USAC Meeting minutes - Vanderbilt University

advertisement

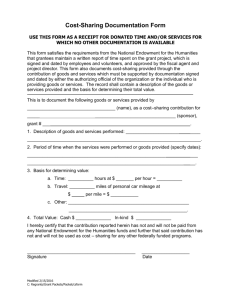

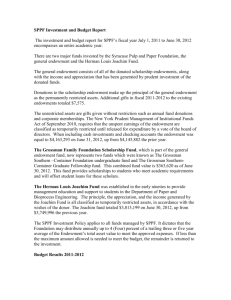

1 Meeting Minutes; Tuesday, August 11, 2015 Alumni Hall, Room 201 8:32 am President, Rachel Harrell, called the meeting to order. We still have a vacancy at secretary. You would have the opportunity to be part of the Executive Committee. If you’re interested or have questions about it, please contact me to find out more information. OLD & NEW BUSINESS ANNOUNCEMENTS Motion to approve July meeting minutes approved. COMMITTEE REPORTS Rules and Administration, Rachel Harrell on behalf of Melissa Wocher and Vickie Latham Nothing to report If you haven’t yet chosen a committee, be sure to put one on the sign in sheet or email the Membership chair. Membership, Rachel Harrell for Susan Rose Please chose a committee if you have not yet already. Committee meeting will be this month. Communications, Jenny Mandeville Our first meeting was August 7th, but feel free to join if you haven’t yet. Our first project will be updating the website. We are also promoting our social media channels and keeping those updated regularly. Please follow USAC (vanderbiltusac) on Facebook, Twitter and Instagram. Staff Life, Andy Richter and Al Brady If you haven’t yet chosen a committee, Staff Life is available. Our biannual poll will be September 14th. Our next CARE event will be November 17th at noon. So far we have Tim Corbin and Anita Genius. The theme will be Workplace Civility: Think Before You Speak. 2 Events, Rachel on behalf of Michael Pring and Wynn Jeter Our blood drive was on July 31st. We had a goal of 20 units and got 18 units. Employee Celebration Tailgate will be September 19 from noon-3pm. We usually give out tattoos. The Event Committee’s first meeting will be in the next few weeks. Events could still use more people if you haven’t yet signed up. STANDING COMMITTEES Benefits: First meeting was August 10th. HR is splitting into two like all of VU. Rick Ohmer is going to the medical center. Terri Armstrong will be the head of VU Benefits. Traffic and Parking: Nothing to report. Athletics: Meeting scheduled for September 17th. Susan Rose presented our Member of the Month for August, Shelley Darling. She has been a big help organizing greeters. GUEST: Anders Hall, Vice Chancellor for Investments and Chief Investment Officer I am happy to be here and talk about the endowment. I will have my two-year anniversary at Vanderbilt in September. For the last 11 years I worked at Duke in their investment office. The endowment supports our efforts in healthcare and research, bringing students here who couldn’t afford it and get athletes to come here as well. Endowment Background Not one singular, homogeneous fund. This is a pool of about 2500 endowments that support all types of things across the University like financial aid, professorships, athletics, plant/equipment, and unrestricted support. Structure is a lot like a mutual fund. Investors purchase shares of the endowment (43.9 million shares at $98/share). Spending/payout is now 5% calculated based on a 3-year average. $4.3B sounds like a lot but we’re relatively unendowed compared to our peers like Harvard ($35.9B), Texas ($25.4B), etc. Often correlated to age of the institution. If you don’t generate good returns, dollar loss can be real over time. Growth has come from market growth and investment gains plus injection of new capital into the endowment. $330M added in last 10 years. The way you really grow the endowment is added capital. 4% of our budget is supported by the endowment. Princeton is the most well-endowed university relative to its size. 52.5% of their budget is supported by the endowment. The Divinity School’s budget is 77% supported by endowment but this is different for all schools; Med is 4%. Our endowment has been up 40 of the last 44 years. Last year there was a lot of dispersion across aspects of the market, but our endowment was up. 3 *Question: how do you justify growing the endowment beyond say 10% given the chance for huge loss in economic downturn? Office of Investments Our team is 24 people including public and private investment teams, risk management, operations team, and assistants. Asset Allocation Typical endowment has large allocations in private equity and hedge funds. There are seven asset classes. We get to invest in all asset classes and invest locality as well (ex: land). Our portfolio is currently invested in global equity (32.8%), private capital (28.2%), hedged strategies (21%), commodities, fixed income, real estate, and natural resources. We have to generate a 5% return plus inflation to maintain what we have. Beta Factors Rationale: most investments focus