Chapter 7

Managerial Economics &

Business Strategy

Chapter 7

The Nature of Industry

Industry Concentration

• Four-Firm Concentration Ratio n

The sum of the market shares (w i

= Sales i

/ Sales of entire industry) of the top four firms in the defined industry: C

4

= w

1

+ w

2

+ w

3

+ w

4

• Herfindahl-Hirschman Index (HHI) n

The sum of the squared market shares of firms in a given industry, multiplied by 10,000: HHI = 10,000

S w i

2

• Limitations n n

Market Definition: National, regional, or local?

Global Market: Foreign producers excluded n

Industry definition and product classes

• See concentration ratios on WSU online

Rothschild Index

• A measure of the elasticity of industry demand for a product relative to that of an individual firm (or how price sensitive an individual firm’s demand is relative to the entire market):

R = E

T

/ E

F n n n

E

T

= elasticity of demand for the total market

E

F

= elasticity of demand for the product of an individual firm.

R has a value between 0 (perfect competition) and 1 (monopoly).

• When an industry is composed of many firms, each producing similar products, the Rothschild index will be close to zero (i.e., the firm’s % age change in Q

D given a 1% change in price > the overall industry’s).

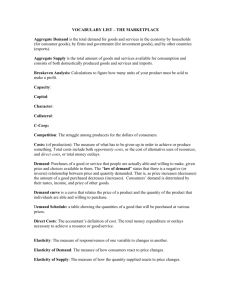

Own-Price Elasticities of Demand and Rothschild Indices

Industry

Food

Tobacco

Textiles

Apparel

Paper

Chemicals

Rubber

Elasticity of Market

Demand

-1.0

-1.3

-1.5

-1.1

-1.5

-1.5

-1.8

Elasticity of Firm’s

Demand

-3.8

-1.3

-4.7

-4.1

-1.7

-1.5

-2.3

Rothschild

Index

0.26

1.00

0.32

0.27

0.88

1.00

0.78

Potential Entry & Barriers to Entry

• Numerous factors make it difficult for firms to enter an industry n

Patents n

Economies of scale or large capital outlays n n

Strategic behavior by existing firm(s) to keep competition out!

Can’t enter by law (e.g., Liquor stores in Utah, Utah

Power).

n n

When 1 firm has control or ownership of a scarce resource (e.g., DeBeers)

When government auctions off “monopoly rights”

Pricing Behavior

• The Lerner Index n n n n n

L = (P - MC) / P = -1/E

Qx,Px

A measure of the difference between price and marginal cost.

An index from 0 to 1.

L≈0 implies more competition

Indication of the degree of market power a firm has.

L also equals -1/E

Qx,Px

(see chapter 8). What this shows is that the more elastic demand, the smaller the L. n n

Markup Factor

Rearranging the above formula,

P = (1/(1-L)) MC

P/MC = 1/(1-L) is the markup factor.

Lerner Indices & Markup

Factors

Food

Industry

Tobacco

Textiles

Apparel

Paper

Chemicals

Petroleum

Lerner Index

0.26

0.76

0.21

0.24

0.58

0.67

0.59

Markup Factor

1.35

4.17

1.27

1.32

2.38

3.03

2.44

Lerner Index and Elasticity of

Item

Saline solution

Rubber arm pads for crutches

Rubber tips for crutches

Heating Pad

Pair of Crutches

Esophagus Tube

Demand (E

D

)

P MC P/MC

Lerner

Index

Implicit

E

D

$44.90 $0.81 55.4 0.98 –1.02

$23.75 $0.90 26.4 0.96 –1.04

$15.95 $0.71 22.5 0.96 –1.05

$118.00 $5.74 20.6 0.95

–1.05

$103.65 $8.35 12.4 0.92 –1.09

$1,205.50 $151.98 7.9 0.87

–1.14

Integration and Merger Activity

• Integration leads to larger companies than would otherwise exist without integration n n

Vertical Integration

• Where various stages in the production of a single product are carried out by one firm.

Horizontal Integration

• The merging of the production of similar products into a single firm.

n

Conglomerate Mergers

• The integration of different product lines into a single firm.

• Obj. of Merging: reduce transaction costs, enjoy benefits of economies of scale/scope, increase market power, etc.

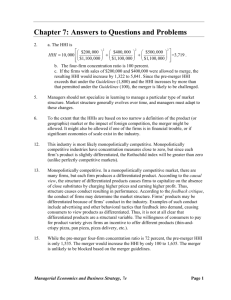

DOJ/FTC Merger Guidelines

• Based on HHI = 10,000 S w i

2

• Merger may be challenged if

• HHI exceeds 1800, or would be after merger, and

• Merger increases the HHI by more than 100

• But...

n

Recognizes efficiencies: “The primary benefit of mergers to the economy is their efficiency potential...which can result in lower prices to consumers...In the majority of cases the Guidelines will allow firms to achieve efficiencies through mergers without interference...”