Chapter 7

Cash and Receivables

7–1

Pivotal Issues When Managing

Cash and Receivables

1. Cash needs

2. Credit policies

3. Level of accounts

receivable

4. Financing receivables

5. Ethical estimates of credit

losses

© Royalty Free PhotoDisc/ Getty Images

Copyright © Cengage Learning. All rights reserved.

7–2

Cash Considerations

Most liquid of all assets

Central to operating

cycle

Consists of:

Currency and coins on

hand

Checks and money

orders from customers

Deposits in checking

and savings accounts

Copyright © Cengage Learning. All rights reserved.

© Royalty Free PhotoDisc/ Getty Images

Cash may include a

compensating balance—a

minimum amount required

by a bank for a creditgranting agreement.

7–3

Seasonal Cash Needs

Cycles of business activities require different

levels of cash needs

Plan for these cash activities:

Cash inflows

Borrowing

Copyright © Cengage Learning. All rights reserved.

Cash outflows

Investing

7–4

Cash Requirements

Copyright © Cengage Learning. All rights reserved.

7–5

Cash Equivalents

example SE3, hwk E5

Investments like time

deposits or certificates of

deposit (CDs) that have a

term of 90 days or less

Nike’s Annual Report

Cash and equivalents represent cash

and short-term, highly liquid

investments with maturities of three

months or less at date of purchase.

The carrying amounts reflected in the

consolidated balance sheet for cash

and equivalents approximate fair

value.

© Royalty Free PhotoDisc/ Getty Images

Copyright © Cengage Learning. All rights reserved.

7–6

Cash Control: Imprest Systems

Petty Cash Fund

Established at a fixed amount

Reimbursed periodically,

based on documented

expenditures

Total cash and receipts must

equal the original amount

One person should be made

responsible for the accuracy

and security of the fund

Copyright © Cengage Learning. All rights reserved.

© Royalty Free C Squared Studios/ Getty Images

7–7

Cash Control:

Electronic Funds Transfer (EFT)

Method of conducting business transactions

in which funds are transferred electronically

from one bank to another bank

Wal-Mart makes

75% of its

payments to

suppliers using

EFT

Copyright © Cengage Learning. All rights reserved.

Electronic Banking

ATM transactions

Debit and credit card purchases

Online bill-pay

7–8

Cash Control: Bank Reconciliations

The bank statement is reconciled to the company’s

Cash account to account for any difference between

the two balances

What items might appear

in the company’s records

that do not appear on the

bank statement?

What items might appear

on the bank statement

that do not appear in the

company’s records?

Outstanding checks

Deposits in transit

Errors

Service charges

NSF (nonsufficient funds)

checks

Miscellaneous debits or credits

Interest income

Errors

Copyright © Cengage Learning. All rights reserved.

7–9

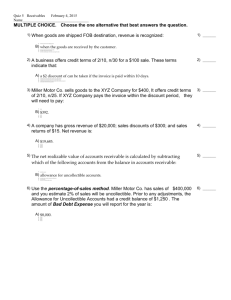

Illustration: Bank Reconciliation

1. A $138.00

deposit was

mailed to the

bank on

August 31 and

has not been

recorded by

the bank.

Terry Services Company

Bank Reconciliation

August 31, 2010

Balance per bank, August 31

Add deposit of August 31 in transit

$1,735.35

138.00

Balance per books, August 31

$1,207.95

Copyright © Cengage Learning. All rights reserved.

7–10

Bank Reconciliation (cont’d)

Terry Services Company

Bank Reconciliation

August 31, 2010

2. Five checks

issued in

August or

earlier have

not been paid

by the bank.

Balance per bank, August 31

Add deposit of August 31 in transit

Less outstanding checks:

No. 551

No. 576

No. 578

No. 579

No. 580

Balance per books, August 31

Copyright © Cengage Learning. All rights reserved.

$1,735.53

138.00

$75.00

20.34

250.00

185.00

65.25

595.59

$1,207.95

7–11

Bank Reconciliation (cont’d)

Terry Services Company

Bank Reconciliation

August 31, 2010

3. A deposit on

August 6 was

incorrectly

recorded in the

company’s

books as

$165.00. The

bank correctly

recorded the

deposit as

$150.00.

Balance per bank, August 31

Add deposit of August 31 in transit

Less outstanding checks:

No. 551

No. 576

No. 578

No. 579

No. 580

$1,735.53

138.00

$75.00

20.34

250.00

185.00

65.25

Balance per books, August 31

Less:

Overstatement of deposit of October 6

Copyright © Cengage Learning. All rights reserved.