solely on traditional asset classes. Shortcomings include diversification complacency and asset classes versus legal structures. Beta factors provide additional perspective on a portfolio. We developed new targets for our beta factor objectives. Our strategic ranges are really wide (25%-75% for equity, -5%-30% for commodity, etc.). As of 6/30/15 we are within the ranges, except cash (-10%-10%), we are at 11.9%. We own more stocks and cash now since commodities etc. are running low. Capital Market Research Understanding the market microstructure, especially cross-sectional volatility, can help identify markets with the highest return dispersion. Global markets are more easily managed due to less volatility but very risky. Tools are used to supplement information from our capital allocation managers. Manager Selection: We pick managers to invest Vanderbilt’s capital. Core beliefs: Healthy level of skepticism. Alpha is scarce. There is the opportunity to outperform the market. Question: Why outsource the management? It is a different skillset. Office of Investments is sort of like HR, we find the smart people with the right skills that can help us generate returns. Adverse selection issues: We can wait for them to come to us or we can be proactive and find the best ones out there who may not even need us! We market ourselves using an active sourcing process (small, unique and unscalable opportunities; they are motivated) and leveraging staff pre-existing relationships. Our typical fee is 1% management and 10% in excess of their targets. We negotiate really hard on fees to keep them reasonable. Concentration: Allows managers to focus on their best ideas rather than diluting returns with low-conviction ideas 4 Other characteristics: Discernible investment edge and investment opportunity. Ability to preserve capital. Preference for low-to-moderate leverage. We aren’t really supportive of taking on a lot of risk. Ongoing Due Diligence Monitoring: We travel to visit them and they will come here. We also do phone calls. There are weekly/monthly/quarterly reports, annual meetings, and portfolio monitoring. Termination Decision: Tough decision when we allocate capital to something else. Reasons include consistent underperformance, key and/or high personnel turnover, better investment opportunities, unexpected events, etc. Recent Activity (since September 2013) Added 24 new global equity managers totaling $998 of market value Launched Hedge Strategies separately-managed account platform Introduced commodities as a new asset class Reduced fixed income allocation Deep dives on private investments portfolio (private capital, real estate, natural resources) Completed office remodeling (open floor plan) and hired 15 new staff (from lots of other places who want to be part of our culture) Made 61 new investments in total Have you been burned by any managers? Of our new ones, some of the portfolios are down in commodity markets, but some of them are over-performing. Of the old ones, we got rid of some and accepted some losses. We have a 15 year time horizon so I don’t worry as much about 1-2 years. How does the split affect you guys? Not a lot. Of the endowments, the amount that belongs to VUMC is somewhere between $80100M ($200M in cash on balance sheet). How do you handle underperforming endowments during a campaign where you’re asking donors to invest in the endowment? There are 95 endowments with over a $1M in assets. Our performance was in 95th place as of 2014. We made some investment mistakes and didn’t optimize but we now have a world-class team and a good portfolio. We’re optimistic about our prospects going forward. If I were a donor, why would I want to increase the endowment when we could have another recession? I don’t have a good counter to that. We are undersized relative to our peers and if that persists, it will impact our competiveness for applicants, professors and research dollars so we can be more competitive. How are your performance reviews, are you reviewed on the performance of the endowment? 5 If the numbers don’t look better in 5 years, the Board will probably fire me. Good performance is relative, too. It is within our control since we determine asset allocation and managers. We are accountable relative to the market and there are no excuses. Doesn’t the hospital contribute a lot to the endowment? No. Our next meeting will be Tuesday, September 8th in the Commons. Our guest speaker will be Chief of Police, August Washington. We will spend some time getting into groups to decide on Group Communicators if that hasn’t been done already, and meet members of your group. Meeting is adjourned at 10:00am For more information about the council, please visit the USAC website.