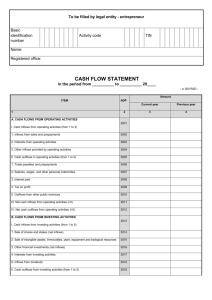

Statement of Cash Flows

advertisement

Module 6 Statement of Cash Flows Motorola and Blockbuster Motorola (in millions) 2000 1999 1998 Net earnings (loss) $1,318 891 (907) Net cash flow from ops (1,164) 2,140 1,295 Blockbuster (in millions) 2000 1999 1998 Net loss (75.9) (69.2) (336.6) Net cash flow from ops 1,320.8 1,142.8 1,234.5 History Statement of Sources and Uses of Funds Funds Statement Statement of Changes in Financial Position SFAS 95 – Statement of Cash Flows effective for annual financial statements for FY ending after 7/15/88 Overview of SCF One of the major financial statements Purpose is to provide information about cash inflows and outflows Explains the changes in cash What is cash and cash equivalents?? – Cash – Short term investments in T-bills, commercial paper and money market funds Three classifications of cash flow activity Operating Investing Financing Operating Activities Cash inflows from: – Sales of goods or services – Interest – Dividends – Sale of trading securities Cash outflows from: – Merchandise inventory – Salaries – Interest expense – Purchase of trading securities Investing Activities Cash inflows from: – Sales of property, plant and equip – Sale of available for sale and held-to-maturity securities – Collection of money loaned to others Cash outflows for: – Purchase of property, plant and equipment – Purchase of securities above – Making loans to others Financing Activities Cash inflows from: – Capital stock – Debt (loans, bonds, notes) Cash outflows for: – Buying back corporate stock (Treasury stock) – Paying the principal portion of debt – Paying cash dividends to shareholders Tips for categorizing Look at company’s perspective, not the type of account involved. Example – dividends Example – loans Example – common stock Users of SCF Info Management Stockholders Creditors FASB prohibits companies from disclosing cash flow per share Presentation Method Direct v. indirect Difference lies in operating section Direct method – Recommended by FASB – Shows classes of gross receipts and disbursements Indirect method – Starts with net income (accrual basis) and adjusts to a cash basis income – Used by more companies Operating Income v. Cash Flows Company 1995 (in 000’s) 1996 (in 000’s) 1997 (in 000’s) Alaska Airlines Inc fm Ops CF - Op 24,800 104,400 45,600 203,000 76,000 323,200 Boeing Inc fm Ops CF - Op -36,000 2,135,000 1,818,000 3,611,000 -178000 2,100,000 125,763 -38,722 68,805 -24,313 89,620 -90,031 Office Max Inc fm Ops CF - Op How do I use the information? Adjusted Cash Flow to Income Ratio Disclosure – operating income Cash inflows primarily coming from asset sales, borrowing or equity offerings Computer adjusted cash flow and income from continuing operations Cash flow ambiguities Motley Fool’s view Enron (in millions) 2000 1999 1998 Net income $ 979 893 703 Net cash provided by operating activities 4,779 1,228 1,640 Caution Flags Failure to generate cash from operating activities Large fluctuations in cash flow from operating activities over time Net income and cash flow from operations not tracking closely Net income and cash flow from operations moving in different directions Positive cash flow from investing activities because company is selling off assets to generate cash Caution Flags Positive cash flow from financing activities for several periods –0 possibly indicating borrowing needed to offset lack of internet cash generation Company highlights cash flow in shareholders’ letter, especially in same paragraph discussing falling stock price Adjustments to net income from changes in receivables, inventories, and payables not in line with sales Management’s explanation of adjustments to net income obtuse or missing