595.59

$1,207.95

$ 15.00

7–12

Bank Reconciliation (cont’d)

Terry Service Company

Bank Reconciliation

August 31, 2010

4. A credit

memorandum was

enclosed with the

bank statement

showing a note

had been collected

in the amount of

$140.00 along

with interest of

$10.00. A debit

memorandum was

enclosed for the

$2.50 collection

fee.

Balance per bank, August 31

Add deposit of August 31 in transit

Less outstanding checks:

No. 551

No. 576

No. 578

No. 579

No. 580

$1,735.53

138.00

$75.00

20.34

250.00

185.00

65.25

Balance per books, August 31

Add:

Note receivable collected by bank

Interest income on note

$140.00

10.00

Less:

Overstatement of deposit of August 6

Collection fee

$ 15.00

2.50

Copyright © Cengage Learning. All rights reserved.

595.59

$1,207.95

7–13

Bank Reconciliation (cont’d)

Terry Services Company

Bank Reconciliation

August 31, 2010

5. An NSF check

was returned

with the

statement for

$64.07. The

NSF check

from Austin

Chase was not

reflected in the

company’s

books.

Balance per bank, August 31

Add deposit of August 31 in transit

Less outstanding checks:

No. 551

No. 576

No. 578

No. 579

No. 580

$1,735.53

138.00

$75.00

20.34

250.00

185.00

65.25

Balance per books, August 31

Add:

Note receivable collected by bank

Interest income on note

$140.00

10.00

Less:

Overstatement of deposit of August 6

Collection fee

NSF check of Austin Chase

$ 15.00

2.50

64.07

Copyright © Cengage Learning. All rights reserved.

595.59

$1,207.95

7–14

Bank Reconciliation (cont’d)

Terry Service Company

Bank Reconciliation

August 31, 2010

6. A debit

memorandum

for the monthly

$6.25 service

charge was

enclosed with

the bank

statement.

Balance per bank, August 31

Add deposit of August 31 in transit

Less outstanding checks:

No. 551

No. 576

No. 578

No. 579

No. 580

$1,735.53

138.00

$75.00

20.34

250.00

185.00

65.25

Balance per books, August 31

Add:

Note receivable collected by bank

Interest income on note

$140.00

10.00

Less:

Overstatement of deposit of August 6

Collection fee

NSF check of Austin Chase

$ 15.00

2.50

64.07

Service charge

Copyright © Cengage Learning. All rights reserved.

595.59

$1,207.95

6.25

7–15

Bank Reconciliation (cont’d)

Terry Services Company

Bank Reconciliation

August 31, 2010

7. Interest earned

by the company

on its average

balance was

$7.81.

Balance per bank, August 31

Add deposit of August 31 in transit

Less outstanding checks:

No. 551

No. 576

No. 578

No. 579

No. 580

$1,735.53

138.00

$75.00

20.34

250.00

185.00

65.25

Balance per books

Add:

Note receivable collected by bank

Interest income on note

Interest income

$140.00

10.00

7.81

Less:

Overstatement of deposit of August 6

Collection fee

NSF check of Austin Chase

Service charge

$ 15.00

2.50

64.07

6.25

Copyright © Cengage Learning. All rights reserved.

595.59

$1,207.95

7–16

Bank Reconciliation (cont’d)

Example SE 4, hwk E6

Terry Services Company

Bank Reconciliation

August 31, 2010

After all items

have been listed

on the

reconciliation,

total the columns.

The adjusted

bank balance

should equal the

adjusted book

balance.

Balance per bank, August 31

Add deposit of August 31 in transit

Less outstanding checks:

No. 551

No. 576

No. 578

No. 579

No. 580

Adjusted bank balance, August 31,2010

$1,735.53

138.00

$1,873.53

$75.00

20.34

250.00

185.00

65.25

Balance per books

Add:

Note receivable collected by bank

Interest income on note

Interest income

$140.00

10.00

7.81

Less:

Overstatement of deposit of August 6

Collection fee

NSF check of Austin Chase

Service charge

$ 15.00

2.50

64.07

6.25

Adjusted bank balance, August 31,2010

Copyright © Cengage Learning. All rights reserved.

595.59

$1,277.94

$1,207.95

157.81

$1,365.75

$87.82

$1,277.94

7–17

Accounts Receivable (A/R)

Short-term financial assets

Result from extending credit to an individual or a

business, also called trade credit

Retailers like Sears,

Lowe’s, and JCPenney

offer credit terms to

customers

Wholesalers and

manufacturers also

provide credit terms to

their customers for

purchases

© Royalty Free PhotoDisc/ Getty Images

Copyright © Cengage Learning. All rights reserved.

