5 $50 no no Graph Producer Surplus with values. Producer Surplus Calculations Units Supplied P = $40 Cost PS = P - Cost 1 $40 $10 $30 2 $40 $20 $20 3 $40 $30 $10 4 $40 $40 $0 5 $40 $50 Will not be supplied TOTAL PS = $60 Producer Surplus Calculations Problem: The S curve for a product is P = 2Qs. The current price is $60. Compute Total Producer Surplus. Draw the S curve with P and Qs. Shade PS. PS = ½((60)(30) = $900 ∆P Affects PS Units Supplied P = $30 Cost PS = P- Cost 1 $30 $10 $20 2 $30 $20 $10 3 $30 $30 $0 4 $30 $40 Will not be supplied 5 $30 $50 Will not be supplied TOTAL CS = $30 Graph the new CS. ∆P Affects CS PS when P . PS when P . CS, PS and TS Measure what? CS = (value to buyers) – (amount paid by buyers) Buyers’ benefit from participating in the market PS = (amount received by sellers) – (cost to sellers) Sellers’ benefit from participating in the market Total Surplus = CS + PS Total gains (loss) from trade in a market Consumer Surplus, Producer Surplus and Efficiency A trade had been made anytime a consumer makes a purchase from a producer. Widget Buyers WTP Widget Sellers Cost 1 $10 A $2 2 9 B 3 3 8 C 4 4 7 D 5 5 6 E 6 6 5 F 7 7 4 G 8 Consumer Surplus, Producer Surplus and Efficiency Gains From Trade Widget Buyers WTP Price CS Widget Sellers Price Cost PS 1 $10 $6 $4 A $6 $2 $4 2 9 6 3 B 6 3 3 3 8 6 2 C 6 4 2 4 7 6 1 D 6 5 1 5 6 6 0 E 6 6 0 6 5 6 NT F 6 7 NT 7 4 6 NT G 6 8 NT What is CS, PS and TS? CS, PS and Efficiency An Efficient Market is….. Equitable gains from trade. No way to make some better of without making others worse off. CS, PS and Efficiency An Efficient Market performs four important functions. Allocates good consumption to buyers who value it most Demonstrated by WTP Allocates sales to sellers who value the right to sell the good most Demonstrated by cost Ensures every consumer values the good more than every seller who makes sale Trade is mutually beneficial Ensures every consumer who DOES NOT make a purchase values the good less than every seller who DOES NOT make a sale NO mutually beneficial trades are missed CS, PS and Efficiency NOT ALL MARKETS ARE EFFICIENT (EXTERNALITIES) AND/OR EQUITABLE Widget price of $6 fair for some but not for those whose WTP < $6. TPS – List two goods/service you think are unfairly priced. State one thing you would do to correct the price issue? (minimum wage is a price floor since the wage for unskilled labor is considered unfairly low – abolish minimum wage to increase efficiency?) CS, PS and Efficiency TAXES Equity and efficiency are at the root of the debate surrounding taxes. TPS – What is the purpose of taxes? Redistribute some income from wealthy to the poor CS, PS and Efficiency TAXES A Progressive tax … rises MORE in proportion to INCOME Higher-income pays a higher % than low-income in taxes A Regressive tax … Rises LESS in proportion to INCOME Higher – income pays a smaller % than low-income in taxes A Proportional tax … Rises IN Proportion to INCOME All tax payers pay the same % of their income The Effects of Taxes on Total Surplus The Excise Tax is … Levied on each unit of a good sold Ex: Gasoline, tobacco, alcohol, hotel rooms The Effects of Taxes on Total Surplus EXAMPLE: Smog City is free of any taxes. P = $2/gallon, and 1 million gallons are sold/day. P $5 S1 2 D1 1 Q (millions) The Effects of Taxes on Total Surplus EXAMPLE: Smog City decide to impose a $1 tax on gasoline sellers on every gallon of gas sold. Sellers must receive $3/gallon so they can send $1 to the Smog City government. What is causing the S curve to shift? Which direction will the S curve shift? What amount will the S curve shift by? S2 P $5 S1 2.60 2 1.60 1 D1 .8 1 Q (millions) The Effects of Taxes on Total Surplus Price Elasticities and Tax Incidence A Tax Incidence is … the distribution of the tax burden Depends on the elasticity of the D and S curves. Buyers pay more when D curve = Inelastic and S curve = Elastic Sellers pay more when D curve = Elastic and S curve = Inelastic Benefits and Costs of Taxation Revenue from an Excise Tax Tax revenue = (# gallons sold)*(per gallon tax) = 800,000 * $1/gallon = $800,000 P $5 Revenue S2 S1 2.60 2.00 1.60 D1 .8 1 Q (millions) Benefits and Costs of Taxation Costs of Taxation The Tax Revenue collected by the government is … A redistribution of CS and PS to the government. The True Cost of the Tax is Deadweight loss. Deadweight Loss is the inefficiency created by the tax. Benefits and Costs of Taxation Cost of Taxation Deadweight Loss = Before Tax TS – (After Tax TS + Gov. Revenue) $2,500,000 – (1,680,000 + 800,000) = $20,000 P $5 Revenue S2 S1 Deadweight Loss 2.60 2.00 1.60 D1 .8 1 Q (millions) Utility Maximization Utility is a measure of satisfaction the consumer derives from consuming good and services. Total Utility is the total happiness (utility) received from the consumption of a number of units of a good. Marginal Utility is the change in happiness (utility) between the initial consumption of a good and each subsequent consumption of the good. Diminishing Marginal Utility is the principle describes what happens when each successive unit of a good consumer adds less to total utility than the previous utility. Utility Maximation Number of Slurpees (in a week) Total Utility (TU) Received (happy points) 0 0 1 40 2 70 3 90 4 100 5 105 6 90 Marginal Utility (MU) from each Utility Maximization MU = ∆TU/∆X MU >= 0 the consumer will choose to consume it. When does the consumer no longer consume Slurpees that week? Assumption: consumer can afford to buy 5 Slurpees in a week. Budgets and Optimal Consumption Consumers want to maximize utility BUT must do so within a budget. Consumers need to … Find the bundle of goods which are affordable Choose the bundle that provides the highest utility Bruno’s Budget and Optimal Consumption Bruno’s income is $50. Notebooks cost $5. CDs cost $10. 1. Write the linear equation for Bruno’s data. $50 = $5N + $10CD He CANNOT afford a bundle >$50. 2. Create a table of Bruno’s consumption options. Bruno’s Consumption Options Q of Notebooks Q of CDs 0 5 2 4 4 3 6 2 8 1 10 0