FM902_5

advertisement

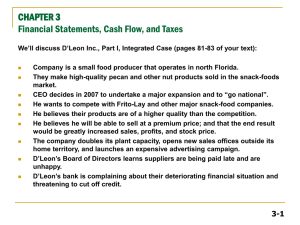

2-1 NOTES Balance Sheet is “Stock” (as of) Other Statements are “Flow” (through time) When analyzing, keep “unusual events” in mind” 2-2 What effect did the expansion have on net operating working capital (NOWC)? NonNonNOW = interest interest C bearing CA bearing CL NOWC98 = ($7,282 + $632,160 + $1,287,360) - ($524,160 + $489,600) = $913,042. NOWC97 = $793,800. 2-3 What effect did the expansion have on capital used in operations? Operating capital = NOWC + Net fixed assets. Operating = $913,042 + $939,790 capital98 = $1,852,832. Operating = $1,138,600. capital97 2-4 Did the expansion create additional net operating profit after taxes (NOPAT)? NOPAT = EBIT(1 - Tax rate) NOPAT98 = -$690,560(1 - 0.4) = -$690,560(0.6) = -$414,336. NOPAT97= $125,460. 2-5 What is your initial assessment of the expansion’s effect on operations? Sales NOPAT NOWC 1998 1997 $5,834,400 $3,432,000 ($414,336) $125,460 $913,042 $793,800 Operating capital$1,852,832 $1,138,600 2-6 What effect did the company’s expansion have on its net cash flow and operating cash flow? NCF98 = NI + DEP =$519,936 + $116,960 NCF97 = -$402,976. $87,960 + $18,900 = $106,860. OCF = NOPAT + DEP 98 = -$414,336 + $116,960 = -$297,376. OCF97 = $125,460 + $18,900 = $144,360. 2-7 What was the free cash flow (FCF) for 1998? FCF = NOPAT - Net capital investment = -$414,336 - ($1,852,832 $1,138,600) = -$414,336 - $714,232 = -$1,128,568. How do you suppose investors reacted? 2-8 What is the company’s EVA? Assume the firm’s after-tax cost of capital (COC) was 11% in 1997 and 13% in 1998. EVA98 = NOPAT- (COC)(Capital) = -$414,336 (0.13)($1,852,832) = -$414,336 - $240,868 = -$655,204. EVA97 = $125,460 - (0.11)($1,138,600) = $125,460 - $125,246 = $214. 2-9 Would you conclude that the expansion increased or decreased MVA? Market value Equity capital MVA = of equity supplied . During the last year stock price has decreased 73%, so market value of equity has declined. Consequently, MVA has declined. 2 - 10 Does the company pay its suppliers on time? Probably not. A/P increased 260% over the past year, while sales increased by only 70%. If this continues, suppliers may cut off trade credit. 2 - 11 Does it appear that the sales price exceeds the cost per unit sold? No, the negative NOPAT shows that the company is spending more on it’s operations than it is taking in. 2 - 12 What effect would each of these actions have on the cash account? 1. The company offers 60-day credit terms. The improved terms are matched by its competitors, so sales remain constant. A/R would Cash would 2 - 13 2. Sales double as a result of the change in credit terms. Short-run: Inventory and fixed assets to meet increased sales. A/R , Cash . Company may have to seek additional financing. Long-run: Collections increase and the company’s cash position would improve. 2 - 14 How was the expansion financed? The expansion was financed primarily with external capital. The company issued long-term debt which reduced its financial strength and flexibility. 2 - 15 Would external capital have been required if they had broken even in 1998 (Net income = 0)? Yes, the company would still have to finance its increase in assets. 2 - 16 What happens if fixed assets are depreciated over 7 years (as opposed to the current 10 years)? No effect on physical assets. Fixed assets on balance sheet would decline. Net income would decline. Tax payments would decline. Cash position would improve. 2 - 17 Other policies that affect financial statements Inventory valuation methods. Capitalization of R&D expenses. Policies for funding the company’s retirement plan. 2 - 18 Does the company’s positive stock price ($2.25), in the face of large losses, suggest that investors are irrational? Common stock has limited liability. Therefore, it can never have a negative value. If it is expected to produce future cash flows, it will have a positive value. 2 - 19 Why did the stock price fall after the dividend was cut? Management was “signaling” that the firm’s operations were in trouble. The dividend cut lowered investors’ expectations for future cash flows, which caused the stock price to decline. 2 - 20 What were some other sources of financing used in 1998? Selling financial assets: Short term investments decreased by $48,600. Bank loans: Notes payable increased by $520,000. Credit from suppliers: A/P increased by $378,560. Employees: Accruals increased by $353,600. 2 - 21 What is the effect of the $346,624 tax credit received in 1998. This suggests the company paid at least $346,624 in taxes during the past 2 years. If the payments over the past 2 years were less than $346,624 the firm would have had to carry forward the amount of its loss that was not carried back. If the firm did not receive a full refund its cash position would be even worse. 2 - 22 Got questions? Get answers!! Voicemail: (404) 651-2691 chodges@gsu.edu Email: Electronic Bulletin Board: http://www-cba.gsu.edu/ ~wwwfin/finconf/finba862/finba862.html