7–18

Credit Policies

To increase the likelihood of selling to customers who will

pay on time, companies develop control procedures and

maintain a credit department

The credit department:

Examines the financial resources and debts of the

credit applicant

Asks for personal references

Gets credit rating from credit bureaus

Determines the extent to which the company can

grant credit, if any

Copyright © Cengage Learning. All rights reserved.

7–19

Evaluating the Level of

Accounts Receivable

How many times, on

average, does a company

turn its receivables into

cash during an accounting

period?

Receivable Turnover

Copyright © Cengage Learning. All rights reserved.

How long, on

average, does it take a

company to collect its

accounts receivables?

Days’ Sales

Uncollected

7–20

Receivable Turnover

Reflects the relative size of a company’s accounts

receivable and the success of its credit and

collection policies

Net Sales

Receivable Turnover =

Average Net Accounts Receivable

(Amounts in Millions)

Nike’s Receivable

Turnover for 2007

=

=

Copyright © Cengage Learning. All rights reserved.

$16,325.9

($2,494.7 + $2,382.9) ÷ 2

6.7 times

7–21

Days’ Sales Uncollected

example SE2, hwk E4

To interpret a company’s ratios, take into

consideration the industry in which it operates

Days’

Sales Uncollected =

Nike’s Days’

Sales Uncollected

Copyright © Cengage Learning. All rights reserved.

365 days

Receivable Turnover

=

365 days

6.7

=

54.5 days

7–22

Receivable Turnover for

Selected Industries

Copyright © Cengage Learning. All rights reserved.

7–23

Estimating Uncollectibles

There will always be

customers who do not

pay their accounts,

called uncollectible

accounts, or bad debts

Match these expenses

of selling on credit to

the revenues they help

generate

Estimate the uncollectible

expense in the fiscal year

in which the sales are

made

© Royalty Free PhotoDisc/ Getty Images

Copyright © Cengage Learning. All rights reserved.

7–24

Estimating Uncollectibles and Ethics

Because estimations are involved, earnings may

be easily manipulated…

If the amount of losses

from uncollectible accounts earnings are overstated.

are understated,

If the amount of losses

from uncollectible accounts

are overstated,

Copyright © Cengage Learning. All rights reserved.

earnings are

understated.

7–25

Uncollectible Accounts

Accounts owed by

customers who will

not

or cannot pay

• Losses may be

recognized using

– Direct charge-off

method

– Allowance method

© Royalty Free PhotoDisc/ Getty Images

Copyright © Cengage Learning. All rights reserved.

7–26

Direct Charge-Off Method

Recognize a loss

at the time it is

determined that

an account is

uncollectible

Date

Tax law requires

use of this

method when

computing

taxable income

Uncollectible Accounts Expense

Accounts Receivable

XXX

XXX

Most companies do not use this method for financial reporting

purposes because it does not conform to GAAP.

Copyright © Cengage Learning. All rights reserved.

7–27

The Allowance Method

Most companies use this method for financial reporting

purposes because it conforms to GAAP.

Losses from bad debts are matched against the

sales they help generate

At the time of sale, management cannot

identify which customers will not pay

To observe the matching rule, losses from

uncollectible accounts must be estimated

The estimate becomes an expense in the

fiscal year in which the sales are made

Copyright © Cengage Learning. All rights reserved.

7–28

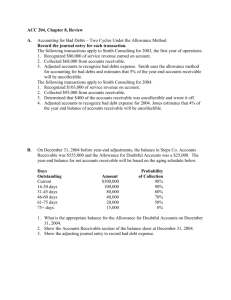

The Allowance Method Illustrated

Dec. 31, 2010: Management estimated that approximately $12,000 of

the $200,000 of accounts receivable was uncollectible.

Dec. 31

Uncollectible Accounts Expense

Allowance for Uncollectible Accounts

Uncollectible Accounts

Expense appears on the

income statement as an

operating expense

12,000

12,000

Allowance for Uncollectible Accounts appears

on the balance sheet as a contra-asset account

that is deducted from Accounts Receivable

Accounts receivable may be shown “net,” with

the amount of the Allowance for Uncollectible

Accounts shown in a note to the financial

statements

Copyright © Cengage Learning. All rights reserved.

7–29

Alternate Account Names

Allowance for

Uncollectible Accounts

Uncollectible

Accounts Expense

Allowance for Doubtful

Accounts

Allowance for Bad

Debts

Reserve for Bad Debts

(not used in modern

practice)

Bad Debts Expense

© Royalty Free C Squared Studios/ Getty Images

Copyright © Cengage Learning. All rights reserved.

