any property used as security, which may include

advertisement

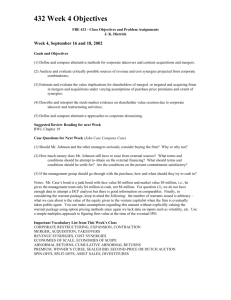

Phil Scott, Director, AFR Consulting 1 Welcome Selling Your Business March 2012 Agenda • Introduction • Current Environment • Why Consider an Exit Now • Sales Timeline • Grooming • Tax Planning • Buyer Motivations • Synergies in Action • 10 Pointers to a Successful Sale Current Environment • Mid market (£10-100m) the most resilient sector and the least impacted by the slowdown • Smaller M & A deals have become increasingly difficult to “get across the line” • Volume of overseas corporate transactions both in the North West and UK increasing • While advisors and investors are starting to see an upturn in opportunities this is not coming through in the number of completed deals • Pricing index is now at its highest since Q3 2007 • Reasons to be optimistic although M & A market remains delicate over concerns of debt levels in the US, degradation of credit ratings for Greece & Italy and the ongoing Eurozone crisis Why Consider an Exit Now – Macro Factors • Large corporates have cash and are seeking growth – Synergy opportunities will create profit opportunity • Weakness of sterling has reduced the relative valuation of UK assets • UK is attractive entry point into the EU • Increasing evidence of purchasers from outside EU/USA • Pressure on Private equity funds to release substantial uninvested funds • Private equity starting to move down the value chain below £5m deal size • Private equity willing to pay higher values than trade for good quality assets operating in unique and interesting sectors “Despite gloomy economic backdrop there are factors driving the M&A market” Why Consider an Exit Now – Personal factors • Retirement/lack of management succession? • Organic growth is tough – will valuations get better? • Is your business facing long-term challenges? • High income tax rates in comparison to low capital gains tax rate • Favourable tax environment – 10% Capital Gains Tax Band covers first £10m of gains for each qualifying shareholder “Most owners are surprised when we explain the sales timeline” Sales Timeline Year 1 Year 2 Year 3 Year 4 Year 5 Grooming & Planning Sales Process Implementation Phase • Most owner managers will need to remain in situ during the Implementation Phase Grooming • • • • • • Start 1-3 years before sale Establish who the buyers are likely to be Build a business those buyers want to buy Increase profits: – Organic growth – Bolt on acquisitions Identify potential value destroyers – Major contract renewals during sale process – Unresolved legal disputes Reduce company debt and build up cash balances – Review shareholder/directors remuneration policies – Reduce working capital cycle – Review capital expenditure v lease options – Review sale and lease back options – Eliminate discretionary capex – Pre-empt “cash free/debt free” negotiations Grooming Strategy • • • Increase earnings multiple: – Reduce reliance on key customers – Reduce reliance on key suppliers – Increase recurring revenue – Strong order book – Tie in key personnel with employment contracts and incentives – Secure and protect intellectual property rights – Plc level governance: Quality infrastructure and systems Quality of management reporting Understand the synergies – Cross selling opportunities – Cost synergies Tax Planning Tax Planning - Capital Gains Tax Regime • Currently have a very attractive Capital Gains Tax (‘CGT’) regime • Business assets potentially attract a top rate of tax of 10% due to availability of Entrepreneurs relief • Available on first £10 million of gain subject to qualifying conditions • Disposals of shares in a personal trading company or business assets where a material disposal of a trade is being undertaken • For shares to qualify the individuals need to have the following: – Over 5% of beneficial share ownership and 5% voting rights – Hold shares for minimum period of 12 months – Must be a company officer or employee Tax Planning - Capital Gains Tax Regime • Possible to “double up” on available relief by moving shares to spouse (initial gift is free of tax) Example Sale of business for £20m CGT 10% on first £10 million 1,000,000 28% on next £10 million 2,800,000 3,800,000 • If share stake can be divided between 2, CGT would be reduced by £1.8 million to £2 million Tax Planning - Capital Gains Tax vs Income Tax Differential between Capital and Income Sale of 100% shareholding qualifying for Entrepreneur’s Relief − Sales proceeds - − Total Capital Gains Tax paid − Net income • - £10,000,000 - £1,000,000 £9,000,000 In order to receive the same income how much would the company need to pay to the shareholder/director and what is the tax impact? Tax Planning - Capital Gains Tax vs Income Tax • Earnings required to receive equivalent income − Annual net income for 10 years - £900,000 − Total income tax paid for period - £9,367,347 − Total cost to company • Additional tax cost = £8,367,347 - £20,902,041 Benefit of Grooming/Tax Planning Profits Multiple Debt Gross proceeds 10% CGT on first £10m 28% CGT on next £3.25m 10% on all proceeds Net proceeds Pre £’000 Post £’000 2,500 2,750 6.5 7 16,250 19,250 3,000 2,000 13,250 17,250 1,000 - 910 - 1,910 - - 1,725 11,340 15,525 Buyer Motivations Private Equity Overseas Purchaser Trade Purchaser Strong Management Team Access to Major Customer(s) Synergies Strong organic Growth Branding Synergies 5 Year Financial Plan Market Position Synergies Ultimate Exit Market & Industry Expertise Synergies Financial Commitment Access into Europe Synergies Acquisitive Growth Critical Mass Synergies Plc Governance Strong Management Synergies Robust Financial Systems Synergies Synergies Synergies in Action Turnover Gross margin Overheads (Loss/Profit) Company A £’000 Company B £’000 3,000 5,000 600 1,750 20% 35% 1,600 1,500 (1,000) 250 − Company B lacks funding to grow its business and appoints HURST to advise − Company A based overseas needs UK presence to serve global customers in Europe − Company A has no warehousing/logistics infrastructure and pays 15% gross margin to third party − Company A to close its operation and transfer business to Company B Synergies in Action Post transaction P&L Turnover 8,000 Gross margin 2,650 33% Overheads Profit 1,750 900 10 Pointers to a Successful Sale 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Appoint advisers early on in the process Groom the business – better to plan than react Get the timing right Be realistic about valuation Minimise your tax Approach purchasers with strategic interest and financing resources – buyer due diligence is key in the current climate Create competition Maintain confidentiality to minimise the threat of collateral damage to your business and its goodwill Present the business to highlight: – True profitability – Synergy benefits – Growth opportunities Last but not least focus on the business – make your adviser earn their fees! Contact Nigel Barratt Corporate Finance Partner Tel: 0161 429 2523 nigel.barratt@hurst.co.uk Tim Scott Corporate Finance Associate Partner Tel: 0161 429 2518 tim.scott@hurst.co.uk Lisa Dicken Tax Partner Tel: 0161 429 2516 lisa.dicken@hurst.co.uk Thank you 22 March 12 Ed Clivery & Brian Devlin, NatWest, Commercial Banking 1 Accessing Business Finance MANAGING YOUR DEBT Funding Options Your Bank Relationship – make it work for you Business Planning How NatWest is supporting the SME Market? Financing the Supply Chain Sector Focus Support Bank Debt Finance March 12 Bank Funding Model and capital Structure Customer Funding need Security may be required. Product fees may apply. Over 18s only ANY PROPERTY USED AS SECURITY, WHICH MAY INCLUDE YOUR HOME, MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER DEBT SECURED ON IT Invoice Finance is provided by RBS Invoice Finance, part of The Royal Bank of Scotland Group, Registered in England No. 662221. Registered Office: Smith House, Elmwood Avenue, Feltham TW13 7QD. 3 Financing Options • Overdraft (Unsecured) – Review the trade debtor book discount intercompany and overdue. Lend a percentage of the book up to 60%. Contractual debt much lower perhaps 20%. Renewal every 12 months, fee, agreed limit and margin plus base charged on the outstanding balance. • Term loan- Defined expenditure within a business, payback over a period of time i.e. a term fee, margin over base/Libor (size), committed, covenants (size) • Asset Finance – Funding is provided against kit/vehicles- Hire Purchase (HP), Lease Purchase, Receivables Finance – (Lombard) • Revolving Credit Line – A commitment overdraft, something that can be repaid and redrawn and provides flexibility for a business that has a constant need for finance. • Invoice Finance- Capital efficient hence very attractive to the banks. Payout up to 85% as soon as the invoice is raised, the balance of 15% is paid to the customer when their client settles the invoice. Flexible, grows with sales, confidential (not disclosed to customers), allows the co to negotiate with suppliers –Pay early discounts from suppliers, insure against loss, help with customer viability/ongoing secondary checks. Fees higher due to extra work. Security may be required. Product fees may apply. Over 18s only ANY PROPERTY USED AS SECURITY, WHICH MAY INCLUDE YOUR HOME, MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER DEBT SECURED ON IT Asset Finance is provided by Lombard, part of The Royal Bank of Scotland Group, Registered in England No. 337004. Registered Office: 3 Princess Way, Redhill, Surrey RH1 1NP. Getting the most from your relationship What you should do What your bank should do • Reporting Systems – share what you have • Alternatives and suggestions • Honesty – avoid surprises • • Understand the business and your ambitions Future – share the plan. • Transparency and Honesty • Review services, funding structures and costs regularly. • Add