Principles of Economics Financial markets and Money supply

advertisement

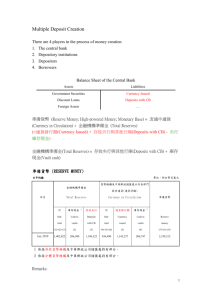

Principles of Economics Financial markets and Money supply Tomislav Herceg, PhD Faculty of Economics and Business Zagreb Modern financial system • Finance is a process of intermediation between borrowers and lenders. • Financial system consists of: 1. Money market 2. Markets for fixed interest assets (bonds, mortgages) 3. Stock markets 4. Foreign exchange markets Functions of financial system • Borrowing and lending takes place on FINANCIAL MARKETS (stock, bond, foreign exchange)through FINANCIAL INTERMEDIARIES (commercial banks, insurance companies, pension funds and investment funds) • Functions of financial system: 1. Transfer of resources across time, sectors and regions 2. Risk management (insurance) 3. Portfolio diversification (investment funds) 4. Clearinghouse function (rapid everyday payment) Flow of funds Households purchase stocks, bonds or mutual funds shares Financial markets Firms issue bonds or stocks investors savers Households deposit salaries and savings Financial intermediaries Investors borrow from lenders Financial assets • • • • • Money Savings accounts (guaranteed by government) Government securities (bonds and bills) Equities (ownership right to companies) Financial derivatives (assets derived from the value of another asset) • Pension funds Money • Money is a mean of exchange • Evolution of money: o Barter o Commodity money (cattle, olive oil, wine, metals, gems, tobacco) o Modern money has no value by itself but in the goods for which it can be exchanged (paper money and e-money) Interest rates and returns • Interest rate is the price paid for borrowing money, usually calculated as annual %. • Present value of an investment: 𝑁1 𝑁2 𝑁𝑡 𝑉 = + + ⋯+ 2 1+𝑖 1+𝑖 1+𝑖 𝑡 • Interest rates vary depending on TERM OF MATURITY, RISK and LIQUIDITY (ability to be converted into cash) • Nominal interest rate ≈≈ real interest rate inflation Components of money supply M • Narrow money (M1): 1. Cash (coins & paper) outside banks (all cash today is fiat money – one believes it carries the value written on it) 2. Checking accounts • Broad money (M2), or Near-money: 1. M1 2. Savings accounts and small time deposits 3. Retail money market mutual funds Money demand L Demand for money is deducted from demand for trade and exchange Functions of money: • Medium of exchange • Unit of account • Store of value Opportunity costs of holding money: the interest forgone for not investing it When i rises M1 falls. M1 should not be in a part of a well balanced portfolio Banking • Banks seek to earn profits for their owners by lending at a higher interest rate than the borrowing (saving) interest rate. • Balance sheet of a bank (at certain point of time) has assets (what bank owns) and liabilities (what bank owes) and net worth (difference between them) • Reserves are a part of a balance sheet of a bank (it used to be 100% when gold was held) Money creation • Central bank determines the reserve ratio. The rest of the money is lent. That money then forms deposits in other banks. • Assume 50% obligatory reserve: • Jane puts 1000 HRK on her savings account. 500 HRK is stored as a reserve and 500 is lent. The borrower takes it to another bank where 250 HRK is a reserve and 250 is lent. Then 250 is lent and 125 is kept by a third bank as a reserve etc. Finally, 1000 HRK is kept among several banks and additional 1000 HRK is on the current accounts. The lower reserve ratio, the greater M1 Creation of money when r = 50% Bank 2 Bank 1 Starting deposit Ban k5 Bank 3 Bank 4 Money-supply multiplier • For a starting deposit d bank lends (1 – r) proportion of the money they received and each further bank lends (1 – r) proportion of what they got: • 𝑀1 = 𝑑 1 − 𝑟 + 𝑑 1 − 𝑟 2 +⋯+𝑑 1 −𝑟 infinite number of transactions • Hence money-supply multiplier is: ∆𝑀 = 1 𝑑 𝑟 ⇒𝒎= 𝟏 𝒓 𝑛 = 𝑑 1−𝑟 for • m shows total amount of loans and deposits for a 1 HRK deposit • Loan multiplier: l = m - 1 • l shows how much money was lent for a 1 HRK deposit Leakage from money creation spiral • Money supply calculated using money-supply multiplicator assumes no leakage which occur in real life: leakage in cash (somebody takes money from the bank in cash) or banks decide to have excess reserves Stock market • Stock market is a market for shares of publicly owned companies • Rate of return is % gain from security: 1. For bonds, bills and savings accounts it interest rate 2. For other assets it is a dividend +/- change in the asset value (capital loss or gain) • Risk is variability of return • Risk-averse investors are those that evade risks. Stock market (II) • Bubbles are situations in which speculations increase value of certain asset up to the unrealistic level (bubble). • Crashes are bursts of bubbles (when prices go down to the level where they should be) • 1929 Wall Street bubble crash • Prices of assets have a random walk (completely stochastic/unpredictable movement) Exercise 1 • Ann deposits 100 000 kn on her savings account. Obligatory reserves are 20% and there is no leakage in the system. Analyze multiplication process: – a) for the first 5 banks – b) for the rest of the banks – c) for total banking system • Calculate money-supply multiplicator, new loans, new reserves, loan multiplicator, new reserves, excess reserves and money supply increase Commercia Initial l banks deposits New deposits r A 100 000 B C D E Σ first five All the other banks 100 000 Sum 100 000 80 000 64 000 51 200 41 000 336 200 163 800 500 000 0,2 0,2 0,2 0,2 0,2 0,2 - New Excess reserves reserves 20 000 16 000 12 800 10 200 8 200 67 200 32 800 100 000 80 000 64 000 51 200 41 000 32 800 269 000 131 000 400 000 New loans 80 000 64 000 51 200 41 000 32 800 269 000 131 000 400 000 Money supply increase 0 80 000 64 000 51 200 41 000 236 200 163 800 400 000 • Each new deposit is 20% smaller (r = 0,2) • Money supply multiplier: m=1/r = 1/0,2 = 5 Sum of new deposits = 1 /r × d = m ×d= 5 * 100 000 M1 = 500 000 • b) New reserves = new deposits × r • c) Excess reserves = new deposits – new reserves • d) k = 1/r – 1 = m – 1 = 5 – 1 = 4 Sum of new loans = l * d = 4 × 100 000 = 400 000 • e) Money supply increase = Sum of new deposits – initial deposit (d) = 500 000 – 100 000 = 400 000 Exercise 2 • Mandatory reserves in a country are 30 Bill.€, cash is 70 Bill. €, and it is known that reserve ratio is 20%. Find the value of M1. solution • M1 = cash + current account deposits • 30 = current account deposits×0.2 =>deposits are 150 Bill. • M1 = 70 + 150 = 220 Bill. Exercise 3 • Commercial banks’ reserves are 56 Bill. HRK, cash 120 Bill. HRK, and reserve requirement 20%. – Calculate M1. – What is the change in M1 caused by a reserve increase by 4 Bill. HRK and cash increase by 10 Bill. HRK solution • a) • M1 = cash + current account deposits • M1 = 120 + 56/0,2 = 120 + 280 = 400 • b) • M1 = 130 + 60/0,2 = 130 + 300 = 430