7–30

Estimating Uncollectible Accounts

• Estimated loss should be:

Realistic

Based on objective information

Based on past experience

Based on current economic conditions

Two commonly

used methods for

estimating loss

1. Percentage of net sales method

2. Accounts receivable aging method

Copyright © Cengage Learning. All rights reserved.

7–31

Percentage of Net Sales Method

How much of this year’s

net sales will not be

collected?

The answer determines the

amount of uncollectible

accounts expense for the year

The amount is actually based on the company’s historic losses

© Royalty Free C Squared Studios/ Getty Images

Copyright © Cengage Learning. All rights reserved.

7–32

Percentage of Net Sales

Method Illustrated

Dec. 31, 2012: Account balances: Sales, $322,500; Sales Returns and

Allowances, $20,000; Sales Discounts, $2,500; Allowance for

Uncollectible Accounts, $1,800. Management estimates that

uncollectible accounts will average about 2 percent of net sales.

Uncollecti ble accounts expense .02 x ($322,500 – $20,000 – $2,500) $6,000

Dec. 31

Uncollectible Accounts Expense

Allowance for Uncollectible Accounts

6,000

6,000

example SE5, hwk E7

After the above entry is

posted, Allowance for

Uncollectible Accounts will

have a credit balance of

$7,800

Copyright © Cengage Learning. All rights reserved.

Allowance for Uncollectible Accounts

Dec. 31 adj.

1,800

6,000

Dec. 31 bal.

7,800

Dec. 31

7–33

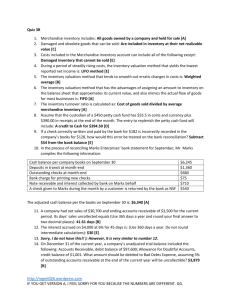

Accounts Receivable Aging Method

How much of the ending

balance of accounts

receivable will not be

collected?

The ending balance of

Allowance for

Uncollectible Accounts is

determined directly through

an analysis of accounts

receivable

The difference between the amount determined to be

uncollectible and the actual balance of Allowance for

Uncollectible Accounts is the expense for the period.

Copyright © Cengage Learning. All rights reserved.

7–34

Analysis of Accounts Receivable

by Age

The total past due for each category is multiplied by the

estimated percentage uncollectible

The sum of the totals for each category is the estimated

balance of Allowance for Uncollectible Accounts

Notice that the estimated percentage uncollectible increases as

accounts become further past due.

7–35

Accounts Receivable Aging Method

(Case 1)

Dec. 31, 2010: Management has estimated that $4,918 of Accounts

Receivable are uncollectible. Allowance for Uncollectible Accounts

has a credit balance of $1,600.

Allowance for Uncollectible Accounts

Dec. 31 adj.

1,600

3,318

Dec. 31 bal.

4,918

Dec. 31

The target balance for

the account is $4,918

Dec. 31

A credit adjustment of $3,318 will bring the

account to its target balance

Uncollectible Accounts Expense

Allowance for Uncollectible Accounts

To bring the allowance for uncollectible

accounts to the level of estimated losses

Copyright © Cengage Learning. All rights reserved.

3,318

3,318

7–36

Accounts Receivable Aging Method

(Case 2)

Dec. 31, 20x6: Management has estimated that $4,918 of Accounts

Receivable are uncollectible. Allowance for Uncollectible Accounts

has a debit balance of $1,600.

Allowance for Uncollectible Accounts

1,600

Dec. 31

The target balance for

the account is $4,918

Dec. 31

Dec. 31 adj.

6,518

Dec. 31 bal.

4,918

A credit adjustment of $6,518 will bring the

account to its target balance

Uncollectible Accounts Expense

Allowance for Uncollectible Accounts

To bring the allowance for uncollectible

accounts to the level of estimated losses

6,518

6,518

example SE6, hwk E8

Copyright © Cengage Learning. All rights reserved.

7–37

Comparison of Two Methods

hwk E9

Copyright © Cengage Learning. All rights reserved.

7–38

Estimates Differ from Write-Offs?

Accounts receivable written off during a period will

rarely equal the estimated uncollectible amount

Allowance for Uncollectible Accounts

Shows a debit balance

when the total of

accounts written off is

greater than the

estimated uncollectible

amount

Copyright © Cengage Learning. All rights reserved.

Shows a credit balance

when the total of

accounts written off is

less than the estimated

uncollectible amount

7–39

Writing Off an Uncollectible Account

When it becomes clear

an account will not be

collected, the amount

should be written off to

Allowance for

Uncollectible Accounts

The uncollectible

amount was already

accounted for as an

expense when the

allowance was

established

Copyright © Cengage Learning. All rights reserved.