value! • • 2 way Communication Ask – one level up Security may be required. Product fees may apply. Over 18s only ANY PROPERTY USED AS SECURITY, WHICH MAY INCLUDE YOUR HOME, MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER DEBT SECURED ON IT Business Planning Firstly before approaching the bank, prepare a coherent business plan. New deal - • Entity Structure/Ownership • Business Profile • Management – Who are you ? What have you done before? • Financials- Realistic? understand trends? Base Case? • Facilities – Right Structure? Right Amount? • Security – What are you happy with? You know we will ask? What are you happy with? Remember it is your business plan so if the accountant has prepared it you still have to understand it Security may be required. Product fees may apply. Over 18s only ANY PROPERTY USED AS SECURITY, WHICH MAY INCLUDE YOUR HOME, MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER DEBT SECURED ON IT How have NatWest supported the SME Market? • In 2011 RBS Group provided of £30bn of new lending to SME’s • RBS Group provided 48% of all SME finance in 2011 • 48p in £ to SMEs from RBS Group – we lent two times as much to SMEs as our competitors • Discounted lending – Manufacturing Fund, Cap Ex fund, Renewable Energy Fund and Franchise Fund. • Out of 27 lenders NatWest and RBS have provided over 40% of EFG loans • Support for Exporters Security may be required. Product fees may apply. Over 18s only ANY PROPERTY USED AS SECURITY, WHICH MAY INCLUDE YOUR HOME, MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER DEBT SECURED ON IT How have NatWest supported the SME Market? • Number one provider for Asset Finance (Lombard) as advised by the Finance and Leasing Association and Invoice Finance (RBSIF) is one of the largest providers of invoice finance in the UK • 2 years Free Banking For Start Ups, Business Start Up Courses & Business Plan Review Service • Business Hotline & Start Up Hotline • RBSG lent £550m to SME’s which benefited from the discounted rate supported by European Investment Bank (EIB) Security may be required. Product fees may apply. Over 18s only ANY PROPERTY USED AS SECURITY, WHICH MAY INCLUDE YOUR HOME, MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER DEBT SECURED ON IT Fee Free Banking: Free banking means that the charges for the day to day running of your account (know as your “service charge”) will not apply during the free banking period. At the end of this period, you will automatically move to the Standard Tariff. Charges for “Additional Services” and “Unarranged Borrowing” are not part of the free banking offer. Free banking applies to businesses that started trading within the past twelve months with projected or existing annual turnover not exceeding £1 million. Financing the Supply Chain • Trade Finance – Covers a massive area of specialism within the Natwest. • Voted Best Trade Finance Provider in the UK in Euromoney’s 2011 Trade Finance Survey and Best Trade Finance Bank 2012 in the United Kingdom by Global Magazine • Presence in 36 countries and partnership arrangements in 24 countries. • We can help you secure payment for exports. • Increase your margin by offering payment terms. • Reduce the cashflow impact on your business of paying for your supplies. • Introduce you to in country banking specialists on overseas visits. • Strategic relationship with UKTI who can help you explore the potential of overseas markets, make in-country introductions, educate your staff on the issues that arise when exporting and provide training courses. Other Sources of Finance March 12 Security may be required. Product fees may apply. Over 18s only ANY PROPERTY USED AS SECURITY, WHICH MAY INCLUDE YOUR HOME, MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER DEBT SECURED ON IT 10 Questions March 12 11 WORKSHOPS 34 Workshop: Effective credit management is an essential element of a well run business, particularly in these difficult economic times • What are the most important considerations in designing an effective credit management policy and procedure • What are the most effective strategies for ensuring your customers pay on time and to terms • What can you practically do when customers won't pay What other options does an FD have to reduce credit risk 35 Workshop: Exchange rate volatility can affect the bottom line of any business in many different ways • How do you identify these exposures in your business • What strategies can you employ to manage these risks • What are the biggest challenges in implementing these strategies and • How can you best deal with these challenges 36 Workshop: The role of an FD in de-risking a business • Name the main categories (areas) of a business that can be looked at when considering the de-risking of a business? (maximum 5) • Discuss the steps that can be taken to manage the risk in each category? Also, discuss whether they should de- risked in house or outsourced? 37 Thank you! 38