© Royalty-Free/Corbis

7–40

Writing Off an

Uncollectible Account Illustrated

Jan. 15, 2011: TV GO, who owes Gomez Company $500,

is declared bankrupt by federal court.

Jan. 15

Allowance for Uncollectible Accounts

500

Accounts Receivable

To write off receivable from TV GO as uncollectible

because of his bankruptcy

500

example SE7, hwk E12

Accounts Receivable

Allowance for Uncollectible Accounts

Dec. 31

Jan. 15

4,918

Dec. 31

88,800

500

Jan. 15

Bal.

The write-off does not affect

the estimated net realizable

value of accounts receivable

4,418

Bal.

500

88,300

Net realizable value of A/R

Before write-off

$88,800 – $4,918 = $83,882

After write-off

$88,300 – $4,418 = $83,882

7–41

Notes Receivable

Unconditional

promises to pay

a definite sum

of money on

demand or at a

future date.

© Royalty Free PhotoDisc/ Getty Images

Copyright © Cengage Learning. All rights reserved.

7–42

Making and Paying Notes

A promissory note is an unconditional promise to pay

a definite sum of money on demand at a future date

Maker

Person or company that

signs the note and

promises to pay the

amount

All promissory notes that the

maker holds that are due in less

than one year are categorized as

notes payable in the current

liability section of the balance

sheet

Copyright © Cengage Learning. All rights reserved.

Payee

Entity to whom

payment is to be made

All promissory notes that the

payee holds that are due in less

than one year are categorized as

notes receivable in the current

assets section of the balance sheet

7–43

A Promissory Note

Copyright © Cengage Learning. All rights reserved.

7–44

Key Components of Promissory Notes

Maturity Date

Date on which the note must be paid

Duration

Length of time in days between the

note’s issue date and its maturity date

Interest and

Interest Rate

Cost of borrowing money or the return

for lending money, usually stated on an

annual basis

Maturity Value

Total proceeds of a note at maturity

date (face value plus interest)

Copyright © Cengage Learning. All rights reserved.

7–45

Maturity Date

Ways in which maturity date may be stated:

Due “November 14, 2010”

Due “three months after November 14, 2010”

Due “90 days after November 14, 2010”

Exclude the date of the note when computing the maturity date:

A note dated May 20 and due in 90 days would be due on August 18,

determined as follows:

Days remaining in May (31 – 20)

Days in June

Days in July

Days in August

Total days

Copyright © Cengage Learning. All rights reserved.

11

30

31

18

90

7–46

Duration of a Note

Why is duration of a note important?

Interest is calculated on this basis

If maturity date is stated as

a specific number of days

from date of note…

If maturity date is stated as

a specific date…

Copyright © Cengage Learning. All rights reserved.

duration is easy to

calculate. Duration is the

same as number of days.

number of days must be

calculated.

7–47

Interest and Interest Rate

hwk E13

• Amount of interest

is based on:

Principal

Rate of interest

Loan’s length of

time

© Royalty Free PhotoDisc/ Getty Images

What is the interest on a 90-day, 8 percent, $1,000 note?

Principal x Rate of Interest x Time = Interest

$1,000 x .08 x 90/365 = $19.73

Copyright © Cengage Learning. All rights reserved.

7–48

Maturity Value

example SE8, hwk E16

Total proceeds of loan

90-day

8 percent

proceeds

$1,000 loan

= Principal + Interest

= $1,000 + ($1,000 × 8/100 × 90/365)

= $1,000.00 + $19.73

= $1,019.73

The maturity value of a non-interest-bearing note is the

principal amount. In this case, the principal includes an

implied interest cost

Copyright © Cengage Learning. All rights reserved.

7–49

Accrued Interest

A promissory note received in one accounting

period may not be due until a later period

Accrue the interest applicable to the note at the end

of the accounting period

$1,000 note, 90-day,

8 percent note was

received on Aug. 31.

The fiscal year ends

on Sept. 30.

© Royalty-Free/Corbis

30 days interest, or $6.58 ($1,000 × 8/100 × 30/365 =

$6.58), is earned in the fiscal year that ends on Sept. 30

Copyright © Cengage Learning. All rights reserved.

7–50

Dishonored Notes

When the maker of a note does not pay at

maturity, the note is said to be a dishonored note.

© Royalty Free PhotoDisc/ Getty Images

Copyright © Cengage Learning. All rights reserved.

The holder, or

payee, of the note

should make an

entry to transfer

the amount due

to an accounts

receivable from

the debtor.

7–51